Book review: Work Optional by Tanja Hester

Last week, I published an extended excerpt from Grant Sabatier’s new book, Financial Freedom. Sabatier’s core message is that time is more valuable than money — and that freedom is more valuable than time.

Several GRS readers took issue with the book’s seemingly anti-work tone.

- “There is a lot of talk about the drudgery of work; [I’m] pretty lucky [that] I love my job and have a lot of autonomy,” wrote Angelica.

- S.G. said, “The ‘wage slave’ rhetoric gets old.”

- And our pal El Nerdo didn’t like this sentence: “I retired early because I didn’t want to spend the best years of my life working in a poorly lit cubicle at a stressful job I didn’t particularly enjoy.” El Nerdo’s response? “Could you maybe just find a better job? One that you enjoyed? With no cubicles, and better light?”

These comments are telling. They’re representative of a common complaint leveled against the FIRE movement. (As you probably know, FIRE is a clumsy acronym for “financial independence/retire early”. The FIRE movement is all about saving enough to retire as soon as you can.)

Much of the financial independence and early retirement messaging comes off as anti-work. While this appeals to some folks, it repels others. Not everybody hates their jobs. In fact, some people truly enjoy what they do.

If you love your job but are still interested in what the FIRE movement has to offer, you should take a look at Tanja Hester’s new book, Work Optional, which was released today. It’s a solid addition to anyone’s personal finance library, with a core philosophy very much aligned with the one I espouse here at Get Rich Slowly. Best of all? As you might guess from the book’s title, Hester doesn’t pretend that work is a cage that we all want to escape.

For those unfamiliar, Hester is the braniac behind the popular Our Next Life blog and The Fairer Cents podcast. She’s also an all-around cool cat.

The Value of Work

Hester says that Work Optional is about “reclaiming your life from our nonstop work culture so that you decide what role work will play in your life, instead of society deciding for you”. She truly wants to help readers find ways to make work optional, an activity they can do or not do as they see fit.

I like this. It’s a conventional idea of financial independence stated in a new way, a way that gives power to the individual without denigrating all work as undesirable. I also respect that Hester and her husband had fulfilling careers they enjoyed. She writes:

To us, retiring early was never about not liking work. Work can be a source of self-worth, of community, of proof that we add value to the world. And Mark and I both got that from our careers. We just didn’t want to let work be the defining feature of our entire lives…

Because of the book’s title and because its message is not anti-work, I had high hopes that Hester would spend more time exploring this concept, re-framing of early retirement and/or financial independence in a new way. I love the notion that we can reach a point at which work is optional.

And make no mistake: Much of this book is indeed about constructing a life in which work isn’t necessary. The problem, however, is that Work Optional tries to tackle two themes at once. Is the book’s subject early retirement? Or is the book’s subject its stated thesis: creating a work-optional life? There’s plenty of overlap between these two topics, sure, but they’re not the same thing.

Look at it this way. I’ve written before about the stages of financial independence.

Early retirement is the fourth or fifth stage of financial freedom, the point at which you have enough money to support yourself for the rest of your life. Hester’s “work optional” point, however, is more like the third stage of financial freedom, at which you could quit your job without a moment of hesitation.

In other words, you can reach the work optional stage without ever reaching early retirement. Many people do.

Okay, enough nitpicking! Let’s take a quick look at what this book covers.

Define Your Work-Optional Life

The the first section of Work Optional is its best. The first chapter provides info on the history of retirement (and early retirement), as well as background on Hester herself. The next two chapters are all about defining what a work-optional life means to you.

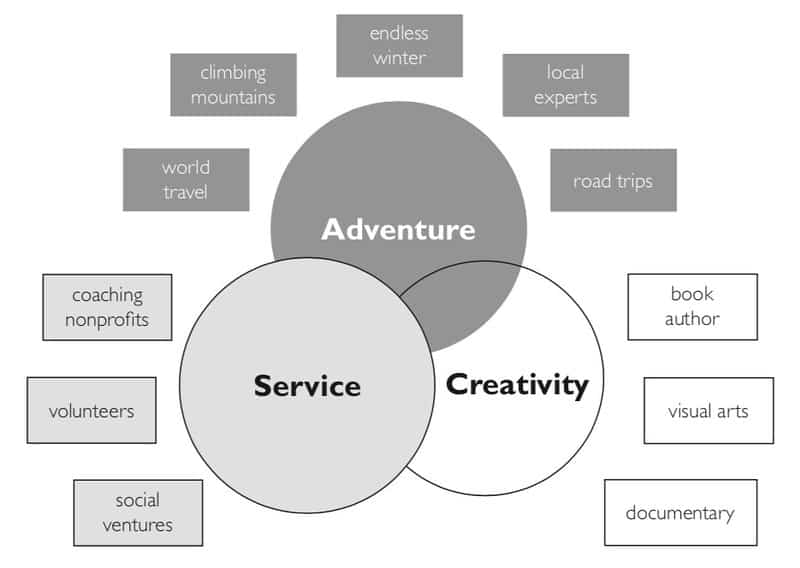

“The money part of early retirement is deceptively simple,” Hester writes. “But the life portion — the far more important part — is significantly more complex.” She leads readers through four pages of questions designed to spur self-reflection. From these answers, she then urges folks to find interests and themes. (This process is similar to some of the exercises for finding purpose that I’ve shared in the past.)

These interests and themes will help direct what you do with your life.

After you’ve mapped the interests and themes you’d like to pursue with your life, Hester asks you to create a money mission statement, which “[outlines] a spending philosophy that’s aligned with your priorities.”

“Spending isn’t inherently bad,” she writes. “Spending on the things you truly value is the best thing you can possibly do with your money.” Or, as I’ve been writing here at Get Rich Slowly for nearly thirteen years: Do what works for you.

What does a money mission statement actually look like? Here’s an example.

My money’s mission is to provide for my life of service, adventure, and creativity, eventually allowing me to retire early and stop working for money. To support that mission, I will stop shopping online without a list, I will stop shopping at Target, and I’ll notice when I’m spending aspirationally in hopes that a product will make me better in some way. And I’ll be more mindful about the money I do spend on adventures so I get the full experience without spending more than I must.

As I said, I like the first section of Work Optional very much. No surprise, I guess. It explores themes that are near and dear to my heart. I like Hester’s exercises so much, in fact, that I hope to find time to share one or two of them here at GRS in the near future. And I’ll absolutely be using them (and crediting her when I do) in upcoming talks and presentations.

Create a Financial Plan

I have a love-hate relationship with the second section of Work Optional. The content is great; the organization is lousy.

After walking through the emotional and psychological aspects of prepping for a work-optional life, Hester devotes a bulk of the book to exploring familiar personal finance topics in order to help readers create a financial plan. Although Hester covers a lot of familiar material — saving rate, safe withdrawal rates, index investing, and so on — she does so thoughtfully, often presenting new ideas or new perspectives. This is a Good Thing.

It’s an even Better Thing that she tackles topics that are rarely covered elsewhere: the pros and cons of homeownership, substantially equal periodic payments, Roth conversion ladders, sequence of returns risk, and more.

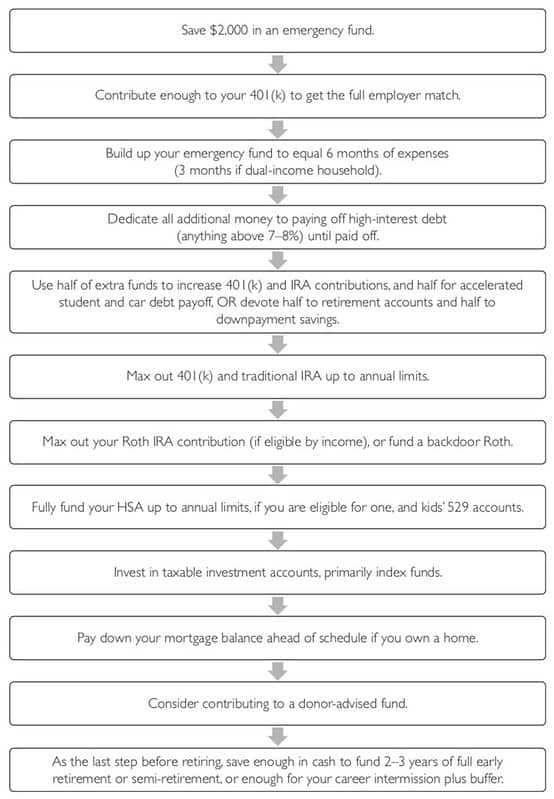

I especially like Hester’s diagram for “sequence of saving”. While this isn’t an ironclad rule for everyone, it’s a general guideline that most of us can build upon to determine what to save first…and what to save next.

In a way, this is like a super-advanced version of Dave Ramsey’s “baby steps”. I like those baby steps, and I like this “sequence of saving” flowchart even more.

What I don’t like, however, is how this section of Work Optional is organized. This is the largest part of the book. It’s the meat. It’s the heart. It contains some excellent information, but it doesn’t follow a logical progression.

- After the book’s first section (about psychology, purpose, and missions), we jump immediately to a chapter on investing. Whuh? That’s a strange transition. It feels like we’re taking on advanced stuff before addressing the basics.

- Next is a chapter on big expenses, like housing and health care.

- This is followed by a chapter on saving rates and withdrawal rates.

- The fourth chapter of this section is about the mechanics of expense tracking and saving. I feel like Part Two should have started with this info!

- Next up, Hester tackles income and more large expenses. This should have been the second chapter in Part Two.

- The section closes out with a chapter on making your financial plan “bulletproof” via insurance, etc. It’s the only chapter that feels like it’s in its proper place.

Because the info in this section is vital, I wanted the concepts and chapters to build on each other in some sort of natural way. They don’t. This might sound like a minor quibble, but I found myself frustrated with the order the topics were tackled. Why are we discussing index investing before we ever touch income and expenses? Why aren’t basic concepts covered first?

(I’m especially sensitive to this issue because my own book, Your Money: The Missing Manual received plenty of justified criticism for the same problem!)

Make the Leap

How do you prepare to leave work? If you’re losing some (or all) of your income, how do you replicate a regular paycheck with your investment accounts? (This is something I wish I’d known five years ago!) What about taxes and continued retirement contributions? Most importantly, what about your mental, physical, spiritual, and social health?

A lot of the concepts in Work Optional will be familiar to GRS readers. I write frequently about mission statements, lifestyle inflation, mindful spending, and so on. The value of this book, however, is that it brings everything together in one cohesive package. (In some ways, it’s like a supersized version of my Money Boss Manifesto.)

One of the book’s strengths is Hester’s voice. She’s not judgmental. She’s not arrogant. She’s not prescriptive. She’s smart, thoughtful, and approachable. Reading Work Optional feels like you’re reading the thoughts of a friend, not some out-of-touch money guru who thinks his way is the only way.

I’ve shared a couple of concerns about Work Optional, but don’t let that fool you. I like this book. It’s well written, well edited, and filled with useful information. As a result, it’s a pleasure to read. This might not be a big deal to some folks, but I appreciated reviewing a money book that I wanted to read instead of feeling like it was a chore.

This book has earned a permanent spot on my reference shelf. I know I’ll use it not only to research future articles here at Get Rich Slowly, but more importantly to look up info I need to know for my own work-optional life.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)