Picking the best online retirement calculator

After my rant about how dumb it is to base your retirement needs on your income rather than your spending, you might guess that I hate most online retirement calculators. You are correct.

The vast majority of online retirement calculators use your current income to compute how much you need to save for retirement. It's dumb when financial advisers do this, and it's even dumber when automated programs do it. Retirement calculators tend to be dumb in lots of other ways too.

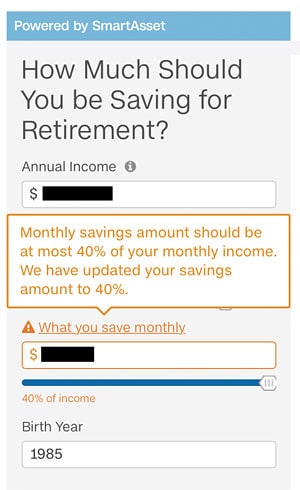

When computing how much to save for retirement, they tend to focus on current income rather than current spending. Plus, many of them have other problems — like arbitrarily deciding that you shouldn't save more than 40% of your monthly income.

Really? Really? “Monthly savings amount should be at most 40% of your monthly income?” Yet another example of how the Real World just doesn't deal well with early retirement and financial independence. (All of the CNN retirement calculators are terrible. I found one that wouldn't allow a retirement age of less than 50 or a saving rate of over 25%. Plus it calculated that a $1.6 million nest egg would allow $95,000 year of spending if you retired at 50. Absurd!)

Today I want to share brief reviews of the Personal Capital retirement planner and the retirement planning tool from NewRetirement. Both of them are awesome. I've also included five more online retirement calculators that actually provide meaningful results: cFIREsim, FIRECalc 3.0, the early retirement calculator from NetWorthify, the retirement income calculator from T. Rowe Price, and Bankrate's retirement income calculator.

The Personal Capital Retirement Planner

First up, let's look at the retirement planner built into the free Personal Capital app. I raved about this tool when I compared Mint and Personal Capital in February, and for good reason. It offers a lot of flexibility, allowing users to enter a variety of possible spending goals, such as vacations, weddings, education, and home purchases. You can also account for changes in income.

The Personal Capital retirement planner allows users to create a highly-customized projection of income and expenses on the road to retirement — and beyond.

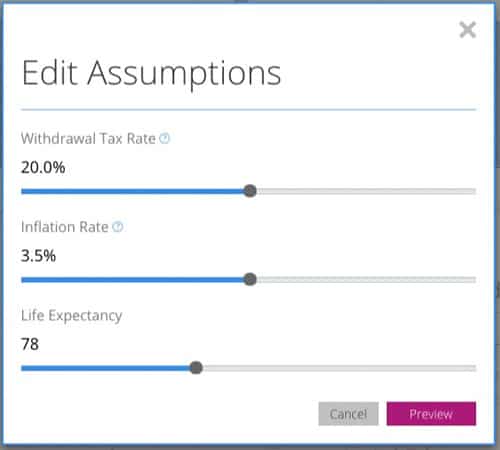

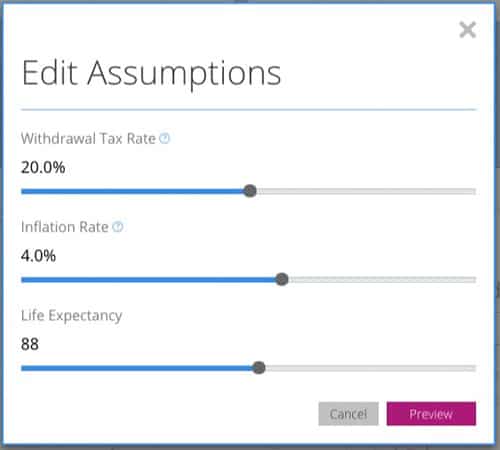

But the Personal Capital retirement planner goes beyond customizing assumptions about your own life. You can also alter larger economic factors such as life expectancy and inflation rate in order to learn how these changes could affect your future cash flow.

As always, let's look at a real-world example.

Here are the assumptions I make about global factors:

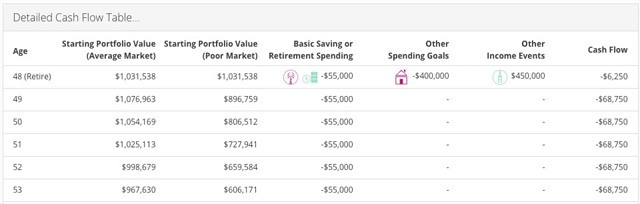

And here's the report that Personal Capital produces after crunching the numbers:

Note that these calculations also take into account the “income events” and “spending goals” that I've fed into the system.

Because Personal Capital is already connected to all of your bank and investment accounts, its default is to project your future retirement spending based on your current actual spending. If you don't have a lot of unusual expenses, this might be fine. In my case, however, it thinks I spend far more than I do because it can't recognize that certain transactions are actually investments and not blatant consumerism.

As you can see, the Personal Capital retirement planner calculates that I have an 81% chance of being able to fund the retirement I envision. Not bad! But let's look what happens if I alter a few key assumptions.

What if inflation is just a little higher than the historical average? And what if I surprise myself by living a decade longer? And what if my spending is actually higher than I think it is? Trouble happens, that's what!

You can see that increased spending and increased inflation would have a huge impact on the longevity of my portfolio. All the more reason I want to continue earning money while cutting back on spending!

Here's one final thing I like about the Personal Capital retirement planner: While the default graph is handy, it's not nearly as useful as raw data — at least not for this money nerd. Fortunately, you're able to view a detailed cash flow table, which shows you an annual projection of your portfolio value based on both average and poor markets.

Regardless which online retirement calculator you play with, it can be handy to supplement your info by using the U.S. government's Social Security retirement benefit estimator. (Well, assuming you live in the U.S., anyhow.) Enter your vitals, and the calculator will project how much you should receive each month based on your actual earning records. For instance, I'll receive an estimated $1580 per month ($18,960 per year) at full retirement age of 67. Handy!

The NewRetirement Planning Tool

As much as I love the Personal Capital retirement planner, there's another tool that's even better. The retirement calculator at NewRetirement is comprehensive but still easy to use. It doesn't connect to your bank accounts, so you have to enter info by hand — but that's okay. NewRetirement allows users to save data — you're required to create a login — so you can go back again and again to tweak your assumptions.

As flexible as the Personal Capital planner is, the NewRetirement tool is even more customizable.

NewRetirement allows users to enter tons of info, such as life expectancy, estimated Social Security benefits, anticipated changes in income, possible windfalls (from inheritances, for instance), evolving monthly expenses, predicted medical costs, and current debt load (and predicted payoff dates).

Because you enter a wider range of data, you're able to make more adjustments. After you've set your basic assumptions, you can page through each section to tweak your numbers. As you do, NewRetirement provides advice and links to outside resources such as a life expectancy calculator and the afore-mentioned Social Security benefits calculator. NewRetirement also provides opportunities for users to learn about topics like debt consolidation or estate planning.

The NewRetirement planning tool creates two models simultaneously. For many of the parameters, users are asked to enter both optimistic and pessimistic assumptions. For instance:

- When I entered a predicted inflation rate, I chose 3.5% on the optimistic side and 4.5% on the pessimistic side.

- When I entered a predicted average rate of return on my retirement accounts, I chose 6.5% on the optimistic side and 2.5% on the pessimistic side.

- When I entered a predicted rate of increase for my home value, I chose 8.0% (the max) on the optimistic side and 0.5% on the pessimistic side.

- When I entered a predicted rise in health-care costs, I chose 5.0% on the optimistic side and 10.0% on the pessimistic side — and this had a dramatic impact on my ability to meet my goals!

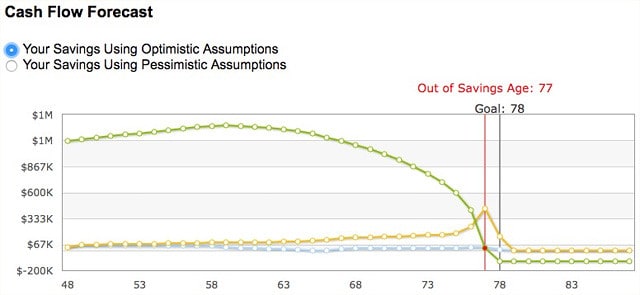

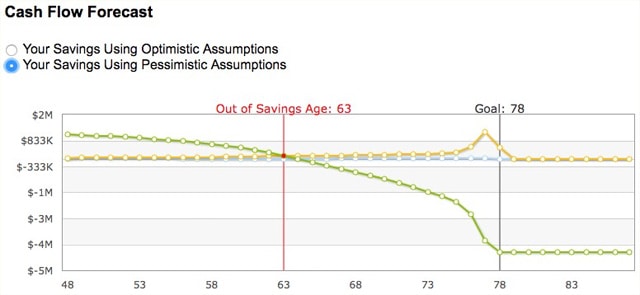

As you make changes to your assumptions, the NewRetirement planner re-calculates the likelihood that you'll have enough saved to meet your goals. Here are the charts it produced for me, first for my optimistic assumptions, then for my pessimistic assumptions:

I'm not sure why there's a huge spike in my spending at age 77, but I suspect it's due to predicted end-of-life care. Kind of morbid, eh?

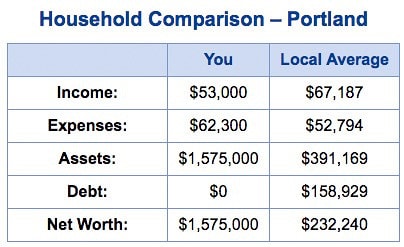

But wait! That's not all! After you've entered and analyzed your retirement plan, NewRetirement allows you to do all sorts of things with it, such as review key dates in the future and compare your finances to folks in your neighborhood.

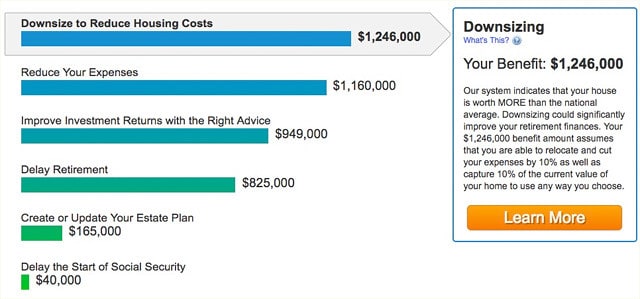

I think my favorite part of the NewRetirement tool is how it offers suggestions for boosting your retirement savings. In my case, it noted that if I downsized my home I could save buckets of money. (This is something I've already realized, of course, and is one of the primary reasons Kim and I are considering a move.)

The NewRetirement tool is far more comprehensive than most other retirement calculators. It's a resource, not just a gadget. Best of all, the developers are constantly adding new features and making improvements, both large and small.

More Retirement Calculators

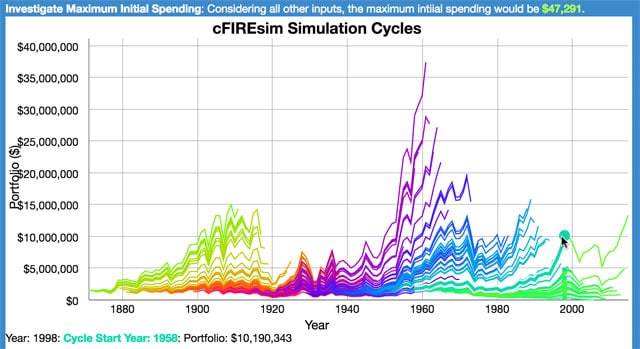

- If you like detail, then cFIREsim is for you! This crowdsourced (and Open Source) retirement simulator allows you to enter tons of different parameters. New or casual users might find it overwhelming, but because of its depth it offers accurate and realistic results.

- FIRECalc 3.0 uses a similar methodology to cFIREsim but requires far less input. You tell the calculator how much you have saved, how much you plan to spend each year, and how many years you plan to be retired. FIRECalc compares these numbers to every U.S. stock market since 1871 to determine whether your money would have lasted. Quick and easy but far more sensible than trying to guess how much you need in retirement based on your current income.

- If you're still in wealth accumulation mode, the When can I retire? calculator from Networthify is a great tool for estimating how soon you'll reach financial independence. It's not nearly as useful if you've already achieved FI, however. (By this I mean it doesn't show how long your savings will last if you've already retired.)

- The excellent retirement income calculator from T. Rowe Price bases its results on your spending needs. You supply your current savings and salary, specify an asset allocation, then tell the calculator when you expect to retire and how much you anticipate spending. The program runs “1000 market simulations” to determine how much money you'll need, then compares that with how much you're expected to have.

- Bankrate's retirement income calculator bases its numbers solely on your savings. I like the notion behind this calculator, but I question the results. They seem high. (See below for more info.)

- Finally, there's the rule of thumb I use frequently here at Money Boss. This isn't an online tool, but a quick calculation you can run to get a rough idea of where you are with your retirement saving. It works like this: Divide your net worth by 25. This is the annual spending your current nest egg will support long-term. (If you're risk-averse, divide by 30. If you're aggressive, divide by 20.) So, if you have $1,000,000 saved, my rule of thumb says you can spend $40,000 per year — or about $3333 per month. (That's $2778 per month if you're risk-averse, or $4167 per month if you're bold.)

Looking at the results from just one retirement calculator isn't very useful. But if you compare the numbers and recommendations from several, you can get a pretty good idea of how much you'll need to save for the retirement you want.

If I run the numbers for my own situation using each of these methods, I get the following results:

- cFIREsim says that, based on past U.S. market history, I am 100% safe to spend $47,291 per year (or $3941 per month).

- With FIRECalc, I had to run the numbers several times to find the lowest level of annual spending that would have lasted forty years 100% of the time. It's $46,750 (or $3896 per month).

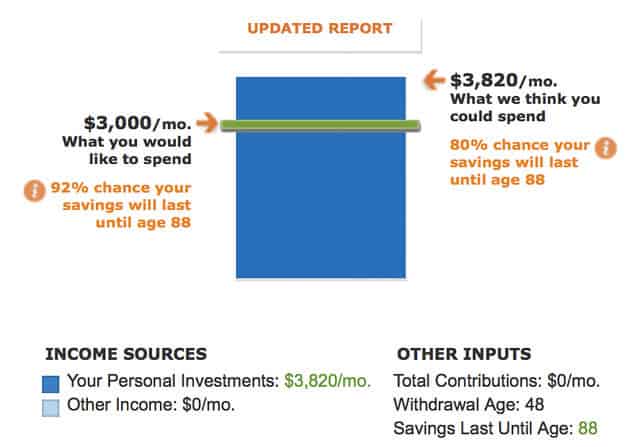

- T. Rowe Price says I can afford to spend $3820 per month — more once Social Security kicks in.

- Networthify doesn't give me any useful info. It's meant for folks who have not yet achieved financial independence.

- Bankrate says I'm able to spend $6014 per month. WTF, Bankrate? Why are your numbers so far off from everybody else?

- My own rule of thumb says I have $4667 per month available — $3889 if I want to play it safe. (I'm not willing to make aggressive assumptions with my retirement savings.)

It seems pretty clear that I can safely spend nearly $4000 per month for the next forty years and I won't run out of money. If I'm willing to take a chance and/or supplement my income, I can probably bump that to $5000 or $6000 per month. Since my normal burn rate (when I'm not traveling the U.S. in an RV) is about $3000 per month, I should be fine.

The Bottom Line

I wrote about online retirement calculators last summer because I wanted to crunch the numbers to see if I was spending at safe levels. I'm worried about burning through my savings. At the time, based on my assumptions, I thought I was okay.

This year, however, I've been tracking my actual spending. In the process, I've discovered that my burn rate is higher than I believed it to be. I don't spend $3000 per month; I spend $5000 per month. Knowing this, I went back and re-ran the numbers to see how this affects my retirement plans. (In some cases, my spending level didn't change the calculations — just my financial status.)

- cFIREsim says that, based on past U.S. market history, I'm 100% safe to continue spending $60,000 per year (or $5000 per month).

- FIRECalc shows that my current spending would be sustainable 98.3% of the time. To reach 100% success, I'd have to cut my spending to $57,500 per year (or about $200 per month).

- The calculator at NetWorthify still doesn't handle my situation well. But based on what I can tell, it seems to think my current spend level is 100% sustainable indefinitely.

- According to T. Rowe Price, there's an 83% chance that my current spending level will allow my savings to last until I reach age 78 — but that's not counting on future Social Security benefits.

- The Personal Capital retirement planner shows that my current level of spending has a 72% chance of success. I need to cut back to $4833 per month to boost my odds to 80%.

- The NewRetirement tool gives both optimistic and pessimistic projections. Optimistically, I have a 93% chance of funding retirement until age 78. Pessimistically, my chances are only fifty-fifty.

- My own rule of thumb — that you can safely spend 4% of your net worth long-term (or 3% of you want to be extra safe) — indicates that I can spend $5370 per month without issue. If I want to be conservative, I should spend $4475, which would require cutting back by about $500 per month from current levels.

Footnote: My pal Todd at Financial Mentor has commissioned a variety of terrific financial calculators, including a few focused on retirement. Because he offers so many different tools, there's bound to be one that works for you. (If you're already retired, for instance, the retirement withdrawal calculator might be handy.)

So, I'm not in bad shape. Based on my current spending and retirement savings, the best retirement calculators generally think my burn rate is about where it should be. But because I want a margin of safety, I'm going to continue to take steps to improve my odds.

I'd love to hear your feedback about these retirement calculators, especially the two new tools I reviewed today. What do you think of the Personal Capital retirement calculator? Take the NewRetirement planning tool for a spin. Do you like it as much as I do?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)