The GRS Holiday Gift Guide

Every year at about this time, I start getting questions by email and social media — and even in Real Life: "Do you have any personal finance or money-related gift ideas?"

I know how tempting it can be to choose gifts that encourage smart financial choices. You look at the poor decisions your brother or sister have made, and you feel like you could help. If only they would read this one book that helped you so much!

I get it. I've felt the same way. After all, my financial turnaround is a direct result of reading two books that were gifted to me by friends: Your Money or Your Life and Dave Ramsey's The Total Money Makeover. Continue reading...

A list of personal finance events, conferences, and retreats

Last week, my colleague Patrick from Cash Money Life pinged me on Facebook. "Hey, J.D. What are some of the other personal finance conferences out there?" he asked. Patrick and I brainstormed a list of money events, and I realized that this might be useful for GRS readers.

(Well, this list might be useful eventually. Right now, during COVID, this list isn't useful to anyone haha.)

Here's a quick list of the various personal finance events, conferences, and retreats that I'm aware of. If you know of others that should be on this list, please drop me a line. I'm happy to add them.

Essentialism: The mindful pursuit of quality

It's been quiet around here for the past few months. Generally when things go dormant at Get Rich Slowly, that's not a good sign. It usually means that I've sunk into the depths of depression, the pit of despair.

I'm pleased to report that in this case, that's not the issue. In this case, the opposite has happened. Lately, life is grand. During the past three months, I've been diligently working to eliminate the net negatives from my life while also emphasizing those things that are essential. To that end, I've:

- Recorded, edited, and published nearly 50 YouTube videos. These are rough, and I know it, but I'm learning from them — and having fun.

- Given up alcohol. And recently, I've given up pot. I'm experimenting with complete sobriety for a while.

- Lost nearly twenty pounds through simple, sensible eating (and calorie counting). This morning, I weighed in at 186.8, down 17.4 pounds since I started on July 28th.

- Cleaned and organized nearly every space in my life, "editing" my belongings in an attempt to cut back to the essentials.

- Worked hard in the yard. I've built a fence with one neighbor and am starting another fence with a second neighbor. Plus, I've continued our landscaping projects.

- Begun reading again for pleasure. Yay!

- And much, much more.

I've had a busy three months. And while, yes, I've had a few bouts of depression, they've been minor and brief. Mostly, I've been happy and productive. Continue reading...

How to prepare for a natural disaster

My world is on fire.

As you may have heard, much of Oregon is burning right now. Thanks to a "once in a lifetime" combination of weather and climate variables -- a long, dry summer leading to high temps and low humidity, then a freak windstorm from the east -- much of the state turned to tinder earlier this week. And then the tinder ignited.

At this very moment, our neighborhood is cloaked in smoke.

Accentuate the positive, eliminate the negative

When Kim and I go to bed each night, we spend time casually browsing Reddit on our iPads. It's fun. Mostly.

She and I enjoy sharing funny animal videos with each other (from subreddits like /r/animalsbeinggenisuses, /r/happycowgifs, and /r/petthedamndog). Kim dives deep into /r/mapporn and /r/documentaries. I read about comics and computer games and financial independence.

But here's the thing. After browsing Reddit for thirty minutes or an hour, I'm left feeling unsatisfied. In fact, I'm often in a bad mood. After browsing Reddit, I have a negative attitude. My view of the world has deteriorated. Why? Because for all the fun and interesting things on Reddit, it's also filled with a bunch of crap.

We didn’t start the FIRE: The true history of financial independence

I used to be a collector. I collected trading cards. I collected comic books. I collected pins and stickers and mementos of all sorts. I had boxes of things I'd collected but which essentially served no purpose.

I can't say I've shaken the urge to collect entirely, but I have a much better handle on it than I used to. A few years ago, I sold my comic collection and stopped obsessing over them. Today, I collect three things: patches from the countries I visit, pins from national parks, and -- especially -- old books about money.

Collecting old money books is fun. For one, it ties to my work. Plus, there's not a huge demand for money manuals, so there's not a lot of competition to buy them. (Exception: As much as I'd love a copy of Ben Franklin's The Way to Wealth, so would a lot of other people. That one is out of my reach.)

Action creates motivation

Human beings are interesting creatures. I'm fascinated by them. That's probably the reason I was a psychology major in college. It's certainly the reason that I believe (strongly) that everybody is talented, original, and has something important to say. (That bit of philosophy is something I picked up from Brenda Ueland's marvelous book, If You Want to Write.)

People are awesome — even if we're each flawed in our own way.

One thing I've noticed over the past few years is the dichotomy between knowing something and doing something. It's one thing to understand a concept or fact intellectually; it's a completely different thing to experience a fact or concept, or to put it into practice. Continue reading...

I am the one thing in life I can control

Three weeks ago, I drove from Portland to Colorado Springs to participate in Camp FI, a weekend retreat for people interested in financial independence and early retirement.

Under normal circumstances, I wouldn't drive this distance. It's a 1300-mile trip that takes at least twenty hours to cover. Or, if you're me, it's a 1400-mile trip that takes 23 hours of driving spread over two days.

But, in case you haven't noticed, we're in the middle of a global pandemic, and although I'm not nearly as cautious as many of my friends, I don't relish the idea of confining myself to close quarters with dozens of strangers for hours on end in an airplane. Besides, I like to drive. And I love the beauty of the American west. And I needed some time alone to think deep thoughts — and to listen to the Hamilton soundtrack over and over and over again. Continue reading...

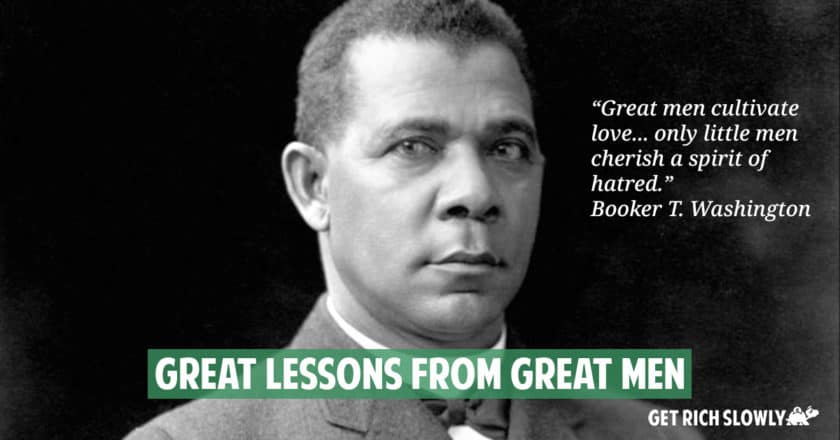

Great lessons from great men

Because I write a personal finance blog, I read a lot of books about money. I'll be honest: they're usually pretty boring. Sure, they can tell you how to invest in bonds or how to find the latest loophole in the tax code. But most of them lack a certain something: the human element.

Over the years, I've found that it's fun to read a different kind of money book in my spare time. I've discovered the joy of classic biographies and success manuals, especially those written by (or about) wealthy and/or successful men. When I read about Benjamin Franklin or Booker T. Washington or J.C. Penney, I learn a lot — not just about money, but about how to be a better person.

Here are some of the most important lessons that these books, written by and about great men of years gone by, have taught me. Continue reading...

What is a robo-advisor? An introduction to automated investment tools

One of the joys of writing a money blog like Get Rich Slowly is the continuing self-education. I'm always reading and learning about personal finance. A lot of the times -- as in the past month -- this education is about esoteric topics. I'm currently diving deep into the history of personal finance, a subject that's interesting to me but admittedly not of much practical use in the modern world. (Today in the mail, I got a book about advertising and the use of credit during the 1920s. How's that for esoteric?)

But sometimes, this self-education does have practical uses, and it's stuff that I can share with you folks so that you too can become better educated.

For instance, I have a huge blind spot when it comes to so-called "robo-advisors". When I stopped writing here in 2012, robo-advisors existed but they hadn't yet become a Big Deal. By the time I re-purchased this site in 2017, things had changed. Robo-advisors had become a major force in the investment industry -- and I was clueless about what they were.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)