How to manage a windfall successfully

This entry is part of JLP's October project — a month-long, cross-blog review of the book The Bogleheads' Guide to Investing. Some of what follows is taken directly from the book.

You have won $50,000! So, what do you do now?

Every day I give advice on following the slow, sure path to wealth. But what happens if you do manage to get rich quickly? What happens if you win the lottery, or hit the jackpot in Vegas, or inherit a million bucks from your Great Aunt Tilley?

Continue reading...

Every day I give advice on following the slow, sure path to wealth. But what happens if you do manage to get rich quickly? What happens if you win the lottery, or hit the jackpot in Vegas, or inherit a million bucks from your Great Aunt Tilley?

Continue reading...

Make a wish list of financial goals

If one moves confidently in the direction of his dreams, and endeavours to live the life which he has imagined, he will meet with a success unexpected in common hours. — Henry David Thoreau

What would you do if money were not a concern? Would you quit your job? Would you travel? Would you live in another state? Another country? Would you write? Would you garden? Would you devote your life to charity? Would you race cars? Would you enter politics?

Many people make poor financial decisions because they don't have long-term personal goals. If you don't understand that buying a new cell phone or playing a game of poker takes money from a larger goal — a new home, a new car, a vacation to Europe — then there's no incentive not to use the money for whatever seems fun at the moment.

<The high cost of being fat

I am fat.

I am fat, but I am not obese. I do not pause to catch my breath when climbing stairs. I do not avoid hikes or sports for fear of failure. But — no mistake — I am fat. I am far above my normal weight. I carry 205 pounds on a frame built for someone forty pounds lighter. [PDF: Body mass index and health, from the USDA.]

How does this relate to personal finance? Your health is your most important asset. Not your house. Not your car. Not your job. Not your retirement account. These are secondary. Your health is your most important asset. Even someone as young as I am (37) can face serious financial repercussions from being overweight.

Are You Normal About Money?

How much do families spend on food? How much has the average person saved for retirement? Do others balance their checkbooks every month? Every week? Every day? When shopping for homes, how much time do people take?

I recently spent $4 on a book that answers these questions and others like them. Are You Normal About Money? by Bernice Kanner purports to offer a statistical representation of the financial lives of normal Americans. While I question the methodology — it mostly comprises the results of surveys at bloomberg.com, hardly a scientific sample — the results are interesting.

Here are some typical questions and responses:

How much should you tip? Tipping guidelines for the U.S.

What about when I pick up Chinese takeout? Should I have tipped the guys who delivered our new gas range last fall? What about a hotel bellhop? A parking valet? Out of curiosity, I did some research on tipping practices in the United States. There's actually significant disagreement about how much to tip for even common services.

For example, you know you should tip your waitress. But how much should you leave? Some people claim that 10% is adequate. Others claim that 20% is standard. But I suspect that most of us learned to tip 15%, and to give more for exceptional service. (The Wikipedia entry on tipping currently contains the bizarre claim that "18% is generally accepted as a standard tip for good service".) Which amount is correct? Continue reading...

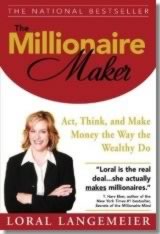

Book review: The Millionaire Maker

Loral Langemeier claims that she can turn anyone into a millionaire. In her recent book The Millionaire Maker, she writes:

You can give me someone who's severely in debt, you can give me a single mom on a low income, you can even give me a guy who's living a big lifestyle on fumes. I can take all of them and make them millionaires.

The Millionaire Maker attempts to codify Langemeier's "proprietary Wealth Cycle Process". (That's how she writes it — with capital letters. Langemeier is big on capitalized jargon, tossing around terms like Financial Baseline, Gap Analysis, Freedom Day, Cash Machine, Wealth Accounts, Forecasting, Wealth Account Priority Payment.)

Continue reading...

The Millionaire Maker attempts to codify Langemeier's "proprietary Wealth Cycle Process". (That's how she writes it — with capital letters. Langemeier is big on capitalized jargon, tossing around terms like Financial Baseline, Gap Analysis, Freedom Day, Cash Machine, Wealth Accounts, Forecasting, Wealth Account Priority Payment.)

Continue reading...

Money interviews: Imagination Movers

This is the first of a planned series in which I interview friends and family about their attitudes toward money. Most of these will be anonymized (and much shorter). Some will not. This first interview is with Scott Durbin, a member of Imagination Movers, a rock band for kids. This band is an entrepreneurial venture that required a huge leap of faith.

Scott, what made you and the other Movers decide to form a band? And why a band for kids?

Once you get into your 30s, you begin to feel opportunities to be creative evaporating. This time in our lives is often devoted to starting families, working for the company, paying bills to stay above the proverbial water, or working on our various relationships (wife-husband, boyfriend-girlfriend, other). I could get philosophical about the conflict and guilt of doing something seemingly self-indulgent versus being a good father/husband/worker, but let's save that for another day. Luckily I have an amazing wife!

Several forces led to the founding of the Imagination Movers.

I Was a Grade-School Entrepreneur

My father was an entrepreneur. He was always starting businesses. Most failed. Some succeeded in a wild fashion. (The inheritance he left the family is in the form of his most successful business, the source of my day job.)

It's no surprise that as a child, I wanted to make money too.

I made my first business venture when I was in the second grade. I sold lemonade by the side of the road. It was miserable failure. I was trying to sell lemonade in March, on an infrequently-traveled stretch of country road, in rural Oregon. I didn't sell any lemonade.

In praise of the debt snowball

During my twenties, I accumulated nearly $25,000 in consumer debt. I had a spending problem. With time, I was able to get my spending under control (mostly), but I still owned overwhelming debt. How could I get rid of it?

The personal finance books all suggested the same approach:

- Order your debts from highest interest rate to lowest interest rate.

- Designate a certain amount of money to pay toward debts each month.

- Pay the minimum payment on all debts except the one with the highest interest rate.

- Throw every other penny at the debt with the highest interest rate.

- When that debt is gone, do not alter the monthly amount used to pay debts, but throw all you can at the debt with the next-highest interest rate.

This made perfect sense. By doing this, I would be paying the minimum amount in interest over the long term. The trouble was, my highest-interest rate debt was also my debt with the biggest balance (a fully-maxed $12,000 credit card at 19.8% interest). I'd plug away at this debt for several months at a time, but then give up because it felt like I was never getting anywhere.

Track every penny you spend

I struggled with debt for years. I couldn't get a handle on where my money went. I made a decent wage, but I was always broke! Where did I spend it all? Then I read Your Money or Your Life and heeded the book's advice to "keep track of every cent that comes into or goes out of your life". The results were startling.

What does it mean to keep track of every penny you earn? Your Money or Your Life recommends that you keep a Daily Money Log. This log can take any form.

- a pocket-sized memo book

- an index card (or the hipster PDA)

- an actual PDA

- an appointment book

- a computer text file

- a checkbook register

- personal finance software

- a spreadsheet

The most important thing is to use the log. Every time you get money -- whether it's from a paycheck or a garage sale or picking up change from the ground -- write it down. Every time you spend money — whether it's paying bills or buying coffee or paying bus fare — write it down. Keep track of every penny that enters or leaves your life.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)