How to Sell a Used Car

Most buyers are honest people, and are happy to be working with a private party instead of a dealership. To get the best price from your car, follow these steps:

- Prep your vehicle. Check the vehicle to be certain that everything works. You may consider having a mechanic examine your car and issuing a report about its condition.

- Research the market. Spend a few weeks scouring your local used-car classifieds to learn what people are asking for similar vehicles. Use the Kelly Blue Book or NADA Guides to get additional information.

- Set a competitive price. Determine what you think your car is worth, and then add a little to the price for wiggle room. (You don't want to start negotiations from the price you think the car is worth.) Decide on a rock bottom price below which you will not entertain offers.

- Gather records. Prepare a folder containing all maintenance records. If you had a mechanic inspect the car, include his report. Consider purchasing a vehicle report from CARFAX — it can help set potential buyers' minds at ease. Also have a bill-of-sale ready to go. (What you need for a bill-of-sale will vary by location; here's a list of state motor vehicle division websites.)

- Clean your vehicle. Wash the car thoroughly. Don't just run it through a car wash — scrub it down. Wax it. Clean the interior. Get all the junk out of it and vacuum it. Make it look its best.

- Create an advertisement that sells. Mention top options and improvements. List any recent upgrades, such as new tires or battery. Has your car lived all its life in a garage? Say so! Do you have all the maintenance records? Mention that, too.

- Spread the word. Get as much exposure for your ad as possible. The more demand you can generate, the more money you'll make. Online, try craigslist, Autotrader, and Cars.com. (Quality photos are important for online ads.) Run your ad in a newspaper over the weekend, when it will reach the largest audience.

- Be prepared to answer questions. People will call or e-mail to ask for more specific information. Be ready to provide it. Keep a list of key facts by the phone.

- Show your car to interested buyers. If you're nervous about your ability to deal with people, get somebody to help. You're selling yourself as well as the car, so make a good impression. Allow the buyer to take a test drive, but be sure to ask for a valid driver's license first! Permit buyers to take the car to their mechanic, even if you've already taken it to yours.

- Negotiate a fair price. A good price is fair to both parties. Having done your research, you'll know what your car is worth. Be confident in this knowledge. When you're sure of a vehicle's value, it's easy to stand strong when somebody tries to lowball you. Have a firm bottom price in mind, but if a reasonable offer is only a couple hundred dollars from this figure, consider accepting it.

- Make the sale. Complete a bill-of-sale transferring ownership. Again, what you need for a bill-of-sale will vary by location. (Here's a list of state motor vehicle division websites.) Ask for cash or a cashier's check. (Here's a page about avoiding fraud, including fraudulent cashier's checks).

- Take care of details. After the sale is complete, cancel your insurance on the vehicle. Offer your phone number to the buyer so that you can answer questions, but be clear that the sale is final.

If anything about the transaction makes you nervous, call it off. If the buyer seems shady, he probably is. If the buyer wants to pay more than you're asking and then be issues a refund, he's probably trying to pull a scam. Don't do it. Trust your gut.

If your car has trouble, if it's a lemon, don't sell it to a private party. Sell it to a dealer. You'll get less money, but you won't be screwing over somebody else. And the dealer will be better equipped to repair the trouble. Remember: your goal is to provide an excellent transaction for yourself and for the buyer. You're not there to rip anybody off.

Financial Advice from a Founding Father

In celebration of Independence Day, I've gathered some personal finance advice from Benjamin Franklin, one of our Founding Fathers. Franklin was witty, wise, and eminently practical. He was a master of thrift and frugality. Nearly three hundred years later, his advice is still worth heeding.

- "A penny saved is a penny earned."

- "Buy what thou hast no need of and ere long thou shalt sell thy necessities."

- "Beware of little expenses. A small leak will sink a great ship."

- "Fools make feasts and wise men eat them."

- "In this world nothing is certain but death and taxes."

- "He that goes a-borrowing goes a-sorrowing."

- "By failing to prepare, you are preparing to fail."

- "Fond pride of dress is, sure, a very curse;

Ere fancy you consult, consult your purse." - "'Tis easier to surpress the first desire than to satisfy all that follow it."

- "The second vice is lying, the first is debt."

- "Lying rides upon debt's back."

- "Creditors have better memories than debtors."

- "The borrower is slave to the lender and the debtor to the creditor."

- "Rather go to bed supperless than rise in debt."

- "Women and wine, game and deceit,

Make the wealth small and the wants great." - "Many estates are spent int he getting,

Since women for tea forsook spinning and knitting,

And men for punch forsook hewing and splitting." - "A fat kitchen makes a lean will."

- "Learning is to the studious and riches to the careful."

- "Have you somewhat to do tomorrow? Do it today."

- "Diligence is the mother of good luck."

- "Industry pays debts, while despair increases them."

- "There are no pains without gains."

- "Industry need not wish."

- "Having been poor is no shame, but being ashamed of it, is."

- "Early to bed and early to rise, makes a man healthy, wealthy and wise."

- "Sloth makes all things difficult, but industry all things easy."

- "But doest thou love life? Then do not squander time, for that's the stuff life is made of."

- "He that can have patience can have what he will."

- "He that is of the opinion money will do everything may well be suspected of doing everything for money."

- "For having lived long, I have experienced many instances of being obliged, by better information or fuller consideration, to change opinions, even on important subjects, which I once thought right but found to be otherwise."

- "Any society that would give up a little liberty to gain a little security will deserve neither and lose both."

If you're interested in more of what Franklin has to say about thrift, please read his thoughts on "The Way to Wealth", which are too extensive to reprint here.

Necessary Hints to Those That Would Be Rich

(by Benjamin Franklin, from Poor Richard's Almanack (1737))

17 Ways to Save Big at the Supermarket

My wife isn't one of those women who can buy hundreds of dollars of groceries for $12.93. She is, however, a frugal shopper, and can often trim an $80 bill to a $60 bill. Here are some of her top tips:

-

- Don't shop for groceries if you're hungry. You've probably heard this before, but it's true. Studies show that folks who shop when they're hungry buy more. It's true for me: If I go to the store for milk on a Sunday morning without eating breakfast, I'm likely to come home with donuts and orange juice and Lucky Charms, too.

- Shop with a list. Make a list and stick to it. The list represents your grocery needs: the staples you're out of, and the food you need for upcoming meals. When you stray from the list, you're buying on impulse, and that's how shopping trips get out of control. Sure, a magazine only costs $5, but if you spend an extra $5 every time you make a trip to the supermarket, you waste a lot of money.

- Choose a grocery store and learn its prices. As I mentioned yesterday, supermarkets monkey with prices. You can't be sure a sale price is really a deal unless you know what the store usually charges. Once you learn the prices at one store, you can save even more by adding another supermarket to the mix. Learn its prices, too, and note how they compare to the first. Your goal should be to recognize bargains. You want to know when those Lucky Charms are really on sale.

- Buy in bulk, when possible. You can save a lot of money by taking advantage of economies of scale. But there are times you shouldn't buy in bulk, too: if the larger bundle is actually more expensive per serving, if you don't have room to store larger packages, if you won't actually use more of the product before it spoils. You don't want stale Lucky Charms.

- Stock up on non-perishables, if you have space. Investing in five tubes of sale toothpaste is better than buying one on sale now and four later at the regular price. If a favorite product goes on sale, buy as much as you will use before it goes bad. Again: be certain that the sale price is really a bargain. Great items to hoard include: dried pasta, canned foods, toiletries, baking supplies, cereal, and cleaning supplies.

- If you do seasonal baking, stock up year round. Dried fruit and nuts will keep in the fridge or freezer. Decorating supplies can be stored in a cupboard or cellar. By planning ahead, you can purchase seasonal goods when they're cheapest rather than when you need them.

- Know when to shop at big box stores. Costco and Sam's Club don't always have the best prices, and their selection is limited. However, they do have great deals on many items, including vitamins, toiletries, baking supplies, pet supplies, and paper products.

- Compare unit pricing. The biggest package isn't always the cheapest. Stores know that consumers want to buy in bulk, and so they mix it up: sometimes the bulk item is cheaper, sometimes it's more expensive. The only way you can be sure is to take a calculator. (Mapgirl says she uses the calculator on her cell phone.) Our grocery store posts unit pricing for most items, which makes comparisons easy.

- Check your receipt. Make sure your prices are scanned correctly. Make sure your coupons are scanned correctly. Sale items, especially, have a tendency to be in the computer wrong, and yet few people ever challenge the price at the register. You don't need to hold up the line: simply watch the price of each item as it's scanned. If you suspect an error, step to the side and check the receipt as the clerk begins the next order. If there's a problem, politely point it out. It's your money. Ask for it.

- Use coupons, but only to buy things you actually need (or want to try). Gather coupons from your Sunday newspaper, from weekly circulars, from in-store booklets, or from online sources. Ask friends and family to save them for you. Sort through them while you're doing something mindless — watching television, talking on the telephone, riding the bus. Clip coupons for products you use (or cheap alternates), or for products you'd like to try.

- Use coupons for staple foods and ingredients, not highly-processed foods.

Highly-processed foods have enormous markups. "You shouldn't even buy processed foods because the markups are so high," my wife advises. Coupon savings barely make a dent in the price. If you must buy processed foods, wait for a good sale and then add the coupon so that you can get them at an excellent price.

- Take advantage of special coupons whenever possible. Double coupons are great. My wife's likes the "get $10 if you spend $50 or more" variety. Coupons for produce are rare — seasonal produce is often the cheapest and freshest. These special coupons can yield big savings.

- For maximum savings, combine coupons with in-store sales. What happens when you combine a steep in-store discount on Lucky Charms with a 50-cents-off coupon and a double coupon? You get very cheap Lucky Charms, that's what.

- Plan your meals around what's on sale. Every week, before making a shopping list or planning what to eat, go through your flyers and coupons. Check the calendar to see if there are any big events approaching for which you'll need food. If you like meat, plan your menu based on the sale cuts.

- Examine sale flyers carefully. On the front page are the things that the store really wants you to buy. Be wary of these. Note any special bargains. This week, for example, our store had many items on sale at ten for ten dollars, including dried pasta.

- Take advantage of "buy one, get one free" offers. Split with a friend, if needed. You many not need two pot roasts, but it's the same as getting one for half price if you find a friend to split the expense. (Alternately, pay the normal price and give the second away as a gift. Who wouldn't love a free pot roast?)

- My wife's final piece of advice? "Let your husband come with you for the company, but don't let him put anything in the cart." The experts agree.

Note: this entry started as a response to Punny Money's grand coupon experiment. Nick is convinced that he can't save any money with coupons. I went to my wife for a rebuttal, but I didn't get one. "Coupons are usually for things you don't need," she told me. "Sales are the same as coupons — you have to lump them together in your head. It's all just finding bargains."

Things Your Supermarket Won’t Tell You

SmartMoney has a list of ten things your supermarket won't tell you. Though this was first published five years ago, it's still informative:

- "We trick you into paying higher prices." Frugal folk preach "buy in bulk". But supermarkets have caught on. Now bulk isn't always cheaper. "We found proof at a store near the SmartMoney offices, where a 12-ounce bottle of Aunt Jemima syrup cost $2.09, while a 24-ounce bottle was $4.65; a quart of Lactaid milk was selling for $1.79, while a half-gallon was $3.85." Always check the unit pricing.

- "Our 'specials' are anything but." Some stores raise prices on advertised specials. Coupons are often for more expensive brands. Your best defense: shop at one store and learn its prices.

- "Everybody pays a price for our 'loyalty' program." You either pay higher prices by not joining, or you pay with your privacy by signing up. Some experts advise using a fake name when joining these programs.

- "Our stores might make you sick..." Insects, rats, and other vermin are a problem for any place that handles a large quantity of food.

- "...and if they don't, our employees will." Cleanliness programs cost money. And people are lazy, in the grocery industry just as anywhere else. Surveys have found that nearly half of all deli and meat workers engage in unsafe practices.

- "Federal guidelines? Who cares?" There's no uniform standard for supermarket safety. Some of the guidelines are thirty years old, and there's little enforcement.

- "'Fresh' is a relative term." "Except for regulations about baby food and infant formula, there are no federal laws mandating product dating. In most states a retailer may legally sell foods beyond the date on the package as long as the product can be considered unspoiled and safe to eat. Even repackaging is legal."

- "We like to play head games." Remember my review of Why We Buy? Supermarkets use many subtle ploys to get you to buy more than you plan. Sometimes not even shopping with a list will save you.

- "Our product offerings are rigged." Supermarkets make more profits from manufacturers than from consumers. Manufacturers pay "slotting fees" to have their products placed in desirable locations. Supermarkets say these fees keep costs low for customers, but the manufacturers say the fees result in increased wholesale prices.

- "Our scanners are a scam." You're overcharged more than you think. "Over the course of one year, [one man] patronized California supermarkets that give customers an item for free if the scanner rings up the wrong price. By year's end, he says, he took home more than $4,000 in free good..."

More insider info on grocery stores

This article was posted at Digg, where the members have shared some great comments. Here are some of the best.

One supermarket employee notes:

Phil Town’s rule #1 investing

Rule #1 by Phil Town is not a general personal finance book, and it's not a book for beginning investors — it turns a lot of conventional investment wisdom on its ear. The book explores a philosophy ascribed to Columbia University's Benjamin Graham (author of The Intelligent Investor), and popularized by Graham's student, Warren Buffet (perhaps the most successful investor of all time).

Rule #1 by Phil Town is not a general personal finance book, and it's not a book for beginning investors — it turns a lot of conventional investment wisdom on its ear. The book explores a philosophy ascribed to Columbia University's Benjamin Graham (author of The Intelligent Investor), and popularized by Graham's student, Warren Buffet (perhaps the most successful investor of all time).

What is The Rule? "There are only two rules of investing: Rule #1: Don't lose money [...] and Rule #2: Don't forget Rule #1." Town writes: "Most Americans are trapped in mutual funds that, at best, ride the waves of the market." He believes that his method can help investors break free from these cycles.

At its heart, Town's philosophy is simply "buy low, sell high". He's not pushing a get-rich-quick scheme (though at times, especially early in the book, that's exactly how it comes across). But he's certainly encouraging his readers to abandon traditional "get rich slowly (and surely)" techniques. Continue reading...

How to Walk for Fun and Profit

In the United States, we value our cars. We've become a nation of drivers. It rarely occurs to us that walking might be an option, even for short journeys. One-quarter of all automobile trips in the U.S. are less than a mile in length; forty percent are less than two miles (one source of many). Looked at another way: of all trips less than a mile in length, eighty percent are made by car (source).

I know a man who drives to work, even though he lives half a mile from his office. Why does he drive? Because he may need the car for some errand during the day. How many errands did he run during the workday last week? None. The week before? None.

I have a family member who will spend time circling a parking lot, looking for the perfect space. In the time it takes her to find these utopic spots, she could usually have parked farther from the entrance and burned some calories by walking a few hundred feet to the store.

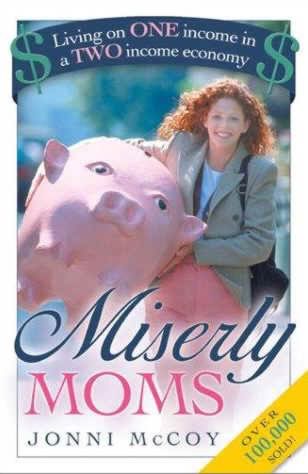

Miserly Moms: Living on One Income in a Two-Income Economy

Don't judge a book by its cover. Most especially, don't judge a personal finance book by its cover. Books promising quick riches and sure-fire investment schemes are generally filled with impractical gimmicks, or lead the reader into the land of financial risk, where fortunes are lost more often than they're made.

Don't judge a book by its cover. Most especially, don't judge a personal finance book by its cover. Books promising quick riches and sure-fire investment schemes are generally filled with impractical gimmicks, or lead the reader into the land of financial risk, where fortunes are lost more often than they're made.

Sometimes it's the most unassuming of books that offers the best advice, that can actively help you on your quest to get rich slowly. Miserly Moms: Living on One Income in a Two-Income Economy by Jonni McCoy is one of these books.

Miserly Moms doesn't offer advice for the Big Picture. Its focus is helping people save money on the little things. The book is ostensibly a guide for stay-at-home mothers, but is actually filled with useful tips for anyone who is concerned with frugality, especially for parents with young children.

Free comics from the federal reserve

Many frugal folks are geeks at heart. Now you can indulge both sides of your personality with comic books from the Federal Reserve Bank!

The Federal Reserve Bank of New York has been publishing educational cartoon-style booklets since the 1950s. "The Story of the Federal Reserve System" is one of ten titles currently available. The comic book is intended for the general public, especially students in high school and introductory-level college economic courses.

Up to 35 copies of each comic book are available free. Additional copies are 25 cents each, with exceptions for classroom use. To order, write to the Public Information Department, Federal Reserve Bank of New York, 33 Liberty Street, New York, New York 10045. These publications can also be ordered online.

26 cheap camping tips

Backpacking and camping are awesome frugal activities. It costs nothing to take a hike. It costs a bit more to camp overnight, but even that can be done inexpensively. While browsing the web for camping stuff, I stumbled upon a great list of frugal suggestions that were originally posted to the Usenet group rec.scouting on 03 December 1994!

According to the original poster:

These low-cost equipment/ideas/fixes for Scouting and camping in general [were] originally found on a F-Net Scouting board and [were] reposted on Fidonet on Nov 11/92 by Steve Simmons. The file evidently originated with BSA Troop 886 in the USA.

Once-a-Month Cooking: Cooking for the Rushed

Get Rich Slowly-reader Kevin comments:

Eating well on a budget requires some thought. But planning out a whole month of meals, and shopping for that month (you only get two paychecks a month) is the real challenge. Is there a website with a month long meal plan of healthy meals, in a spreadsheet shopping list, that can be used at most grocery stores? I cannot find any.

While you can try the 14-day trial of $5 Meal Plan, my brother suggests books might be more useful than websites for long-term meal planning. His family has been using a couple of volumes that do just what Kevin wants:<