Building financial empathy

Every night, I listen to audiobooks all night long. They lull me to sleep.

If I tried to listen to new books, of course, that’d be a problem. I wouldn’t hear 90% of the story. But I’ve learned to listen to books I know and love — books like True Grit and The Lord of the Rings — because then it doesn’t matter when I miss large chunks of the story. I already know what happens. If I wake up for five minutes at 2 a.m., I can listen as Frodo and Sam tramp through the Dead Marshes then drift back to sleep again.

This week, I’ve been listening to one of my favorites: Harper Lee’s To Kill a Mockingbird (read by Sissy Spacek). It’s terrific.

Near the start of of the book, young Jean Louise Finch — better known as Scout — comes home from her first day of school and tells her father she never wants to go back. Atticus thinks for a while before offering his daughter a piece of advice:

“If you can learn a simple trick, Scout, you’ll get along a lot better with all kinds of folks. You never really understand a person until you consider things from his point of view…until you climb into his skin and walk around in it.”

Atticus is trying to convince Scout that her teacher isn’t all bad — she just has a different background and a different point of view. Atticus believes that before Scout condemns or criticizes Miss Caroline, she should practice a bit of empathy.

This is great advice for everyone, and for all aspects of life — even personal finance. Empathy is a skill that seems to have faded from our society (if it ever was truly present); instead, we’re quick to judge each other based on caricatures and stereotypes and incomplete information.

- “Trump supporters are ignorant fools!”

- “Liberals vote based on emotion, not logic!”

- “If you’re in debt, you’re an idiot!”

It’s very easy to judge (and condemn) others who believe differently than you do. It’s especially easy when these folks make seemingly dumb decisions: Your best friend buys a new Dodge Challenger when she can barely pay her rent; a former co-worker takes a week-long vacation to Venice immediately after losing his job; your sister buys a new house even though she intends to move in a couple of years.

Rather than write these people off as “stupid”, I think it’s important to stop for a moment to consider why they do the things they do. It’s rarely because they lack intelligence. There’s usually something deeper going on. And as Atticus Finch suggests, it’s in our best interest to climb inside their skin and walk around in it. That’s the only way we can understand what makes them tick.

A Rush to Judgment

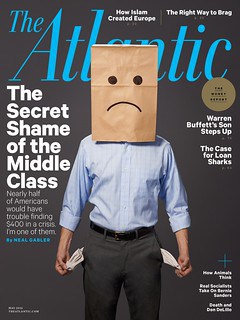

The May 2016 issue of The Atlantic contained an article that caused big waves in the personal finance community. Neal Gabler wrote about what he calls the secret shame of middle-class Americans: They’re broke and in debt. They suck with money.

Gabler writes:

Financial impotence goes by other names: financial fragility, financial insecurity, financial distress. But whatever you call it, the evidence strongly indicates that either a sizable minority or a slim majority of Americans are on thin ice financially.

Gabler cites a survey that found nearly half of all Americans would struggle to cope with a $400 emergency. He admits he’s one of them. He then spends 6000 words describing dumb things he’s done with money: He chose to live in a city with a high cost of living (New York). He continually moved to more expensive homes. He chose to pay for his daughters’ college education. And their weddings. Gabler and his wife didn’t just deplete their own savings — they depleted his parents’ savings as well!

It is very, very easy to pick this article apart and marvel at the poor choices the author made. His entire financial life seems to have been reactive rather than proactive. Honestly, Gabler is the polar opposite of what I call a money boss, a person who actively strives to take charge of her financial situation.

Two years ago, it was interesting to hear people’s reactions to Gabler’s article. Many folks told me they had zero sympathy for him and his situation (largely because it’s totally self-induced). “The author’s an idiot,” one person said. Another person wrote by email: “This article really made my head spin. It is the opposite of everything I believe in.”

My initial reaction was similar. As I read the essay, I was dumbfounded by Gabler’s decisions. (I was even more perplexed by what point he was trying to make. What was his purpose for writing the article? What’s his thesis? I mean, it has to be more than “half of Americans are unprepared for financial emergencies” — doesn’t it?)

But then I got to thinking. I used to be like this too. For decades, I did dumb things with money. I financed my lifestyle with credit-card debt. I bought things not because I valued them, but because they were the things people my age (and in my circumstances) bought. I had no savings. If a $400 emergency arose, I borrowed money from a family member.

The problem wasn’t that I was stupid or that I didn’t understand how money works. I understood perfectly well! But just because you know how to do something in theory, that doesn’t mean you can do it in practice. (Example: In theory, I know how to give a great speech. In practice, I suck.)

My problem with money wasn’t the math. My problem was the emotions. I didn’t have a handle on my personal psychology. It wasn’t until I decided to manage my life like a business that my situation improved. Again, that decision had nothing to do with math. It was all about mindset.

Because I was once in Gabler’s shoes, I can empathize with his plight. And, generally speaking, I can empathize when the people I know do dumb things with money. When a friend makes a poor choice, instead of rushing to judgment I try to put myself in their place, to ask why they did what they did. That doesn’t mean I approve of their choices — just that I try to understand them.

Financial empathy allows me to appreciate other people’s motivations, and that in turn helps me provide better advice about money.

A Mental Exercise

There’s another less-obvious way you can use financial empathy. In fact, it’s one of my favorite mental exercises. Here’s how it works.

Whenever you encounter somebody with an interesting lifestyle, try to extrapolate what your life would be like in a similar situation given your current financial resources (and knowledge).

Let me give you some examples of what I mean.

Based on my current savings and spending, I am financially independent. I have a net worth of around $1.5 million and I normally spend less than $50,000 per year. My resources can support my lifestyle — but they can’t support every lifestyle.

During our 15-month RV trip across the U.S., Kim and I stopped in Montana to see some friends who have a high income and abundant savings. They live in a fancy new house on the banks of a river. They have fancy furniture. They take fancy vacations. After the visit, I tried to work out how much their lifestyle cost and how long my financial resources would support it if I were in their shoes. Answer: Not long. Four or five years, at best.

I did the same thing when we spent a day in downtown Chicago later in the trip. I loved the look and feel of the city, and wondered what it would cost to live there. I looked up home prices. (A place in the Jetsons-like Marina City complex would cost about the same as my home in Portland.) I noted grocery prices. I took into account I wouldn’t need to own a car. I tried to imagine what my life in the Windy City would be like. Ultimately, I concluded it’d probably cost a little more than what I spend in Portland, but that I’d still be financially independent.

Of course, not every place is as expensive as downtown Chicago or the banks of a river in northern Montana.

At the end of our RV trip, Kim and I spent a few days visiting my cousin Gwen in Tahlequah, Oklahoma. She and her family live on 100 acres they purchased for $110,000 in 2007. Because they’re conservative Mennonites, they have what most would consider a simple (or basic) lifestyle. They grow much of their own food in a large vegetable garden. They raise goats and cows for milk and meat. They get their water from a mineral spring running through their back yard. They’re not completely self-sufficient, but they do what they can to keep costs down.

If we sold our “country cottage” here in Portland, we could buy a similar creek hollow near Tahlequah, build a house, and still have plenty of money left over from the sale of my home. Because cost of living is so low in rural Oklahoma, I could live like a king indefinitely. I wouldn’t even have to watch my spending! I could buy the fanciest groceries, eat in the fanciest restaurants, and wear the fanciest clothes. There’s almost no way I could exhaust my savings unless I started buying expensive sports cars or flying first-class to Asia.

You don’t have to travel across the United States to do this exercise. You can do it in your own hometown. You can do it by trying to put yourself in the place of people you know. When you visit with a friend who seems to handle money poorly, put yourself in his shoes. Imagine you have your current financial resources but otherwise lived his life. Could you afford it? What changes would you have to make in order to afford it?

I believe mental exercises like this are invaluable. They not only help you explore other possible lifestyles, but they help you develop financial empathy. After putting yourself in your sister’s shoes, you still might think she’s making poor decisions. But at least you’ll have a better appreciation for what she’s experiencing.

Building Financial Empathy

Financial empathy can be used in lots of other ways.

For instance, I’ve noticed that people have a tendency to think that because they do something a certain way, everybody else can (and should) do it that way too. If their path to Financial Independence includes working three jobs, they think everyone should work three jobs. If they’ve elected to cut costs by living without a car, they think everbody should live without a car. And so on. When people don’t do the same things they do, they judge them harshly.

I don’t like this attitude. It demonstrates a fundamental lack of financial empathy.

I’m not saying that you should condone frivolous spending from family and friends, or that you shouldn’t share (and advocate for) the methods that have helped you achieve financial success. But don’t fall into the trap of thinking that yours is the only way — and don’t let yourself think of others as “stupid” or “weak” when they make mistakes.

When I started Get Rich Slowly, my motto was: “Do what works for you.” By this I meant that there was no one right way to dig out of debt, buy a house, or fund retirement. Some strategies might be more effective than others, but that doesn’t make them “right”. (Dave Ramsey’s version of the debt snowball is fine example. Not optimal from a mathematical perspective, but often the best choice from a psychological point of view.)

Similarly, no two people will pursue financial freedom in an identical fashion. My path to Financial Independence involved writing millions of words about money while purging half of my possessions. I’ll bet your path has been completely different.

The bottom line? We’d all do well to heed the words of Atticus Finch: “You never really understand a person until you consider things from his point of view…until you climb into his skin and walk around in it.” Rather than rush to judgment, take time to consider things from other people’s perspectives — financially and otherwise. Doing so will not only help you better understand your friends and family, but will also help you better understand yourself.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)