A brief history of U.S. homeownership

During the month of May at Get Rich Slowly, we’re going to turn our attention to home and garden topics. To start, I want to take a brief look at the history of the U.S. housing market. Some folks might find this dry. I think it’s fascinating.

Private land ownership is baked into the U.S. culture and Constitution. It’s part of the material plenty we expect from the American Dream. For most Americans, homeownership implies success and freedom and wealth.

But for a long time, homeownership was the exception rather than the rule. Only farmers were likely to own land and a house during the country’s early days. With the coming of the Industrial Revolution, homeownership became more common for urban dwellers. Still, less than half of all Americans owned their homes until the late 1940s.

Here’s how U.S. homeownership rates of changed over the past 128 years according to the U.S. Census Bureau and the Federal Reserve Bank of St. Louis:

The current U.S. homeownership rate as of January 2018 is 64.2%.

I’m sure you could write a doctoral thesis on the reasons for the growth of homeownership over time. I’m not going to do that. After several hours of research into the history of mortgages and the real-estate industry, I feel like we can summarize everything in a few paragraphs. This article — which is information-only — will serve as background for future Get Rich Slowly discussions about homeownership.

In the Beginning

During the 1800s, most folks had no way to own a house. They didn’t have the lump sum required to make the purchase, and banks wouldn’t lend money for average people to buy homes. Mortgages didn’t become common until the U.S. banking system was stabilized following the National Bank Acts of the 1860s.

After this reform, banks began to experiment with lending money for homes, and by the 1890s, mortgages were popular across the U.S — although not precisely as we know them today.

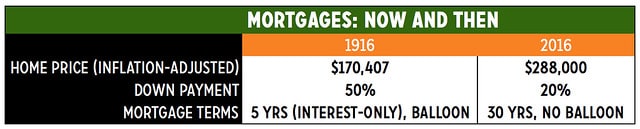

A typical mortgage in the early 1900s might have a term of five years and require a 50% down payment. Plus, they were usually structured with interest-only monthly payments and a balloon payment for the entire principal at the end of the term. Borrowers could (and did) renegotiate their loans every year.

Compare this to modern mortgages, which usually have 30-year terms and require a down payment of only five to twenty percent. (I bought my first home in 1993 with a down payment of less than one percent!)

These early mortgages worked fine until the Great Depression. When that crisis hit, banks had no money to lend — and the average borrower had no cash either. As a result, potential homeowners couldn’t afford to buy, and many existing homeowners defaulted. (At one point during the 1930s, nearly 10% of all homes were in foreclosure!)

Note: This article originally appeared at Money Boss in April 2016. I’ve updated text-based stats through 2018, but graphics-based data is two years old. However, nothing material has changed in the past 24 months.

Bubbles and Booms

To stabilize the housing market, the U.S. government created the Home Owners’ Loan Corporation in 1933, the Federal Housing Administration in 1934, and the Federal National Mortgage Association (now Fannie Mae) in 1938. These institutions helped to arrest the housing crash and, eventually, spur homeownership to new heights.

But it was the G.I. Bill of 1944, which provided subsidized mortgages for World War II veterans, that changed the face of the housing industry and the American economy. From encyclopedia.com:

The GI Bill’s mortgage subsidies led to an escalated demand for housing and the development of suburbs. One-fifth of all single-family homes built in the 20 years following World War II were financed with help from the GI Bill’s loan guarantee program, symbolizing the emergence of a new middle class.

As homebuying became more common (and more complicated), real-estate brokers helped sellers find buyers for their homes. The National Association of Real Estate Boards adopted the term Realtor in 1916. As the housing market boomed during the 1940s and 1950s, so did the real-estate profession.

By 1950, for the first time in American history, more than half of all Americans owned their homes. As demand for housing increased, so did prices.

For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but he’s also researched historical prices. He’s gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website.

This graph of Shiller’s data (through January 2016) shows how housing prices have changed over time:

Shiller’s index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?)

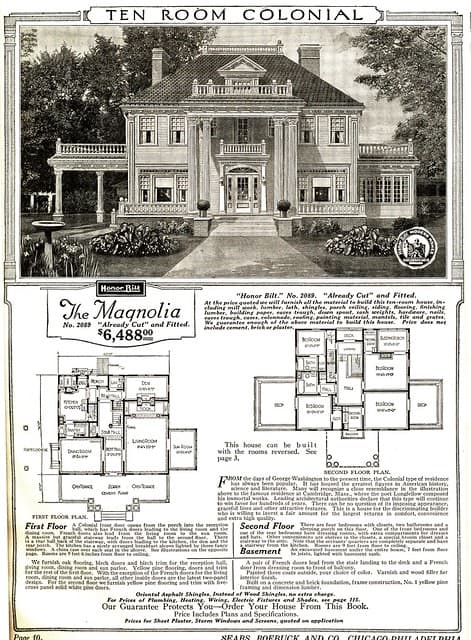

As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didn’t recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale.

For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like we’re at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale.

What caused the housing bubble during the last decade? And what’s feeding the current buying frenzy? That’s a great question, and it’s open to debate. Some folks blame loose lending standards. Some blame a lack of government oversight. Some blame real-estate speculators. Some blame the American propensity for consumption. Some blame cheerleading from the real-estate industry. Me? I think it’s a little of everything.

Bigger Everything!

Naturally, increased home prices and increased ownership rates brought increased mortgages. During the past fifty years, long-term mortgages with large balances became more common until now they’re the standard.

Between 1949 and the turn of the twenty-first century, mortgage debt relative to total income of the average household rose from 20% to 73%, and from 15% to 41% relative to total household assets.

One reason mortgage sizes have increased is that housing sizes have increased.

According to the U.S. Census Bureau, the median size for a new home built in 1973 was 1525 square feet. By 2016, that number had jumped to 2422 square feet. In those forty years, kitchen sizes have doubled, ceilings have risen more than a foot, and bedrooms have grown by more than 50 square feet.

But home sizes are ballooning even as households are shrinking! The average household had 2.9 people in 1973. In 2016, the average household had 2.5 people. Let’s run the numbers: Forty years ago, we had 526 square feet of living space per person; today, we have 969 square feet of living space per person.

To me, this seems crazy. Why do we need such huge houses? What’s the point? And do homeowners truly consider the costs when they choose to buy big? A larger home doesn’t just carry a larger purchase price. It costs more to maintain. It costs more to light, to heat, and to furnish. For too many people, big homes are the destroyer of dreams. (I’m not joking. I truly believe this.)

Full disclosure: In the past, I’ve been guilty of pursuing home-size inflation myself, although I eventually came to see the error of my ways. My first house (purchased in 1993) had 1383 square feet. My second house (purchased in 2004) had 1814 square feet. That was “peak bigness” for me. The condo I sold last year had 1547 square feet. And the house we moved into last July has 1235 square feet. I think about 1000 square feet is ideal, but Kim likes having the extra room.

I’m not saying you should live in a shack. Nor am I suggesting everyone should own a tiny home. But I believe it’s important to be logical when it comes to housing. Remember that size comes with a price. If you need the space, buy it. If you don’t, you’re better off saving your money for something else.

The Bottom Line

Housing is by far the largest expense in the typical budget. According to the U.S. government’s 2016 Consumer Expenditure Survey, the average American family spends $1573.83 on housing and related expenses every month. That’s more than they spend on food, clothing, healthcare, and entertainment combined!

Here at Get Rich Slowly, I’m adamant that one of the best ways — if not the best way — to improve your cash flow is by cutting your costs on housing.

Remember, your goal is to manage your financial life as if you were managing a business. If you were looking to balance the budget at a company you owned, you wouldn’t do it by trying to trim the small expenses. No, you’d tackle your biggest expenses first.

If you reduce your labor costs by 5%, for instance, you might be able to save $50,000 per year. But saving 5% on office supplies would probably only save you $50 per year.

The same principle applies in your personal life. If the typical American household cut their grocery budget by 5%, they’d save only $200 per year. If they cut housing by 5%? Well, they’d save $900 per year. So why do so many people put so much effort into clipping coupons while continuing to shell out for more home then they can afford (or need)? Good question.

In the weeks ahead, I’m going to explore different pieces of the housing equation. When does it make sense to rent? When does it make sense to buy? Is it better to prepay your mortgage or to keep it forever? How can you determine how much home you can afford?

If you have a specific question about housing and money, please let me know!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)