How much house can I afford?

“How much house can I afford?” Answering this question correctly is one of the keys to building a happy, wealthy life. Unfortunately, there's a vast housing industry in the U.S. that's geared toward providing the wrong answer.

You see, housing is by far the largest expense in most people's budgets. According to the U.S. government's 2016 Consumer Expenditure Survey, the average American family spends $1573.83 on housing and related expenses every month. That's more than they spend on food, clothing, healthcare, and entertainment put together!

Too many folks struggling to make ends meet focus their attention on fine-tuning their budget. They try to save big bucks by clipping coupons, growing their own food, and/or making their own clothes. While there's nothing wrong with frugal habits — I applaud everyday thriftiness! — all of these actions combined won't (and can't) have the same impact on your budget as keeping your housing payments affordable.

Part of the problem is what I call the Real-Estate Industrial Complex, each piece of which has a vested interest in convincing consumers that bigger, more expensive homes are better. Real-estate agents, mortgage brokers, home-shopping shows, and glossy magazines all encourage folks to buy at the top end of their budget. But buying at the top end of your housing budget is dangerous.

Buying a home is a huge decision, financially and otherwise. If you're going to purchase a place, it's important to know how much house you can truly afford.

Debt-to-Income Ratio

Economists have used decades of financial stats to create computer models to predict how much people can afford to spend on housing and debt. Banks use these models to figure out how much they think you can afford to spend on housing.

Traditionally, lenders use what's called a debt-to-income ratio (or DTI ratio) — a measure of how much of your income goes toward debt every month — to estimate how much you can afford to pay for a home without risk of defaulting. This might sound complicated, but it's not.

To find this ratio, divide your monthly debt payments by your gross (pre-tax) income. So, for example, if you pay $400 toward debt every month and you have an income of $4000, then your DTI ratio is 10%. If you pay $800 toward debt on a $4000 income, your DTI ratio is 20%. The lower your debt-to-income ratio, the better.

Banks and mortgage brokers look at two numbers when deciding how much to loan:

- The front-end DTI ratio (sometimes called the housing expense ratio), which includes only your housing expenses: mortgage principle, interest, taxes, and insurance.

- The back-end DTI ratio (also known as the total expense ratio), which include all of the above plus other debt payments like auto loans, student loans, and credit cards.

The key thing to understand about debt-to-income ratios is that they're used to estimate the lender's risk, not yours. That is, your mortgage company uses them to check whether they think you'll be able to make the payments — not whether you can comfortably make the payments.

If you want room in your budget for fun, you should opt for a lower debt-to-income ratio than your real-estate agent and mortgage broker say you can use.

If you're a money nerd, you can read more about debt-to-income ratios at Fannie Mae's website.

How Much House Can You Afford?

During the 1970s (before credit-card debt was common), DTI wasn't split between front-end and back-end. There was only one ratio, and it was 25%. If your mortgage, taxes, and insurance costs were less than 25% of your income, people assumed you could make the payment.

This is still an excellent rule of thumb: Spend no more than 25% of your budget on housing. (In fact, this is the number that money guru Dave Ramsey advocates.)

That said, debt-to-income guidelines have relaxed over the years.

- When my ex-wife and I bought our first home in 1993, our mortgage broker told us that our front-end DTI ratio had to be 28% or lower, meaning we couldn't pay any more than 28% of our gross income toward housing. The back-end DTI ratio was capped at 36%, which meant that our housing expenses and other debt payments combined couldn't be more than 36% of our income.

- When my ex-wife and I bought a new home in 2004, the accepted DTI ratios had grown by 5%. “That 28% figure is outdated,” we were told. “Most people can go as high as 33%.” The back-end ratio had been raised to 38%.

- According to the Fannie Mae website, in 2018 maximum back-end DTI ratios are up to 45% (and sometimes even 50%). These numbers are insane. Nobody should be spending half of their gross income on debt — not even mortgage debt! That's a recipe for financial disaster.

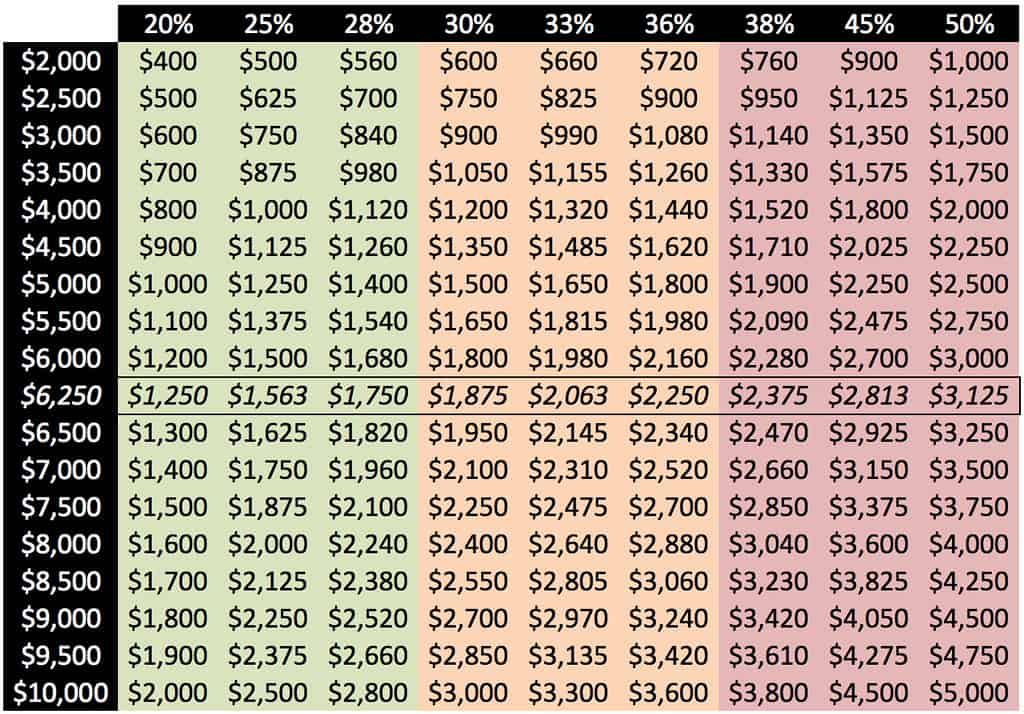

Here's a little table I whipped up to show what sort of housing payment you'd be looking at based on your pre-tax income (the left-hand column) and various debt-to-income ratios (the header row):

A 5% increase in your debt-to-income ratio might not seem like a big deal. But when you're talking about a house payment, it's huge.

In 2016, the average American household earned $74,664 before taxes. Using this, a 5% change would be $3733.20 per year or $311.10 per month. Many folks lost their homes during the housing crisis because they took on mortgage payments that were just $300 more than they could afford each month.

Real-Life Examples

When my ex-wife and I moved in 2004, our housing payments went from around $1200 per month to roughly $1600 per month. This $400 per month difference was enough to make me panicked about money.

Similarly, my youngest brother made the mistake of believing the banks when they told him he could afford a big housing payment. He could at first. But when the financial crisis hit in 2008 and 2009, he was screwed. Because he'd bought at the top end of his budget, when his income faltered, so did his ability to pay his mortgage. He lost his home to foreclosure.

For the most part, banks are happy to lend you as much money as you want. (Within reason, of course, and if your credit is good.) They're not going to stop you from taking on more debt if their computer models say you can afford it. It's up to you to exercise caution.

In The Automatic Millionaire Homeowner, David Bach writes [emphasis is mine]:

You should generally assume that the amount the bank or mortgage company will loan you is more than you should borrow…Don't fool around with this. Do the math. Be realistic about your situation. Don't pretend you're in better shape than you are.

Remember: Nobody cares more about your money than you do. Your real-estate agent, mortgage broker, and bank all have a vested interest in encouraging you to buy as much house as possible — their incomes depend on it. Listen to what they have to say, but make your decision based on what's best for you.

Playing House

If you think you're ready to buy a house, take a few months to do a trial run. In The Money Book for the Young, Fabulous, and Broke, Suze Orman says that you should “play house before you buy a house”. I like this idea. Here's how it works:

- Figure out how much you think you can afford to pay for a home every month, including mortgage and maintenance. Let's use $1750 as an example.

- Subtract the amount you're currently paying for housing. If your rent (or current mortgage) is $1000 per month, you'd subtract this from our hypothetical $1750 to get $750 per month.

- Open a new, separate savings account. On the first day of each of the next six months, stick $750 into this account.

This exercise lets you experience what it's like to make a higher housing payment. If you can't make these numbers work, Orman says you need to wait:

If you miss one payment, or if you are consistently late in making the payments, you are not ready to buy a home. If you can handle the extra payments, then you've got the thumbs-up to start looking for a home to buy.

Generally speaking, once you've saved 20% for a down payment and you can afford monthly mortgage payments, you're ready to start looking for a home. Yes, you can buy a home with a smaller down payment — I bought my first place with a 2% down payment! — but it'll cost you in the long run. You'll need to carry private mortgage insurance (PMI), you'll pay more in interest, and you could put yourself in a position where you can't afford to keep your home.

The Bottom Line

Homebuyers are often told to “buy as much house as you can afford”. But the problem with this advice is that it leaves you without a buffer. What if you lose your job? What if you're forced to sell your home after housing prices have dropped?

Instead of buying as much house as you can afford, buy only as much house as you need. Think of conventional debt-to-income ratios as ceilings, not targets.

Give yourself margin for error. Instead of basing your home-buying budget on a 36% front-end DTI ratio, consider dropping that to 28%. Or, better yet, 25% (just like the olden days!).

If you have an average U.S. household income of around $75,000, a 36% DTI ratio would lead you to budget $2250 per month for housing (assuming you have no other debt). If you were to go with a more conservative 25% DTI ratio, that budget would be $1563 per month. That's a savings of $687 per month — over $8000 per year! Just think: What could you do with a chunk of change like that?

Another way to create a buffer is to base your budget on your net (take-home) pay instead of your gross pay. Or, if you're in a relationship where both partners work, run the numbers for only one of the two incomes.

No, you won't be able to afford a big mortgage if you do what I'm recommending. But you know what? You won't feel pinched by your mortgage payments. And you'll be at much less risk the next time the housing market implodes. Best of all, you can plow all of the money you've saved on housing into a building a ginormous wealth snowball!

Mortgage offers

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 1 comment to "How much house can I afford?".

Hi JD,

Where did you get a home for 2% down? Did you have excellent credit?

Thank you.