How to avoid hiring a shady financial adviser

How would you feel if the financial adviser you hired to take care of your investments had four previous instances of customers filing a complaint against them? What if they had been fired from two previous financial institutions? Hopefully it would give you the same sick feeling it gives me.

How would you feel if you learned that you could have discovered all of this if you had spent less than 10 minutes doing some online research? Don’t answer that quite yet. More on that in a bit…

Navigating the choppy waters of the investing world isn’t easy. You’ve got a multitude of account options to consider and even more investments and insurance to protect your family. Having a solid financial adviser by your side to guide your ship through to calm waters is an invaluable asset.

Unfortunately, the act of finding a good adviser is difficult, and there is a sea of job titles to understand that potentially confuse the issue. Some of them are meaningless and don’t describe the depth of knowledge or experience required to acquire the title. Others take years of experience and study to pursue, but the title may not help you discern that. You want someone on your team with the latter, not the former.

Yet even finding the right designation isn’t a guarantee you’ve found a good adviser. Some advisers are just out to make a buck while others have unrealistic expectations about what kind of returns can be earned in the market. (There are 7 types of financial advisers I want to punch in the face, so make sure your adviser doesn’t have any of these qualities either.)

Once you have a list of candidates in front of you, the next step is to find out about your adviser’s background. Grab your shovels; we’re going digging.

How to check your financial adviser’s background and qualifications

Here are seven ways to check up on a financial adviser’s background and professional qualifications. It might look like a lot of effort — but work with me, people! The following can be done in less than 30 minutes. Unfortunately, some of my clients learned that the hard way.

The clients were in their 70s and didn’t have a good feeling about their adviser. Their kids shared their sentiments and reached out to me. After spending a total of 15 minutes doing some research online, I discovered terrifying news: There were four separate instances where a client had filed a complaint against the adviser. In fact, he had been let go from his previous brokerage firm because of the complaints.

A few of the allegations included “breach of fiduciary duty” and “fraud.” I don’t know about you, but I wouldn’t trust someone to manage my money who can been involved in several wrongdoings. These are the grievances we know about. What about the ones we don’t?

You’re willing to spend four days researching the best price and deal on your next big-screen TV purchase, right? By comparison, for less than an hour of your time, you can protect yourself — your retirement, your investment in your kid’s education, and your overall financial well-being — from a scam artist. Presumably, it’s worth your time. Let’s get to work.

1. Understand the adviser’s credentials

Just because someone has a crazy alphabet soup of titles behind their name on their business card doesn’t mean they are truly qualified to be your financial adviser. Do some research on the actual credential first. You can use Investor Watchdog’s Check a Credential page. It’s a huge list of the various certifications and credentials you might find tacked onto the end of someone’s name.

Each credential listed has a separate page that shows the prerequisites, the curriculum, whether the study was in a classroom, online, or self-study, how long it should take an adviser to earn the credential, how long the exam is, and any continuing education requirements in order to keep the credential. You’ll be able to determine if the credential took two days of classes or two years.

2. Check your adviser’s credentials

Now that you have verified the adviser has some real, worthwhile credentials, you want to make sure they are still in good standing with the certification board that oversees that credential. For example, the Certified Financial Planner (CFP) designation is run by the CFP Board. It is one of the, if not the absolute, most valued credentials for financial advisers because it takes so long to get. (Here’s what it takes to become a CFP.) You have to have two to five years of experience. There is a ton of studying involved. The test takes forever (not everyone passes) and there are continuing education requirements to keep the CFP designation.

If someone tells you they are a CFP, that’s great, but you need to verify. Pretty much all of the quality credentials offer a search function on their website, and the CFP Board is no different. You can do a search under Find a CFP Professional.

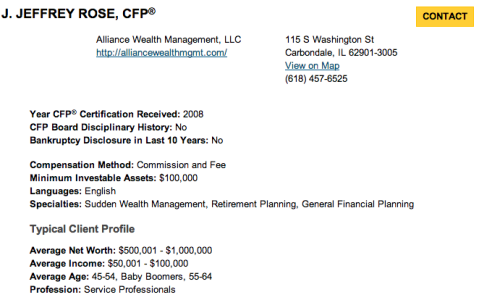

If you did a search for me, this is what you would find:

- My info on CFP.net

As you can see, it shows that I received the CFP designation in 2008, that I haven’t had a bankruptcy in the last 10 years, and that I’ve never been disciplined by the CFP Board. If your adviser doesn’t show up in the search or has disciplinary action from the board, that is a red flag.

3. Perform a FINRA Broker Check

Next you will want to perform a FINRA Broker Check. FINRA stands for “Financial Industry Regulatory Authority.” It is the largest independent regulator of securities firms in the United States.

Broker Check will show you:

- whether the adviser is registered with FINRA. (I haven’t been since 2011 when I left my employer to start my own financial advising firm.)

- which industry exams the adviser has passed, such as, the Series 7 (to become a stockbroker, broker-dealer, or Registered Representative) and Series 66 (to become an Investment Adviser Representative).

- any disciplinary action that has been taken against the adviser.

- the adviser’s previous employment history for the last 10 years. (If they change brokerage firms every 12 months, that would be a concern.)

- states in which the adviser is allowed to do business. (If your state is not listed, run!)

- any outside business interests that the adviser has. (If part of his pitch is to get you to invest in a new condo development and it turns out he owns a majority stake in it, run!)

I had to drop my Series 7 when I started my own firm, so that’s why I’m not registered with FINRA. Even so, it makes sense to check my information with this tool. I voluntarily dropped my Series 7 so my info still looks clean in FINRA’s eyes. But what if I was no longer registered with FINRA because they had to discipline me four times? Look out!

4. Perform SEC and NASAA searches

Your next stop on the research train is the good ol’ SEC. No, I don’t mean college football. We’re going to check in with the regulators at the Securities and Exchange Commission.

Generally speaking, if you are in the business of giving advice on investing in securities, you must either register with the SEC or register with your state’s regulatory authority. You register with the big boys if you manage more than $25 million in client assets. Smaller than that and you are your state’s problem, not the SEC’s.

The SEC has a ton of good information on avoiding scams on their website, and they offer a broker search as well. The only info I could find on me was from FINRA’s Broker Check which the SEC utilizes. If I worked for a massive firm, you could search that as well.

The SEC will also point you to the North American Securities Administrators Association. This is the association of state regulators, and for over 100 years they have defended the small investor from local scams. You definitely want to check in with them even if it means you actually — gasp — have to pick up the phone and call the state regulators yourself. NASAA says it best on their site:

“State securities regulators should be the first call for an investor before you turn over any money to a broker or investment adviser. You can access extensive employment, disciplinary, and registration information about your stockbroker or investment adviser through your state securities regulator.”

5. Ask individuals you trust

So you’ve done your “official” homework. You poked around at the regulatory bodies that should know about serious wrongdoing by your potential adviser. Don’t stop there.

The searches above are only going to show you the grievous offenses by the adviser. Those are absolutely critical to know, but it doesn’t paint the full picture. You also need to know simple things like if the adviser calls his or her clients back in a timely manner and whether or not people actual enjoy using his or her services.

So ask around. Ask your friends, colleagues, and family members. Have they heard of the adviser? Good? Bad? Indifferent?

Reputation in the local area is a big deal. Do take everything with a grain of salt — just because one person is super upset doesn’t mean the adviser is terrible — but a bunch of bad comments would be of concern.

6. Check out the web and read social media profiles

Lastly there is this one amazing tool that I’m sure you’ve never heard of.

Are you ready?

It’s called Google.

I know, right? Crazy. You can search for your potential adviser’s information on Google. Seeing a lot of news articles about a Ponzi scheme they might be running? You know what to do. (Hint: Run quickly to the nearest CFP with a fiduciary duty to you.)

You can also check out Facebook profiles, what they’re saying on Twitter, or if they have any recommendations on LinkedIn. These social media tools will give you a better idea of the type of person who will be investing your money. Maybe they went to your university’s rival school and you just can’t bring yourself to trust “them,” or maybe their Facebook page is full of photos of an event at your favorite non-profit and you feel an instant connection.

You don’t have to be best buddies with your adviser, but understanding who they are and how they act outside of the formal, professional website for their services is important too.

7. Ask the adviser this critical question

You’ve whittled your list of potential advisers down to a few key people. It’s time to sit down with them in person for your first consultation. (Hopefully it’s free.) You can talk about their experience, background, exams, and all that. That’s fine.

But there is one thing you really need to ask: “Mr. Adviser, do you have a fiduciary duty to me?”

Any answer other than an immediate “yes” should make you uncomfortable. Fiduciary duty is where someone legally puts your best interests above their own.

Let’s say that one more time so it sinks in. If your adviser has a fiduciary duty to you, they must legally operate in a way that puts your interests above their own.

How about the opposite? If your adviser doesn’t have a fiduciary duty to you, then they can operate so that they put their best interests above yours. That means they could put you in expensive investments with high fees that they get paid a huge commission on when there are better, less expensive alternatives available.

An adviser who doesn’t put you first is one whom I would be hesitant to hand my financial future to because there’s no guarantee he or she won’t do whatever they want with my money to earn themselves an income rather than to protect my financial assets.

I mention asking this question in person versus on the phone because you want to see if the potential adviser squirms or tries to walk around the question. You deserve a straight answer and you want to see how they react.

Protect yourself with a little effort

What’s sad to me as an adviser is it is pretty rare for someone to go through all of these steps, yet they take so little time to perform. Again, think about your last major purchase whether it was a car, a refrigerator, or a TV. You probably spent hours standing in the big box store staring at the TV screens, going home, and reading technical reviews online. And that’s for a television.

Invest a little bit of time to make sure you aren’t going to ruin your entire financial future by signing up with a scam artist rather than a legitimate financial adviser. You’ll be glad you did.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)