How to read a mutual fund prospectus

If we’ve learned anything from the current financial crisis, we’ve learned that it’s important to understand what it is we’re actually investing in. No more black-box investing, right? That’s true of the folks on Wall Street, but it’s also true of the average mutual-fund investor, too.

If you invest in mutual funds and you want to understand what you are about to buy, you’ll have to thumb through the prospectus and Statement of Additional Information. These two documents tell you what the fund managers intend to do with your money — and how much they’re going to charge you for doing it. Unfortunately, this information is usually drowned in a soup of legalese, but the information is there, and I’m going to show you how to find what you need in less than 10 minutes.

You’ve probably heard the term prospectus, but you may have never heard about the Statement of Additional Information (SAI). The SAI is where the fund’s lawyers put all the information they want to hide from the avid prospectus-reading public.

When you first think about actually reading a prospectus and SAI, you might be frightened. Buck up. We’re going to get through this together. There are really only a handful of items you need to be concerned with.

What Can the Fund Managers Do With Your Money?

Let’s consult the prospectus first. Go to your mutual fund’s website and download the fund prospectus and while you’re at it, get the Statement of Additional Information. For an example of a prospectus and SAI, take a look at those from the Vanguard Capital Value Fund.

If you turn to the Table of Contents (in the prospectus) you’ll probably see a section that talks about Risk/Return. Each fund family uses different headings for the sections so you’ll just have to look around a little. If you don’t see a section heading for “Risk/Return”, glance through the first several pages. You should see a discussion about Investment Objectives, Primary Strategies, and Primary Risks. I downloaded the prospectus of a very popular large-cap growth fund (not the one linked above) and turned to the risk section.

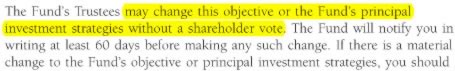

Under that section, I found a brief description of the main objective of the fund. But buried in the third paragraph I also found this little goodie:

Interesting, huh? What you’re buying today may not be what you own tomorrow. I continued by looking at the “Investment Policies and Restrictions” section in the SAI. When I did, here’s what I found:

Each Fund may invest up to 15% of its net assets in illiquid investments (i.e., securities that are not readily marketable).

This particular SAI also pointed out that the fund may put up to 20% of its assets into High-Yield-Risk Bonds, it may invest in futures contacts, and may invest in other mutual funds. I also found that the fund can sell securities short.

When you read the section in the prospectus about risk/reward and the section in the SAI about Investment Policies and Restrictions, you may not be familiar with all of the terms. High-yield bonds? Futures? Selling short? What’s all that? Rather than enroll in the nearest MBA program you can find, I would approach it as follows.

The “Risk” and the “Investment Policies” sections are there to point out the risks you take when you buy the fund. If they mention something in these sections that you don’t understand, either call the fund company and ask them what it means or find another fund. If you call the company, ask what the risks of these other investments are. Never buy a fund if you don’t understand what they do with your money. (As an added bonus, if you follow this rule, you’ll never be a victim of a Ponzi scheme.)

Once you understand what the company does with your money, make sure it’s consistent with your ultimate goals. For example, let’s say you want to buy a fund that invests in large, well-established companies. You’ve done your homework and you are comfortable with the risks of doing that. If you read the prospectus and it mentions that the fund can also invest in other areas, you may want to pass. Why? Because it may be investing in areas that have much greater risk than you are comfortable taking.

What Are the Fund’s Investment Returns?

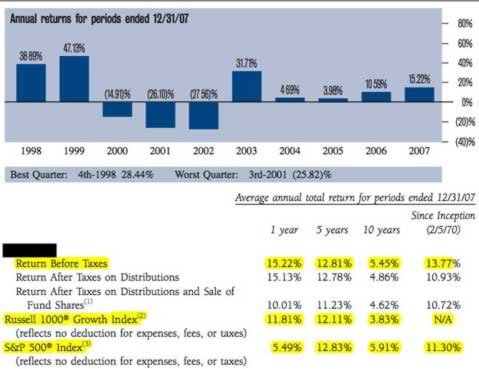

In most cases, the information about investment returns is straightforward and easy to understand. Here’s a peek at the returns section from the prospectus I downloaded.

First look at the “Returns Before Taxes” and compare the numbers to the Russell 1000 and S&P 500 Index numbers. Compare the before tax numbers because the indexes are also all before tax.

You can see that this fund out-performed the indexes in 1-, 5-, and 10-year periods and also since inception. That’s encouraging. The question is whether or not the fund is being compared to the correct index. You’ll get a feel for that by reading the “Fund Profile” in the prospectus. For example, if you are considering investing in a fund that buys shares in small cap international companies, the prospectus shouldn’t compare its performance to the S&P 500.

While these 1-, 5-, and 10-year averages are helpful, the yearly numbers are more important. You see that information in the blue graph. This tells you how the fund did in each of the last several years. You can see how the fund did in good and bad years. For example, in 2002 the fund lost 27% and in 2003 it was up 31%. Is that volatility in line with your appetite for risk? If not, look for a different fund.

Conclusion? Read the Risk/Return section of the prospectus and the Investment Policies and Restrictions in the SAI. Again, the fund families use different topic headings but with a little common sense, you’ll pinpoint this information. This will tell you what the fund can and can not do with your money. It will also tell you how they performed. Once you review this, you might find that your fund leaves you with a bad taste in your mouth.

What Are the Fees and Expenses?

There are two types of fees:

- shareholder fees, and

- fund expenses

Shareholder fees consist of loads, exchange fees, and redemption fees. If you are clever enough to read Get Rich Slowly, you are also too smart to buy loaded funds. This particular fund has no upfront loads but does charge you 2% if you sell it within 90 days. So don’t buy this fund unless you are sure you’ll hold on to it at least that long.

Don’t get too cozy yet. Every mutual fund investor in the galaxy is still subject to a second class of fees. These are fund expenses, which are paid out of the funds’ assets — even if the fund loses money. You don’t get a bill for these expenses, but the costs are taken out of the fund and it reduces the value of your account each year. Watch fees carefully because they can be a huge ripoff.

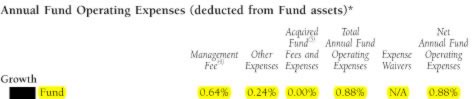

In the prospectus, go to the section that is usually called Fees and Expenses. It might look something like this:

All you really care about is the percentage number under Net Annual Fund Operating Expenses. In this example the total is 0.88%. If you invest $10,000, the fund will charge you $88 per year. Not too bad — so far.

But if you go back to the Table of Contents in the Prospectus and look up a section titled Management of the Funds, you might find a section called “Investment Adviser and Management Expenses”. This is important because the fund might hide some of their fees there. In the prospectus I reviewed, I found a performance bonus that was not disclosed elsewhere. This performance bonus basically rewards the fund manager if he or she outperforms its benchmark. In this particular case, if the fund manager does earn the bonus, it can boost total expenses from 0.88% to 0.95%. That may not be a lot of money, but from where I’m sitting, I don’t want to be told the expenses are 0.88% when in fact they could be 0.95%.

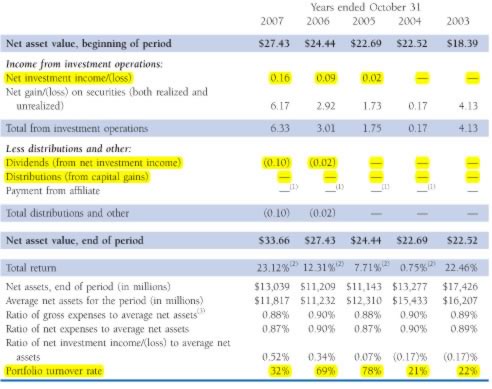

Also in the prospectus, turn to a section called “Financial Highlights”. In the example I used, this section was on the next to last page. I wonder why? This section has some of the most important information in the entire prospectus:

Look at the Distributions section. This tells how much taxable interest and capital gains were distributed in the past. Big numbers here mean higher taxes for you. Beware.

But by far one of the highest costs that investors usually overlook is the turnover cost. Turnover is basically the number of times the entire portfolio is bought and sold. Generally, the higher the turnover the greater the cost.

Why is turnover so expensive? First, it creates commission expenses. But it also results in higher prices when the fund buys stocks and lower prices received when securities are sold. Why? Let’s look at an example.

When you or I sell our measly 100 shares of Apple, the price of the stock doesn’t budge. But what happens when our mega-fund sells 10 zillion shares of Apple? They can’t sell all the shares at once. If they do, the price will tank. No, they buy or sell shares slowly, and even then the purchase or sale of so many shares impacts the price of the shares. So the more often the funds buy or sell, the more often you are impacted by this movement in price. It’s called “slippage” and believe me, when you slip and fall on this baby, it hurts.

John Bogle of Vanguard fame has spoken about turnover many times. According to his estimate, a 100% turnover adds another full 1% to the cost of a fund. So in the example above, the turnover was 32% last year. As a result, we have to add another 0.32% to the total costs. At this point, let’s review:

- Net Admin Costs 0.88%

- Potential Bonus 0.05%

- Turnover Cost 0.32%

- Total Expense 1.27%

That’s a 44% increase in total disclosed costs!

Are Their Potential Conflicts of Interest?

There’s one more piece of information I’d like you to consider.

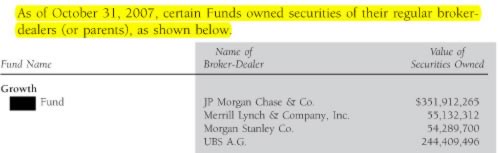

Look for investments your fund makes in brokerage companies. Look for a section that is called “Portfolio Transactions and Brokerage”. In this case, our fund had almost $700 million invested in the shares of brokerage firms it uses.

This is important because it raises the issue of impartiality. The fund’s one and only job is to make money for you and me. So is it buying shares of those brokerage firms to help you and the other investors make money? I don’t know. Maybe the fund buys those brokerage shares to pressure them into selling more of the fund. That would certainly help the owners of the fund but it may really hurt you and me.

It reminds me of going to a doctor who owns lots of shares in a particular pharmaceutical company and the doctor keeps prescribing meds from that pharmaceutical firm. Is the medication to help me — or the doctor?

Summary

Not all prospectuses are dark and evil.

For example, I’ve found that Vanguard prospectuses were written in plain English and easy to understand. They also have about half the pages that many other prospectuses have. There are probably other fund families that offer easy-to-read documentation, but I came away with the sense that the thicker the prospectus, the more the fund family had to hide.

Have you ever taken the plunge and actually read the prospectus? Were you surprised by what you found? Are you going to pick up the gauntlet and read those beasts next time they find their way to your mailbox?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)