Your money blueprint — and how it shapes your world

A few years ago, I had a memorable dinner with two friends from high school. Tom, Paul, and I shared good wine, good food and, especially, good conversation. We spent a lot of time talking about how we perceived money when we were younger, and about how these “money blueprints” shaped us as adults.

Tom's family was poor. They lived in a single-wide mobile home. His father built bar stools in the garage; his mother waited tables. Because there was no room inside the trailer house, Tom's family slept outside in tents. And because his father's business never made much money, his mother learned to pinch pennies. She was a queen of thrift.

“I didn't learn much about money from my mom and dad,” Tom said as he sipped his wine. “I learned more from Paul's parents. I remember going over to his house and marveling that he had opened a savings account. I remember that passbook you had, and how your parents would drive you into town to make deposits. I went home and told my mom that I wanted a savings account, but it never amounted to much.”

“I still have that savings account,” said Paul. “The same account my parents opened for me when I was a kid is my savings account today.” Paul's father also taught him how to invest in the stock market. His parents owned a split-level home on several acres of land, and they raised their children in a middle-class environment. They instilled smart money habits in their kids. Paul and his sister were raised with effective money blueprints.

“I wish my parents had taught me some of that,” I said over a mouthful of pasta. When I was a boy, my family was poor. I grew up in a trailer house too (although we never had to sleep outside in tents like Tom's family did). I lived in this house from the time I was two until I left for college:

Dad was sometimes unemployed. During those dark days, he had trouble putting food on the table or buying clothes for his kids. But he wasn't always broke.

“When Dad hade money, which wasn't often, he spent it on toys,” I told Tom and Paul. “He didn't save. He didn't invest. I can't remember that he ever invested a dime in anything. He bought computers and airplanes and sailboats. But then when he was broke, he turned around and sold them again. He and mom never taught me anything about money.”

But my father did teach me about business. He was a serial entrepreneur, always starting one business or another. Many of those businesses failed, but some were wildly successful. (In fact, one business — the custom box factory — still supports most of my family thirty years after Dad started it!)

My friends and I finished our food, paid the bill, and went our separate ways. But that conversation about money has stuck with me for years. I often think about how each of us has a money blueprint — and how some money blueprints are better than others.

Mental Maps

It's important to note that these money blueprints are but a piece of the larger mental maps we use to find our way through life. Recently, I've been re-reading M. Scott Peck's The Road Less Traveled, in which he writes extensively about how our individual mental maps shape our view of (and ability to cope with) reality.

“The more clearly we see the reality of the world,” Peck writes, “the better equipped we are to deal with the world.” He continues:

Our view of reality is like a map with which to negotiate the terrain of life. If the map is true and accurate, we will generally know where we are, and if we have decided where we want to go, we will generally know how to get there. If the map is false and inaccurate, we generally will be lost.

We're not born with these maps, Peck says. We create them as we go. As we experience life, we draw new features on our maps so that we can better navigate in the future.

This concept has some interesting implications:

- Each of us has a different mental map of the world. No one map is 100% correct, but there are lots of folks who believe theirs is the only accurate map.

- Our mental maps require constant revision in order to be useful. The world around us is constantly changing. The tools we have for interacting with the world are also constantly changing. More importantly, we are constantly changing. If we don't update our maps, they no longer reflect reality.

- “The more effort we make to appreciate and perceive reality, the larger and more accurate our maps will be,” says Peck. But revising our mental maps takes effort. Sometimes the effort is painful. As a result, some people stop adding to their maps in adolescence. “By the end of middle age most people have given up the effort. They feel certain that their maps are complete…”

Here's the thing: Although each of us has a mental map with which we “negotiate the terrain of life”, for most of us these maps are hidden. They're subconscious. We never overtly check them for accuracy, and we never deliberately revise them.

Invisible Scripts

He provides several examples of the assumptions embedded in our culture (and our personal mindsets), such as:

- If you don't have money, you can't go to college.

- To be happy, you should follow your passions.

- You should hook up with a lot of people before settling down.

- “I work hard, so I deserve a nice apartment.” (Or nice car or nice wardrobe.)

- “I'll be happy once I make more money.”

- Spending a lot on a gift shows how much you care.

- People who love each other never fight.

- “No pain, no gain.”

Again, not all invisible scripts are bad or wrong. In fact, many invisible scripts are useful. As Peck noted in The Road Less Traveled, when they're accurate our internal maps help us make the most of reality.

But Peck argues that much of mental illness stems from “clinging to an outmoded view of reality”, from failing to make revisions to our mental maps, to our invisible scripts.

What happens when one has striven long and hard to develop a working view of the world, a seemingly useful, workable map, and then is confronted with new information suggesting that the view is wrong and the map needs to be largely redrawn? The painful effort seems frightening, almost overwhelming.

What we do more often than not, and usually unconsciously, is to ignore the new information. Often this act of ignoring is much more than passive. We may denounce the new information as false, dangerous, heretical, the work of the devil. We may actually crusade against it, and even attempt to manipulate the world so as to make it conform to our view of reality. Rather than try to change the map, an individual may try to destroy the new reality.

The challenge then is to remain dedicated to reality, to truth. Instead of using an outdated map to navigate a new and uncertain future, be willing to revise your working model of the world so that it helps you rather than hinders you.

This is true with both your larger mental map and with sections of that map — such as your financial blueprint.

Like Father, Like Son

When I grew up, I made the same poor choices. I followed the same invisible scripts my parents had followed. For a long time, I spent everything I earned. It was a game to see how long I could skate with nothing in my bank account. Worse, I developed a credit-card habit (something my parents had always avoided). Instead of improving my financial blueprint, I was making myself more miserable. (Peck would say that I was suffering from a form of mental illness!)

At the same time, I followed in my father's entrepreneurial footsteps.

As a boy, I imitated him by starting kid-sized businesses of my own. I sold my extra Star Wars trading cards to other kids at school. I also sold the Hardy Boys books I'd finished reading. I drew comic books and sold them at the school store.

Fortunately, I eventually learned from other people who were better examples with money.

My ex-wife, for instance, has always been financially savvy. Kris showed me it was possible to use credit without going into debt. She showed me it was possible to live well while still setting aside over thirty percent of your income. Her parents had provided her with a sound money blueprint, and in time I was able to incorporate some of these good habits as my own.

It took me twenty years, but I managed to completely re-draw my money blueprint from one that kept me depressed and in debt to one that allowed me to save and invest and make my money work for me. I taught myself new “invisible scripts”.

Your Money Blueprint

Our financial blueprints don't just shape how we interact with money; they also define how we relate to other people when money is involved. Do you lend money to friends? Do you give to charity? How much do you tip in restaurants? How do you feel if your spouse never saves a penny?

Unfortunately, most of our financial blueprints have flaws that prevent us from having healthy relationships with money. A huge part of getting rich slowly is developing a money blueprint that allows you to build a sound financial foundation for tomorrow and today.

As you contemplate your own money blueprint, ask yourself the following questions:

- Are you a spender or a saver? Why do you think that is? If you're a saver, could you ever become a spender? If you're a spender, do you think you could become a saver? Were your parents spenders? Is your spouse a saver? How do you feel about people who have a different attitude toward money than you do?

- Should a couple have joint finances or separate finances? Some combination of the two? Does it make a difference whether the couple is married? How do you feel about pre-nuptial agreements? What's the best course of action if one partner is a tightwad and the other a spendthrift?

- When is it okay to talk with friends about money? Is it okay to lend to family? To friends? Okay to borrow from them? If a friend offered a chance to get in on the ground floor of a business, would you do it?

- When is debt okay? Is it ever okay? What about abandoning debt? How do you feel about defaulting on loans? Walking away from a mortgage? Are credit cards okay? If so, how should they be handled?

- How do you feel about saving and investing? Have you begun saving for retirement? Does the stock market scare you? Do you go out of your way to learn how money works? Is it all a mystery? Are precious metals a store of wealth? What about real estate? What about bitcoin?

- How much does the larger economy affect you? The stock market? Unemployment? Interest rates? How do you feel about taxes? Are government social programs a necessary evil or are they just evil? To what degree is your own financial fate subject to the fate of the world around you?

- How do you feel about work? Are you willing to take two jobs (or three!) in order to achieve your goals? Are you unwilling to work overtime because it's more important to be with your family? Are certain jobs beneath you? Are some jobs unobtainable because you don't have the education or experience or the right social background?

- What does it mean to be rich? Would having a million dollars make you rich? Would earning a million dollars per year make you rich? Or have you won the lottery of life simply by being born where you were born? How do you feel about rich people? Are they admirable? Are most of them crooks?

- How willing are you to take financial risks? Do you gamble at casinos? Do you invest in the stock market? Is there a difference between the two? What about playing the lottery? Is it a tax on the stupid or is it a chance for the average joe to catch a lucky break?

- When it comes to money, is there “women's work” and “men's work”? If so, which jobs belong to the man and which to the woman? Are certain financial tasks beneath you? Are you willing to clip coupons? Bake your own bread? Make your own laundry detergent? Who pays the bills in your household? Why? Do both partners understand your complete financial situation? Or is money the sole responsibility of one person in the home?

- What must you have and what can you live without? Is cable television a necessity? What about transportation and housing? Can you live without a car? Do you need a home with a yard? Is renting for fools? Is homeownership the path to wealth? Do you plan to pay off your mortgage early? Or will you continue to refinance until you die?

- How does money make you feel? Does thinking about money make you stressed? Does it make you happy?

- What is money for? What is its purpose? Does that purpose change over time? Does it change as you get older? Does it change depending on where you live?

That's a lot to think about, I know. I've overwhelmed you with questions. Still, I hope that you'll take the time to ponder each of these and to think about how your answers play into your current financial situation.

How do you think your answers would compare to those of your family members? Your friends? Your colleagues? Are there right answers to any of these questions? To all of them? What makes the answers “right” or “wrong”?

Like it or not, your financial blueprint defines who you are and how much money you have. If you're unhappy with your financial situation, things will not improve if you continue to do the same things and think the same thoughts. For things to get better, you must make deep and lasting changes.

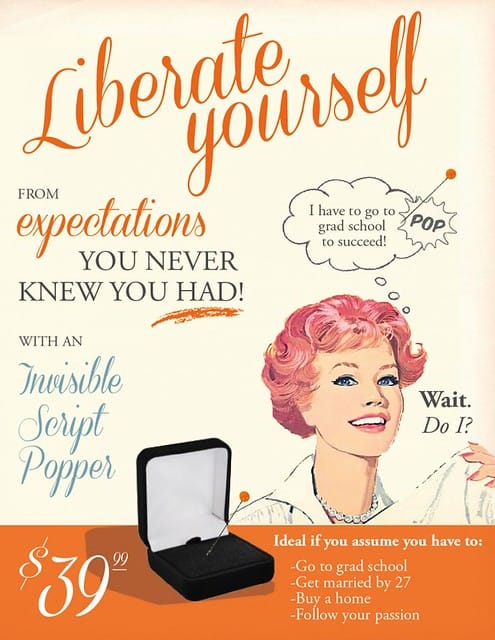

[The “Liberate Yourself” poster comes from the now-defunct Small Answers blog.]Exercise

Think about the people you know who are successful with money. (Define “successful” any way you wish.) What do they have in common? Do they share certain attitudes and beliefs? Pick one of these people. Contact her. Ask if you can take her to lunch and pick her brain about personal finance. (If it'll help, point her to this webpage.) During the meeting, listen carefully to what she says. How is her money blueprint different than yours? What parts of her blueprint have helped her to achieve financial success? Most importantly, how can you incorporate some of these attitudes and beliefs into your own life?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 1 comment to "Your money blueprint — and how it shapes your world".

Though am based in Africa where there aint many financial products in as far as the stock market is concerned, the articles have provided enough knowledge and action points that have started to yield positive results. I have had a relook at my behavior patterns with money. More importantly I have staterd saving and investing in real estate and pig farming. . Many thanks to you J.D