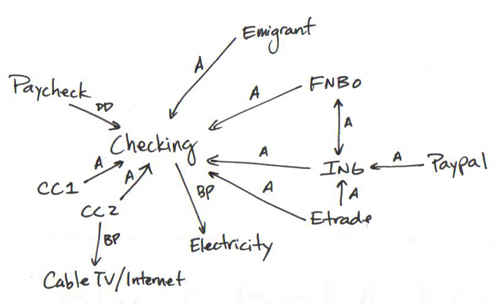

My financial infrastructure

Mapping your financial infrastructure is a mundane task. It’s not exciting. It’s not likely to save you big bucks. Instead, it’s the sort of Big Picture exercise that each of us ought to perform from time-to-time just to be sure that everything’s working the way we think it is. If you do this every year or two, you just might catch some inefficiencies that need to be corrected. I did.

A map of Jim’s financial network

(Photo credit: Bargaineering.com)

I didn’t map my accounts with pictures. Instead, I described the connections with words, starting with the account that collects all of my income:

Business checking account

I have a business checking account at Wells Fargo, a large traditional brick-and-mortar bank. This was not a conscious decision, and is a legacy from the origins of my former computer consulting business.

Currently, all of my income is routed through this account (because all of my income comes from the business). This checking account is used to pay all business expenses, including:

- Books and magazines

- Computers, cameras, etc.

- Meals with readers and colleagues

Most of the time, these expenses are made with a business credit card, which I pay in full at the end of the month.

Personal checking accounts

From time-to-time, I move money from the business account to my personal checking account at the local credit union. This process is not automated. (In fact, none of my infrastructure is automated right now, except for paying a couple of bills, which I’ll explain at the end.) To transfer money, I have to write a check to myself and go deposit it.

I have a second checking account at a different credit union, but I rarely use it. I opened this about a year ago because I was intrigued by the chance to earn 5% in a rewards checking account. But the nearest branch is 15 minutes from my house and out of my way. That’s a huge passive barrier to using it. I guess what I should do is just put some cash in there and see if I use it enough to qualify for the bonus interest rate.

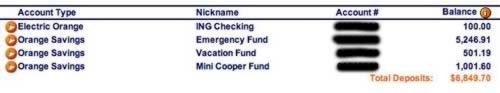

High-yield online savings account

The bulk of my money sits in a high-yield online savings account at ING Direct. Actually, I have multiple accounts at ING, which I manage from a single screen.

When I have money to save, I move it from my credit union to the appropriate savings account. This is done electronically, but it’s not automated. I consider this my main pool of money because it’s where I track my progress as I save toward specific goals. I’ve never actually moved money out of an ING account yet, so I don’t know what that process is like.

Credit and debit cards

I carry four pieces of plastic, each of which has its own use.

First, I carry a personal credit card. I lived for nine years without a personal credit card because I had a history of abusing them. But when Kris and I were preparing to travel overseas, GRS readers recommended obtaining Capital One No Hassle Cash Rewards cards for the trip.

Though I was wary about returning to credit, I signed up. Over the past two years, I’ve used it responsibly, always paying my bill every month, and never buying anything for which I could not pay cash. (Plus the card gives me 1% back on everything I buy!)

I also carry a debit card that is tied to my personal checking account. I use this for any purchase that I cannot (or will not) put on credit. For example, I have a rule that I won’t purchase comic books or videogames on credit, so those expenses go on my debit card.

Finally, I have two business credit cards. The first is a Visa from Wells Fargo. It offers no perks, so I try not to use it. The second is the TrueEarnings Business Card from Costco and American Express OPEN, which offers cash back on a variety of purchases. I try to make all of my business purchases with this card, and I really wish I could use it for personal expenses, like fueling the car.

Retirement accounts

I have two retirement accounts. My Roth IRA is through Sharebuilder. I used to make automatic monthly contributions for dollar-cost averaging. Now I make large lump-sum contributions. (And I’ve considered moving my IRA to Zecco. Can anyone speak to the differences between Zecco and Sharebuilder?)

My main retirement account right now is a Fidelity self-employed 401(k). I love this account because it lets me contribute up to 25% of my income — and I do! Plus it has a huge cap on contributions, which gives me something to aim for. As much as I love Roth IRAs, I’ve been prioritizing this account lately because it makes the most sense for my situation. I make lump-sum contributions to this, too.

Paperless automation

In my dream world, the connections between all of these accounts (and the bills they each pay) would be both automated and paperless. I’ve made some progress toward a paperless personal finance system, but little of my infrastructure is automated at the moment. I have automated payments to a few of my bills (auto insurance, natural gas), but that’s it.

Because my finances have been in such a state of flux over the past eighteen months, it’s been impossible to automate anything else. One month my income is up; the next month my income is down. We’re making accelerated mortgage payments; then we’re refinancing. I quit the day job. I’m doing dollar-cost averaging into a Roth IRA; then I’m making lump-sum contributions to a 401(k). And so on. Things keep changing!

I can foresee a time toward the end of 2009 when things will have finally settled down. When this happens, I’ll begin to automate the connections between my accounts.

My command center

And how do I track all of this information? I have two primary weapons:

- My Fujitsu ScanSnap S510M document scanner (Windows version)

- Quicken for Mac (Windows version)

I try to sit down once every week (though lately it’s been more like once every three weeks) to scan my financial documents. I convert them to PDF, archive them on my iMac (and to my backup hard drive), and then update all of my bank accounts. I keep tabs on my accounts day-to-day, but I only update Quicken (and QuickBooks for the business) once per week.

Ideally, I would receive only electronic statements. It’s nice that I can convert my paper receipts to PDF, but I’d rather receive them that way in the first place. That’s something to aim for. Also, I do intend to give another shot at using an online money-management tool. I’m going to start with Wesabe, and if that doesn’t meet my needs, I’ll try something else.

Final thoughts

Writing this out makes it seem more complicated than it really is. Things are actually fairly streamlined, with only a few weaknesses.

- I have two business credit cards. Ideally, I’d have only one. However, American Express is not accepted everywhere that Visa is. This means I have to carry the extra Visa card around to cover the exceptions.

- I have checking accounts at two credit unions. Ideally, I’d use only one. If my main credit union offered rewards checking, this choice would be easy. It has branches conveniently located in all of my main stomping grounds.

- I would like to consolidate my retirement accounts with one provider. This means I’ll probably be moving my Roth IRA from Sharebuilder to Fidelity. The Fidelity self-employed 401(k) is a fantastic product, and I’m not giving it up.

And, of course, I’m eager to automate the connections between these accounts so that I don’t have to think about things. (I’d still review each account every week, of course.)

What about you? What are the key components of your financial infrastructure? Do you have accounts that you would recommend to GRS readers? Is your financial network map simple or complex? Do you have accounts that you never used? Have you automated things? Do you plan to? Do you have suggestions on how I could improve my setup?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)