How to Choose the Right Bank Account

On my first day of college, I chose a checking account because the bank was handing out free Frisbees. This was my only bank account for nearly 20 years.

On my first day of college, I chose a checking account because the bank was handing out free Frisbees. This was my only bank account for nearly 20 years.

Eventually, I opened a savings account at the local credit union. Then I discovered the benefits of a high-yield savings account. Last autumn I opened my first certificate of deposit. And just a few months ago, I started a money market account.

Why so many accounts? To me, each bank account serves a specific purpose. Not every account is suitable for every need. Though not everyone needs (or wants) as many bank accounts as I now have, it's still a good idea to make sure you're using the right tool for the job.

How to open a money market account

\

\Here's how to open a money market account, a type of savings account that offers the security of FDIC insurance, the higher interest rates of a savings account and the flexibility of access that comes with a checking account:

- Shop around. Find a bank or credit union that's offering a competitive interest rate with the features you value the most -- don't just go for the bank down the street or where you have your checking account (unless, of course, they are offering a great deal for bundling multiple accounts). For many consumers, the highest possible interest rate will be the biggest factor, but you'll also want an interface that's easy to use and solid customer service. If you want the ability to write checks, be sure to ask. Some money market accounts allow limited check-writing privileges, others may not. It's also important to know how many transactions you'll get before triggering a fee.

Online banking: Choices for higher interest rates and increased security

In its July 2009 issue, Consumer Reports Money Adviser published a brief overview of the best online banking options according to their research. "Online banking, despite a rocky start, is becoming the rule rather than the exception," the article says, noting that online banking can net savers better interest rates and increased security.

I'd love to be able to point you to an online version of this article, but none exists. And I'm not about to reproduce large chunks of the text here. (Consumer Reports doesn't like that.) But I can highlight their main points about online banking, as well as list the results of my own research into online banks.

Some of the article's main points:

Making the most of your checking account

In the past, we've discussed the best online high-yield savings account, covered the basics of certificates of deposit, and even explored the beauty of Roth IRAs. But we've never talked about checking accounts.

Many people believe checking accounts are the dinosaurs of the banking world. They're not extinct yet. In the past few weeks, I've received two questions about them:

- "Where can I get the best rate on a checking account?"

- "How much should I keep in a checking account?"

Under certain circumstances a checking account can offer a better return than a savings account! In fact, there are a couple of ways to do it.

Stale-dated checks: How long do you have to cash a check?

While running errands this afternoon, I stopped by the bank to deposit a check. All of the tellers were occupied with difficult clients. (I'm old-fashioned and go inside to make deposits for my business finances.) While I waited, I eavesdropped on the nearest conversation. A woman was frustrated because she'd just opened a checking account a few weeks ago, and now it was overdrawn. She couldn't understand. "I don't see how that's possible," she said.

The teller was very patient and very polite. She tried to help the woman figure out where the problem was. Together, they went through the woman's checkbook register and compared it to the bank's computer. Finally, they discovered the culprit: a $50 check the woman had written on June 21st.

"They deposited that?" the woman said.

How to open multiple accounts at ING (now Capital One 360)

One of my favorite saving techniques is the use of targeted accounts. If I want to save for something big — like a Mini Cooper, for example — I'll open a new savings account specifically for this purpose. I first learned about this method from Robert Pagliarini's The Six-Day Financial Makeover:

Traditionally, most people invested for various vague goals and lumped all of their savings together in a single investment account. That's pretty boring. It's not very inspiring or effective. Purpose-Driven Investing satisfies our need for a purpose and our need for instant gratification by thinking of each of our goals as a separate “basket”. Each of our baskets represents a single goal with a clear purpose that we can see and grow.

What does this mean in the real world? It means that we have a single investment account for every goal. For example, if one of your goals is to take the family on a European vacation, create a separate savings account called “Family European Vacation Fund”. This account or basket contains all of your savings toward that one goal. Every penny in the account is for the European vacation — not for retirement, a new car, your emergency fund, your kids' college tuition, or any other goal.

Continue reading...How to avoid bank overdraft fees

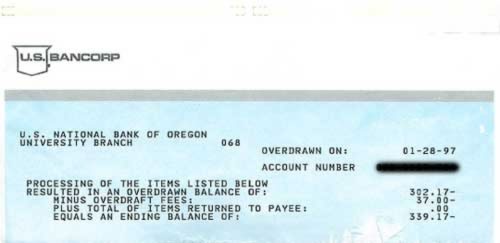

Continue reading...Last fall, I discovered my Quicken data file from the mid-1990s. It contains all my transactions from 01 January 1995 until 06 April 1998. There are many fascinating insights to be gleaned from my crazy spending a decade ago, but as I was looking through my checkbook register, one thing in particular stood out.

Before nearly every paycheck, my bank balance would dwindle to $12.33 or $7.14 or something similar. When I was paid, the balance would shoot up for a day or two, only to be spent right away. Sometimes, in fact, I overspent. During these 3-1/2 years, I racked up a couple hundred dollars in overdraft fees.

On one particularly bad day, my bank socked me with three overdraft charges at once. When the notice came in the mail, my stomach sank. How could I be so stupid? Speaking as one who's been there, overdraft fees are an indication that you're not tracking your finances as closely as you think you are. Tracking finances only through receipts, or only through your bank's website is inadequate. You need to keep a separate ledger (perhaps a checkbook register) or use a piece of software (such as Quicken) in order to track every expense.

More about...Banking