Why you should track your spending (and why Quicken sucks)

Last year wasn't good for me. Depression and anxiety reigned supreme. By objective standards, my life was pretty good. But subjectively, life sucked. Going into 2020, I decided I needed to make some changes. I'm pleased to report that the first five weeks of the year have gone swimmingly. Life is grand.

I've made three specific changes that I believe have contributed to this improvement:

- I've rented office space outside the house. My office is for work only. I do not allow myself to play games (or engage in other shenanigans) at the office. Zero tolerance.

- I've begun getting up early. I tend to be an early riser anyhow, but early for me means about six o'clock. This year, I'm generally rising at 4:00 or 4:30, which means I'm at the office by five.

- I've curtailed my drinking. In fact, I didn't touch a drop of alcohol during January. I've had a few drinks in February, and it's been interesting to see how it affects me, both in the moment and then for days after.

Taken together, these three changes have mitigated my mental health problems and made me more productive. I love it. Over the next six weeks, I plan to integrate two additional changes into my life: I'm going to begin exercising regularly and I'm going to cut back on videogames. I expect this to provide an additional boost to my well-being.

There's been an unexpected benefit to my quest to become a better version of me. January was — by far — my best month with money in years.

My January 2020 Spending

As you know, I track every penny I spend. I've been doing this since 1993 (with occasional breaks). It's a valuable practice.

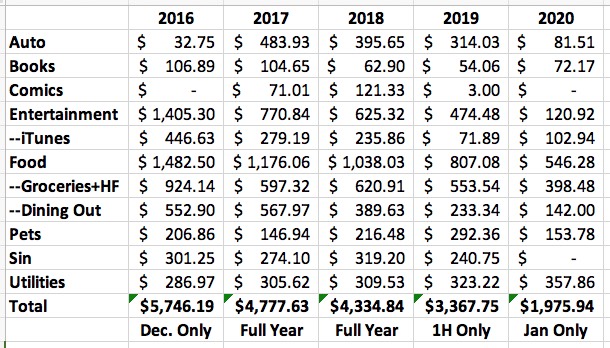

Earlier this decade — after my divorce but before my RV trip — my monthly spending averaged about $4000. After returning from our cross-country adventure, that number spiked. From 2016 to 2018, I was spending closer to $6000 per month. This led me to push for austerity measures last year, measures that worked. My 2019 spending averaged $4221.27 per month.

In January, I spent $3212.24. This is a fist-pumpingly fine number, one that I'm proud of. But I'm even prouder of how I achieved those cuts. My top financial goal for this year is to spend less on food. I did that. And because I didn't drink, I spent nothing on alcohol.

Because I was curious, I decided to explore my spending over the past few years. I think you might find it interesting too. Here's a snapshot:

This spreadsheet shows monthly spending in select categories during the past five years. This spreadsheet does not show all of my spending. The 2016 numbers are for December only (because that's when I resumed tracking after our RV trip). The numbers for last year are only for the first half of the year. And, obviously, the numbers for this year are only for January.

Some thoughts:

- Generally speaking, my vehicle costs are low. They were high in 2017 and 2018 because my 2004 Mini Cooper needed repairs. They were high last year because I spent $1900 to buy a 1993 Toyota pickup.

- My entertainment spending is dominated by three specific expenses: my Portland Timbers season tickets, our subscription to Broadway in Portland, and my iTunes movie and TV purchases. The theater tickets are a one-time expense each February. The Timbers tickets (which I may not renew this year) are a one-time expense each August. I continue to work to keep my iTunes purchases under control.

- I spend more on our pets than I thought. A lot more. I love our dog and three cats, but wow! I paid $142 to support them last month, and there were no vet expenses in January. Much of this spending is for pet-sitting when I travel.

- Look at my food spending! Holy cats! I've been pushing hard to reduce this over the past five years, and January was a shining example of what I can get this down to if I try. Kim and I didn't feel deprived. We just made smarter choices.

- Finally, when I'm not drinking, my spending on sin — which includes alcohol, occasional tobacco, and legal pot — falls off a cliff. Obvious, but also wow.

I know I'll spend more in February than I did in January. Our theater tickets renew and that's a $1500 expense, for instance. Still, I expect that I'll continue this trend toward reduced spending, and I'm glad. It makes me happy. It's yet another way that 2020 is off to a better start than 2019.

Why It's Important to Track Your Spending

It might seem strange that I'm such a vocal advocate of expense tracking. After all, don't I have all of the money I need? I do. But I think part of the reason I keep that money is because I'm so vigilant with my spending.

In fact, this seems to be a key habit with most wealthy people I know. They keep tabs on where there money goes. In The Millionaire Next Door, the authors write that the three words that best describe the wealthy are “FRUGAL FRUGAL FRUGAL”. They also point out that most millionaires keep budgets.

Tracking your spending demystifies money. You begin to perceive it as a tool. You gain a sense of power; you no longer feel that money controls you, but that you control money. Your awareness of your money habits is heightened, allowing you to make changes to improve your situation. You begin to understand how your one-DVD-a-week habit affects other parts of you your life.

When you track your spending, it’s important not to make judgments in the moment. This activity is meant to describe your money habits, not to change them. (You probably do want to change them, of course, but that’s a different task.)

To make it easier to track your spending, remember the following:

- Be careful with transactions that are easy to forget. Some transactions – cash transactions, online transactions, transactions without a receipt – are quickly forgotten. Take special steps to remember these, such as…

- Get a receipt for everything. It’s easy to forget where you spent your money yesterday morning. Make a habit of always asking for a receipt. Keep them in one place so you know where to find them.

- It’s best to process your transactions daily. The more diligent you are about recording your expenses, the less likely you are to forget something. But daily book-keeping can be a chore. Try to do this weekly at the very least. (Make it a habit, a ritual. Do it at the same time every Saturday morning, for example.)

Expense tracking paints a picture of your spending habits as they actually exist – not as you think they exist. You can use this information to build a budget and to set financial goals. At the very least, you’ll get a snapshot of where your money has been going. Without doing this, it’s difficult to know how much you’ve really been spending – and what you’ve been spending it on.

Plus, if you're a money nerd like me, it's fun to track your spending. I love putting the numbers in by hand, then looking at the data with different graphs and reports.

This isn't just my personal opinion. There's plenty of research (and practical experience) that proves the value of writing down what you spend. In fact, while curating material for Apex Money this morning, I came across two articles about this very topic.

- “I made one simple financial change and it lowered my spending.”

- “This Japanese approach to saving completely changed how I spend my money.”

- “What I learned from tracking every penny I spent for a month.”

Expense tracking is powerful, especially if you're doing some portion of the work by hand. Automated tracking is good. Manual tracking is better.

How to Track Your Spending (and a Rant)

During the 1990s and 2000s, it was easy for a curious person to track her spending. There were a variety of tools she could use: Quicken, Microsoft Money, Andrew Tobias' Managing Your Money. Nowadays, though, your pickings are slim.

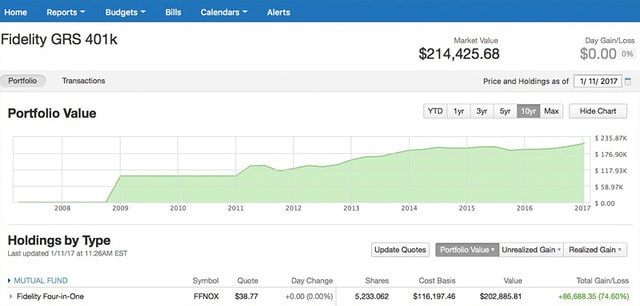

Yes, I know there are all sorts of apps out there that purport to track your spending. My business partner Tom uses Mint. Many folks are fans of Personal Capital. And, of course, Quicken still exists.

Although I do use Personal Capital (here are my thoughts on the pros and cons of Personal Capital), I do so primarily for its nifty retirement planner. I'm not a fan of automated money trackers, those that download and categorize info from your financial institutions. I feel like Mint and Personal Capital don't do a great job at this. Plus, I track my spending because I want awareness. Manual data entry helps with this.

That means I want a tool like Quicken, which allows me to enter info by hand.

But even Quicken has become problematic. Are you ready for a rant? Tough. You're going to get a rant.

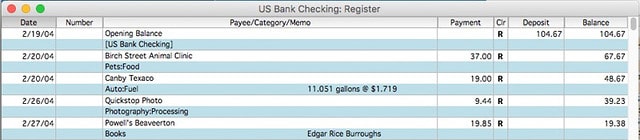

For years, I used Quicken 2007 for Macintosh. I love Quicken 2007. It's everything I could want in a money-management tool. It replicates the feel of a check ledger, which appeals to old men like me. It's ugly, but that's okay because it's filled with functionality. I'll take personality over pretty any day!

The downside? It doesn't run on modern versions of the Macintosh operating system. To keep using it, I have to hold on to an old iMac with an old version of the OS.

Quicken 2017 is…okay. It's certainly much prettier than the older version, and it does its job reasonably well, but that's about the best I can say for it.

Entering transactions manually (which is how I enter transactions) is maddening. There's no way to do this quickly. There's a serious lack of reporting tools, and what reports do exist have limited functionality. (Want to get a net worth report for a specific date? Sorry. You can't.)

Here's my detailed comparison of Quicken 2007 and Quicken 2017.

How frustrating is it to enter transactions into Quicken 2017 compared to Quicken 2007?

Today, it took me nineteen minutes to enter twenty transactions into the new version. This is partly due to the crappy UI and partly because I had to track down (and fix) a couple of strange ways it handled account transfers (such as paying a credit card from a checking account). When I drove home and re-entered these same twenty transactions into Quicken 2007, it only took me six minutes and everything worked as expected without any fuss on my end.

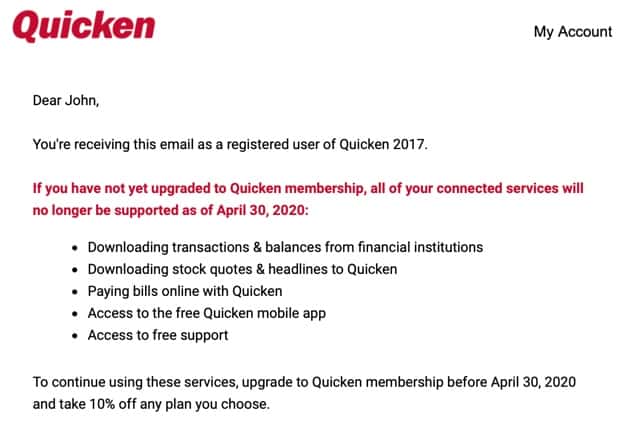

Despite this, I had made the decision to move everything to Quicken 2017. Last October, I made the switch. Then, last week, I got this email from Quicken.

As of 30 April 2020, Quicken 2017 will no longer support downloading stock prices. In fact, all automated downloads and connections will be disabled. But hey! If you upgrade to the new version of Quicken — which is now a subscription-only product (meaning you have to pay every single frickin' year) — you get to save 10%.

This is bullshit of the highest order.

When companies do this, it makes me livid. There's no way in hell I'll upgrade, and there's no way I can in good conscience encourage you, my readers, to support Quicken if they're going to pull this sort of bullshit.

So, I'll be sticking with Quicken 2007. Thankfully, Quicken doesn't have the power to disable features in that version of the program. They can't force me to upgrade. And since it's a superior product to 2017 anyhow, I'm okay with that. But it means I have to keep one computer on hand that I don't upgrade to a new version of the OS.

What if you don't have access to Quicken 2007? How should you track your spending? Here are a few possibilities:

- If you're in the early stages of money mastery, I recommend You Need a Budget. Yes, YNAB uses a subscription-based model, but I've heard enough people rave about it to recommend it. (Plus, I like the YNAB philosophy.) Here's my YNAB review.

- If you don't want or need manual data entry, use an app like Mint or Personal Capital. Personally, I'd go for Personal Capital. I've heard reports that more and more, people feel like Mint is fading away.

- If, like me, you want an online tool that allows manual entry, find an older version of Quicken somewhere. If you're a PC user, you might consider using Microsoft Money. This product is no longer published (or supported) but Microsoft offers a free download of the final version of Microsoft Money Deluxe from ten years ago.

- If you use Quickbooks or something similar to manage your business finances, it's possible to also track your home finances with that software. (But I don't think accounting tools will integrate investments. I could be wrong.)

- Many people actually use home-brewed systems for expense tracking. Most of these are built around customized spreadsheets, although I've also seen people who use pen and paper (!!!) to track their spending.

Ultimately, it doesn't matter which tool you choose. What matters is that you track your spending.

Conclusion

Expense tracking is one of the cornerstone habits of smart personal finance. Not everyone needs to do this, of course. Some folks have so much money and spend so little that expense tracking becomes unnecessary. Others are naturally hyper aware of their behavior. But for most of us, expense tracking grants keen insight into how we use our money.

Unfortunately, there's no great solution right now for folks who want software that allows manual data entry.

The last time I complained about this, one GRS reader suggested that I create my own software tool. Honestly, that's not a bad idea. I probably no longer possess the skills to code this myself, but I do possess the experience, knowledge, and opinions that would help me design a piece of software that could be useful and effective. Plus, I'm not motivated by greed, which I think is a bonus.

For now, I'll continue to use Quicken 2007. It's a small hassle to keep an old iMac around with an old version of Mac OS, but I can do it. When that computer dies, though? Well, I'm not sure what I'll do.

Like me, my buddy John at ESI Money is a long-time Quicken user, with data going back to 1994. Like me, he enters transactions by hand. Like me, he recently tried to upgrade. Unlike me, he intends to continue using the new version of Quicken.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 2 comments to "Why you should track your spending (and why Quicken sucks)".

Thank you for your article! It opened my eyes to some things that are not obvious. However, the question that doesn’t bother me is: Don’t you think that instead of dealing with a zoo of applications that try to please everyone at once and yet get further and further away from you, it would be easier to keep a budget simply in a spreadsheet? I find it quite tempting to get a tool that meets all my needs and doesn’t offer me things I don’t need.

I’ve been trying to build a spreadsheet like this for the past few weeks, and I think I’ve almost achieved what I want. Your article gave me a lot of confidence as well as a few hints. Thank you again!

Quicken and the subscription model does not bother me, but the fact they will not fix it to work with my cash management account gives me pause and has forced me not to renew. No sense paying for an application that will not track my spending. I’m talking Web and Mobile apps, for those who choose to jump in and defend this sorry company.