Your First Rental Property

It's official: Kim and I have moved from Portland to Corvallis, Oregon. We closed on our home — a 1964 daylight ranch with fully converted basement — at the end of August, and we've spent the past six weeks moving and unpacking. I thought I'd have time to post the gory details of our purchase, but obviously that hasn't happened. We've been too busy!

The short version is this: After offering $128,000 over asking on our dream home (and still losing out to a cash offer), we came close to joining in another bidding war on a similar house. But we didn't. While other folks were bidding up a place down the street from $589,000 to $707,000, we snuck into a home we liked better for $680,000 — just $5000 over asking. We got lucky.

And while I was worried that we might experience buyer's remorse, I'm pleased to report that absolutely has not happened. We love our home and we love Corvallis. How could we not?

Corvallis is the best biking city in the state of Oregon. (Yes, even better than Portland.) Our home isn't a walker's paradise, but it is within range of two grocery stores and a handful of restaurants. Corvallis has hardly any traffic congestion. The town is surrounded by forested foothills filled with hiking trails. Every day, we have squirrels and deer and wild turkey in our yard. There are two off-leash dog parks nearby. Our neighbors are super friendly.

I could go on, but I won't. You get the picture.

We had high expectations for Corvallis, but so far the city has exceeded them. I'm not kidding. This is exactly what Kim and I were looking for during our three-month search for a new place to live. It's our Stars Hollow.

And our home, while ginormous for two people, has also exceeded our expectations. Sometimes it feels as if it was custom-designed for the two of us and our lifestyle. Early days yet, I know, but after six weeks we're pleased.

A Tiny Real-Estate Empire

Kim and I also like that we've already begun building friendships in town. I've spent some time with Jeff from The Happy Philosopher, for instance, and Kim does weekly dog walks with one of the neighbors. Last weekend, we enjoyed happy hour with our real-estate agent and his wife.

Michael and Rae have lived in Corvallis for maybe ten or twelve years. In that time, they stumbled on the idea of “financial freedom” without ever discovering the burgeoning FIRE movement. (FIRE is a clumsy acronym for “financial independence and early retirement”.) Like many others who eventually find FIRE, these two invented their own version in a vacuum.

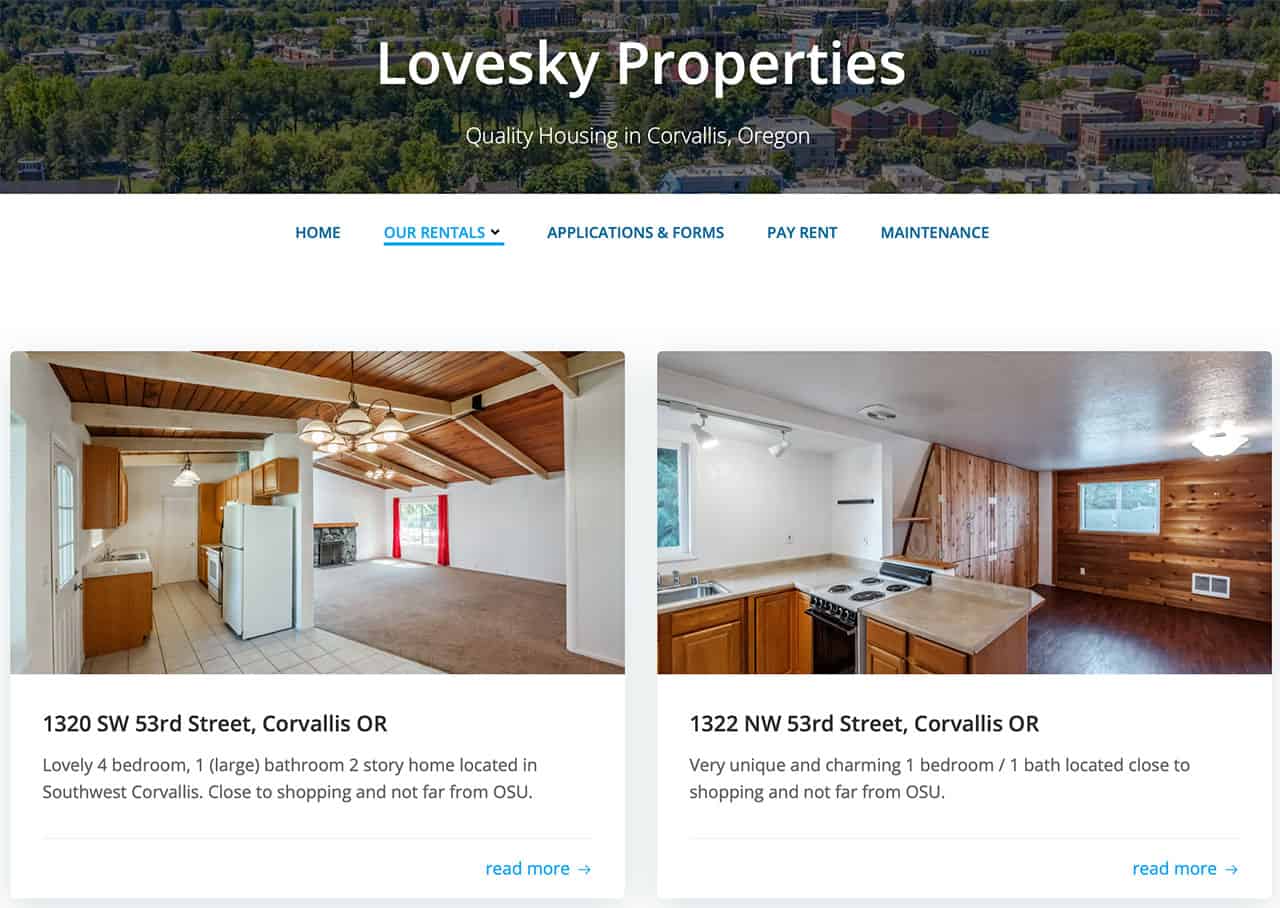

Michael and Rae have been slowly building a tiny real-estate empire, which currently comprises six homes. They'll buy a place, live in it while making improvements, then rent it out when they're ready to buy another property. Their goal, which they're approaching, is for the cash flow from their rentals to cover their monthly expenses.

Last week, over cocktails and appetizers at Magenta, Kim and I grilled Michael and Rae about their experience.

“Now that we've settled here in Corvallis, we've begun to talk about the idea of buying rental properties ourselves,” I said.

“I just turned 49,” Kim said. “My years as a dental hygienist are starting to take their toll. My back hurts. My shoulder hurts. My wrist hurts. I want to find a way to earn money without killing myself.”

Michael nodded. “We're happy to share what we know,” he said. “But you need to understand that this isn't some magical path to wealth. It's work. Maybe not the same kind of work you do now, but it's work. And it takes time to build an income stream.”

“I get it,” Kim said. “I get it. It sounds like you guys have it figured out. Didn't you tell us that you're renting only to college students? And that they come back year after year after year?”

“We don't rent only to college students,” Rae said, “but it's mostly students. Right now, one of our six homes is rented to a ‘normal' family. But you're right. We've been lucky to have low tenant turnover.”

“We try to maintain long-term relationships with our tenants,” Michael said. “We don't want to be their friends, but we do want to have good communication. We want them come back every school year. Often that means we don't raise their rent. Or, when we do, it's a very small increase.”

“That's smart,” Kim said. “It makes your tenants more loyal and prevents turnover. Turnover is probably tough.”

“It is,” Michael agreed. “We'd rather keep our tenants in place at rents slightly below market rate than deal with turnover every year. When somebody moves out, then we can move things to match the market. Besides, building strong relationships with our tenants seems to help keep them motivated to care for the place. And we're starting to see it helps when their siblings come to school in Corvallis. They contact us because their brother or sister had a good experience with us.”

“I like your ethical approach,” I said. “And listening to you talk about this makes me want to learn more about real-estate investing.”

“You know that I want to learn about it,” Kim said. “I've been saying that for years.” (She has!)

“You know,” I said, “many of my colleagues are into real-estate investing. I've talked with them about it, even though I haven't ever pursued it for myself. Do you read any of the real-estate blogs?”

“Not really,” Michael said. “I'm familiar with Paula Pant at Afford Anything, though. I like her stuff.”

“Paula and I are good friends,” I said. “We've been close since 2012, and we often call or text to catch up on life. In fact, last week we hung out at Fincon in Austin. She asked me to help promote her real-estate course.”

“You should do it,” Michael said. “I haven't seen the course, but she has solid info on her site.”

I thought for a moment.

“You know what I should do,” I said. “I should help Paula promote the course, sure, but more than that I should take the course for myself. I should take it so that I can learn about real-estate investing.”

“Yes, you should,” Michael said. “Not that I have an ulterior motive in having you buy more properties.” We all laughed at that.

“You know what'd help?” I said. “Whenever a rental property comes on the market, you send out a video that analyzes its potential. I love those, even if I don't completely understand everything you're talking about. I particularly like the spreadsheet you use to crunch the numbers.”

“That's no surprise,” Kim said.

“Would you be willing to record a YouTube video that explains your rental property spreadsheet?” I asked. “I could play with that spreadsheet myself while I take Paula's course at the same time.”

“You bet!” Michael said. “I'll record a video for you next week.” And that's just what he did. Here's Michael explaining the spreadsheet he uses to screen potential rental properties:

Your First Rental Property

I recently read Todd Tresidder's How Much Money Do I Need to Retire? I may write a full review of the book at some point. The key thing to understand at the moment, though, is that Todd thinks that it's somewhat risky to use the four-percent rule as a gauge for financial freedom. He makes a compelling argument that it's much safer to define financial independence the way Vicki Robin does in Your Money or Your Life: that point at which your passive income exceeds your expenses.

While my recent move to Corvallis has led me to once again become financially independent when defined in terms of the four-percent rule, I am not financially independent based on cash flow. My expenses exceed my passive income. I'd like to change that. And I think rental properties could be a part of a strategy for doing so.

This morning, I signed up for Your First Rental Property, Paula Pant's real-estate course. Reading the sales copy on the landing page was entertaining. I generally hate sales pages, but it was as if Paula had written this one with me in mind. It sounds as if the course is perfect for my needs.

It helps, I think, that I know Paula personally. Over the years, she and I have talked a lot about her various real-estate adventures. I've watched her slowly build her rental portfolio. Plus, I know that she's both smart and trustworthy. If I'm going to pay anyone for a real-estate course, it's Paula.

I also like and trust Chad Carson. Coach Carson's real-estate courses would be a good option too, and I may actually look at them for myself in the future.

Here's the thing. I get a lot of requests to promote books and courses and events here at Get Rich Slowly. I nearly always decline. I've never wanted this to be a platform for promoting products. I want GRS to be a platform for education.

That said, I do enjoy sharing books and events that I believe you folks will find valuable. That's why I'm keen on Ramit Sethi's I Will Teach You to Be Rich. That's why I've been personally involved in this year's EconoMe Conference, and why I'm urging others to join us in Cincinnati next month. Some of this stuff is terrific and ought to be shared.

Obviously, I cannot yet vouch for the quality of Your First Rental Property, but I did just plunk down my own money to purchase it. (“Did you mean to buy the course?” Paula's assistant emailed me. “Yes,” I said. “I want to take it.”) I'm going to ask Kim if she wants to work through the course together. I think it'd be fun to do as a couple!

And who knows? Maybe in a few years we'll have acquired some rental properties of our own…

Your First Rental Property, like many online courses, has a limited window of availability. (I think Paula offers it only once per year.) Sales for this cohort end October 14th. Get Rich Slowly earns a commission on each sale through our site.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)