How does a strong dollar affect you?

You have probably heard it before: At the end of yet another melancholy rant about how bad things are in America, someone inevitably adds “… and then the dollar is so weak, too.” Well, lament no longer because the dollar recently reached a seven-year high.

How is the Dollar Measured?

The U.S. dollar is used to measure so many things. The gold price is quoted around the world as so many U.S. dollars per fine ounce. Oil, too, is quoted as yea-many American dollars per barrel. Many other countries establish the value of their currencies against the dollar. So what do you use when you want to measure the thing that measures seemingly everything else? How do you answer the seemingly simple question: What is a dollar worth?

Pretty much the only way to measure the value of a currency is by comparing it to another one, and that is how you know whether it is strong or weak. You can measure the dollar against the Japanese yen, but what if Japan goes into recession and the value of its currency declines? That will increase the value of the dollar as measured in yen; but if Europe doesn’t have that same weakness, the dollar won’t increase as against the euro.

To solve the dilemma, experts have evolved something like a basket of currencies, some kind of average as a means of comparison. Well, that’s nice, but which average do you use? What most observers use is what is called a “trade-weighted average” where they identify the countries with which the United States trades the most to understand the purchasing power of the dollar. In rough numbers, these are the main countries trading with the United States for the first nine months of 2014:

- Canada — 17 percent

- China — 14 percent

- Mexico — 14 percent

- Eurozone — 12 percent

- Japan — 5 percent

- S. Korea — 3 percent

- United Kingdom — 3 percent

(Total trade is being defined here as the sum of imports and exports, as opposed to a balance-of-payments view, which nets those out.)

The currency basket which is used to measure the dollar, then, becomes a fictional currency which consists of 17 percent Canadian dollar, 14 percent Chinese yuan, 14 percent Mexican peso, and so forth.

How is the U.S. Dollar Doing?

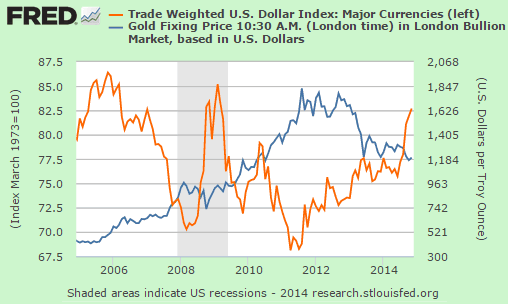

Here’s a recent chart supplied by the Federal Reserve:

You can see how sharply the dollar has risen in the last six months or so, and you may have heard people use the terms “strong dollar” or “weak dollar” before but not truly understood what it means. Usually, a strong dollar means the dollar value (measured by the trade-weighted bucket of currencies described above) is high and rising, whereas a weak dollar usually refers to a dollar value that is low and dropping.

You can also see that the dollar’s value moves in a cycle — it doesn’t always go up or always go down.

Using that terminology, we can say today that the dollar is strong. Although it is strong, its value is not as high as it was in 2006 (at the height of the booms in housing and collateralized mortgage obligations) or toward the end of the Great Recession, when the countries we trade with had their economies crash even harder than ours.

Why is the Dollar so Strong These Days?

The value of the dollar is not set by our government, or by any other government or group of governments; it is set by the demand for U.S. dollars. When other countries buy American products or services, they need American dollars to pay for them. But that’s not all. There are trillions of euros, yen, pesos, riyal, renminbi and all other currencies under investment by the pension funds and other big investors. When those big-money investors think American investments will make them more money, they come here to buy American properties, bonds, stocks, ETFs and mutual funds. For that, they also need American dollars.

Comparing the first nine months of this year to 2013, the increase in American net imports of goods and services was negligible (stronger exports of corn and crude oil accounted for a good share of that increase). Therefore, the main reason people from other countries have been buying U.S. dollars is for investment purposes. When you look at the rising stock market and investment-driven real estate purchases, you can see why. Foreign investors are counting on the value of an investment in something American rising not only because of the investment itself, but also the increase in value because it is denominated in a currency that is rising compared to theirs.

The strong dollar will not last forever, of course — it never does. But, it is what it is, at least for now — which brings us to the most important question.

What Does a Strong Dollar Mean For You?

A friend of mine once told me that nothing is all good or all bad. And so it is with a strong dollar: It brings benefits and challenges.

Challenges

The biggest challenge of having a strong dollar occurs at a macro level: a strong dollar makes our exports more expensive for buyers in other countries. When Qantas has to decide whether to buy 100 Boeing 787 Dreamliners or Airbus A350s, it is easy to see how a strong dollar can persuade them to buy from Airbus. It is also easy to see how that can hurt American workers … right at a time when the country is desperate to recover quality jobs.

A stronger dollar also makes American travel more expensive for foreign tourists. In turn, that hurts workers and businesses connected to tourism.

With a strong dollar, those American companies which make most of their profits overseas now make less, simply because the money they make in Brazil, Italy or Japan add up to fewer American dollars.

On a personal level, if you are someone who believes investing in gold is a good thing, a strong dollar is bad news. You can see from the chart below that the gold price usually goes down when the dollar goes up, and vice versa. That explains in great measure the gold price decline of the past couple of years that is shown in this chart.

Benefits

In contrast to the challenges of a strong dollar, which tend to be more nebulous, affecting other people, you personally reap several benefits from a strong dollar. Here’s how:

1. Imports: The biggest benefit, of course, is that imports are cheaper. (Well, they are cheaper in theory. at least.) That iPhone 6 no doubt is costing Apple a lot less to make, but someone in Cupertino conveniently forgot to notice that, because iPhone prices didn’t come down. At least they didn’t go up either, which could have happened if the dollar was weak. Christmas gifts made in China might turn out to be better this year, for example.

2. Gas prices: You have probably noticed that gas prices have been dropping these past few months. In part, that is due to Saudi Arabia putting on a bit of a power play, but a significant portion of that reduction also stems from a strong dollar.

3. Inflation: When the cost of so many imported things we buy goes down, particularly oil, that eases inflationary pressure considerably. While food prices have gone up, those increases get balanced by the decrease in the cost of the imported things we buy. The Fed would like to see inflation up around 2 percent per year, but the strong dollar has helped keep it down to around a percent and a half.

4. Investments: A strong dollar attracts foreign investors, as pointed out above, who push up the price of your investments.

5. Travel: If you have been saving for a trip overseas, this might very well be a good time to make those travel plans. The reason being, if you have been budgeting hard for travel, as Holly loves to do, you will still be spending some cash on vacation wherever you go, and that cash will go further when the dollar is strong.

Will This Strong Dollar Bonanza Last?

In a word, no. Nothing in the economy lasts forever. The charts above clearly show the ups and downs. It is hard to tell how long the dollar will remain strong because so much of it depends on expectations and other intangibles. The moment investors think somewhere else is “hot,” they will sell their dollars and buy whatever they think the next El Dorado will be. A few years ago it was the BRIC countries (Brazil, Russia, India, and China), then it was the good old USA, and tomorrow it may be India — but who knows?

And when that happens, other benefits will emerge: In the late ’80s, a weak American dollar attracted billions of dollars in “hard investment,” i.e., factories — especially to make automobiles. Those investments created jobs, some of which we still have today.

What do you see as the benefits of a strong dollar? How can you use this information in your financial decisions?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)