Your credit score — and why it matters

For today’s edition of “back to basics” month at Get Rich Slowly, we’re going to talk about credit scores. What is a credit score? Why should you care?

As you go about your life, you leave a trail of transactions. You take out a mortgage, you buy a new car, you use your credit card to buy new clothes and your debit car to purchase groceries.

Every month, your creditors — the companies to which you owe money — send info about your recent activity to a variety of credit reporting agencies (commonly referred to as credit bureaus). Each agency collects this info into a file called a credit report.

Your credit report is a history of how well you’ve managed your credit. It contains info about where you’ve lived, how much you’ve borrowed, and whether you tend to pay your bills on time. It also notes if you’ve ever filed for bankruptcy.

The credit bureaus — Equifax, Experian, and TransUnion — sell your credit report to other businesses so they can decide whether to lend you money, sell you insurance, rent you a home, or give you a job.

Credit reports may be boring, but they’re vitally important because they provide the basis for your credit score.

How to Get Your Free Credit Report

The U.S. government has mandated that consumers be allowed to view their credit reports from each of the three major reporting agencies once every year. This is easy to do via the free AnnualCreditReport.com website. (Beware of scammy lookalikes. This one is the official government-sanctioned site.)To get your report, you need to provide some basic info like your Social Security number. You might also need to answer some questions about current and/or past accounts. Sometimes these questions get tricky if you don’t have quick access to your files. (When Kim had to check her credit report recently, she couldn’t remember the amount of her mortgage payment from 2005. Her request was denied.)

If you’d like, you can obtain reports from all three credit reporting agencies at once. Or, you can stagger your requests, possibly requesting one report every four months from a different agency.

Your Credit Score

While your credit report collects info about your debt history, your credit score is a single number that summarizes all of that data.

Credit scoring has been around for decades in one form or another. It only became widely used during the 1980s after a fim called Fair Isaac (now known as FICO) developed a new type of credit score called a FICO score. The mortgage industry recognized the usefulness of credit scores, widely adopting them in the mid-1990s. Other industries followed suit.

To generate your credit score, FICO takes bits of data from your personal credit report and compares this info to similar data from millions of other people. FICO then uses secret formulas to squeeze all of this information into a single number, which can range from 300 to 850. This number is a measure of risk. It gives lenders a good idea of how likely you are to pay them back. They use it to decide how much to lend you, what interest rates to charge, and what terms to set.

Note

Although the FICO score is the most widely used credit score — used in over 90% of U.S. lending decisions — it’s not the only credit score. Other companies offer competing credit scores, and FICO (the company) offers a variety of specialized scores to measure things like how likely you are to declare bankruptcy, close an account, and so on.Take a company like Credit Sesame, for instance. Credit Sesame offers a variety of credit-monitoring tools including a free credit score. But Credit Sesame does not use a FICO score. The company uses the VantageScore, which was developed by the three major credit bureaus as an alternative to the FICO score.

Confused? Don’t sweat it. The important thing to remember is that we often talk about “your credit score” like it’s just one thing when it’s actually many credit scores.

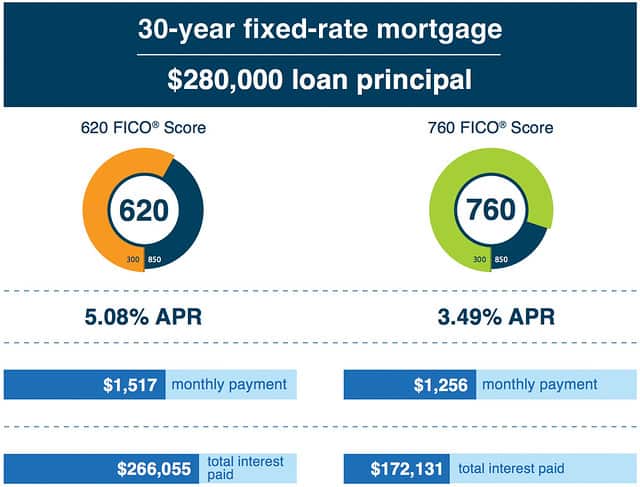

“A bad or even mediocre credit score can easily cost you tens of thousands and even hundreds of thousands of dollars in your lifetime,” Liz Weston writes in Your Credit Score. “You don’t even have to have tons of credit problems to pay a price. Sometimes all it takes is a single missed payment to knock more than 100 points off your credit score and put you in a lender’s high-risk category.”

A high credit score will get you the best interest rates on credit cards and loans, including mortgages. With a low score, you’ll pay higher fees and interest rates.

Here’s an example from FICO:

Bad credit can cause a downward spiral. One money mistake leads to bad credit, which costs you more money and leads to more debt, which drops your credit score…and so on. But your credit history doesn’t just affect your ability to borrow money. Nowadays, it’s used by insurance companies, landlords, and even employers.

- Some insurance companies use a specific credit score (known simply as your insurance score) — combined with other info — to gauge how likely you are to file a claim. A lower score can lead to higher insurance premiums.

- When you try to rent a home, your prospective landlord may run a credit check. If your credit score is low, she may see you as a high-risk tenant and ask for a larger security deposit — or simply turn down your application.

- Current and potential employers can pull your credit report if you grant them written permission. This is especially true for which security is important. To some employers, a good credit record shows that you’re less likely to steal from the company, to take bribes, or to reveal sensitive information.

As you can tell, your credit score can have a very real impact on your life. But how is your credit score actually calculated? Let’s take a look.

The Anatomy of a Credit Score

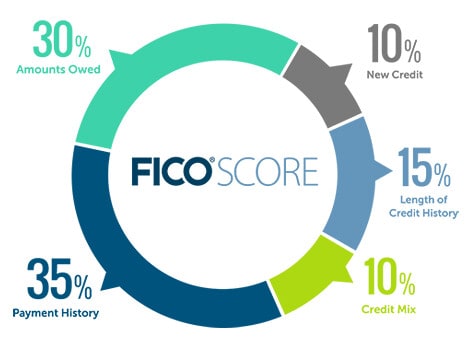

According to FICO, your credit score is determined by a variety of factors that predict how likely you are to repay the money you borrow. Your credit score tracks 22 pieces of information from five broad categories:

- Payment history (35% of your FICO score): Do you pay your bills on time? If you pay late, how late? How long has it been since you missed a payment? How many times have you had problems? The more responsible you’ve been, the higher your score.

- Amounts owed (30%): How much credit do you currently have? Of that credit, how much are you using? How many of your accounts have balances? The less of your available credit you use, the better your score.

- Credit age (15%): How long have your accounts been open? How long has it been since you used them? The longer you’ve had accounts, the better your score.

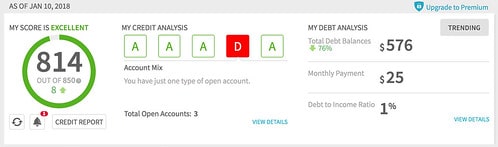

- Credit mix (10%): How many different types of credit accounts do you have? (The two main kinds are installment debt like a car loan or a mortgage and revolving debt like credit cards.) How many do you have of each type? Your FICO score will be higher if you use a mix of different kinds of credit. (This is the only weakness to my own score. I don’t have any installment loans at the moment.)

- New credit (10%): Have you opened new credit accounts recently? How many? Opening new accounts may ding your score, especially if you open many at once.

For some folks — like young adults who don’t have a lengthy credit history — the weight of each individual category may be a little different.

While FICO shares this broad overview of how they determine scores, the actual formulas are confidential. If you want more info, download the free “Understanding FICO Scores” booklet from FICO.

How to Get Your Free Credit Report

Even a decade ago, it was tough for a consumer to get her credit score. They were considered top secret info. It was a Big Deal to find some sort of hack that let you see your number.Nowadays, there are a variety of ways to see your credit score for free. Both my Capital One credit card and my Chase credit card, for instance, give me access to my credit score. On those rare occasions I need to make a large financial transaction, I’m almost always offered my credit score.

And, of course, there are now companies like Credit Sesame, which are set up to offer consumers a variety of credit-monitoring tools, including a free credit score. (I’ve been watching my credit score with Credit Sesame for a while now. It was 804 a year ago. It was 810 in November. It’s 814 now. But I still get a “D” for my account mix. If I had other types of credit, my score would be higher.)

What is a Good Credit Score?

According to FICO, the national average FICO score is 695. While the company doesn’t share detailed stats about credit scores, they have published the following guidance:

- A FICO Score of 800+ is considered exceptional.

- A FICO Score between 740 and 799 is considered above average.

- A FICO Score between 670 and 739 is considered average.

- A FICO Score between 580 and 669 is considered below average. (Many lenders will still approve loans with scores in this range.)

- A FICO Score below 580 is well below the U.S. average and shows that you’re a risky borrower.

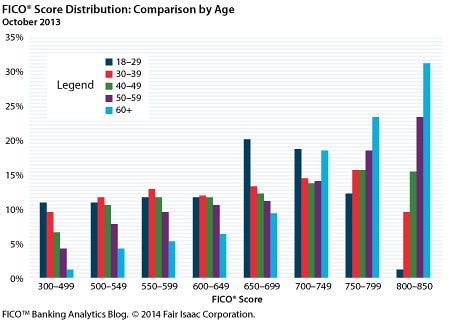

Each of these ranges (or quintiles) contains roughly 20% of the American population. (About 17% of the U.S. has a score below 580, for example, while 19.9% have scores above 800.)

Last February, I signed up for a new credit card. My banker was chatty and we had an amusing conversation about credit and credit scores.

“Your credit score is 804,” he noted. “That’s unusual. The average credit score is below 700. You also pay off your balance every month. That’s unusual too.”

“It is?” I asked.

“You bet,” he said. “Something like 90% of our credit card clients carry a balance. I can tell we’re probably not going to make any money off of you, but that’s okay. You can’t win them all!”

Although income is not a direct factor in computing credit scores, there is a strong correlation between household income and credit scores. The more a person earns, the higher her credit score is likely to be. Age is also a factor (which isn’t surprising since you have to build a credit history to have a good score).

How to Improve Your Credit Score

Simply knowing your credit score doesn’t do you a lot of good. If you’re not happy with your score, you can take steps to improve it. My pals at Stacking Benjamins just published a podcast interview with Farnoosh Torabi about the keys to raising your credit score. From my reading, these five factors are important in giving it a boost:

- Pay off your debt. According to credit expert Liz Weston, “The most powerful thing you can do to improve your credit score is to reduce your credit utilization.” In other words, reduce your credit card balances. FICO reports that about one in seven people who carry credit cards are at over 80% of their credit limit. “Below 30% is good,” Weston says. “Below 10% is better.”

- Pay on time. According to Weston, if your FICO is 780, a single late payment can drop it 100 points. If your score is 680, a late payment can cut it 70 points. If you miss a payment, don’t panic. Do what you can to get current and stay current.

- Only open new accounts you need. Don’t open a store charge account just for kicks or because the salesman pressures you into it. New accounts are only a small part of your total score, but they do have an effect. Keep new accounts to a minimum, especially if you’re planning a big purchase (such as taking out a mortgage).

- Don’t close old accounts. It’s okay to cut up old cards or to free them in a block of ice, but to maximize your score, keep the accounts open. If you have to close an account or two, close newer accounts before older ones.

- Keep tabs on your credit report. Even if you do everything right, your credit score can take a hit from identity theft and other forms of fraud. Even simple errors can hurt your score. Check your report regularly, and correct any problems you find.

Here’s a final word of advice: Don’t obsess over your credit score. Sure, it’s important, but ultimately it’s a number for lenders, not for you. A less-than-perfect score isn’t the end of the world.

I just spent the weekend in a group of 58 early retirees. Many of these folks have more than a million bucks in the bank but have lousy credit scores because they do things like travel hacking. They’re not worried because they know their credit score is just one piece of the puzzle.

If you struggle with compulsive spending, it’s far better to cancel your credit card accounts and take the hit to your credit score than it is to risk getting buried deeper in debt. The bottom line? Be smart with your money and your credit score will be fine.

Next Steps

If credit scores are important to you or interest you, I recommend Liz Weston’s Your Credit Score. Whether she likes it or not, Weston has been pigeon-holed as one of the top credit score experts in the nation. Her book is packed with great info on how credit scores work and how to improve yours.I also recommend checking your credit score regularly. I pull mine whenever I check my credit report. But I try to to look at it every month or two, even if I’m not checking my credit. I use one of my credit card accounts, if I think of it while I’m doing my finances. Otherwise, I just pop into Credit Sesame.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)