The most important factor in retirement savings

“Wanna see something neat?” Kris asked the other night. She was holding the year-end statement from her work-based retirement plan.

“Sure,” I said. “Show me the money.”

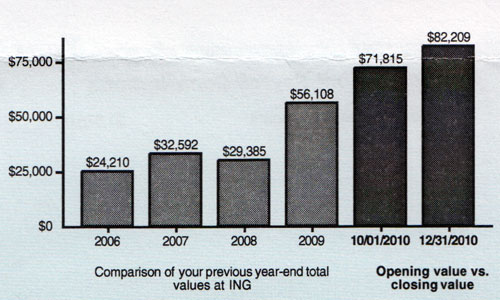

She handed the statement to me. “Look at my account balance,” she said. “Look how it’s grown. It went down a little bit in 2008, but because I kept contributing, the balance has gone crazy during the last two years.”

Kris’s retirement account took a hit in 2008, but rebounded in 2009 and 2010.

“How do you earn such great returns?” I asked. “I’ll bet readers at Get Rich Slowly would love to hear.”

“Well, it’s not just investment returns,” Kris said. “A lot of that growth is because I save so much. I max out the allowable contribution in this account. I started by contributing 8% of my gross [pre-tax] pay. When I got my raise the next year, I bumped that to something like 10%. Then 12% with the next raise. And so on.”

“What percentage do you contribute now?” I asked.

“I’m not sure,” she said. “Last year, I did the max, which is $16,500 a year. I’d contribute more, if they’d let me, but they don’t, so I just invest it elsewhere. Like my Roth IRA and my mutual funds.” (All of Kris’s investments are in mutual funds, but she calls one particular account her “mutual funds”.)

Kris smiled. “Pretty cool, huh?” she said. Yes. Yes, it is. Pretty cool, my savvy wife.

There are a number of great lessons here — including the wisdom of sticking with an investment plan even during a down market — but one in particular stands out. Kris’ experience highlights the most important piece of the retirement savings puzzle: The number-one factor in determining how much you’ll have at retirement is the amount you save. Please re-read that sentence, because it’s not really as obvious as it may sound.

The economy, your choice of funds, your tax bracket — all of these play a role in your final retirement balance, but none of them is as important as how much you’ve actually set aside. All of the compounding in the world won’t help you if you never save any money. But if you consistently save as much as you can, you’ll be better able to weather market downturns — and take advantage of bull markets like the one we’ve enjoyed the past two years. The more you save now, the more you’ll have when you need it.

The National Economy vs. Your Personal Economy

Last January, Get Rich Slowly and MoneyRates asked readers of both sites for their opinion about the current state of the economy. Over 1200 people responded. This January, we asked the same question and received nearly 2100 answers. The results are certainly un-scientific, but they’re interesting:

Where do you think the economy sits right now?

- Strong growth. Full steam ahead! 2010: 2%, 2011: 3%

- On solid ground and growing some, thank goodness. 2010: 15%, 2011: 26%

- Stagnant. Not growing, but at least not getting worse. 2010: 43%, 2011: 39%

- Not horrible, but looks like it’s going downhill. 2010: 20%, 2011: 17%

- Free falling. I’m bracing for the worst. 2010: 21%, 2011: 15%

Regardless of the state of the national economy, it’s important to remember that ultimately, you are responsible for your personal economy. When times are flush, you need to set something aside for the future – be it through a retirement savings plan, savings account, or other method. Then, when things turn dark and dismal, you’ll be better shielded from the slings and arrows life hurls your direction. My wife, for example, has done a fine job of ignoring the world at large while trying to improve her own situation.

It’s been a while since I stressed this point, so let me repeat what I’ve said before. A strong personal economy is built on personal finance fundamentals such as these:

- Clear financial goals

- An adequate emergency fund

- Limited use of debt

- The practice of thrift

- Smart investing for the future

The national economic situation will affect our personal financial decisions to some degree. When unemployment soars, it’s important to maintain an adequate emergency fund and to limit your use of debt. When the stock market is down, you need to understand your investment objectives, and how these relate to your risk tolerance and your investment timeline. (And when the stock market is up — as it is now — you need to ask the same questions.)

Ultimately, all you can control are your personal finances. Take matters into your own hands: Save for retirement today.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)