Morningstar ratings: Useful or useless?

The financial industry generally places more emphasis on style than substance. Because of this, when their work is actually evaluated, results tend to be disappointing. Wall Street's earnings forecasts? Overly optimistic. Performance of mutual fund managers? Quite embarrassing. You may be wondering: Do Morningstar ratings also belong in the same category?

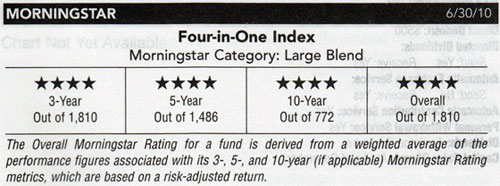

You're probably familiar with Morningstar and their one- to five-star mutual fund ratings. Many investors rely on Morningstar for stock and mutual fund research, and mutual fund companies love using Morningstar ratings in their marketing materials. But is there any value in a five-star Morningstar rating? (Disclosure: I use Morningstar software sold to investment advisors almost everyday.)

Fortunately for us, researchers recently looked into these ratings and published their results. They compared Morningstar ratings to fund expense ratios as a predictor of future performance.

Choosing a target-date fund

So, you find the lazy way to invest very appealing: You like the simplicity and the long-term results. But you don't want to bother with building your own lazy portfolio of index funds and adjusting it as you get older (same as creating your own target-date fund). At this point in your life, you just want a set-it-and-forget-it solution, at least until you feel more comfortable building your own investment portfolio. Target-date funds seem perfect for the job, but which one is right for you? Let's walk through choosing a target date fund.

Related >> Investing 101: An Introduction to Index Funds and Passive Investing

How do bonds work and are they worth it?

You probably know how to find and buy stocks, but how do bonds work?

You probably know how to find and buy stocks, but how do bonds work?

Unfortunately, while online stock brokers have made stock investing child's play over the last 10 years, bond investing has been slow to catch up. In fact, on many online broker sites, online bond platforms don't even exist. That's made the world of individual bond investing pretty murky.

You know that a certain percentage of your portfolio should be allocated to bonds (say 40% if you're in your 40s), but you've probably relied on bond mutual funds to do that. And that's not a bad thing: Bond mutual funds let you own bonds from hundreds of companies with only a small investment. They also have professional managers who can do research into bond investments for you. But bond funds also have one, significant disadvantage to owning individual bonds.

The Best Mortgage Rates

Current Mortgage Rates

Getting the best mortgage or home loan rate can save you thousands over the course of your loan. If you are looking to refinance your existing mortgage loan or are looking for a new home mortgage loan, the table below can help you find the best mortgage rates quickly and easily.

It currently displays refinance loan, rates for $150,000, mortgage loans in your state. If you are looking for a different type of mortgage, you can customize your search using the box below. Also, if you would like to receive customized quotes from up to 4 lenders, complete form on the right.

Compare Below:

Know Your Consumer Rights When it Comes to Credit Cards

Some 3 billion pieces of mail are sent to U.S. consumers each year from credit card companies, according to 2015 statistics highlighted in Business Insider. That's a lot of marketing to wade through. And, as you know, it's simply not enough to pay your balance in full and on time. Credit card companies are looking for ways to penalize you for paying your balance off. They can cancel a card if you are not using it, which can hurt your credit score. Did you know they can raise your APR on one card simply because they found out you were late on a payment to another? Did you also know that the fine print on contracts states they can increase your APR at any time they want, for any reason?

Fighting back doesn't take one borrowed dollar. Here are ten ways to turn the tables on credit card companies.

Best personal finance podcasts

Podcasts are a great and free way to learn about saving and investing. Here are some of the very best personal finance podcasts we feel are worthy of your "must-listen" line-up:

Planet Money

Planet Money is perhaps the best all-around podcast about money and economics out there right now. The production values are extremely high -- as you'd expect from any NPR show -- but it stands out for its ability to explain the most complex economic issues in straightforward and innovative ways. Their most famous episode, "Giant Pool of Money" with This American Life, remains one of the best pieces of explanatory journalism on the housing crisis in any medium. If you still aren't certain what caused the housing crisis of 2008 and the global money panic that followed definitely give this episode a listen.

Bad With Money

If you don't know a stock from a bond or an IRA from the IRS, you may want to check out Bad With Money with YouTube comedian and former BuzzFeed writer Gaby Dunn. While primarily geared toward millennials, this podcast is a sonic kick-in-the-pants for anyone who needs to get a handle on their money management (or lack thereof.) One of the better episodes allowed listeners to come along as Gaby unloaded all her financial baggage to a financial psychologist. Yes, your parents' attitudes about money are likely affecting you today. This is not the place for advice on sophisticated financial instruments or advanced savings and investing -- by any means -- but Gaby's voice is fresh and the tone 100 percent non-judgmental.

I quit my job — What should I do with my 401k?

When you leave your job, you have several choices regarding your 401(k). These options for a 401(k) rollover are pretty much universal, meaning they apply to every 401(k) and to every job change situation. Your options are:

Cash the 401(k) Plan and Receive a Full Pay-Out

I've listed this option first because it has the most serious ramifications.

The Total Money Makeover review: Dave Ramsey’s best book?

According to Get Rich Slowly founder J.D. Roth, Dave Ramsey and his influential book "The Total Money Makeover" changed his life:

According to Get Rich Slowly founder J.D. Roth, Dave Ramsey and his influential book "The Total Money Makeover" changed his life:

"In the fall of 2004, I had over $35,000 in consumer debt. I was making a solid middle-class salary, but I lived paycheck to paycheck. My money habits were terrible. When I looked into the future, all I saw were years of toil to pay for the things I'd already purchased.

"Then a friend loaned me a copy of The Total Money Makeover, a book by some guy I'd never heard of named Dave Ramsey.

A simple budget planner (free budget template)

J.D. doesn't talk a lot about budgeting at Get Rich Slowly — he uses a spending plan — but I want to share a personal budget planner I've created that has helped me immensely. I'm not historically a budget person myself, but I've been using this for a while and it seems to be working quite well. I hope that some of you find it useful, too.

This budget planning spreadsheet is available in the following formats:

- Microsoft Excel (70kb) — right-click and choose "Save as..." to download. This file should also work with Open Office.

- Google Docs — select "USE TEMPLATE" to save to your account.

Please note: This spreadsheet is designed solely to keep you on a budget you've already set, not to help you create a budget. Budgets vary from person-to-person. Create one that works for you, and use this planner to track your progress. (If you need help developing a budget, try this budget estimator from GRS reader Justin M.)