How to Read a Personal Finance Book

I read a lot of personal finance books. I do this because I learn best by reading, and because I like to review the available literature for readers of this site. When I recommend a book, it's because I think there's something valuable there, maybe not for everybody, but for most people. Books are only valuable, though, if you are willing to do your part.

Be an active reader

You, as the reader, must be an active participant. You must question what you read. You must try to discern the author's motives, and decide how those might cloud the advice she gives.

It does no good to read Dave Ramsey's The Total Money Makeover, for example, if you're only going to read it. For it to have value, you must apply its principles. Not all of the principles, but those appropriate for your situation. As always, do what works for you.

The 4-Hour Workweek review and summary

When I picked up The 4-Hour Workweek, I was worried it was some sort of "get rich quick" book. The first few pages didn't do much to change my mind.  The author, Timothy Ferriss, makes a lot of bold claims, such as: "How do you create a hands-off business that generates $80,000 per month with no management? It's all here."

The author, Timothy Ferriss, makes a lot of bold claims, such as: "How do you create a hands-off business that generates $80,000 per month with no management? It's all here."

But something happened during the first few chapters. When I read a book, I use small sticky notes to mark interesting passages. After the first 100 pages of The 4-Hour Workweek, the book was thick with stickies. By the time I was finished, I had used an entire pad!

Ferriss does make a lot of bold promises, and some of the details along the way do read like the confessions of a get-rich-quick scammer. But I believe that an intelligent reader can easily extract a wealth of useful ideas from the book. For me, it's a keeper. I've read it three times already, and will probably read it again before the end of the year.

In Pursuit of Paperless Personal Finance

I'm swamped with paper. This is partly because I'm a packrat, but mostly it's due to the never-ending bills, statements, receipts, policies, and special offers that flood my desk. The paperless office once seemed like a silly goal to me, but lately it's become a holy grail. Spurred by Leo's adventures in minimalism and my own desire to get rid of clutter, I've begun to explore ways to move my money into the 21st century.

I'm swamped with paper. This is partly because I'm a packrat, but mostly it's due to the never-ending bills, statements, receipts, policies, and special offers that flood my desk. The paperless office once seemed like a silly goal to me, but lately it's become a holy grail. Spurred by Leo's adventures in minimalism and my own desire to get rid of clutter, I've begun to explore ways to move my money into the 21st century.

Here are eight ways to begin moving toward paperless personal finance:

- Reclaim your mailbox. Use OptOutPrescreen.com to stop credit card and insurance offers. Stem the tide of junk mail with the Direct Marketing Association's mail preference service. Cancel unwanted magazine subscriptions.

- Consolidate accounts and close those you no longer use. Reduce the number of credit cards you carry. If you have bank accounts at multiple locations, combine them at a single bank. The fewer accounts you have to track, the less paper you have to deal with. (Be aware that closing unused credit card accounts will cause a temporary ding to your credit score.)

- Use electronic billing. If you have a choice between paper and paperless, opt for the latter. Not only will this reduce clutter, but it can also save you money. I save $2/month through electronic billing for my auto insurance. Now I'm considering whether it's worth the $5/month cost to sign up for electronic billpay through my credit union. When I calculate how much I'd save on stamps, and count the $2 I've already saved with my insurance company, I could move to completely electronic bill payments for a net cost of $1/month.

- Computerize your checkbook. For years, I've used Quicken to balance my checkbook. This is probably normal for young adults, but many of my middle-aged friends still balance their checkbook by hand. One couple I know began using Quicken to track their finances this summer, and are blown away by how easy it is to use. Even a simple spreadsheet can reduce the amount of paper you're shuffling.

- Photocopy documents. I have a friend who, at the end of each month, photocopies his financial documents and places them in a three-ring binder. He's been doing this for years. While not quite paperless, this is a great option if you don't have access to a scanner. It sure beats my stack of shoeboxes!

- Scan receipts. My accountant uses a $900 scanner that automatically converts documents to PDF files. You don't need anything so fancy. My sister-in-law scans her receipts and bills and saves them to her hard drive as jpegs, vastly reducing the amount of paper she keeps on hand.

- Use the web. Online apps offer smart ways to track your finances while reducing clutter. Due.com is a web-based personal finance program with a community element. Shoeboxed lets you scan or photograph your receipts and organize them online.

- Know which financial records to keep (and how long to keep them). Purge your archives. For years, I've kept every financial document that comes into my life. I literally have dozens of shoeboxes in storage filled with financial documents, most of which I no longer need. By learning which documents you need to keep, you can be sure that you're not storing useless paper.

Paperless personal finance isn't without its pitfalls, of course. Keep the following best practices in mind if you decide to pursue this route:

Grocery store vs. Farmers Market: Which has the cheapest produce?

Last year I asked, "How much do you spend on food?" Answers varied widely. Some commenters couldn't comprehend that others could spend so much — or so little. I've always believed that buying produce at the farmers market is a good way to cut food costs. But is it really? This weekend I decided to find out.

Over the past two days, I've surveyed produce prices at five different locations: the farmers market, a produce stand, and three different grocery stores. I did my best to compare apples to apples (so to speak), but I cannot guarantee that my methodology was flawless. Still, this survey was accurate enough for me to draw general conclusions about my personal shopping. Here are the places I scouted:

Milwaukie Farmers Market

The nearby farmers market is a great source for produce, but it's not exactly convenient. It's open every Sunday from 9:30am to 2:00pm between May and October. The market is a crowded, bustling place with dozens of local growers offering their wares. Quality is good, and most items are raised organically. The market also features cheese-makers, bakers, and the all-important knife man. (We take our blades to be sharpened at the end of every summer.) Continue reading...

What if the Stock Market Makes You Nervous?

A couple of readers have mentioned that they're nervous about the stock market's recent volatility. I've read similar concerns on other blogs and financial news sites. People are worried that the stock market's performance over the last month portends an impending bear market, and they don't know what to do.

Reading these concerns reminded me of Why Smart People Make Big Money Mistakes, which I reviewed last week. In the book, the authors discuss panic selling as a common financial pitfall. When people suffer from loss aversion, short-term losses cause them to sell investments prematurely, which can lead to greater pain:

One of the most obvious and important areas in which loss aversion skews judgment is in investing. In the short term, being especially sensitive to losses contributes to the panic selling that accompanies stock market crashes. The Dow Jones Industrial Average tumbles (along with stock prices and mutual fund shares in general), and the pain of these losses makes many investors overreact: the injured want to stop the bleeding. The problem, of course, is that pulling your money out of the stock market on such a willy-nilly basis leaves you vulnerable to a different sort of pain — the pangs you'll feel when stock prices rise while you're licking your wounds. Continue reading...

Why Smart People Make Big Money Mistakes (and How to Correct Them)

Continue reading...Money is more about mind than it is about math — that’s one of the key tenets of this site. People make financial decisions based not on mathematical ideals, but on emotion.

There’s actually a branch of economics called behavioral finance devoted exclusively to this phenomenon, exploring the interplay between economic theory and psychological reality.

On a recent train ride across Ireland, I read a book on behavioral economics called Why Smart People Make Big Money Mistakes (and How to Fix Them), which was published in 1999 by Gary Belsky, a former writer at Money magazine, and Thomas Gilovich, a psychology professor at Cornell University. In this short book, Belsky and Gilovich catalog a menagerie of mental mistakes that cause people to spend more than they should. What might have been a boring topic becomes fascinating thanks to an engaging style and plenty of anecdotes and examples. This book covers a couple dozen psychological barriers to wealth. I’m going to highlight just a few.

For example, do you treat “found money” — gifts from grandparents, tax refunds — differently than you do the money you earn from working? If so, you’re guilty of mental accounting, and it’s probably costing you. If you’re tempted to take money out of stocks when the overall market drops, you suffer from loss aversion, and overcoming it will allow you to earn more from your investments.

I've always been a packrat. When I was a boy, I had a closet that my parents called my "rat's nest". I stashed anything I could find in there. As I grew older and began to earn money, my urge to possess things became a compulsion: I bought tapes and records and books and clothes and comics. I would buy anything that seemed like a bargain. (I often bought on credit, of course.) I used to have a stack of Costco clothes in my closet that I'd never worn. I once brought home six boxes of free books from a bookstore's "going out of business" sale. These books may not have cost me any money, but I now realize that they weren't exactly "free".

How does this relate to my trip to Europe?

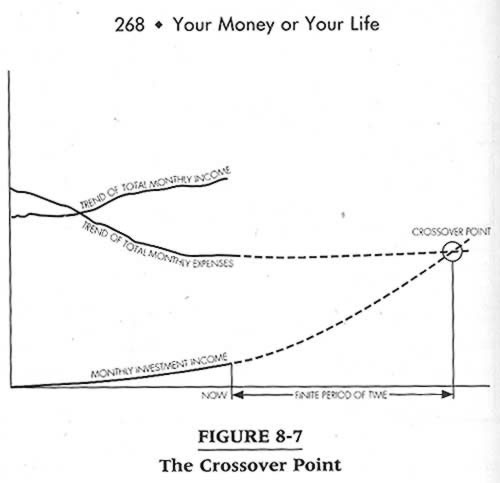

More about...PsychologyAn introduction to the crossover point

The book Your Money or Your Life popularized the notion of the Crossover Point. The Crossover Point is simply that point in time at which your investment income exceeds your monthly expenses. For most people, this never occurs.

YMoYL is about getting readers to the Crossover Point. The authors want people to achieve Financial Independence, which they define as "having enough — and then some". They ask readers to track income, expenses, and investment income, plotting each of these on a wall chart. The entire book is about finding ways to get the investment income line (low on the graph) to meet (and then cross over) the expenses line.

This is esoteric, I know, but it's important. Reaching the Crossover Point means that, if you wanted, you could stop working for money. You could retire. You could work for self-fulfillment. You could travel the world or write a book. If YMoYL were a novel, this would be the climax of the story: Continue reading...

Debt is Slavery book review

Continue reading...One of my goals for the next two years is to write a book about personal finance. I want it to be a practical volume filled with great tips, while also exploring the personal side of money issues.

The real trick is that I want it to be a short book — no quizzes, no jargon, no padding — and that's not something that appeals to most publishers. Unfortunately (or perhaps fortunately), Michael Mihalik has already written a book similar to the one I have in mind!

The body of Debt is Slavery (and 9 Other Things I Wish My Dad Had Taught Me About Money) is just 88 pages packed with sensible advice about money. Like me, Mihalik made some dumb financial choices when he was young, and he spent years struggling to recover from his mistakes. Debt is Slavery is the distillation of all that he has learned about personal finance. If you've been reading Get Rich Slowly for a while, Mihalik's lessons won't be new, but he does an excellent job of presenting each point.

How to Find Great Deals on eBay

My friend Lisa is something of an eBay addict. I'll be at her house admiring something or other and she'll smile confidentially and whisper, "I got it off eBay."

She recently showed up at a dinner party wearing a smart cocktail dress. When the other women admired it she smiled confidentially and whispered, "I got it off eBay." At Christmas she made some crafty little things that amazed and delighted the recipients. When we asked how she came up with the idea she smiled confidentially and whispered, "I got it off eBay."

More about...Uncategorized

More about...Uncategorized

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)