Cost of living: Why you should choose a cheap place to live

While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.)

“Things are cheaper here in North Carolina than they are in Portland,” I said. “Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are!”

“Yeah, housing costs are lower here than in many parts of the country,” Justin said.

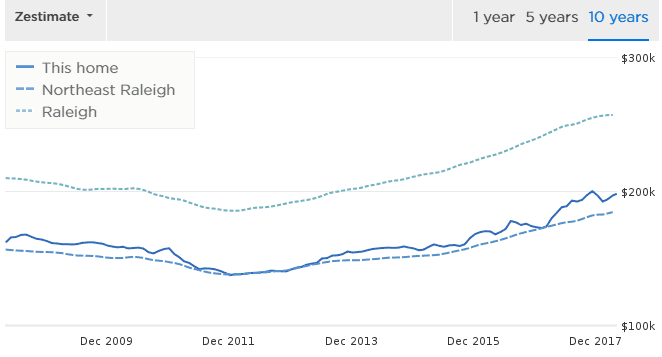

“Take our house, for instance. We bought it in 2003 for $108,000. Zillow says it’s worth around $198,000 right now. But I’ll bet that’s a lot less than you’d pay for a similar place in Portland.”

He’s right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. There’s only one place for sale in Portland right now that matches these stats and it’s going for $430,000 — more than twice the price the same home would fetch in Raleigh.

Housing is by far the largest slice of the average American budget, representing one-third of typical household spending. Because of this, the best way to cut your costs (and, therefor, boost your “profit margin”) is to reduce how much you spend to keep a roof over your head.

One obvious way to cut costs on housing is to choose a cheaper home or apartment. But if you truly want to slash your spending, consider moving to a new neighborhood. Or city. Or state. If you’re willing to change locations, you can supercharge your purchasing power and accelerate your saving rate.

Cost of living is one of those factors that people seldom consider, but which can have a huge impact on the family budget — sometimes in unexpected ways. According to The Millionaire Next Door:

Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.

It’s one thing to talk about the effects of high cost of living, but another to actually experience it.

Cost of Living in Real Life

On our fifteen-month road trip across the United States, Kim and I made a point of watching how prices varied from city to city and region to region.

While stranded for ten days in rural Plankinton, South Dakota, for example, I paid $10.60 for a fancy men’s haircut. At home in Portland, I pay $28 for the same fancy haircut. In Fort Collins, Colorado, I paid $30 for a haircut. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas was cheaper in South Dakota too. So was food. So was beer and whisky. So were movies. So was just about everything, including housing. Housing prices followed a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. In South Dakota, that same home would cost about $106,000.

A couple of years ago, I exchanged email with a reader who had first-hand experience struggling with the high cost of living. She gave me permission to share her story:

I had been saving about 40% of my relatively modest salary for eight years. I had built up an emergency fund as well as a good sized savings…and then we had kids.

We lost our rent-stabilized apartment right after our children were born. We live in New York City, and while I maintain that there are many things about the city that are actually very budget-friendly (public transit and free entertainment top my list), the cost of rent and daycare in NYC are over the top.

In one year, the cost of a market-rate apartment in our neighborhood plus two kids in daycare ate into my hard-earned savings. By the end of the year, the pot of money that I had worked so hard to save was down by almost $50,000.

Luckily, my husband and I have never carried any kind of debt and had already been living well below our means before the kids came along. But that also meant there was very little fat left to trim in our budget other than rent and daycare expenses. (We’d already dropped the landline, never had cable, cooked almost all of our meals at home, and cut out our modest “allowance” of $50/month for splurges.)

We are the very definition of penny wise and pound foolish!

Eventually, we moved into a cheaper apartment. Although we haven’t had to dip into savings since we moved, we’re still essentially living month to month because of daycare and rent. The neighborhood is cheaper for a reason.

Real Life will force us to make another move in the spring. One of our jobs is going away, so it will force a decision one way or another since we can’t stay in New York on one salary. Change is definitely coming.

This reader and her husband are already frugal-minded — that’s how she built her buffer of savings to start with — so there isn’t much more the family can cut. This is an example where the only real solution is to seek a city with a lower cost of living.

Saving in Savannah

Which places are cheapest to live? Which are most expensive? This map from Governing magazine shows how far the average paycheck goes in 191 U.S. metro areas.

Dark green (blue?) dots indicate cities where your wages buy more after adjusting for cost of living. Dark brown dots are places where you have to work harder to get what you want. (Click through to play with an interactive version of the map.)

As you can see, large coastal cities tend to be more expensive than smaller towns in the center of the country. If you have a fixed budget, you’ll get more bang for your buck by buying a home in Oklahoma City or Sioux Falls than by living in San Francisco or Washington D.C.

It’s not just coastal cities, though. There are spendy pockets throughout the U.S. from Flagstaff, Arizona to Hot Springs, Arkansas. And some coastal cities — Boston, Houston, Seattle, Tampa — are relatively inexpensive. (In Boston and Seattle, though, that’s because wages are high, not because things are cheap.)

In the middle of our road trip, Kim and I decided to stay the winter in Savannah, Georgia. During our six months in Savannah, we spent much less than we would have for the same lifestyle here in Portland. According to the CNN cost-of-living calculator, Portland is 44% more expensive than in Savannah. (And housing costs nearly three times as much here as it does in Georgia!)

In larger cities, there are often cost-of-living differences between neighborhoods. When deciding where to live in Savannah, for instance, we had a choice:

- We could rent a small apartment in the downtown historic district for $1750 per month. The place would have been a lot of fun because it was surrounded by shops and restaurants, and it was close to anything we might want to do.

- We could opt instead for a modest-sized condo on the outskirts of town at $1325 per month. This location was next to nothing. We could walk to the grocery store, but we’d have to drive into the city if we wanted to indulge ourselves.

After considering financial and lifestyle factors, we chose to rent the condo in the middle of the marshlands. On the surface, this decision saved us $425 per month. In reality, it saved us much more than that.

If we had lived downtown, we would have had to pay to park the Mini Cooper ($95/month). We would have been constantly tempted to eat out or go for drinks. It would have been too easy for window shopping to become actual shopping. Instead, we enjoyed one Date Night each week. We spent the rest of our time working and exercising.

I believe that opting for the less glamorous location saved us a minimum of $5000 over our six month stay — and the real savings are probably far greater.

Pinching Pennies in Portland

This same concept — certain neighborhoods costing less than others — was a driving factor in our decision last year to sell our condo and move to “the country”. We loved where we lived, but the costs were crazy.

- First, there were the maintenance costs for a place that we ostensibly owned outright. Even without a mortgage, we were paying nearly $1200 per month for HOA fees, utilities, insurance, and more. (In our new place, we spend half that.)

- Plus, there was the sneaky cost of lifestyle inflation. Our condo was in a fun neighborhood filled with restaurants and bars. It was all too easy after a long day to simply walk up the street to one of our favorite spots, where we’d drop $50 or $100 on food and drinks. Moving to our new place cut our restaurant spending in half.

- Lastly, the cost of goods in our new neighborhood is lower than in our old. In Sellwood, our grocery options were limited. And expensive. The nearest markets were both high-end organic-only affairs, the kind of places you might see on an episode of Portlandia. Yes, the quality was outstanding. But since we’ve moved, we’re spending about 25% less on groceries each month.

Moving helped us save big on some cost-of-living items. But it also brought with it a few increases in spending. Because we’re more rural now, we drive more often. Kim, especially, is spending more on gas. Our “new” home also has greater maintenance costs than the condo. We’ve poured a ton of money into this place since moving in. (I guess that’s not actually a cost-of-living issue so much as a homeownership issue, though.)

My point is that even within a city, there are cost-of-living differences you can leverage to your advantage — especially if you’re willing to live in a rougher part of town.

The Bottom Line

Obviously there’s more to picking a place to live than pure price.

When you choose a city (or neighborhood) to call home, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), Omaha might not be a good choice for you. (Savannah isn’t a good choice for me long-term, but it was fine for a few months.)

Here’s the bottom line: Where you choose to live has a greater effect on your long-term financial success than almost any other factor. How much you earn is sometimes more important (not always), in which case cost of living is a close second.

Cost of living can wreak havoc on your pursuit of financial freedom. Or it can help you achieve your goals sooner than you thought possible. The choice is yours.

Other ways to make the most of your housing budget? Consider renting. Live close to where you work so that you can walk, bike, or take the bus. Purchase a house that fits your lifestyle and needs rather than the commonly cited “buy as much home as you can afford”. The latter is self-serving advice from real-estate agents and mortgage brokers. You don’t need a big house; you just need someplace comfortable.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

![There are cheap (and expensive) places to live scattered across the country... [Cost of Living map]](https://www.getrichslowly.org/wp-content/uploads/cost-of-living-map.jpg)

![It's cheaper to live in Savannah than in Portland. There are other factors to consider, of course. [Cost of Living calculator]](https://www.getrichslowly.org/wp-content/uploads/cost-of-living-calculator.jpg)