The thin green line: Why you should be skeptical of financial blogs

- Blogging has become more business-like and less personal. A decade ago, most blogs — even money blogs — were rooted in the author’s individual experience. Nowadays, most big financial blogs have a minimal editorial voice. They’re much like money magazines used to be.

- Audience interaction is limited. In the mid-2000s, it wasn’t unusual for blog articles to get dozens (or hundreds) of comments. This site has old articles with over 1000 comments. Nowadays, many blogs have removed reader comments…because they receive so few reader comments. And when blogs do allow comments (as here at GRS), they’re scarcer than they used to be.

- Today, most bloggers want to make money. In fact, that’s their primary goal. When I started blogging in 1997, there was no way to make money from it. When I launched this site in 2006, my primary goal was to get out of debt. My secondary goal was to help others get out of debt. Yes, I wanted to make money — but that was only my third aim. It was almost an after-thought. (This was, in part, because it was more difficult to make money blogging in 2006.)

Most of the changes in the world of blogging are neutral. They’re neither good nor bad. They just are. But I think the move to a more money-centric approach often does a disservice to readers — to people like you.

How I Became a Blogging Cynic

Twelve years ago, if I read something on a financial blog, I generally accepted it at face value. If somebody recommended a book, I trusted their sincerity. If they wrote about the best bank accounts, I believed they were telling me about the best bank accounts. If they raved about a company or service they liked, I had no reason to doubt them.

Today, I’m much more skeptical. Why? Because most of my friends are bloggers, and I know what they think and say in private.

Now, these folks are not bad people — I love them! — but, like most of us, they’ll sometimes put profit ahead of, well, truth. Honesty. Objectivity.

- Today, for instance, I saw an article from a colleague I respect. He was raving about a financial service. The problem? I’m damn sure he’s never used the service himself and the only reason he’s recommending it is he gets a commission on it. With his huge audience, he can make big bucks by promoting this company.

- Or there was the time I overheard another colleague talking with her partner about an advertiser who had just cancelled their affiliate program. (An affiliate program is, essentially, a commission program. You provide a sale or a lead to a company, and you get a kickback.) “If they’re not going to offer an affiliate program,” my colleague told her partner, “we’re not going to promote them. We need to go back and change articles to feature a company that does offer an affiliate program.”

I wanted to call out my colleague on that last one but I didn’t. I bit my tongue. I think her actions were shady, but I realize that not everyone shares the same values. What isn’t right for me and my business might be perfectly fine for her. What’s perfectly fine for me and my business might seem shady to somebody else.

I’m not willing to criticize other financial bloggers for what they do. I’m not in their shoes. Their business is not my business. They’re free to make choices that adhere to their personal ethics. (My hope is that they’re at least considering ethics when they make these choices.)

But I have to say: The stuff I hear and see behind the scenes has made me cynical. I’ve become skeptical of the stuff I read on other money blogs. (Not on all money blogs — I’ll recommend some I trust later — but on many of them.)

The Thin Green Line

Here’s a prime example of how what’s right for one person (and business) may not be right for another: credit cards.

In the world of personal finance, credit card companies pay big bucks for sign-ups. Why do you get pitches for credit cards in the middle of cross-country airline flights? I guarantee you the flight attendants (or at least the airline) get a kickback. Why do services like Mint promote the hell out of credit cards? Because they make their money when users get new cards!

And why do financial bloggers write credit-card reviews? Because they’re earning $100 or $200 or $500 per sign-up.

Does that mean promoting credit cards is evil? No, of course not. But while some people feel okay promoting credit cards, others don’t.

I have never made a penny on credit cards. Not a cent. The opportunity has always been there, but I’ve never taken it. Having wallowed through twenty years of credit-card debt myself, I don’t want to play a part in trapping other people in the pit. (True story: Ten years ago, I turned down $20,000 for a single blog post about a credit card. That’s right: I could have earned several months’ worth of income for a day’s worth of work, but I said no.)

Now, having said that, I’ve made peace with the world of credit cards. I’ve come to understand that credit cards are not evil. They’re a tool. And like any tool, they can be used constructively or destructively. I now believe I can promote credit cards — and earn commissions — in a responsible manner, doing my best to steer readers clear of debt. As a result, I’ll soon be writing more about the subject, and I’ll include affiliate links when I do. (This might happen as soon as next week!)

So, you see, what’s right for one business may not be right for another. There’s a thin green line that each of us is unwilling to cross — but that thin green line is in a different place for each person and each business. And that line can shift with time.

Actually, this is true for all sorts of businesses, right? One restaurant may not offer alcohol because the owner has religious objections to the stuff. Another restaurant might be vegan-only. Another might source only products from within a hundred-mile radius. And so on. This thin green line isn’t unique to bloggers or to financial bloggers.

Your Mission: Be a Skeptic!

The trouble with the rise of blogging as a business is that the business has become the focus for most financial blogs. Financial bloggers aren’t making decisions based on what’s best for their audience. They’re making decisions based on what’s likely to bring them the most income.

And truthfully? They’re generally looking at short-term profit rather than long-term profit. I’ve seen so many people make choices that earn them a big payout today at the expense of audience trust; as a result, their audience shrinks and they’re less able to earn profit tomorrow.

This problem is even worse with corporate-owned financial blogs. As more and more businesses acquire small, personal blogs, these businesses make decisions based solely on short-term profit. They miss the fact that what’s profitable in the short-term may actually kill the golden goose in the long-term.

So far, it probably sounds like I’m writing this article to call out my colleagues. That’s not the case. They can do whatever the hell they want with their businesses. I wish them all the best. (No, really. I do.)

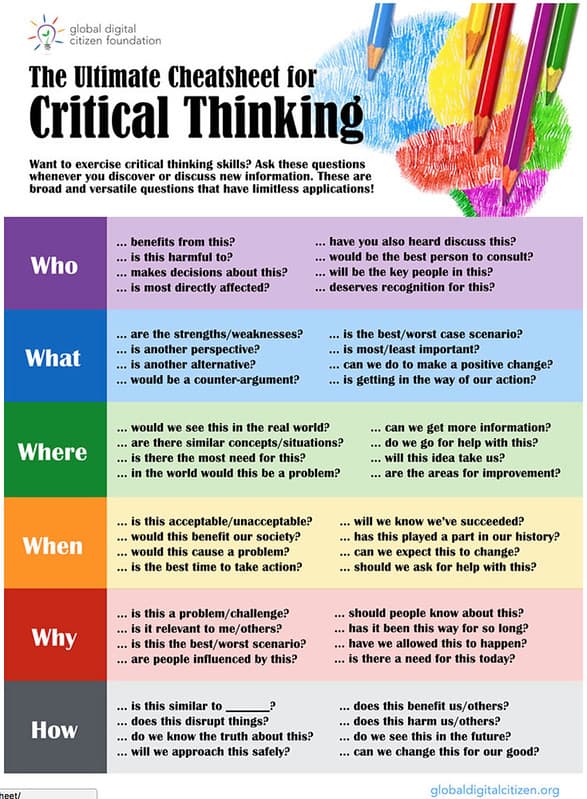

My purpose in writing this article is to encourage you, the blog reader, to approach financial blogs with skepticism. Do the same with any website nowadays, especially if it’s about personal finance. My goal is to get you to think critically about the financial advice you read on the internet.

When a popular money blog recommends a specific mortgage company, ask yourself: Why did they write this glowing review? Did the author use the company themselves? Did anyone in their family use the company? No? Then what other motive could they have? And could their review be colored by the fact they’re getting paid?

That list of “best bank accounts” on Financial Blog X? It’s probably actually a list of “best bank accounts that pay me a commission”. And it’s not just blogs. Find a list of best bank accounts on a nationally-known money site and odds are it’s exactly the same thing. (Another common trick with lists of best bank accounts? Link to the ones that pay commissions, but don’t link to the other ones — even if the other ones are better.)

Based on what I know of the space, it’s especially important to be skeptical of reviews for credit cards, bank accounts, and so-called robo-advisors. Financial bloggers with big audiences (or strong search-engine presence) can make a ton of dough pitching these products, even if they wouldn’t ever choose them personally.

Here are two specific examples:

- A lot of folks promote Bluehost, a company that provides hosting for websites and blogs. Why do they pitch Bluehost? Do bloggers actually use Bluehost? No. I don’t know a single one who does. Yet, people promote the company because they earn $100 per sign-up…maybe more. When asked why they push Bluehost if they don’t use the company themselves, they’ll say, “Well, my blog is too big. Bluehost is good for beginners.” Fair enough. But in private, I’ve never heard a single blogger say they’d use Bluehost even if they were starting out. Regardless, they’re perfectly fine running “How to Blog” articles that promote the company. (I have nothing against Bluehost, by the way.)

- In the personal finance space, you see ads for Personal Capital everywhere. I have them here on Get Rich Slowly. (I even have a Personal Capital review.) In this case, many folks do use (and like) Personal Capital. I like the service — primarily because I think they have one of the best retirement planning tools on the market. But many of the people promoting Personal Capital do not use the app for various reasons. In fact, some have strong objections to the company yet still push it on their financial blogs because they earn thousands of dollars per month doing so.

Every so often, you get to see a public example of a blogger having second thoughts, changing their mind about what they’re willing to do for money. Last week, Early Retirement Dude wrote an article entitled “I Won’t Be Advertising for Personal Capital Anymore, and I Apologize for Doing So”. (I love that piece for its honesty!)

Again, I’m not writing this article to call anybody out. And I’m not trying to hold myself up as “holier than thou”. No, my aim is to make sure that you, as a consumer of financial information, view recommendations with a critical eye.

Actually, skepticism is a handy skill in all walks of life. When you hear something, verify it before you believe it. And don’t just verify it from a similar source. Seek out opposing viewpoints.

This is especially important in the realm of politics. If you hear something from a liberal commentator, seek out a conservative rebuttal — and vice versa. Don’t live in an echo chamber.

One of my favorite ways to check the accuracy of a review? When somebody recommends a product or service to me, I use Google to search for “[product/service] sucks”. Or, if I’m on Amazon, I read the one-star reviews. You can learn a lot from the complaints about a company or product.

Readers First

Other personal financial blogs with traffic similar to Get Rich Slowly (about 10,000 visits per day) earn anywhere from $500 to $2000 per day. (Yes, really.) Get Rich Slowly earns only $50 per day. Crazy, right?

Part of this is because I’m lazy. Part of this is due to fear (no joke). But another part is because I’ve been wrestling with how to make money without compromising my personal values, without crossing that thin green line.

How do I advertise credit cards when I know credit cards cause problems for so many people? How do I promote banks in a way that I’m providing honest, objective info yet still earning commissions?

So far, I’ve been treading water using Google Adsense and Amazon links. I’m earning more than minimum wage with this blog — but not much more.

Get Rich Slowly is a business. It’s a money-making venture. It doesn’t make much money right now — about $2000 per month — but I’m hopeful that it can eventually earn as much as it did in the olden days: over $20,000 per month. That said, I’m not willing to compromise the editorial side of things to make a quick buck.

Here’s my number-one guiding principle at Get Rich Slowly: Readers first.

In everything I do, from design to advertising to content creation, I try to put myself in your shoes. Does this article help my readers? Does this ad interfere with the reader experience? How does the layout of the site help or hinder the folks who come here?

You know why I don’t have pop-ups or splash screens at Get Rich Slowly? Because I think they’re actively reader-hostile. My colleagues tell me they vastly increase the number of subscribers and affiliate conversions, but I don’t care. I personally hate pop-ups, so why would I subject my readers to them? That sounds like hypocrisy to me.

It’s important to note that “readers first” doesn’t mean “readers only”. A “readers only” policy would mean no ads. I’m not willing to run Get Rich Slowly for free. This is work, dammit, and I want to get paid for my work. (This notion is lost on a lot of folks at places like Reddit, where they think any blogger who tries to make money is somehow shady.)

“Readers first” means that before I decide whether to run an ad, before I decide whether to write a review of Personal Capital, I do my best to minimize the negative impact on my audience.

The best-case scenario is promoting something like a bank account. Helping readers sign up for good bank accounts is a win-win-win: a win for the reader, a win for the bank, and a win for me (because I get a commission). Amazon affiliate links are another no-brainer.

A middling scenario is something like banner ads at the beginning and end of my articles. Or my Personal Capital review. Or the upcoming credit-card articles.

Less-than-ideal scenarios include those two stupid ads I have embedded in the middle of articles right now, which seem to be causing headaches for certain readers. (Those are on the chopping block for when the redesign goes live. Eventually.) Or the promotion I did for Credit Sesame back in January. (My solution there? I did the promotion — because I was contractually obligated to do so — but I declined to take money for it.)

Last year at Fincon — the financial bloggers conference — I participated in a panel discussion called “What Will You Do for Money?” We talked about scenarios like this as we explored financial journalism and ethics. If you’re interested in this subject, you can watch this video recording of the entire panel (which the Fincon organizers have graciously made available specifically for this article).

Four Financial Blogs Worth Reading

It’s perfectly possible to run a blog — even a financial blog — in a way that serves the readers and provides an income for the author. That’s how I made money before with Get Rich Slowly, and that’s how I intend to make money in the future.

There are lots of other financial bloggers whose view of the thin green line is similar to mine. Some are big. You’ve probably read Mr. Money Mustache, for instance. Pete and I have remarkably similar views on monetization and serving the audience. It’s easy, though, for MMM to play it safe. His audience is so large that even minimal monetization produces huge income.

I’m more impressed with new, small financial blogs who have made a commitment to serve their readers. When you’re just starting out, you want to make money now now now. It’s tough to wait. Most new bloggers bury their sites in ads. (I saw one a couple of months ago that was almost entirely ads — the editorial content didn’t start until “below the fold”. Ugh.) Most new bloggers want to run advertorials and/or promote products and services with big payouts.

Here are four newer financial blogs that I think do a great job of making money while remembering to serve their readers:

- The afore-mentioned Early Retirement Dude, who is also one of the moderators on /r/financialindependence.

- The Luxe Strategist, who writes about living large while saving large too.

- The data-oriented Four Pillar Freedom.

- And, especially, the hilarious Bitches Get Riches. Kitty and Piggy don’t do any traditional monetization that I know of. Instead, they ask for Patreon pledges. I love this idea and I love their blog. (I love Bitches Get Riches so much that I’m a $50/month Patreon subscriber.)

Please note that these are by no means the only financial blogs worth reading. There are tons of folks producing quality content and putting readers first. These are just four blogs that I personally have found to be filled with useful, entertaining articles without the marketing that mars the experience for me on other sites. Simply put, these newer bloggers have earned my trust.

Honestly, if I were starting out, I’d be tempted to focus on the money too. I’m fortunate that I’ve earned a wad of cash already, so I can sit back and take a more measured approach. I’m not in a hurry to make lightning strike twice.

Instead, I’m going to stick to my Readers First pledge. Yes, I want to make money from Get Rich Slowly, but my primary aim is to help the folks who find this site to make and keep more money for themselves. If there are ways that I can do this while also earning a little scrilla, I’m going to do it.

Meanwhile, I’ll continue to be skeptical of the information I find on other financial blogs. I encourage you to do the same. In fact, you should be skeptical of what you read here too. I know I’m staying on my side of the thin green line, but you don’t know that. I want you to be skeptical of me and my motives until I’ve earned your trust.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)