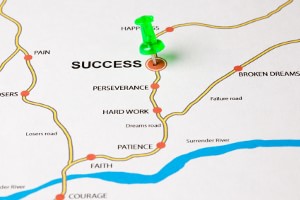

How to achieve long-term financial goals

In my last post, I talked about how personal finance is about playing the long game and “making choices that are harder in the short term for the good of the long term.” But when the payoff is so many years down the road, it can be difficult to stay on track. In order to actually reach long-term goals, you have to keep making the right choices day after day. How easy is it to fall off the wagon a week or two after you start a new diet, for instance? You need a game plan for the short term that supports your long game too.

Establish Priorities

Especially when you are young, there are just so many goals to strive for simultaneously. For example, Jake and I currently have the following goals:

-

House projects. We replaced our HVAC and decided solar panels aren’t for us right now, but we still need to demolish a corroded metal shed and resurface our back deck.

-

Retirement contributions. Both Jake and I started late in the retirement savings department and need to contribute extra to make up for the compound interest we missed out on.

-

Emergency savings. In addition to the repairs and upgrades we planned, we’ve spent several thousand dollars on unexpected repairs. While we have always had enough cash on hand to deal with these situations, that means our emergency fund needs to be replenished constantly, not to mention the fact that we would like to beef up our savings account even further.

-

Student loan repayment. We have paid off all our credit cards and Jake’s car loan, so our consumer debt is behind us. However, we still have student loan debt to pay off that is comparable to a regular-sized mortgage.

-

Pay down our mortgage/refinance. We had a somewhat compressed timeline for buying our house due to the fact that the condo where we were tenants went into foreclosure. Now that we are in our home for good, refinancing into a new loan where we aren’t paying PMI would be smart.

And this is just a partial list of my goals! It doesn’t include other common financial goals such as travel, starting a family, saving for a replacement vehicle, etc. Having many goals that compete for your limited attention and dollars can certainly make you feel like throwing up your hands and walking away.

This is where setting priorities comes in. Knowing what is most important to you can help clarify and tailor your short-term decisions to meet that goal. Similarly, determining which goals must be achieved sooner rather than later can help you prioritize and strategize. Putting your focus on one or two goals at a time may also help keep you motivated because you can make quick progress toward that goal.

Break Your Goals Into Achievable Mini-Goals

Sometimes the highest priority item on your list has such a long-term horizon that it is hard to stay motivated. It can help to break your goals into mini-goals that can be reached more easily and quickly.

This is something I struggle with in regards to my student loans. Because of the way my consolidation worked, I have two loans. One is for $30,000 or so and the other is in the neighborhood of $57,000. No matter how many extra payments I make, it feels like I am barely making a dent.

Jake, on the other hand, has four different accounts. Although in the end he owes a similar amount, right now he is targeting a loan with a balance of about $8,000 in his payoff strategy. He should be able to eliminate that entire loan this year. That’s awesome! But when I compare my debt payoff to his, I feel jealous and frustrated that I won’t have a similar achievement in the same timeframe.

Instead of giving up, however, I set my goals a different way. According to my 2015 goals post, my January student loan balance was $88,243.67. I set my payoff goal for the year to get my student loans under $80,000. This means my balance would start with a seven! That really gets me excited about making my payments! It also means that I would be making progress equivalent to Jake’s achievement.

Motivate Yourself With a Personal Finance Buddy

The type of friendly competition or rivalry I describe above can be motivating for both parties. Can I pay off a similar amount of student loan debt as Jake even though my salary is considerably less than his? Jake isn’t really too concerned about his loans and probably would make the minimum payment if left to his own devices. But he would feel pretty silly if he couldn’t pay off at least as much as his lesser-earning partner! So he’s been throwing extra money at that smaller balance. Win-win.

Of course, rivalry may not be the most motivating type of relationship for everyone. In fact, if the situation between two people is incredibly different, a sense of rivalry can make you feel like giving up even more. For example, if my debts were twice as big as Jake’s in addition to our income disparity, I’d never be able to catch up to his achievements. Instead of motivating me, it might make me frustrated and even more likely to consider giving up. This means that it might be a good idea to try and find a personal finance buddy who is in a similar starting place as you and/or someone with similar means.

Another factor to consider when it comes to finding a personal finance buddy is personality. Some people might get overexcited by their success and gloat instead of encouraging their partner. It isn’t very motivating to be told that the other person is awesome and you suck! I’d rather work with someone who could empathize with my difficulties instead of mocking them.

At the same time, however, you want someone to hold you accountable and call you out when you are not trying as hard as you could. It needs to be someone who will say, “Hey, I notice you only made the minimum payment on your student loan last month, but you went out to eat five times. What gives?” Sometimes we don’t even notice when we are slipping into bad habits. Having a friend who will not only notice, but gently remind you that you have gone off track can be helpful.

Whatever Your Plan, Establish it in Advance

Reaching big, long-term goals such as getting out of debt or saving for retirement depends on how well you can persevere and meet your short-term goals. Staying motivated is key. So it is best to establish a plan at the outset for how to keep your motivation high. If you wait until you are already in a motivational slump, it may be hard to find your way out of it.

Are you trying to reach a lot of long-term goals? How do you keep yourself motivated when big goals can take such a long time to reach?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)