The inner workings of a car dealership (and how to use them to your advantage)

Yesterday a reader named Dave Black left a long comment on an old article about how to buy a new car without getting screwed. This is his glimpse into the inner workings of a car dealership. I've edited Black's comment to make it a little more readable, but the advice is all his.

Front of the house profit is derived from the MSRP less the invoice price (the price the dealer actually pays for the car). Each deal has a "pack charge" or "lot fee" of $200-600 or more that goes in as part of the dealer cost, so when a dealer tells you for example, our invoice is $22145, you can subtract $200 to $600 for the lot fee. There are also dealer rebates and consumer rebates to factor in.

Is the Roth right for you?

This year, it happened -- something many have been predicting for years: Taxes went up. And most likely, the hikes will just keep coming. There's no other way to pay off the country's debt and fund the ballooning entitlements due the baby boomers as they retire. The increases may not affect everyone, and those who earn more will pay more, but someone's gotta pay.

One way to hedge against higher tax rates is to contribute to a Roth retirement account. Your contributions aren't tax-deductible, but the withdrawals are tax-free once you turn 59 ½ and you've had a Roth account for at least five years. Who wouldn't want tax-free money if tax rates are just going higher?

Well, as attractive as the Roth can be, it's not always the best choice for everyone. You see, a contribution to a Roth means you are forgoing a contribution to a traditional retirement account, which might give you a tax-deduction today in exchange for paying taxes in retirement. So the choice is: Should you pay taxes today or in retirement? Continue reading...

The Many Ways to Know and Control the Flow of Your Dough

How do you know what it costs to be you? That's my question for the day, dear GRS reader.

I've come a bit full-circle in what I think is most important when it comes to financial success. When I was a young, low-paid teacher, I focused on penny-pinching and budgeting. As I got older, I spent more time on investments. Now, I'm coming back to the importance of keeping tabs on expenses. Perhaps it's because investing hasn't been as rewarding over the past several years. Perhaps it's because it seems like financial security seems a bit more precarious these days. Maybe it's because the way I think about the whole kit-and-kaboodle — whether you call it budgeting, or cash-flow management, or a spending plan — a bit differently.

After I left teaching, I became a financial adviser with one of those big-name, full-service brokerages. During our three weeks of training in the Big Apple, we never learned about budgeting — it never even came up. Neither did debt management, financial calculations, or how to choose the right investment account. We only learned about investing (sorta), how to find clients with lots of money, and how to sell, sell, sell.

<The biggest truth in personal finance

For the past six weeks, I've been hard at work writing my "introduction to financial independence and early retirement" project for Audible and The Great Courses. It's been challenging -- and fun -- to rework my past material for a new audience in a new format.

Naturally, I'm emphasizing two important points in this project: profit and purpose.

- I believe strongly that you need a clear personal mission statement in order to find success with money (and life).

- I also believe that the most important number on your path to financial freedom is your personal profit, the difference between your income and your spending. (Most people refer to this number as saving rate. I prefer the term "personal profit" because it's, well, sexier.)

That last point is important.

The Wealthy Barber

When I picked up The Wealthy Barber from the public library, I figured it must be good: the book was well-worn, the cover bent, pages dog-eared, passages highlighted, whole sections annotated in pencil and pen. Only the best personal finance books receive this sort of treatment. I'm pleased to report that The Wealthy Barber is a good read — author David Chilton offers an excellent introduction to personal finance.

When I picked up The Wealthy Barber from the public library, I figured it must be good: the book was well-worn, the cover bent, pages dog-eared, passages highlighted, whole sections annotated in pencil and pen. Only the best personal finance books receive this sort of treatment. I'm pleased to report that The Wealthy Barber is a good read — author David Chilton offers an excellent introduction to personal finance.

The Wealthy Barber's gimmick is that instead of presenting information in a dry subject-by-subject manner, Chilton has written the story of Roy, a small-town barber who is also a millionaire. (Roy got rich slowly.) The reader learns about IRAs and whole life insurance and compound interest as Roy dispenses advice to a trio of customers, each of whom has different financial circumstances. (This allows Chilton to highlight different approaches to certain problems.)

The Wealthy Barber's financial planning guidelines include: Continue reading...

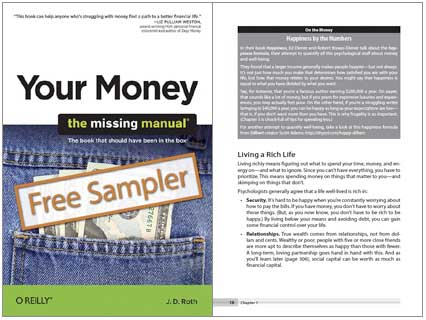

Your Money: The Missing Manual

Things may seem calm and quiet on the surface of the blog, but behind the scenes here at Get Rich Slowly, everything's a whirlwind. I don't know if I've mentioned this before, but blogging doesn't scale. That is, one man (or woman) can handle a small blog with a few hundred readers, but the bigger a site grows, the more demands there are on your time. Even though I'm using more and more help lately, I simply can't keep up. So, the calm surface here belies the turbulence underneath.

Of course, part of the hubbub comes from the release of Your Money: The Missing Manual. The book is now available at Amazon, and folks have had kind things to say about it. (Thanks for all of your nice e-mails; they make me smile.) Other bookstores should be receiving their copies over the next month. It's also now available from Borders and Barnes and Noble, and will soon be available from Powell's.

Speaking of Powell's, I'll be giving a talk at Powell's Technical Books at 7pm on Thursday, April 15th. (Which also happens to be the fourth anniversary of Get Rich Slowly.) I'd love if you came out and gave me some support. I'm a hesitant public speaker, and if there are some friendly folks in the crowd, that'll give me more confidence!

CSS Dummy Page

This is simply a dummy page to demonstrate the custom CSS classes that J.D. uses (and has been using for years) around Get Rich Slowly. It's important that any redesign incorporates these classes because they're a part of the way I work.

I use a handful of custom classes for blockquotes.

A default blockquote is meant to be used when quoting text. This is for when we're excerpting longer sections from books or articles. It needs to be clear to the reader that we're quoting something.

Guest Contributor Guidelines

Thanks for your interest in sharing a guest post with the Get Rich Slowly audience. Here are some things to consider.

There are no length requirements for GRS articles. I always say an article should be as long as it needs to be -- but no longer. If your piece is 500 words, great. If it's 5000 words, that's fine too.

There are no topic requirements for GRS articles. It should probably be related to money, but I'm fine with running anything that helps readers improve their lives.

The Get Rich Slowly File Vault

The GRS file vault contains a whole host of free resources that I've gathered over the years. Some of those resources are from me, but most are from other folks. Everything in the file vault is free and legal to share.

The Money Boss Manifesto

For many, money is a mystery. It’s not the numbers that are complicated — the math behind wealth-building is shockingly simple — but it’s the mental baggage that bogs us down: the psychology, the emotions, the discipline, the peer pressure.

While the majority of Americans struggle with their personal finances, the basics of business are baked into our national subconscious. We all get that in order to survive and thrive, a company has to make money. What most people fail to grasp, however, is that the same concept holds true for household finances.