Pay off student loans or invest — how to move toward funding retirement

In my recent post, “Why investing can be better than paying down debt,” Dianecy’s comment raised a question faced by many: What do you do about investing when you have student loans?

It is quite the dilemma, actually, because the best time to start funding your retirement is when you’re still in your 20s. And as anyone who has been reading Get Rich Slowly for more than, say, 10 seconds would know, few things impede your progress toward getting rich (at any speed) like debt.

The reason is simple: A dollar can be spent only once — either for another person’s benefit or for yours. So it follows that repaying debt benefits the bank; investing those same dollars in a CD or index fund, on the other hand, benefits you and your future.

Therefore, debt avoidance is always the best strategy. It may not always be easy, but it is almost always possible. Many have figured out how to get an education without incurring student debt. I managed to fund my bachelor’s, master’s and doctoral programs without getting into debt. It’s like the old maxim: “Where there is a will, there is a way.”

Not inevitable, but a big problem nonetheless

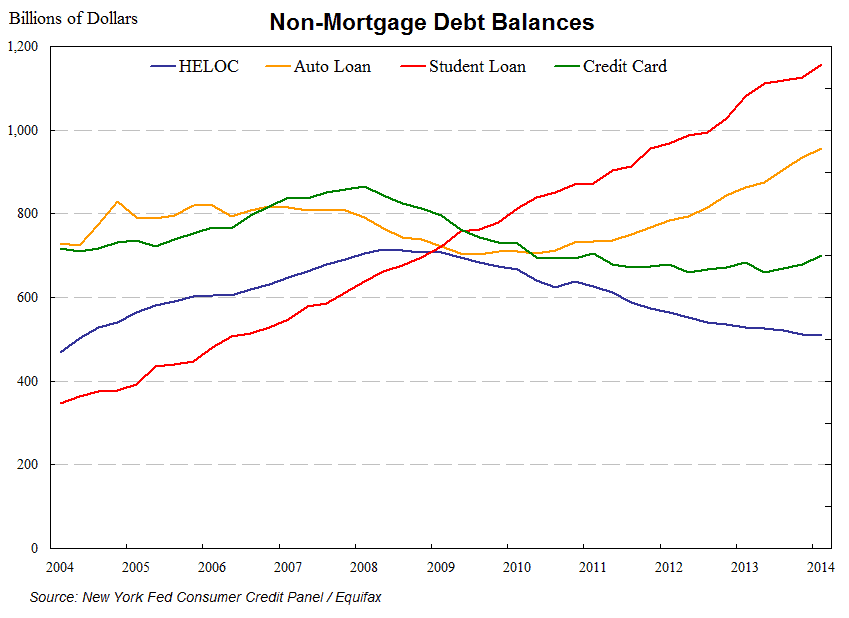

So student debt, therefore, is not inevitable. However, not everyone gets the memo in time, and you may find yourself with some student loans. You are not alone. This New York Fed chart shows the meteoric rise of student debt in the U.S. and how it now dwarfs other forms of debt:

You can see how student debt went from the smallest category of non-mortgage consumer debt to the largest — in less than 10 years. But the size of the problem isn’t the only issue. Concern at a national level over student debt cutting economic growth off at the knees prompted the study from which that chart is taken.

How student debt strangles the economy

It is somewhat of a chicken-and-egg situation: Student debt payments put a drag on young people’s ability to strike out on their own and buy their own homes — two of the prime factors that drive any economy.

This hampering of household formation (in economics-speak) makes for a slow recovery, in turn creating a vicious cycle of low growth which means fewer opportunities, prompting more people to get a degree in order to do better in a weak economy. That, of course, adds to student debt, and the vicious cycle continues.

Moving forward despite the difficulties

What’s true from 30,000 feet is true on the ground: Paying back student debt can put a crimp in anyone’s ability to get on their feet and move ahead financially.

There are two reasons student debt is not as easy to dismiss with the blanket pay-all-debt mantra as, for instance, car loans and credit card debt. The first reason is the interest on a student loan is typically lower than all forms of debt save for home mortgages. The second is a little more complex.

Fixed vs. variable cost — the move

If it wasn’t for one single factor, debt could have been a wonderful thing. What factor is that? Inflexibility. When tough times come (and they come to most of us a few times in our lives), you can adapt by cutting your costs. You can move to a cheaper place, even move in with family. You can eat for less, stop buying new clothes, drive less, and so forth.

The one thing you can’t cut, though, is debt payments. That’s the problem, and it gets worse when you live a lifestyle which leaves little margin for error. Accountants call those inflexible payments “fixed costs” — costs you can’t change when things go bad. The costs you can change (food, gas, clothing,etc.) are called “variable costs.”

Your ability to ride out bad times improves, therefore, when you have few or no fixed costs. Now, if you were able to convert a fixed monthly payment into a variable payment, the greatest risk of that debt would be mostly mitigated.

And with most student debt, you do have that option. According to the Federal Student Aid office of the U.S. Department of Education, most student loans are eligible for one of the following three types of income-driven repayment plans:

- Income-Based Repayment Plan (IBR Plan)

- Pay As You Earn Repayment Plan (Pay As You Earn Plan)

- Income-Contingent Repayment Plan (ICR Plan)

None of them require utilizing more than 20 percent of your disposable income. If you were to sign up for one of those plans, your repayments would become a variable cost, instead of a fixed cost.

If you can do that, your decision to repay the debt or invest becomes a mathematical decision. If you can earn more on your investments than you pay in interest on your student loans, then it makes sense to keep your student loan repayments to the minimum and invest up to your annual maximum in your IRA and 401(k) or equivalent employer retirement plan.

However, that doesn’t work for everybody.

Giving weight to uncertainty

As one of the commenters to the previous post pointed out, you have a great degree of certainty in predicting your debt payments but almost none when it comes to the returns on your investments. He pointed out (correctly) that, when we present the benefit of investing in the future, the chart inevitably has an elegant linear look to it. In truth, however, we don’t know how things will play out in the future — it can be better or it can be worse — but we can be pretty sure it will not be like in the chart.

The problem is that investing returns come in fits and spurts. The cornerstone of most everyone’s investments are stocks. The overwhelming majority of mutual funds (especially index funds) are based on stock investing. The stock market, therefore, is the largest driver of personal wealth in America today (excluding owned residences).

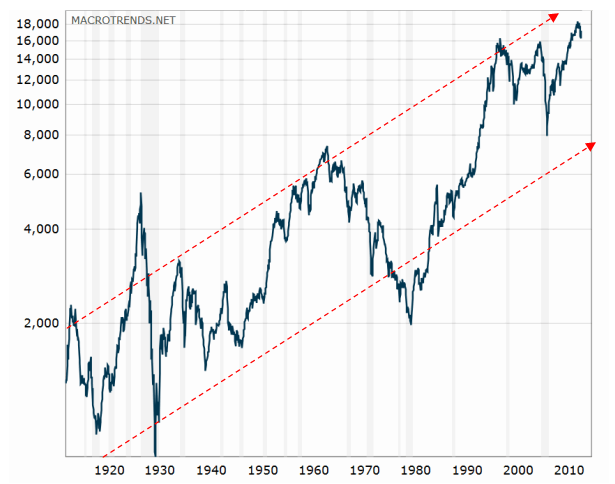

And if there is one thing we know about the stock market, it’s that it goes up and down, as this inflation-adjusted chart of the Dow Jones Industrial Average clearly shows:

We love those ups, don’t we? These past few years the stock market has made double-digit gains every year. Problem is that nobody can predict when those pesky downs will come and wipe out most of those gains. (If we could, we would all be millionaires.)

Be aware of manipulating uncertainty

That’s the bad news. The good news is that, for the past hundred years, through the cycles, the stock market has gone up more than it has gone down, as the dotted red arrows show in the Dow chart above. Cycles typically last 10 years or less (top to top or bottom to bottom). Therefore, if you are in the market for more than, say, 20 years or so, the ups and downs average themselves out and you are left with the long-term uptrend.

As you can see, no two cycles in the past were identical, and it is impossible to guess what the future will hold. After all the ups and downs, the market grew roughly at 8 to 9 percent per year.

(Note: If you pick a start date at a top and an end date at a bottom, the number will look a lot worse; and if you pick a start near a bottom and an end near a top, it will look much better.) That’s why most people use a simple projection of 8 to 9 percent per year, even though we know any given year will be way different from that average.

However, we have no guarantee of even that average. Therefore:

- You typically know exactly what benefit you will derive from repaying your student debt.

- On the other hand, you can’t predict exactly what you will receive when you invest. All you can hope for is some historical average.

Temperament and uncertainty

This is where your temperament comes into play as you weight the uncertainty:

- If you’re a conservative pessimist by nature, you will feel much more comfortable if you prioritize repaying your student debt and removing as much uncertainty as possible.

- However, if you’re an optimist with faith in the future and some tolerance for risk, you will feel more comfortable (excited, even) keeping the student debt payments to a minimum and pushing hard to maximize your retirement investments.

You can make either strategy work for you — there is no single one-answer-fits-all solution to the problem of repaying student loans and investing for your retirement (other, of course, than to avoid getting into debt in the fist place, which naturally frees up that much more to invest for retirement).

Avoiding debt — two practical suggestions

1. The CD ladder

In another of the comments to the previous post, Diva mentioned something which bears repeating and expanding upon:

“When I was in school, a wonderful banker had me break up my loan into monthly portions, and then each portion was set into a CD that would come due every month. That way I stayed on budget and, while the interest was low, came out of it with some grocery money. Every month I started fresh with a new influx of cash, and always had enough until the next loan period.”

In other words, her banker fashioned a CD ladder for her. This is a great strategy when you receive the proceeds of a student loan in a lump sum. By parceling it into multiple CDs with staggered maturities, you get a steady flow of income every month to match your running expenses, and you are freed from any temptation to dip into the loan and leave yourself short later on.

2. Never invest loan proceeds

A few people discussed another bit of practical wisdom pertaining to student debt that bears repeating: Don’t be tempted to invest your loan proceeds when you receive them. Investing normally has a longer time horizon than your studies. With a long-term view, you can ride out short-term dips in the market — but you can’t do that if you need the money to pay expenses in, say, two years. It’s much better to keep the proceeds in something liquid but safe like a savings account or a group of laddered certificates of deposit.

Keep moving to fund your retirement

Of course, the best of all worlds is never to have debt and, if you do, then to kill it while still investing. The best of all worlds is also me having Warren Buffett’s money and Robert Redford’s looks — nice, but not most people’s reality.

Most of our financial pictures have, shall we say, imperfections; but no two people have the same set. The key to success is not to think of the past, but to look to the future and figure out the best thing going forward, given the situation at hand.

Regardless of what others might say (or want to hear), there is no one strategy which works every time. For some, applying their discretionary cash to investing works best; for others, using it to pay down student debt works better. Either way can work if you stay at it diligently.

What works for you — paying off your student loans first or investing while paying student loans? How did you determine an acceptable level of risk and return before investing, if you did?

[Editor’s note: Our thanks to Dianecy for the article suggestions. Stay tuned for more!]Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)