Getting started – Review of the Mint.com signup process

On Tuesday, I wrote that I’ve decided to track my finances again. I’m doing fine financially, but after a few months of not watching my income and expenses closely, I feel a little lost. I miss the ability to know exactly where my money’s going.

I had intended to install the new desktop version of Quicken, which is what I’ve been using for years. (Before that, I used Andrew Tobias’s Managing Your Money, but that hasn’t been updated since 1995!) In the comments to Tuesday’s post, several readers asked why I don’t just use Mint. Good question. I don’t really have a good answer.

What is Mint?

I haven’t tried Mint for several reasons:

- It didn’t offer all the features I wanted, particularly the ability to track investment accounts.

- I didn’t like the revenue model. Mint makes money by pushing new financial products on users. I’ve since realized that — duh! — that’s the same way Get Rich Slowly makes money, as well as the rest of the financial web.

- I was loyal to the folks at Wesabe, a Mint competitor and friend to GRS. Unfortunately, Wesabe shut down earlier this year. (You can read about it here.)

- Though I fully embrace the Internet Age, I’m still wary of giving one service access to all of my accounts.

But enough GRS readers have sung the praises of Mint over the past two years that I finally decided to give it a try. Yesterday, I set up my Mint account.

Getting Started

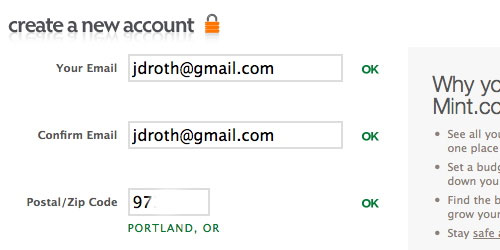

If you’ve signed up for any other web-based service, you know what it’s like to register for Mint. After you enter your e-mail address, your zip code, and your password, you’re ready to go.

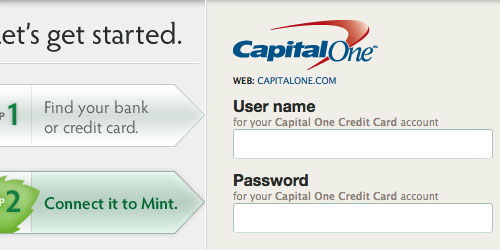

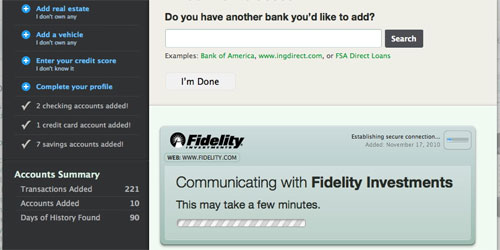

Once you’ve registered, Mint prompts you to enter your financial accounts. You need just two pieces of information to connect to any account.

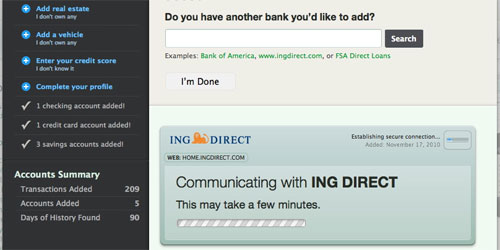

After you supply your login info for each bank or credit card company, Mint connects to the financial institution and slurps up your recent transactions. (I was pleased when my local credit union connected without incident.)

As you set up your Mint account, you can also add loans, real estate (such as your home), vehicles, and “other” accounts. Other accounts include:

- Cash (or debt)

- Collectibles (such as my comic-book collection)

- Jewelry

- Furniture and appliances

- And a variety of miscellaneous items

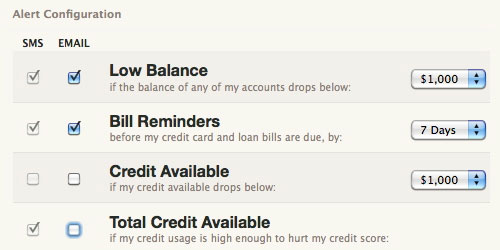

You can also set up e-mail and text alerts based on a variety of parameters. This feature seems very handy, especially in this age of identity theft. I keep tabs on my accounts regularly to be sure there’s no monkey business going on; Mint lets me automate that process.

Mint also allows you the option to enter demographic information (which I did),; I’m sure this leads to better-targeted advertising!

You don’t have to set everything up at the start. You can edit your accounts whenever you want by clicking “Your Accounts” at the top of any page. Good thing, too, because as I’ll share in a moment, the set-up process wasn’t without glitches.

Using Mint

You make your way around Mint through a handful of tabs at the top of each page. These include the following.

Overview

The Overview section gives you a Big Picture view of your finances, including account balances and alerts. It’s meant to be your home base in Mint.

Transactions

In the Transactions tab, you have access to a day-by-day list of your income and expenses. It’s here that you can view and edit each of your purchases (and deposits). Mint automatically assigns a category to each transaction. It does a fairly good job of guessing, but it’s not perfect. Fortunately, it seems easy to make changes.

For example, here I’m telling Mint that the bill from Qwest isn’t for a home phone (because we don’t have one), but for our internet service.

I like that this section lets you view transactions from all accounts at once or narrow things to a single account. Handy.

Budgets

The Budgets section lets you, well, erect a budget to keep your spending focused. I haven’t had time to play around here, so I can’t comment on its utility. I’m hoping that Mint will allow me to put my beloved Balanced Money Formula (or some other broad budget framework) into use.

Goals

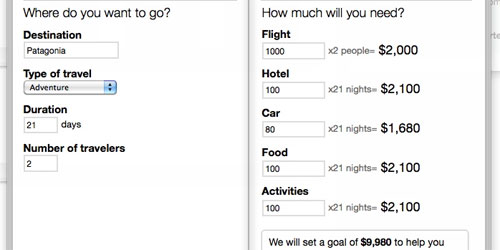

The Goals tab lets you set savings goals, and then walks you through the process of creating a realistic budget for each goal. For example, Kris and I want to go to South America in 2012 (or 2013). Here’s the start of the goal-setting process:

You can even create custom goals if the pre-packaged goals (get out of debt, buy a car, and so on) don’t meet your needs. The goals section is one of my favorite features of Mint.

Trends

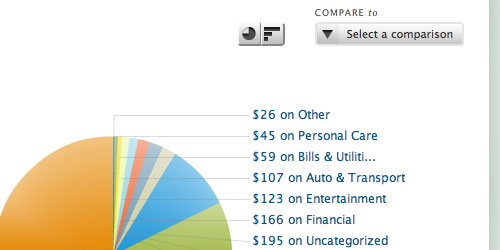

With the Trends tab, Mint shows you standard charts and graphs. I’m sure these will be useful in time — in fact, they’re the main reason I want to track my spending! — but at the beginning, there’s not much to see.

For one thing, there’s only about a month of data. For another, a lot of that data is mis-categorized. For example, Mint thinks my payments to State Farm fall in the Financial category. To me, they need to be in a separate Insurance category.

The Trends area will become more useful as Mint accumulates more of my financial data, and as I make sure it’s categorized so that it means something to me.

Investments and Ways to Save

The final two tabs are Investments and Ways to Save. Both of these deserve a closer look.

A Bad Investment?

Not everything is kittens and roses with Mint. In fact, from what I can tell, the Investment feature doesn’t work at all.

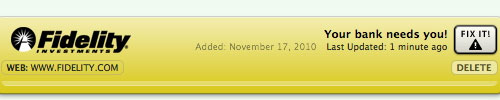

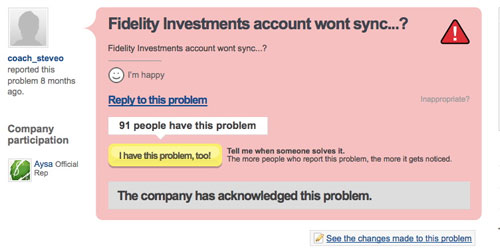

I had real trouble connecting Mint to my Fidelity account. I used the correct login and password, but the connection wouldn’t go through. Mint offered only a cryptic “Your bank needs you!” message without explaining what the problem was.

Clicking the supplied link just took me to the default Fidelity page, where there was no indication that Fidelity was aware there was a problem.

Puzzled, I decided took a look at the Mint discussion forums. Sure enough, other folks were experiencing similar problems. In fact, there seem to be ongoing issues connecting Mint to Fidelity, and have been for months. It’s not an encouraging sign that there are no solutions to be had.

I tried to brainstorm some quick fixes, but no dice. Strangely, however, when I went to the Account Settings page, the Fidelity accounts were listed. When I closed the settings page and visited the Investments page, they didn’t appear. Huh?

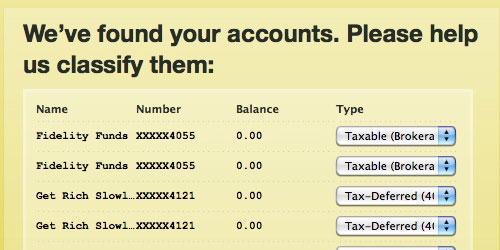

The “add investment account” tool indicated that Mint had now connected to Fidelity — but it showed two of every account: the actual account and a phantom account with a balance of zero dollars. Huh?

When I tried to bring these investment accounts into Mint, I was asked to make additional corrections. After doing so, Mint listed both the real and ghost accounts with zero balances. Huh?

None of this made sense, and there was no help to be found.

After nearly an hour of slogging through various iterations of this madness, I gave up. It seems strange that Mint offers an investment “feature” when it’s not ready for prime time. (Or even, apparently, for the late late show.)

How Does Mint Make Money?

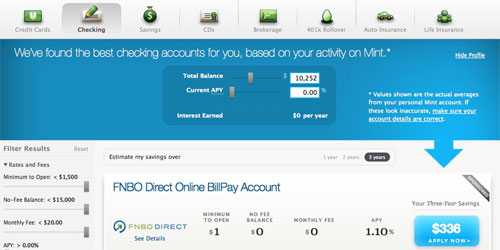

Whenever I see a free online service, the first thing I want to know is how the company makes money. Mint makes money through its recommendation engine. Mint looks at your financial habits and existing accounts, and then offers Ways to Save. If you click on this tab, you receive offers in a variety of categories from partner companies. If you sign up, Mint is paid a commission.

This is basically the same revenue model used by personal finance blogs like Get Rich Slowly and The Simple Dollar, as well as big-name sites like Bankrate and Card Ratings. Mint takes it to a new level by comparing your existing accounts and habits to other accounts in its database. For example, here Mint shows that I could save $336 over three years if I moved checking account from my credit union to FNBO Direct.

These recommendations are probably very useful to many Mint users, and they’re much less annoying than I feared they would be.

The Bottom Line

After using Mint for only a few hours, I like what I’ve seen. Mostly.

The interface is slick, and I can tell the automation is going to be nice. This will indeed let me to track my spending, and may even help prompt me to save for future goals. My big beef is that my investment accounts won’t integrate. This isn’t necessarily a deal-breaker (I don’t make a lot of stock trades), but it’s annoying. I’m used to tracking all of my financial data from within Quicken, and I’d like to do that here. Right now, I can’t.

I’ll use Mint for a few months to see how things go. If I can remember, I’ll post an update on Mint during the first part of April, after I’ve used it full-time for three months. (I don’t plan to make Mint a habit until January 1st.)

Meanwhile, perhaps it’s time for me to dig through the GRS archives. I’ve written before about lesser-known personal finance programs; maybe I should give one of them a spin in the meantime.

If you’ve used Mint for months or years, I’d love to hear your impressions. Have you managed to get the investment tab to work? (With Fidelity?) Are you pleased with the service? How would you improve it? What should a new user like me know before I get too far?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)