The Balanced Money Formula

Building a budget is one of the basic tasks of personal finance. But not everyone can keep a budget. As much as I'd like to, I don't feel comfortable with detailed planning. I continue to use a spending plan as a rough guide to my future, but a traditional budget just doesn't work for me.

Last night I stumbled across the Balanced Money Formula proposed by Elizabeth Warren and Amelia Tyagi in their excellent book, All Your Worth: The Ultimate Lifetime Money Plan [my review]. Like my spending plan, the Balanced Money Formula is an alternative to traditional budgets. Though I considered this concept a little “light” in the past, it really hit home yesterday. It helped me to realize that my own spending has become unbalanced.

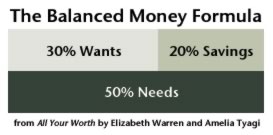

The Balanced Money Formula

The Balanced Money Formula is based on your net income (your income after taxes). Warren and Tyagi say that, ideally, no more than 50% of your paycheck should be spent on Needs (and keeping them below 35% is best). Of the remaining amount, at least 20% should be devoted to Saving, while up to 30% can be spent on Wants.

Here's what it looks like:

That's it. Simple. Three categories. No detail. This is the sort of Big Picture budget that I find useful, and in this case I could see that there was something wrong with my Wants. Here's how the authors define these terms:

- Needs are things you must pay no matter what: housing, food, utilities, transportation costs, insurance.

- Wants are everything else: cable television, restaurant meals, concert tickets, comic books, clothing beyond the basics, etc.

- As in the list of tips I shared a few days ago, Saving comes last in this plan. Everything left after you take care of Wants and Needs is set aside for the future. (If you want to get out of debt, that's also tackled here.)

Warren and Tyagi write:

When your money is in balance, you always have enough to pay your bills, have some fun, and save for your dreams. And here is the best part of all. Once your money is in balance, you can stop worrying about it. Managing your money becomes automatic.

This Balanced Money Formula is a goal. It's an ideal. If you're just beginning to manage your money, your financial life will probably be distinctly unbalanced.

For example, if your income's small (or your mortgage is large), you might be spending 80% (or more) on Needs. If you are a compulsive spender, if you like to dine in fine restaurants or to collect Hummel figurines, you might be spending 45% of your income on Wants. And, of course, few people starting out can afford to set aside 20% of their income for Savings.

Here's what that might look like:

Small income/Large mortgage

| Needs: 80% | Wants:15% | Savings:5% |

Compulsive spender

| Needs: 50% | Wants:45% | Savings:5% |

Here's how your budget might be out of balance if you're trying to reach a goal:

Someone trying to build their emergency fund

| Needs: 40% | Wants:25% | Savings:35% |

Someone who is financially independent

| Needs: 30% | Wants:55% | Savings:15% |

The authors say that your goal should be to move from your current state to something more balanced. For some, that's as simple as re-prioritizing expenses. For most, it's not that simple.

When your Needs are too high, for example, you severely cramp both Wants and Savings. Because most of your income goes to necessities, you don't have enough for fun or for the future. To remedy this, you might need to take drastic action. You might need to move into someplace more affordable (perhaps even to a different city). You might need to find a better-paying job. These are not easy steps.

Life Out of Balance

In many ways, the Balanced Money Formula is brilliant. I agree wholeheartedly that Needs should be kept under 50% of net income. (I think it's a good idea to split Needs: about 25% for housing, about 25% for all other Needs.) I also agree that saving at least 20% of your income (or using that money to repay debt) is an excellent way to find the path to wealth.

But what about that 30% for Wants?

Warren and Tyagi write, “You can spend your Wants money on anything that strikes your fancy, so long as you stay within 30% of your income.” In fact, they warn against spending too little on Wants, suggesting that those who spend less than 20% of their income on the things they enjoy might be missing the point of money. “You certainly won't get into trouble spending like this on Wants,” they say. “Even so, you should ask yourself — are you making enough room for fun?“

Warren and Tyagi write, “You can spend your Wants money on anything that strikes your fancy, so long as you stay within 30% of your income.” In fact, they warn against spending too little on Wants, suggesting that those who spend less than 20% of their income on the things they enjoy might be missing the point of money. “You certainly won't get into trouble spending like this on Wants,” they say. “Even so, you should ask yourself — are you making enough room for fun?“

Excellent question, and here's the truth: I'm spending less than 10% of my income on fun, and I can tell. I'm growing a little cantankerous in my old age. I'm letting things like a trip to the movies raise my blood pressure, when I should just be enjoying life. I've paid off my debt. I'm not spending foolishly. I can afford to go to a movie, even if it is expensive. I can afford to spend the extra 29 cents to have a great mug of cocoa.

All Work And No Play

I've written a lot lately about frugality, and I'm not about to give up my frugal ways. Thrift has been successful for me, has helped me to build wealth. But as some readers have noted, one reason to save money is to enjoy it. It's not just for the future, but for today. Re-visiting the Balanced Money Formula last night brought this point home to me.

I've allowed my own money equation to become unbalanced again. Over the past few years, I've become a Super Saver. Initially, this money went to debt reduction; now it goes to saving and investing. I'm proud of paying off my past and providing for my future, but maybe it's time to spend a little money on today. Maybe it's time to indulge myself. Maybe it's time to give myself a budget for fun.

The Balanced Money Formula puts a lot of minds at ease. It can definitely help you put your finances in automatic mode. But its simplicity also lends itself to being applicable to other life circumstances. If you're reaching for a goal, letting yourself get out of balance with the formula is what naturally happens. I also think being out of balance is something that should last only for a certain period of time, but what do you think?

To learn more about the Balanced Money Formula, borrow the excellent All Your Worth from your public library, or check out this interview with the authors. Photo by SuperFanastic.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)