The rise of alternative investments

Back during the dotcom collapse of 2000, I was losing money in the stock market like a champ. I was a second-year financial analyst who had a serious case of confusing brains with a bull market. When I turned to my VP and told him I was still bullish about the stock market, he almost slapped me upside the head. "We're in a bear market, son. Get used to it and stop dreaming!"

After losing about 30 percent in my after-tax portfolio, my dreams of stock market riches finally faded. I cried "uncle" and moved my money into more conservative investments. The funny part was that my 401k was actually up in 2000 and in 2001 because I had allocated 50 percent of my assets into a hedge fund called Andor Capital Management that went short the market.

Normally, only accredited investors -- those who earn $200,000 a year or more or who have a net worth of over $1 million or more (excluding their primary residence) -- can invest in hedge funds. But my firm had a partnership with Andor that gave us peons access to invest as well.

How to ladder CDs

How to build a CD ladder? It's a great question -- unless you have no idea what a CD "ladder" even is. Let's start at the beginning. A CD ladder is a method of staggering the maturity dates of certificates of deposits so you can invest your money safely and still keep some of it easily available for emergencies.

The Federal Deposit Insurance Corporation (FDIC) insures certificates of deposit (or time deposits) just like they insure savings accounts -- so they are just as safe.

Hidden advantages of savings accounts

Savings accounts? Are you crazy? Boo, hiss. These days, savings accounts are only used as joke fodder for late-night comedians, but there are benefits of a savings account. Take the mom who wants to teach her kids the value of prudent financial management, for example:

For little Bobby's eighth birthday, his mother takes him down to the local credit union to open a savings account. Figuring that all the grownups in his life would pour money into this new savings account to encourage him -- without his lifting a finger -- Bobby reasons that the offer is hard to beat. So, off to the credit union they go.

At his mother's prompting, Bobby explains to the banker that he came to open a savings account. The banker gives a knowing glance to the mother and pushes the application form across the desk to Bobby. "Well, sir, this is your account, so you have to fill it out."

How to evaluate mutual funds to boost your returns

I'm a bit of a nut about Christmas; I even have a daughter named Noelle. So this time of year can be a bit of downer for me. The tree gets disassembled, the Bing Crosby CDs get packed away, and the holiday cards stop coming. Regarding that last one, however, the void in my mailbox will soon be filled by a different type of tiding -- in the form of annual statements from my investment accounts.

OK, so they're not as jolly as cards with pictures of friends and relatives. But using your year-end statements to give your portfolio a thorough checkup can pay off, especially if you discover ways to increase your chances at higher returns. To see the potential benefit, check out this table, which shows how much $10,000 could amount to, given different rates of return and time periods. As you can see, earning another two percentage points a year can add thousands of dollars to your net worth.

| Annual Return | 5 years | 10 years | 15 years | 20 years |

| 6% | $13,382 | $17,908 | $23,966 | $32,071 |

| 8% | $14,693 | $21,589 | $31,722 | $46,696 |

| 10% | $16,105 | $25,937 | $41,772 | $67,275 |

Alas, you can't just snap your fingers and pump up your returns. Most investments involve taking on risk, which many people think of as volatility -- the ups and downs you'll experience -- but I prefer to think of it as uncertainty, as in you generally don't know exactly how an investment will perform, which can make things like retirement planning a bit of a challenge.

30 days to better finances

Learning to manage your finances isn't something most people would put at the very top of their "most fun thing to do" list, but we all know that we ignore money and budgets at our peril. Having a strong handle on what money is going in and what money is going out is an essential first step. But you don't have to be overwhelmed. By setting aside between five and 30 minutes each day, you can transform your finances dramatically in 30 days. Here's one such plan:

Day 1: Compile all your expenses and income. Bucket them by categories such as Savings (retirement accounts, emergency fund), Mortgage/Rent, Household Expenses (food, utilities, heating oil, etc.), Commuting (tolls, commuter rail cards), Debt Repayment (student loans), Entertainment. It doesn't have to be perfect, just complete. Use a service like Mint, software like Excel or even just good old pen and paper -- whatever you are comfortable with. Yearly budgets are more accurate because you will see irregular expenses like property taxes or gifts.

Related >> Building a budget on variable income

Women, insecurity and money: Overcoming the confidence gap

For the past two years, the topic of women and money has come up in my life quite a bit. I'm guessing it has something to do with the fact that I'm a woman who writes about money.

But as a woman who writes about personal finance, I feel have given the topic less attention than it deserves -- not just in my writing, but in my own thoughts too. I suppose I figured personal finance is something that we all struggle with, not just women. But the more I learn, the more it hits home, and the more I realize we should embrace the topic so we can do something about it.

The Confidence Gap

Last year, when I read Barbara Stanny's "Secrets of Six-Figure Women," I found myself nodding in agreement to just about everything she'd written. Some of her points were an unsettling confirmation of my own career shortcomings -- particularly, her chapter on the "traits of underearners." A few of these traits: We have a high tolerance for low pay; we underestimate our worth; we're terrible negotiators. Check, check and check.

Indexing vs. stock-picking: You don’t have to choose sides

A discussion about personal finances can be a polite, congenial affair. Few people come to blows over insurance or budgeting. But some topics inflame financial passions, and one of them is investing. Fellow GRS e-scribe William Cowie encountered this a couple weeks ago when he advocated for investing in individual stocks in certain situations. I thought I would pass along a few thoughts of my own, given that 1) William cited the success he's had with a newsletter from The Motley Fool (my employer for the past 15-plus years), and 2) my own portfolio has big holdings in index funds but also some actively managed funds and individual stocks.

This is a huge topic, with enough books written about the subject to create an entire wall of books. But for today's post, I'll question one of the main arguments against individual stocks, then conclude with a few parting thoughts. And as my posts have traditionally been sprinkled with cat pictures, I'm including this cool "peace" cat as inspiration.

People Aren't Actively Managed Funds

The evidence is clear: Most actively managed funds underperform similarly invested index funds. The Standard & Poor's Index vs. Active (SPIVA) mid-2014 report says that more than 70 percent of actively managed funds lost to their respective benchmarks over the previous five years. The cheerleaders of index funds have plenty of hard evidence to power their pom-poms.

Should you consider ETFs for your portfolio?

Exchange-traded funds (commonly known as ETFs) are a relative newcomer to the American investment scene, having been approved to be publicly traded by the New York Stock Exchange just over 20 years ago. However, in that time, they have managed to capture about $1.7 trillion in investor money. Why are they so popular, and should you consider investing in them?

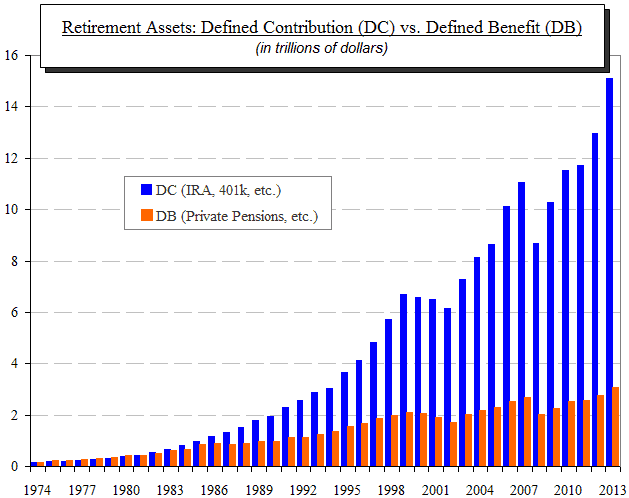

Over the past 40 years we have witnessed a major shift in how America funds retirement. The chart below shows how private employer pensions and other defined benefit plans have been displaced by defined contribution plans (things like IRAs, 401(k) plans and others):

Average 401(k) balance by age

Saving for retirement isn't easy, but 401(k)accounts are a universally popular way to save thanks to hands-off investing features and contributions drawn directly from your paycheck.

But how do you know if you've saved enough? How is your retirement savings plan shaping up against people your same age?

Here's the Data:

Average 401(k)balance up to age 25: $4,048 Median: $1,385

Can you really get rich quickly from fix and flipping homes?

Some reader stories contain general advice; others are examples of how a GRS reader achieved financial success or failure. These stories feature folks with all levels of financial maturity and income.

Mark Ferguson has been a Realtor since 2001 after graduating from the University of Colorado with a business finance degree. He runs a real estate team of 10 that sells over 200 homes a year, fix and flips 10 to 15 homes a year and owns 11 rental properties. Mark also runs www.investfourmore.com, a blog that discusses Mark's fix and flips, rental properties, becoming a real estate agent and everything real estate related.

Many television shows portray fix and flipping as a very profitable business that can easily be done in your spare time. Sure there are usually a few contractor problems, but in the end the house sells for a lot of money and the owners make a killing. In reality, you can make money fix and flipping homes, but it takes a lot of hard work and a lot of flipping to make a lot of money. It is also very easy to lose a lot of money if you do not account for all the costs or overestimate the value of your flip.