The secret to a rich life

There’s this idea in our society that if you want something amazing, there’s got to be some secret to getting it.

People want “magic bullet” answers. They think if they look long enough and hard enough then maybe, just maybe, they’ll stumble upon the SECRETS “THEY” DON’T WANT YOU TO KNOW.

I’m not judging. I used to be like this too. But now I know different. Now I know there aren’t any secrets. The truth is often hidden in plain sight; you just have to learn to see it.

- The secret to fitness? Eat real food and move regularly.

- The secret to being organized? Have a place for everything and keep everything in its place. (Want help? Check out the Konmari Method.)

- The secret to time management? Learn to say “no” and tackle your most important tasks first.

- The secret to writing a novel? Write a little bit every day.

I’ve found that the best way to learn the “secret” of whatever it is I want to achieve is to listen to people who have done it (or are doing it) first.

When I wanted to become a writer, I read advice from my favorite authors. When I wanted to get fit, I read interviews with elite athletes. While digging out of debt, I talked to others who’d done it before me.

Two years ago, I read The Snowball, a fantastic biography of billionaire Warren Buffett. There’s a lot to learn from the world’s third-richest man. I believe that soaking up his wisdom — his “secrets” — helps me become a better investor and a wiser steward of my wealth. It also helps me become a better teacher of personal finance. (It was through reading this Buffett bio that I came up with the concept of the wealth snowball.)

Buffett’s advice probably won’t help me become a bonafide billionaire but a guy can dream, right?

How to Reach Financial Freedom

Taking advice from billionaires is great, but in some ways it’s also impractical. That’s why I also do my best to learn lessons from successful people in my day-to-day world. If I want to uncover the “secret” to a rich life, the best approach is to see what works (and what doesn’t) for average people.

Here’s an example. A while back, Jeff from the Sustainable Life Blog asked 39 colleagues two questions:

- What inspired your journey to Financial Independence?

- What do you think is the most important thing people need to do to reach Financial Independence?

Jeff compiled the responses into a colossal collection of stories and tips about how to achieve financial freedom. If you’re at all interested in this subject, you should bookmark his post: Who else wants to retire early and be free? (Unfortunately, the original article has been “unpublished”. I’ve linked to the archived version from the Wayback Machine.)

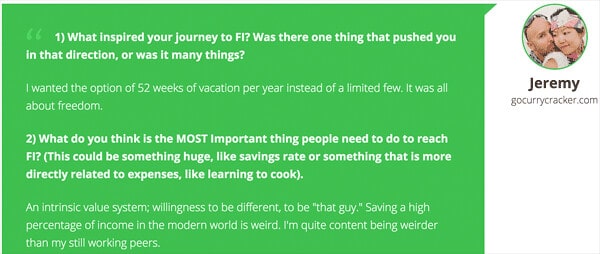

Here, for example, is how my buddy Jeremy answered the questions.

Because I’m a nerd, I spent an hour reading everybody’s answers. And I took notes. And I crunched the numbers. Here are the most common responses:

- Eleven people stressed the importance of a high saving rate.

- Ten people argued that it’s vital to align your spending with your values — and seven more said something about ignoring everyone else and/or learning to think differently from the norm.

- Six people believe the most important thing is to spend less — especially on the big things. Two people emphasized income.

- No other piece of advice had more than three responses.

In other words, when you ask a pool of people who write about Financial Independence what the secret to success is, about half say “spend much less than you earn” and about half say you should be willing to leave the herd to follow your own path.

The Secret to a Rich Life

Put these two ideas together and you have a powerful recipe for a rich life. The secret to a rich life? Save half of your income so that you can pursue your purpose.

That’s the secret.

There’s a real temptation to believe that financial success is more complicated than that…but it’s not. That’s what others have concluded, and that’s what I’ve come to understand after twelve years of reading and writing about money full time. The “secret” to financial success real is this simple. (But, as always, simple and easy aren’t the same thing.)

My entire mission here at Get Rich Slowly is to help my readers do thes two things. That’s why I’m so insistent that folks write a personal mission statement. And that’s why I stress that the most important thing you can do to achieve your financial goals is to boost your saving rate.

To my mind, these two steps are the keys to financial freedom. They’re the secret to a rich life.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)