The pros and cons of an interest-only mortgage

This article was written by Mrs. Micah of Finance and Life. Look for a related post later today.

Getting an interest-only mortgage can seem like a great idea when you're trying to buy a house and can't afford a down payment (or if you have bad credit). Earlier this week, I read the story of a couple who are celebrating home-ownership under just such a situation. But while they're happy, odds are that this is actually a disaster waiting to happen.

Getting an interest-only mortgage can seem like a great idea when you're trying to buy a house and can't afford a down payment (or if you have bad credit). Earlier this week, I read the story of a couple who are celebrating home-ownership under just such a situation. But while they're happy, odds are that this is actually a disaster waiting to happen.

The Pros

There are two reasons an interest-only mortgage might work out for you:

Frugality in practice: Keeping warm in winter

Cold cold cold — I am cold.

Remember George Bailey's "drafty old barn" in It's a Wonderful Life? Our place is like that. This 100-year-old farmhouse is cold all winter long. There are drafts at the doors, there's inadequate insulation, and we have 30 windows in 1800 square feet. (Our old house had eight windows in 1400 square feet.) Every year, we do a little more to make this place energy-efficient, but it's a losing battle. In order to stay warm, we surrender to our heating bill.

Remember George Bailey's "drafty old barn" in It's a Wonderful Life? Our place is like that. This 100-year-old farmhouse is cold all winter long. There are drafts at the doors, there's inadequate insulation, and we have 30 windows in 1800 square feet. (Our old house had eight windows in 1400 square feet.) Every year, we do a little more to make this place energy-efficient, but it's a losing battle. In order to stay warm, we surrender to our heating bill.

(Our house is so drafty, in fact, that the previous owners had a separate furnace in the kitchen. During the winter, they sealed off that room and basically just lived there.) Continue reading...

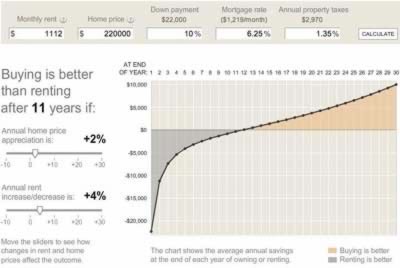

The New York Times rent vs. buy calculator

Is it better to buy or rent? It's one of the eternal personal finance questions, and one that each person has to decide for herself. There are lots of non-financial factors that affect this decision, of course, including your hobbies, lifestyle, and personal psychology.

Despite these non-financial considerations, often the choice comes down to money. What makes the most financial sense? In July, guest-author Tim Ellis shared his thoughts on the rent vs. buy debate with us. While re-reading his article recently, I followed a link to this beautiful rent vs. buy calculator from The New York Times.

This interactive tool allows the user to play with the numbers, providing immediate feedback after adjustments to predicted home appreciation or rent increases. Don't overlook the panel of advanced settings — these can help you evaluate tricky scenarios. Continue reading...

Learning to love the not-so-big house

I had lunch with my friend Cameron a few weeks ago. Over plates of Kung Pao Chicken and Mongolian Beef, the conversation drifted toward personal finance. We began to talk about the repairs and upgrades we've been making to our homes.

Kris and I bought our current house three years ago; Cameron and his wife bought their home two years ago. Both were big upgrades from what we had previously owned. And though neither couple spent more than they could afford, we're now realizing that bigger isn't always better.

Our first house was a 1365 square foot ranch-style home on a 7500 square foot lot. It was an unremarkable house, except that it was located in my home town. We could walk to the grocery store, to the barber, to our favorite restaurants. I could bike to work. If we still lived there, we would be paying off the mortgage next spring.

Accelerated mortgage payments (and the GRS amortization calculator)

What if you've reviewed the compromises required to pay your mortgage early and the idea still appeals to you? You might pay a bank to set up a bi-weekly payment plan or a money merge account. But you can do just as well by taking mortgage acceleration into your own hands. Here are three options I've considered:

- Rather than pay my mortgage, I could deposit my money into a high-yield savings account earning roughly 5% interest. Though this earns the lowest possible rate of return on my money, it gives me the greatest flexibility. I could withdraw the money to pay down the mortgage at any time. Or I could save for other goals.

- On the other hand, I might make extra payments on my mortgage each month. This would effectively earn me a guaranteed rate of return equal to my mortgage interest rate (6.25%). This would also help me spend less on interest. Doing this, however, ties up my money, making it difficult to access if I decide I want it for something else.

- My third choice is to invest the money in low-cost index funds. This would, in theory, provide the highest possible rate of return for my money, but as with any stock market investment, there's an element of risk. If my goal is to pay off my mortgage, a bear market is going to make me sweat.

Kris and I will decide what we intend to do by early next year. Initially, I thought we'd make payments directly on the loan, but after previous discussions here at Get Rich Slowly, I'm leaning toward placing the money in a high-yield savings account until we know better what our long-term financial goals are.

HELOC Payment Calculator for Excel

Meanwhile, I was curious: How long would it take to pay off my mortgage using the HELOC I already have? Would using the HELOC actually save time over applying the payment directly to the mortgage itself? To play with the numbers, I developed a mortgage amortization spreadsheet. (This spreadsheet doesn't account for inflation — that's beyond my Excel acumen.) Continue reading...

Is a money merge account a good way to pay off your mortgage?

Over the past few weeks, I've received several questions about money merge accounts (sometimes called "Australian mortgages"). I haven't paid much attention to these because I'm unfamiliar the products. But when Abbie wrote last week, I decided to do some research. Here's what she said:

Over the past few weeks, I've received several questions about money merge accounts (sometimes called "Australian mortgages"). I haven't paid much attention to these because I'm unfamiliar the products. But when Abbie wrote last week, I decided to do some research. Here's what she said:

My financial guy handed me a DVD for United First Financial the last time I spoke with him. Apparently they are a company that uses "sophisticated algorithms" to compute how to best pay down a mortgage using a HELOC and a Money Merge Account, with the end result being that the mortgage is paid off in fewer than 30 years. (Their preferred statistic seems to be 11 years.)

I'm new to the whole homeowner thing, and know there are differing opinions regarding paying off a mortgage early, but was wondering if you're familiar with this system. I'd appreciate any information or opinion you have regarding money merge accounts or UFF; a bit of web research comes up with inflammatory chats and the company's own claims, but nothing from a reliable third party.

Frugality in Practice: Do-it-Yourself Home Maintenance

I hate plumbing. Whenever a faucet begins to leak or a drain clogs, my stomach sinks. I know it means hours of frustrating work. It's not that plumbing is difficult — it's just that I'm not well-versed in the ways of home-improvement. Somehow I missed that part of Manhood Training.

Despite my apprehension, over thirteen years of homeownership, I've made it a point to do as much repair work as I'm able. It has saved me a lot of money. And while I'm a ball of nerves going into a project, I get tremendous satisfaction when I finish something and know that I did the work with my own hands.

Yesterday we woke to find water on the floor of the upstairs bathroom. When we couldn't immediately locate the source of the leak, we debated calling a plumber. Because it was the weekend, and because we're trying to save money, Kris and I decided to tackle the problem as a team. While she buried herself in the Readers Digest Complete Do-It-Yourself Manual, I took the toilet apart. Ultimately we diagnosed the likely culprit: corroded fasteners connecting the tank of the toilet to the bowl. We drove to the hardware store, picked up replacement parts, and then put Humpty Dumpty back together again. Continue reading...

Renting vs. buying: The realities of home-ownership

This is a guest-post from Tim Ellis, author of Seattle Bubble, a blog and forum dedicated to discussing real estate market conditions in the Seattle area.

"If you rent, you're throwing away your money."

"Owning your own home is a forced savings plan."

"Home ownership is an excellent path to build wealth."

You've probably heard statements like these plenty of times. On television, radio, the internet, and in casual conversation. Such sentiments are common in any discussion that involves home-buying and personal finances. It's common knowledge that buying a home is a better financial move than renting. After all, you're building equity instead of throwing away your money, right? Well, maybe not quite... Rather than assuming the "common knowledge" on this subject is accurate, let's take a look for ourselves at some of the financial differences between renting and home-buying.

What if you’re frugal but your roommates aren’t?

Eleanor wrote with a question that could test even the mightiest personal finance expert. "What," she asks, "can you do when you want to save money and your roommates don't care?"

I share a house with four roommates. This saves me at least $200 a month from what I would be paying if I lived in an apartment. But roommates raise expenses in other, unexpected ways. I have been trying to cut down on monthly bills and am finding it incredibly difficult.

For example, I live with roommates that want digital cable and high-speed internet bundle. I can live without the cable (I don't watch TV) and don't mind having a lower-speed connection. But because three of my five roommates want the more expensive package, that's what we get, and instead of splitting a $60/month bill five ways we're splitting a $100/month bill. I end up paying more money overall. While I can simply not watch cable and argue with them that I won't pay for that fractional cost of the bill, there's no way I can somehow use a lower speed internet connection without some serious technological finagling.

Fact or fiction: Can a rain barrel save you money?

Reader robblat asked about rain barrels: Are they useful? How much do they cost? Where do you get one? My wife just installed a rain barrel last year, so I asked her to explain how they work.

For my birthday last year, I asked my parents for a rain barrel. After doing some research online, I went to our local nursery and paid $100 for a complete barrel set up. While it will mean a small savings on our future water bills, the upfront cost is really too high to justify it from a purely financial standpoint. Instead, I wanted to collect rainwater for several other reasons.

Collecting a Renewable Resource For Our Own Use

Rainwater belongs to everyone, right? But for the most part, we are dependent on a vast infrastructure to collect, purify and deliver this most basic of life's requirements to our doors (er, faucets). I like the idea of harnessing a bit of that rain before it makes it through the whole human system. My plants don't need chlorinated water, anyway! Plus, anecdotal evidence on gardening websites suggests that plants do better with lukewarm rainwater than cold tap water.