The forever fallacy

Last week, Ben Carlson from A Wealth of Common Sense published an interesting article about how staying rich is harder than getting rich. He writes:

Research shows over 50% of Americans will find themselves in the top 10% of earners for at least one year of their lives. More than 11% will find themselves in the top 1% of income-earners at some point. And close to 99% of those who make it into the top 1% of earners will find themselves on the outside looking in within a decade.

It's great that so many people get to taste what it's like to earn a lot of money, if only for a little while. What's not so great is that as most people earn more, they spend more. But if you spend all (or most) of what you earn as you're surfing an income bubble, you can find yourself in trouble when that bubble bursts.

Act surprised: Your wedding ring is a terrible investment

Divorce. It's an unattractive yet common end to a relatively high percentage of marriages in the U.S. In fact, as many as 50 percent of American marriages end this way, often leaving catastrophic personal and financial consequences that linger for years.

The division of assets. Alimony. Child Custody Issues. Who gets the Stuff? These are all things that must be dealt with during and after a divorce, whether one likes it or not. And the truth is, it isn't always pretty.

Unfortunately, my beloved brother recently learned all about divorce the hard way -- by actually going through one. And since he could no longer afford his giant house on his own, he had to move and sell most of his bigger stuff. I wanted to help in any way I could, so I offered to sell some of his bigger items on Craigslist and eBay. And within the timeframe of a few months, I sold his lawnmower and baby grand piano without too much hassle.

Moderators and abstainers

When I was a boy, I told my father I wanted a fish. I meant that I wanted a little orange goldfish in a small bowl that might live on the kitchen counter, just like other kids have. My dad knew that. But instead of buying me a goldfish, he went to the pet shop and purchased a 20-gallon aquarium with a bunch of expensive tropical fish.

The fish were fun for a day, but I was seven or eight or nine years old. I lost interest quickly. The fish became more of a nuisance than a novelty. And, eventually, one of us three boys -- I can't remember which -- broke the tank, and then we had no more fish.

The Get Rich Slowly Anniversary

The middle of April is a Big Deal in my world.

The trees have nearly finished blossoming, which means my allergies will soon go away. We're seeing more of the sun, which means the worst of my seasonal depression is behind me. Today, on the 15th, Get Rich Slowly celebrates its anniversary.

In the Beginning

When I started Get Rich Slowly, I had no idea what it was going to become. I had no grand plan or vision. I just wanted to write about money while accomplishing three goals.

Case study: Deep in debt but scared to take action

Last night, as I do from time to time, I met with a GRS reader. Actually, Debbie doesn't read this site but her sister does. And Debbie means to. Although I met Debbie's sister last year at a Camp FI event, I'd never met Debbie before.

"So, what's your situation?" I asked after our waiter had brought us each a glass of wine. "What do you want to know about money?"

"Everything," Debbie said, laughing. "I feel like I don't know much at all right now. I guess deep down, I know what I need to do. I just don't do it."

Why don’t Americans save?

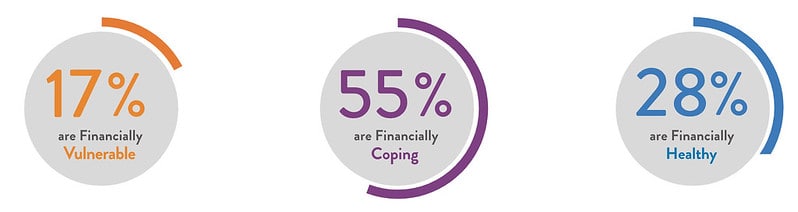

A new report from the Center for Financial Services Innovation says that only 28% of Americans are financially healthy. And it reinforces something we already knew: The U.S. saving rate sucks. Americans don't save.

The U.S. Financial Health Pulse divides people into three tiers of financial health.

- Financially healthy people (28% of the U.S., 70 million people) are "spending saving, borrowing, and planning in a way that will allow them to be resilient and pursue opportunities over time."

- Financially coping people (55%, 138 million) are "struggling with some, but not necessarily all, aspects of their financial lives."

- Financially vulnerable people (17%, 42 million) are "struggling with all, or nearly all, aspects of their financial lives."

How to retire young

While browsing Oregon's best used bookstore earlier this year, I stumbled on a 1989 book called How to Retire Young by Edward M. Tauber. Tauber retired at the age of 43 from a tenured full professorship as Professor of Marketing at the University of Southern California. He's written a number of marketing textbooks, but this was his first (and only?) foray into the realm of personal finance.

How to Retire Young is one of the oldest books I've found on the subject of early retirement. It's fun to see how much of the modern financial independence movement is foreshadowed in the book's pages.

What it means to be rich: The difference between income and wealth

I'm generally a pretty laid-back guy but, like anyone, I do have pet peeves. Because I write about money, I have lots of trivial personal finance pet peeves. (It's "saving rate", not "savings rate". Dave Ramsey did not invent the debt snowball, and his version is but one kind of debt snowball. It's not the only debt snowball. See? I told you these pet peeves were trivial!)

It's silly that I'm bugged by this stuff, but I am. I'm sure you have pet peeves too, especially when it comes to your work.

One of my top pet peeves in the world of personal finance is when people who should know better conflate income and wealth. A high income can lead to great wealth -- although it doesn't always -- but they're not the same thing.

How to profit from economic cycles

(Since April is Financial Literacy Month, a number of articles will be devoted to more educational topics. This is Part IV in a four-part series about how understanding economic cycles could inform your financial decisions. Part I is Understanding economic cycles: An introduction. Part II is Recognizing economic seasons: recovery and growth. Part III is The fall and winter seasons of the economic cycle.)

In the first three parts of this series, you saw how the economy moves in cycles of seven to 10 years, and how each cycle can be broken down into four phases which correspond closely to the seasons of nature. We also looked at some of the telltale signs of economic activity that can help us recognize where we are in the cycle.

You may be thinking, "That's all interesting, but how can I apply that knowledge to my personal financial life?" Let's start by decapitating the elephant in the room -- market-timing. Market-timing is a fool's game. However, most of the time market-timing refers to trying to find the high point in the market to sell high. It is true: Nobody is able to tell when a market has reached its peak.

Car payments: ‘Til death do us part

Your car breaks down on the side of the road … again. It's rush hour and it won't start. You have to have it towed and you're not happy about it. At all.

So what do you do?

You head to the local dealership in a fury, ready to replace it with something far more reliable, but also affordable. But the dealership has a few tricks up their sleeve and, according to Paul (the salesman helping you), it must be your lucky day. Amazingly, your car died at the most opportune time in history. Continue reading...