The Quiet Millionaire

Despite what you see in the media, financial success generally doesn't come with a lot of glitz. The wealthiest people I know are the ones you'd least expect. They've built their wealth slowly — and quietly.

Certified financial planner Brett Wilder has observed the same thing, and has written about the phenomenon in his book, The Quiet Millionaire. Along the way, he shares real-life examples of quiet millionaires. These are the same sorts of people who were profiled in Stanley and Danko's The Millionaire Next Door [my review]. They're frugal, hard-working, and sensible.

From the introduction: Continue reading...

Failing forward: Transforming mistakes into success

Sometimes the best personal finance books aren't about personal finance.

In June 2006, for example, I shared a brief review of Steven Pressfield's The War of Art. Ostensibly this book is about creativity and overcoming procrastination, but I found its lessons valuable for pursuing my financial goals. Last year I read Mastery by George Leonard. On the surface, this book has nothing to do with money, yet it's one of the best books about money I've ever read.

John C. Maxwell's Failing Forward is another of this ilk. It's not meant to be a personal finance book, yet I'm willing to bet that more of you can improve your financial lives by reading it than by reading The Automatic Millionaire or Personal Finance for Dummies (though these are both fine books). Why? Because books like Failing Forward apply to your entire life rather than just one part of it.

Escape from Cubicle Nation

Last Friday, I attended a workshop put on by Pamela Slim, who writes about entrepreneurship at Escape from Cubicle Nation. Before this meeting, I didn't know much about Slim or her message, but her work came highly recommended from my friend, Chris Guillebeau. "Pam is the real deal," he told me. "Her book is what a lot other books have tried to be."

Based on this recommendation, I drove to hear Slim speak. I was impressed. Chris is right: She's the real deal. I was so impressed, in fact, that I spent the weekend reading her book, which is also called Escape from Cubicle Nation.

Opening Up to Opportunities

Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with what's important to you. At times, this almost seems touchy-feely. Almost.

The best books on money: 25 essential personal finance books

I shared a list of my favorite books about money once before, but that was over two years ago. I've read dozens of books since then (and thumbed through dozens more). Here is a revised list of 25 great books about money.

These are all books that I found entertaining or influential. There are still many "big name" books that I haven't read, such as "A Random Walk Down Wall Street" and "The Intelligent Investor," and I've left off some perennial favorites such as "The Richest Man in Babylon" and "The Wealthy Barber."

Reminiscences of a Stock Operator

I read a lot of personal finance books. Most possess a certain sameness. They offer good advice, yes, but there's nothing special about them. Perhaps that's why I'm drawn to two specific types of financial books: narratives and histories. If a book can combine both of these elements, it's a good bet I'm going to like it.

Between 10 June 1922 and 26 May 1923, The Saturday Evening Post published a series of twelve articles by journalist Edwin Lefèvre. These stories, collectively entitled "Reminiscences of a Stock Operator", told the thinly-veiled biography of stock-market speculator Jesse Livermore, and were published as a book by the same name later in 1923.

Reminiscences of a Stock Operator gives the first-person account of the career of "Lawrence Livingston" (a slightly fictionalized Livermore), who, just out of grammar school, goes to work as a quotation-board boy in a stock-brokerage office. (This was during the 1890s, one hundred years before the advent of real-time internet stock quotes. Stock quotes had to be written on a chalkboard!)<

Fail-safe investing? Harry Browne’s permanent portfolio

Never again will I be in a position to lose 50% of my money. There must be a way to see the Big Picture and lighten up on areas that are over-valued, but still enjoy an average return at least approaching that of the market as a whole...I'd love to hear some simple strategies that require a little thought, and don't just focus on keeping a lot of money in cash and short term bonds.

It sounds to me as if Ken is asking about defensive investing, which is actually something I've been thinking about a lot lately. When I was younger, my investments were mostly speculative. They were gambles. I wanted to earn huge returns — and I wanted them today. Even two years ago, I was investing in Countrywide and The Sharper Image.

But as I've built wealth and become better educated about money, I've become a defensive investor. I've become less interested in quick gains. Last year's market collapse was another shock to the system, not just for me but for many others. We've realized that our risk tolerance isn't as high as we once thought it was.

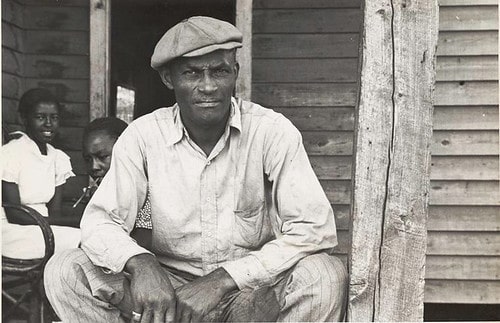

Hard Times: An oral history of the great depression

I don't know anyone who lived through the Great Depression, so to find out what it might have been like, I turned to a book recommended by a couple of GRS readers.

In 1970, writer Studs Terkel published Hard Times: An Oral History of the Great Depression, which features excerpts from over 100 interviews he conducted with those who lived through the 1930s. Terkel spoke with all sorts of people: old and young, rich and poor, famous and not-so-famous, liberal and conservative.

Book review: I Will Teach You to Be Rich

Today I am reviewing a new book written by a colleague. As you read this review, please remember that I am friends with author. For comparison, you can see my reviews of two other books by friends here and here.

I'm often asked to recommend personal finance books for young adults. I've read a few (and have more in my to-read stack), but there are only two that I promote in my presentations to students:

- Debt is Slavery by Michael Mihalik, a short book packed with great advice. This is a fantastic overview, but it's light on tactical tips.

- Suze Orman's The Money Book for the Young, Fabulous, and broke has the opposite problem. It's too long. Again, the advice is solid, but there's too much of it.

Now, however, my friend and colleague Ramit Sethi has written a money book aimed squarely at those in their twenties. And he's done a marvelous job. I can only hope that my own (theoretical) book turns out this well.

Magazines (and websites) about homesteading and self-sufficiency

When I was a boy, my father used to buy Mother Earth News from the grocery store. The magazine was filled with stories about self-sufficient country living, the sort of thing my dad aspired to. I'd read the magazine after he was finished, but never really understood the appeal of building your own greenhouse or raising goats. Now, as an adult, it makes a little more sense.

Kris and I are not radically self-sufficient, but we do enjoy growing our own food. (And she recently agreed that we could get chickens!) The content at GRS reflects my interest in the DIY lifestyle. Besides frequent articles on gardening, in the past I've shared stories like these:

- Frugality in practice: Home canning

- An introduction to homesteading, an article from Phelan of A Homesteading Neophyte

- My review of Back to Basics: A Guide to Traditional Skills

Though our own adventures in self-sufficiency are limited, they're edifying, and I admire those who do even more. I'm a strong advocate of the DIY ethic. I believe there's real value in traditional skills, such as gardening and sewing, canning and carpentry. As a bonus, most of these practices save money.

Confessions of a Butcher: Eating Steak on a Hamburger Budget

Every week, I receive a couple of books in the mail from authors and publishers. (This week there were six!) They're hoping that I'll find time to review their work at Get Rich Slowly. I do my best, but it's impossible to read everything.

Every week, I receive a couple of books in the mail from authors and publishers. (This week there were six!) They're hoping that I'll find time to review their work at Get Rich Slowly. I do my best, but it's impossible to read everything.

When John Smith offered to send me his book, Confessions of a Butcher, I wasn't expecting much. I've read a few niche books like this, and they're usually uninspiring. As a full-fledged carnivore, I'm please to report this one is different. Smith spent more than 30 years in the meat industry, and he's used his experience to produce a short book packed with information.

Confessions of a Butcher contains: