When to use intermittent FMLA

Disclosure: I am not an attorney or HR specialist. This is just my experience with, and understanding of, FMLA.

According to the United States Department of Labor (DOL) website, "The Family and Medical Leave Act ("FMLA") provides certain employees with up to 12 workweeks of unpaid, job-protected leave a year, and requires group health benefits to be maintained during the leave as if employees continued to work instead of taking leave." The whole point of FMLA is to promote work-life balance by taking a reasonable amount of leave to deal with personal or family issues.

Because many situations requiring use of FMLA are health-related, the law also requires that your health insurance be maintained as if you continued to work. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to stay on a former employer's health plan for a limited time after job separation, provided they pay the full premium (employer share and employee share). Unlike COBRA, if you are on FMLA, then your employer still pays their share of the premium for your health plan, even if you are not being paid a salary during your leave.

How to profit from economic cycles

(Since April is Financial Literacy Month, a number of articles will be devoted to more educational topics. This is Part IV in a four-part series about how understanding economic cycles could inform your financial decisions. Part I is Understanding economic cycles: An introduction. Part II is Recognizing economic seasons: recovery and growth. Part III is The fall and winter seasons of the economic cycle.)

In the first three parts of this series, you saw how the economy moves in cycles of seven to 10 years, and how each cycle can be broken down into four phases which correspond closely to the seasons of nature. We also looked at some of the telltale signs of economic activity that can help us recognize where we are in the cycle.

You may be thinking, "That's all interesting, but how can I apply that knowledge to my personal financial life?" Let's start by decapitating the elephant in the room -- market-timing. Market-timing is a fool's game. However, most of the time market-timing refers to trying to find the high point in the market to sell high. It is true: Nobody is able to tell when a market has reached its peak.

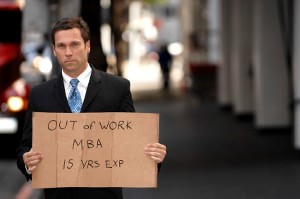

Job search tips that work

You may have noticed that, since last September, many of my posts here at Get Rich Slowly have focused on the job search. Some of you may have wondered why I would write about such a topic at all, since my job tenure was over seven years.

Well, it's because I have been job-hunting. And I succeeded! As I write this, I just wrapped up my first week at a new job.

So I thought it would be helpful to revisit some of the posts I wrote during that time to see what job search tips actually worked for me as I went through the process. Here's an overview of how I approached my job search and what made it successful.

What to do when you can’t find a job?

For the last few months, I've been talking about various aspects of job-hunting. But what do you do if you can't find a job? OK, you can start with cutting your budget to the bone and applying for public assistance programs if you are eligible. But what next? Well, as with many things, the short answer is: It depends. On what, you may ask? Here's what I came up with:

- Are you currently unemployed, underemployed, or employed and just looking for a better opportunity?

- Do you have any debt? How much? What kind (a mortgage, consumer debt, student loans)?

- How big is your emergency fund? Do you have any other liquid reserves?

- Do you have a significant other or other loved ones (including parents or adult children) who are currently earning and/or with whom you can share expenses?

To pick randomly from the list above, an unemployed person with no debt and a beefy online savings account who is married to a high-earner living in Small Town, USA may actually be in a better situation than someone with a full-time job, lots of debt, and no emergency fund who is single and stuck in a lease on a one-bedroom apartment in Manhattan.

Everyone's situation is different, so take my suggestions on what to do if you can't find a job with a grain of salt (and a side of no judgment). That said, here are some strategies for those who are wondering if the recession is over, where are the jobs?

How to interview a prospective employer

Speaking about building wealth, J.D. Roth felt that he could never make this point emphatically enough: "Frugality is important, but if you want to make real progress, increase your income." It's in this context that being able to ace an interview becomes a very important skill. And certainly part of the interview process should include your asking questions of a prospective employer to make sure that the job and the company are right for you.

If you are early in your career, though, it is natural to approach a job interview as if it's a test that you might or might not pass. But this perspective could lead to some undesirable results:

- Firstly (and ironically), it may prevent you from highlighting your strengths.

- Secondly, it may keep you from finding out the things that you need to know in order to properly consider a job offer if they do want to hire you.

Here are three more ways having a test mentality can affect how you conduct your interview and some strategies for how to avoid potential missteps.

How to turn down a job offer (or resign) gracefully

So, you've done it. You've considered all the costs of a new job, networked your heart out, and considered all aspects of your job offer. Now you are facing one of two outcomes:

-

Pull the trigger! Take the new job.

-

Not good enough! For whatever reason, you've decided to decline the offer.

Preparing financially for a job search

Looking for a new job is a multi-faceted process. I've discussed many aspects of career-building that apply even if you are just trying to keep a job you already have. But laying the groundwork for a successful job search is about more than just your reputation. A job search can take months -- in some cases, up to a year or more -- so it is very important to be prepared financially before you start to look.

How to prepare financially for a job search

1: Beef up your emergency savings

To cover the gap between your last paycheck at your old job and your first paycheck at your new job, it is a good idea to beef up your savings. There are many reasons this could be the case: You may need to relocate for your new job, you may find it difficult to time your start and end dates, or you may be laid off or terminated before you can line something else up. These challenges can have a ripple effect on your finances.

For example, if your new job will require that you relocate, your significant other may also need to leave their current job. If you are the primary breadwinner in your family (or you are single) then having a gap in your income can have a major impact on your life. This is especially the case if you are living paycheck to paycheck.<

How to curate your social media presence when job-hunting

Recently, I've been posting on job-related topics like networking strategies and job tenure. Because my current position entails working with college students, I've been asked on numerous occasions to talk to various undergraduate groups about getting into graduate school. In fact, I'm giving one such presentation next week.

Many of the things I cover in such presentations are also broadly applicable to any situation where you are competing against a number of other applicants for a position. This includes job-hunting. I've also taught entire units on job-hunting in upper division business writing courses at the university level. Much of the advice that I give is pretty standard:

- Research the position and the company

- Write a cover letter and résumé that are tailored to the position

- Give your references the information they need to recommend you, including a reminder of your recent accomplishments and details about the position.

One of the tips that I give always makes college students gasp in surprise and dismay -- the idea that their social media presence could impact their employability. I have to admit to being somewhat surprised and dismayed myself that this hasn't occurred to everyone. However, it is one of those things (like checking your credit report and credit score every year) that bears repeating and requires regular attention. Continue reading...

What does your job tenure say about you?

Recently, I wrote about networking strategies that can help advance your career, and that got me to wondering what a "typical" career looks like these days. How have careers been affected by the Great Recession? Are people able to stay in a job and retire if they love it, or is the job market more chaotic than that? And what does it say about you either way? For instance, are there certain features of someone's resume that might identify them as a baby boomer, Gen X, or millennial? Could that even pose an advantage or disadvantage for them?

Lifetime Careers and Pensions Have Gone the Way of the Dodo

People often fall prey to the "rosy retrospection" bias or fallacy, where they have a tendency to remember the past as being better than it actually was. So while your parents' or grandparents' generation would likely have said differently at the time, if you ask folks today about those past decades, they would tell you that it was a stable time when it wasn't too hard to stay with one employer for all or the majority of their careers and retire with a fat pension.

Whether or not that was actually people's lived experience, it is generally acknowledged that the retirement outlook for 20-somethings today is quite different. It is expected now that individuals will hold numerous jobs throughout their lifetimes. In fact, people may have not only different jobs, but different careers over the course of their working years.

To what do you attribute your success — hard work or good fortune?

Every now and then, I get an email from a fellow writer who's just starting out and wondering where to begin. "How did you do it?" they ask. "How did you make freelance writing your career?"

It's flattering, but what do I say? First of all, I'm still working to reach my own writing goals, so I'm not even sure I'd be the best person to ask. But also, any success that I may have had as a freelancer has at least a little to do with luck. True, it's mostly hard work, but auspicious timing and lucky breaks have also helped my career along the way.

For example, when I started writing for MSN, it wasn't because I worked hard to get their attention and relentlessly pursued their editors. It was also because I had an enormously talented and kind friend who landed a job there, and she happened to be hiring freelancers right as I decided to leave my job to become a freelance writer.