The sunk-cost fallacy: Throwing good money after bad

My mother spent three weeks in the hospital in August. Her extended stay affected me in lots of little ways I couldn't anticipate. To escape my daily worries, I went searching for a little solace — I re-activated my World of Warcraft account.

World of Warcraft is a subscription-based online computer game. As a player, you become immersed in a virtual fantasy world, interacting with thousands of other players from around the globe. It's great fun. Enjoyed in moderation, World of Warcraft (or any other computer game) can be a fantastic pastime.

Unfortunately, I'm not so good with enjoying things in moderation. I had quit the game cold turkey several years ago because it was consuming my life. This time, I made an effort to keep my play under control. For the first week, I limited myself to an hour a day. By last week, however, I was playing at least four hours every day, and other areas of my life — my fitness, my mental health, my relationships — were beginning to suffer.

<Financial Success Comes from Within

Success, financial or otherwise, comes from within.

According to studies by psychologists and researchers, people with an internal locus of control are more apt to plan for long-term goals, delay gratification, and accept more risk for the promise of more reward. These qualities should sound familiar to readers of this site because they are precisely the characteristics needed to "get rich slowly."

The locus of control is a way of looking at your circumstances and assigning cause. The difference between external and internal is the difference between saying, "I didn't get the raise because the company is tightening the belt," and, "I didn't get the raise because I didn't prove beyond a reasonable doubt I deserved it." It's also the difference between, "I got the promotion because it was finally my turn after being here long enough," and, "I got the promotion because I performed well on that last project."

How to win the lottery

Ray Otero cannot buy a break. For the past three years, he's spent $500 to $700 a week playing the lottery, but he's only won big a few times: $1,000 once and $2,000 twice. Still he keeps playing. He's sure his luck is bound to change.

Otero's story, told in a recent New York Times article, is simultaneously funny, poignant, and exasperating. This New York City building superintendent simply wants the "easy life" for his family. He wants to find the money to move back home to Puerto Rico.

So why doesn't he save the money from working? Because working is for suckers:

The psychology of happiness: 13 steps to a better life

We think we know what will make us happy, but we don't. Many of us believe that money will make us happy, but it won't. Except for the very poor, money cannot buy happiness. Instead of dreaming of vast wealth, we should dream of close friends and healthy bodies and meaningful work.

The Psychology of Happiness

Several years ago, James Montier, a "global equity strategist", took a break from investing in order to publish a brief overview of existing research into the psychology of happiness [PDF]. Montier learned that happiness comprises three components:

Dangerous Norms: When a Treat Becomes a Routine Matter

But at some point, the treat of dining out became a matter of routine. When I got married in 2003, my wife and I settled into the habit of eating out for almost every meal. Soon, spending $20 on a meal at a restaurant became the norm. There was no joy in this process — it was simply the way we did things, for better or worse.

Later, I began to appreciate cooking at home, particularly when we moved into a larger house with a decent kitchen. We started preparing a lot of food at home, often spending only a few dollars to feed our family of four. After a while, this became the norm — it was normal to spend just a few dollars on a family meal, prepared in our kitchen and served on our dining room table.

Is it more important to be rich or to be happy?

Sometimes we in the United States forget how privileged we are. Because of our relative wealth, we can make claims like "it's more important to be happy than it is to be rich". In this article, Saravanan P of Engineer's Finance argues that for the poor, money is more important than happiness. Though this post has been heavily edited, keep in mind that English is not Saravanan's native language.

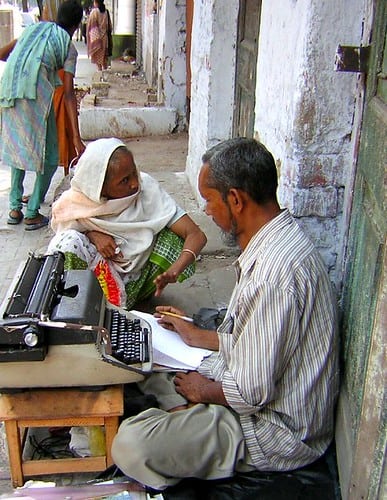

Sometimes I think I know just what it means to have money more than Americans do. I have seen people here in India struggle to earn two to three dollars a day working for more than 12 hours. It's hard, but still people do it. If we were to ask these people whether they are happy, they would say they are, but are they really? They assume they're happy and move on with the life. For them happiness is merely having their bread and butter.

The art of frugal living

Christine just sent me a National Public Radio story about the frugal artists of New York City. Columbia University recently released a study of 213 visual artists over the age of 61. Their average income? $30,000 a year. According to the NPR story:

Most of them said they were satisfied with their lives. However, many reported that they also have had to make daily economic compromises. They don't eat out, buy clothes at flea markets and rarely travel.

Many of these artists manage to make it in New York through frugal living. All they seem to need is some food, a roof overhead and the time and opportunity to practice their art.

Closing the Gap Between Dreams and Reality

While sorting through reader e-mail yesterday morning, I began to detect a subtle recurring theme. People were writing because they had a goal in mind, but their present circumstances seemed to be far from their intended destination. These two points were so far apart, in fact, that my correspondents were afraid to begin moving. Because the distance seemed overwhelming, they were paralyzed.

The importance of action

I used to feel this way, too. I would look at the enormity of my debt — $20,000! $30,000! — and I would stop before I could even begin. This was, of course, completely self-defeating. The most important thing you can do to achieve your financial goals (or any goal, for that matter) is to take action. It matters little which action you take so long as you begin moving in the right direction. You might, for example:

- Start a Roth IRA.

- Open a high-yield savings account.

- Cancel your cable television.

- Read a book about the stock market.

- Learn to bake bread.

Don't be paralyzed because you don't know the best path to take. Pick one good path and follow it. Whatever your financial goal, that first small step is the most important. It leads from inaction to action. It leads to the future.

Making the move from spender to saver

It's fun to look at all my equipment again. It's fun to handle it, to imagine the possibilities. I'm eager to get outside and make some images. (Kris and I are going to a garden show this afternoon, and I'm taking the camera with me.)

As I sorted through my bodies and lenses, though, I had to shake my head. I bought a lot of the gear on credit. For a time, I had the photo bug, and in a bad, bad way. I craved new lenses and bigger memory cards and fancy filters. I wanted to take expensive photography courses. There was always something bigger and better to buy.

Don’t panic! Coping with financial mistakes and setbacks

Preventing Problems

The best defense is a good offense. I used to spend a lot of time reacting to problems: bounced checks, car repairs, soccer injuries, and — worst of all — my own dumb choices. I never could seem to get ahead.

Then I realized that the best way to defend against financial setbacks was to actually prepare for them before they arrived. Simple, I know, but it's the simple stuff like this that forms the basis of smart personal finance. Two methods in particular helped me deflect many setbacks: