Mortgage prepayment made easy: Own your home in half the time

Because I recently eliminated all of my non-mortgage debt, I have a significant positive cash flow. The $1,000 per month I was putting toward debt can now be used for investing. I'm making maximum contributions to my Roth IRA, of course, but that still leaves several hundred dollars each month available for other purposes. This has forced me to evaluate my financial goals.

Mortgage Prepayment Options

For the past year, Kris and I have discussed making accelerated payments on our mortgage. I've written about this choice several times at Get Rich Slowly, and it seems clear that mathematically it makes more sense to invest the money. However, it's also clear that eliminating a mortgage offers a tremendous psychological boost. I've never heard anyone say they regret owning their home outright.

I've researched a variety of mortgage acceleration schemes:

- Refinancing from a 30-year to a 15-year mortgage is appealing, but the interest rate drop (from 6.25%) isn't enough to make this worthwhile.

- I could sign up for my bank's bi-weekly payment program, but I don't like the enrollment fee, and I don't like the increase in paperwork.

- We could make an extra payment every year, or pay an extra $100 per month. But I feel like we could do more.

Ultimately, we decided to use the method described by Charles Givens in his 1988 best-seller Wealth Without Risk:

You can pay off your 30-year mortgage in half the time without refinancing by making extra principal payments. On the first of the month when you write your regular mortgage check, write a second check for the “principal only” portion of the next month's payment.

Wealth Without Risk

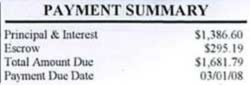

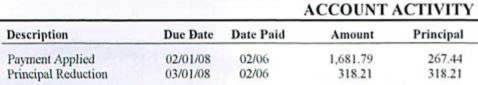

For most of homeowners, the principal portion of a mortgage payment is quite small. For example, our February mortgage bill was $1681.79. Of this, $1119.16 was designated for interest, $295.19 for escrow (taxes and insurance), but only $267.44 for principal.

Using Givens' plan, if I include an extra $267.44 with my payment, I'll also knock off the next month's payment from my mortgage. That $267.44 accomplishes the same thing $1681.79 usually does, but at 16% of the normal monthly cost. That's a bargain.

The advantages this method are:

- It has a sliding degree of difficulty. At first, the extra principal payments are lower. But as we pay down the mortgage, these extra payments increase. We have time to “grow into” these increased payments.

- It's easy for us to back out. If we decide our money is better used elsewhere, we can simply stop making extra principal payments.

- Every time we make a payment, we're essentially making two payments, cutting the term of our mortgage in half.

After discussing the pros and cons, Kris and I have agreed to follow a modified version of Givens' plan. To make things simple, we're using round numbers. During 2008, for example, we're going to pay $2,000 toward our mortgage each month, which gives us an additional $318.21 against the principal.

Every January, we'll adjust how much extra we're paying. If our budget gets too tight, we can cut back at any time.

The Drawbacks

To be fair, Givens doesn't recommend this method for low-interest mortgages like ours. He clearly states, “Never pay off low interest mortgages — those under 9%. Instead, use the extra money in a better investment.” He wouldn't advocate using this method on a 6.25% mortgage.

The March 2008 issue of Consumer Reports has a brief exploration of this topic. Their conclusion?

Many people find peace of mind in paying off their mortgages and owning their homes outright, especially as they approach retirement. That can make an investment in your mortgage a worthy choice, psychologically if not financially.

Still, the bottom line, according to our Money Lab, is this: Although there are exceptions, chances are you'll be better off putting extra money into a good mutual fund, not into prepaying your mortgage.

“Did you see this article?” Kris asked me, after she finished reading it.

“Yes,” I said. “What do you think?”

“I don't care” she said. “I want to do both. I want to invest and prepay the mortgage.”

“So do I,” I said.

Financial Freedom

If we have a substantial emergency fund, if we're fully-funding our retirement plans, and if we're saving for other goals, I believe that paying down the mortgage makes sense for us. We understand that we're sacrificing some theoretical (and probable) future investment returns, but we're also working to create a financial situation that's easier for us to maintain in the long run.

If we have no mortgage, that's $1400 less each month that we have to pay in expenses (we'll still need to pay taxes and insurance). Since we split the payment, that's $700 less per month that I have to pay. Without a mortgage, my fixed expenses would be about $600/month. My total expenses would be about $950/month. This would provide tremendous freedom, granting me an opportunity to try things that I might not otherwise be able to do.

Another Form of Diversification

Every investment book I've read says that a smart investor diversifies his portfolio, putting some of his money into each of several different types of investments. I view prepaying the mortgage as diversification. Sure, the stock market will probably beat the 6.25% I'll earn by doing this, but it's guaranteed money. To me, it's better to put my money into my mortgage than into bonds, certificate of deposit or a high-yield savings account. Especially if we're entering a recession.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)