How rising mortgage rates affect home-buying power

Interest rates on home mortgages are rising rapidly across the United States, which seems to be slowing most housing markets. (Some, like the market here in Corvallis, have been less affected. Give it time.)

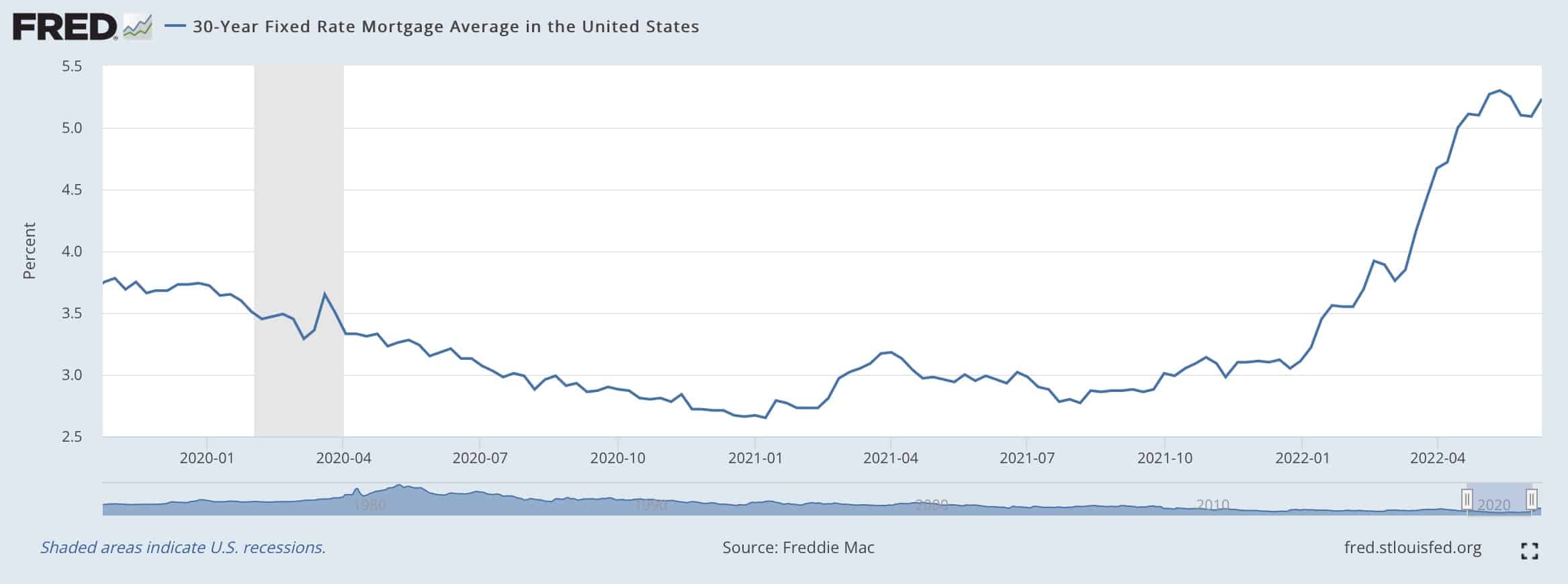

The average mortgage rate for a 30-year loan was about 3.0% at the start of the year; today, it's at 6.245% — even for somebody with an excellent credit score over 800.

Kim and I are fortunate that we bought our home in 2021 instead of waiting until 2022. Mortgage rates weren't actually a factor during our deliberations last year; the historically low rates were simply an added bonus for buying when we did.

When we purchased our home last August, we took out a $480,000 mortgage at 2.625%. We didn't hit the precise bottom of the mortgage market (that was early January 2021, when we might have had a loan for 2.5%), but we came close.

Here's a chart from the Federal Reserve that shows mortgage rates from the past 2.5 years.

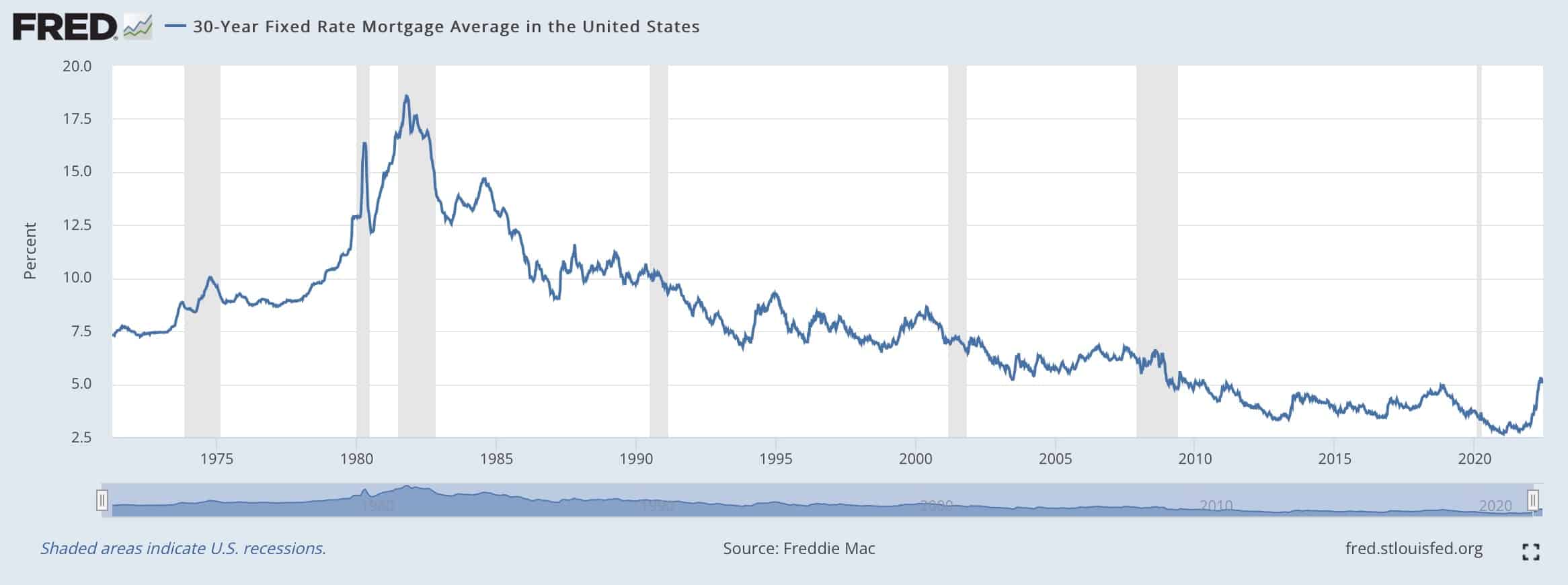

And here's a chart that shows mortgage rates for the past 50+ years:

Mortgage rates have hovered at historic lows since the Great Recession of 2007-2009. And rates fell even further during the COVID pandemic. (These low rates are partly responsible for the blazing-hot housing market of the past two years.)

What do these rising mortgage rates mean to actual home buyers? Let's use our situation as a representative example.

Rising Rates Decrease Buying Power

Last August, Kim and I closed on our home here in Corvallis. It's a 1964 behemoth for which we paid $680,000. With a $200,000 down payment, we managed to get a 2.625% APR on a 30-year loan. We pay $1929.33 each month for principal and interest. (Our actual mortgage payment, including taxes and insurance, is $2528.43 per month.)

Today, that same loan would cost us 6.245%. If we wanted to buy this same house at the same price with the same down payment, our monthly payments for principal and interest would be $2956.04 — an increase of over $1000 per month compared to buying a year ago!

If we were shopping for homes today and wanted to keep our mortgage payment the same — $1929.33 per month — we'd have to lower our sights. Instead of taking out a $480,000 mortgage on a $680,000 home, we'd be looking at a $313,500 mortgage on a $513,500 home.

But wait! That's not all! Home prices in our town have risen 10% during the past year, so that would further compromise our buying power. If we had waited until now to buy and wanted to keep our mortgage payment at $1929.33, we'd be shopping for homes that cost $467,000. Delaying a year would have decreased our buying power by $213,000 — over 30%.

While low mortgage rates didn't spur us to move last year, they certainly gave us an incentive to act quickly. Conversely, if we had waited until this year, I'm not sure what we would have done. Knowing me and my aversion to onerous debt, I probably would have been reluctant to take out a mortgage. I would have tried to find a home to buy with cash, limiting my options even further.

When mortgage rates are at crazy lows like 2.625%, I don't think twice about carrying a mortgage. It's a no-brainer. I want a mortgage on my home every single time, and I never want to pay it off. A rate of 2.625% isn't free money (and I don't want to pretend that it is), but it's pretty damn cheap. The gap between expected long-term stock returns (6.8%) and our mortgage rate (2.625%) is huge. There's a lot of room there, a big margin for error.

On the other hand, there's almost no gap between a rate of 6.245% and expected market returns of 6.8%. There's no margin for error. I'm wary of borrowing money at this rate, especially such a large amount. I'd rather not have a mortgage with rates this high.

What Does the Future Hold?

I expect that rising interest rates will have their intended effect: They'll cool the blazing-hot housing market. Will prices drop? Probably. But who knows? It's clear, though, that a shift is coming.

I have a handful of friends who are real-estate agents. If you too have real-estate agent friends, then you know that they tend to be permabulls when it comes to their industry. They have an unflagging belief in the future of home prices. But even my real-estate friends believe some sort of shift has begun.

Here's a long (and interesting) Facebook comment from one of my real-estate friends:

Last year, home prices were high, but those high prices were mitigated by super-low interest rates on home loans. Now you've got a double whammy: high prices and high rates. Today seems like an especially poor time to purchase a home. That's not a good combo.

I feel sorry for folks who absolutely must move right now. They're getting screwed.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 8 comments to "How rising mortgage rates affect home-buying power".

“there’s almost no gap between a rate of 6.245% and expected market returns of 6.8%.”

And market returns are generally taxable, while for the many people who don’t itemize, mortgage interest is not deductible, and even for those who do itemize, many won’t get the effective full deduction of their mortgage interest.

We had to make a career related move in 1977 with 2 young kids and one on the way. With excellent credit, we were able to get a mortgage rate of 9%. We were LUCKY to buy in ’77 — things got worse in the following years. We were able to afford a 900 sf 2/1 with an attic we built into into a bedroom and a basement we finished part off into a family room.

It’s fascinating to read that comment from your RE buddy. That perspective really lays bare the staggering facets of the situation. My wife and I were super fortunate to buy in late 2010 and refinance in 2015, so we’ll have an easy note paid off in just eight more years; I feel terrible for folks now who are in the situation we were then but facing down houses that cost twice as much and interest rates at least half again what we lucked into.

Put a chart of home price growth over top of that 50 year mortgage rate chart. Home prices almost never go done. Even at near 20 percent rates prices were continuing to go up.

Growth will slow. Significantly. But it seems very unlikely to me prices actually go down. It will just be the most vulnerable getting screwed, as you said.

My husband and I got unbelievably screwed by our homebuying timing. We bought our first home, a condo, in 2007 – intending to stay about 5 years. Well, you know what happened next. Because of how much we put down and our location, we were underwater until prices started to shoot up in early 2021. We took our opportunity and sold, though we still didn’t sell for as much as we paid. (We would have if we’d waited until this year.) With remote jobs now, we decided to rent for a year in a different region to explore and decide where we wanted to settle next.

And now that we’ve mostly made that decision, houses are almost twice as expensive as they were a few years ago and rates are climbing just as our lease is about to end. We’re leaning toward continuing to rent to “see what happens”…but what if it only gets worse? We’ve been saving for a long time for a down payment so I know we have less to complain about than others, but we tried to do things the right way and got screwed. We should have just walked away from our condo in 2010 and our credit would have recovered in time to buy something well before now.

Sorry, my first-ever comment and I’m on a huge rant – but I figured if anyone would understand it would be here. Even our families don’t fully realize how scarred we are by our first homebuying experience and how much it’s impacted so many areas of our life.

It’s not often that the US gets things perfect, but how you handle your mortgages is one of them.

In Australia, mortgage interest rates are not fixed for the full term of the loan – they rise and fall as the official interest rates do. (You can fix them for a few years, but you pay a premium.)

My son is looking to buy now and he had to do his sums by ‘future-proofing’ the interest rates in case they rise a lot higher than they are at present. At present rates are in the 3% zone – he has to borrow, keeping in mind that the rates can suddenly rise. He’s looking at being able to afford to pay 6%+ (just in case.)

You guys are so lucky that once you lock in a loan, the rates are fixed. That’s the way it should be.

A great point. Being able to lock in long-term rates is very helpful for future-proofing. Are your mortgages also typically 30 years? Or do they tend to be shorter in length?

Life comes at ya fast. This article was valid two months ago, but rates are already below 5% – which is still damn good when you look at the chart above for the past 50 years.

Predicting the future is more complex than ever. Timing your life choices and lining up all your ducks in a row is a myth. The only hard data about the future is that demand outstrips supply and will for many years. Until then, live your life – no one here gets out alive.