How rising mortgage rates affect home-buying power

Interest rates on home mortgages are rising rapidly across the United States, which seems to be slowing most housing markets. (Some, like the market here in Corvallis, have been less affected. Give it time.)

The average mortgage rate for a 30-year loan was about 3.0% at the start of the year; today, it's at 6.245% — even for somebody with an excellent credit score over 800.

The economic well-being of average Americans

Last month, the Federal Reserve released a new report: Economic Well-Being of U.S. Households in 2021 [PDF]. This annual survey gauges American financial health and attitudes. The 2021 edition was conducted last November.

Here are some highlights from the report:

- Seventy-eight percent of adults were either doing okay or living comfortably financially, the highest share with this level of financial well-being since the survey began in 2013.

- Fifteen percent of adults with income less than $50,000 struggled to pay their bills because of varying monthly income.

- Fifteen percent of workers said they were in a different job than twelve months earlier. Just over six in ten people who changed jobs said their new job was better overall, compared with one in ten who said that it was worse.

- Sixty-eight percent of adults said they would cover a $400 emergency expense exclusively using cash or its equivalent, up from 50 percent who would pay this way when the survey began in 2013. (Note that this survey is the original source of this oft-quoted statistic.)

- Six percent of adults did not have a bank account. Eleven percent of adults with a bank account paid an overdraft fee in the previous twelve months.

These little nuggets of info are interesting, sure, but what I find even more interesting are the charts and graphs documenting long-term trends.

Learning from history: How this all happened

The older I get, the more interested I am in history.

When I was young, history and myth seemed to be interchangeable to me. To ten-year-old me, there was little difference between, say, Abraham Lincoln and the Greek gods sitting atop Mount Olympus. All of it was abstract stuff that happened to imaginary people long ago.

Somewhere along the way — in my late teens, I think — history began to seem relevant. During my junior year of college, I took a course on Pacific Northwest history and my eyes were opened. I could see in my own life how events decades ago (or hundreds of years ago or thousands of years ago) created the actual world in which I lived my day-to-day existence.

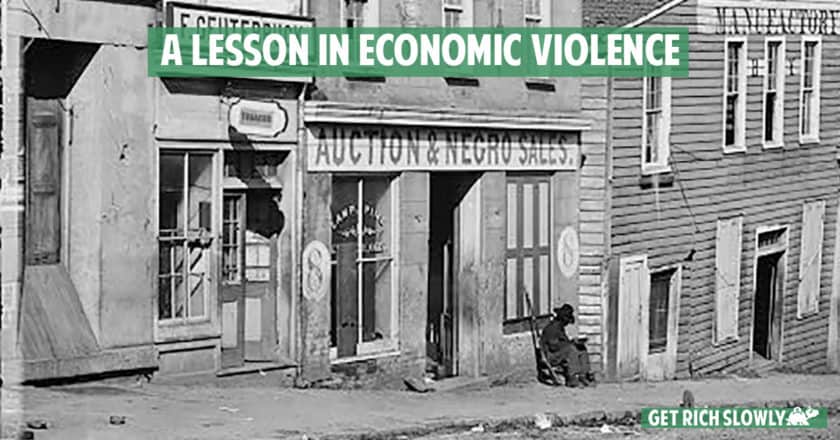

A lesson in economic violence

J.D.'s note: Last September, I wrote that I didn't believe the world of personal finance needed more politics. I acknowledged that there were vast systemic issues that hold people back, but I argued that personal finance is personal.

While I still believe that individual action is (and always will be) the primary driver of financial success, my "no politics" stance has softened. No, that doesn't mean that Get Rich Slowly is suddenly going to change into a politics blog. That's not who I am. But it does mean that I'm willing to address political issues that affect our finances. (And, to be clear, I'm open to addressing these from both liberal and conservative perspectives.)

Right now, at this moment in time, it's important to talk about the issues black Americans face. It's important to talk about why there's so much anger -- and how a huge portion of our population has been disadvantaged for so long. (And continues to be disadvantaged!)

Is buying gold a good investment? Why I don’t invest in gold

Over the past month, I've read a lot of articles about the virtues of investing in gold. Especially in Facebook forums, there's a lot of talk about how gold makes a great long-term investment. (Fortunately, I haven't seen any comments like this in the GRS community on Facebook.)

Whenever the economy gets turbulent, the goldbugs come out in force. They shout from the hilltops that the world is doomed and that the only safe haven is gold. And I'll admit, their arguments can sound pretty convincing.

When I started this site in 2006, I felt unqualified to comment on gold. I hadn't read much about it, and I didn't feel educated enough to offer an opinion. That's changed.

Stopping the motor of the world

"What a crazy day," Kim said yesterday after she got home from work.

"Coronavirus?" I asked.

"Yeah," she said. "My schedule fell apart, which I figured it would. But I did see three patients in the morning. All three were doctors. Obviously, they thought it was safe to see the dentist. A lot of others stayed home though. Staff too. Meanwhile, people are pissed."

How will the coronavirus affect your personal finances?

How quickly things change.

Last week, the coronavirus (or Covid-19, if you prefer) was a distant problem. It was something other people in other places had to wrestle with. Sure, there was a looming sense that maybe this runaway train was steaming our way, but it still seemed distant enough that maybe it'd stop before it reached us.

Not anymore. Now it's clear that the coronavirus isn't just headed to the U.S., it's already here in our communities.

What happens if the stock market crashes? Here’s what to do

Can you feel it? There's panic in the streets! We're in the middle of a stock market crash and the hysteria is starting again. As I write this, the S&P 500 is down six percent today -- and 17.3% off its record high of 3386.15 on February 19th.

Media outlets everywhere are sharing panicked headlines.

How Americans spend money: A look at the latest Consumer Expenditure Survey

When I discuss American spending habits, I try to cite specific numbers. Sometimes people write to ask where I get my info. Simple. Whenever I cite figures about American earning, saving, and spending, I get them from the U.S. government. In particular, I use the Consumer Expenditure Survey (or CEX) from the U.S. Bureau of Labor Statistics.

Here's how the BLS website describes the Consumer Expenditure Survey:

The Consumer Expenditure Survey program consists of two surveys, the Quarterly Interview Survey and the Diary Survey, that provide information on the buying habits of American consumers, including data on their expenditures, income, and consumer unit (families and single consumers) characteristics. The survey data are collected for the Bureau of Labor Statistics by the U.S. Census Bureau. The CEX is important because it is the only Federal survey to provide information on the complete range of consumers' expenditures and incomes, as well as the characteristics of those consumers.

Does the world of personal finance need more politics?

Note: I've added a short addendum to this piece in an attempt to clarify some things. This may or may not have helped.

Earlier this week at The Washington Post, Helaine Olen wrote that the world of personal finance needs more politics.

Olen specifically calls out FinCon, the financial media conference I attended last week. I love FinCon. She doesn't. She's disappointed that so many members of our community emphasize personal action and responsibility instead of directing our efforts toward changing the systemic and societal issues that make it difficult for some people to succeed.