Pay off student loans or invest — how to move toward funding retirement

In my recent post, "Why investing can be better than paying down debt," Dianecy's comment raised a question faced by many: What do you do about investing when you have student loans?

It is quite the dilemma, actually, because the best time to start funding your retirement is when you're still in your 20s. And as anyone who has been reading Get Rich Slowly for more than, say, 10 seconds would know, few things impede your progress toward getting rich (at any speed) like debt.

The reason is simple: A dollar can be spent only once -- either for another person's benefit or for yours. So it follows that repaying debt benefits the bank; investing those same dollars in a CD or index fund, on the other hand, benefits you and your future.

Why investing can be better than repaying debt

It's a difficult choice: On the one hand, you understand the need to begin investing early to make the miracle of compounding work for you; on the other hand, you know that, when you have debt, making those payments hampers the ability to harness the miracle of compounding.

So, what should you do with that $500 you have -- invest it or pay down the debt? The answer is not as simple as some make it out to be.

Reasons to repay debt first

1. Risk of disaster

As I mentioned in the article about starting to save for retirement, life is not always fair or kind. Most of us depend on a paycheck for everything: rent or mortgage, food, gas, utilities and so forth. When something happens, like losing your job, divorce or severe illness, those checks get smaller, or may even disappear temporarily. We can cut back some of our expenses like gas, clothing, etc. But some things are impossible to cut back. That list is usually headed by rent or mortgage payments and those monthly payments all other forms of debt require. You can't cut those back in times of trial.

Starting to save for retirement at 40

There's something about reaching the big 4-0 that often causes you to re-evaluate your direction in life. And when you do, it's hard to escape the fact that your day of retirement is indeed approaching faster than you ever thought possible.

If you're one of those who eliminated debt and made investing for retirement a habit since your 20s, there's very little to do other than enjoy your 40th birthday and continue on with what you're doing. But if you're heading into your 40s having done nothing to prepare for retirement, the prospects can be downright scary.

Why you should make a home your first investment

Originally, this was to be a two-part series discussing the pros and cons of buying a home as opposed to investing. The purpose wasn't to pick a winner or loser, per se. (After all, one of the main tenets of Get Rich Slowly is that you really should do what works for you.) Instead, the purpose was to highlight the strengths and weaknesses of both options in case you were faced with a choice for some reason.

Holly Johnson's article should you buy a home or (invest?) was first; and she said that, if she had to make that choice, she "would invest for the future and forgo the house in a New York minute." I intended to explain the benefits of the opposite side of the hypothetical.

But you stole my thunder! So many people made great comments in response to Holly's post that I thought it would be better to explain what was left over or unclear for some reason. We both started by looking at the past.

How to invest in index funds

This is the third installment of a three-part series examining index funds. In Part I, we looked at the managed mutual fund market. In Part II, we looked at how an index is calculated and what an index fund is. In this installment, we'll consider how to evaluate index funds and where to buy them.

Despite the fact managed mutual funds still dominate the mutual fund landscape, there has been a steady migration of assets from managed funds to index funds and ETFs (most of which are indexed). In fact, there are more than 350 index funds from which to choose, so when you start to look into investing your money in an index fund, you'll need to understand these two things:

- What kinds of index funds are available

- Where do you get them

Types of Index Funds

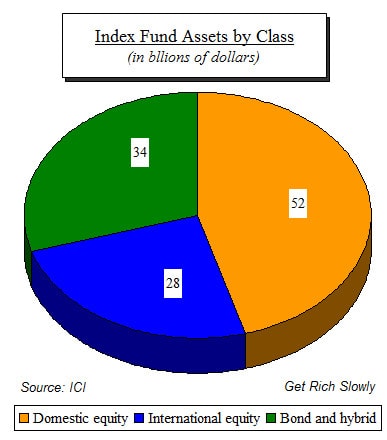

Some people classify money market funds as index funds because they're passively managed, but money market funds are not based on an index. Instead, three broad categories describe how index funds are generally broken down, as shown in this pie chart from ICI data:

What is an index fund exactly?

[This is the second installment in a series examining index funds. In Part I, we looked at the managed mutual fund market. In this installment, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

In the first part of this series, we saw that mutual funds are the dominant investment vehicle for individuals because they reduce risk through diversification on a scale that individuals cannot achieve on their own. And we mentioned that index funds typically have larger returns and lower fees than managed funds but that investors are largely unaware of their existence.

But why do we have index funds, and what are they?

What are mutual funds and how do they work?

[This is the first installment in a series examining index funds. We'll discuss the managed mutual fund market first to form a basis of comparison with index funds. In Part II, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

We can't predict the future — so when it comes to investing, minimizing risk is the name of the game. One highly effective strategy to help limit investment risk is through diversification, and most of us achieve it by investing in mutual funds.

Mutual funds, and their close cousins, Exchange Traded Funds (ETFs), achieve diversification by buying a wide variety of different bonds, stocks, or whatever investments they focus on. You and I typically don't have enough money to achieve that kind of diversification on our own, but we can get it on our limited budget by investing in a mutual fund. Continue reading...

Ideas for a cheap vacation

It's been a long time since my wife and I had the luxury of thinking in terms of vacation. When we came to America more than 30 years ago, we also discovered two things:

-

People in America work very hard, probably harder than anywhere else in the world. Two weeks' vacation seems to be the norm here, while in Europe and the rest of the world anything less than a month is inhuman, insane, or both. (I am not convinced they're wrong, by the way.)

-

With all our family on other continents, we needed to spend those two precious little weeks every year with them. That led to employing all manner of strategies and devices -- like accumulating as much vacation time as we could and squeaking out an advance on the coming year -- so we could spend two whole weeks with our family and another week just for travel, there and back.

How to profit from economic cycles

(Since April is Financial Literacy Month, a number of articles will be devoted to more educational topics. This is Part IV in a four-part series about how understanding economic cycles could inform your financial decisions. Part I is Understanding economic cycles: An introduction. Part II is Recognizing economic seasons: recovery and growth. Part III is The fall and winter seasons of the economic cycle.)

In the first three parts of this series, you saw how the economy moves in cycles of seven to 10 years, and how each cycle can be broken down into four phases which correspond closely to the seasons of nature. We also looked at some of the telltale signs of economic activity that can help us recognize where we are in the cycle.

You may be thinking, "That's all interesting, but how can I apply that knowledge to my personal financial life?" Let's start by decapitating the elephant in the room -- market-timing. Market-timing is a fool's game. However, most of the time market-timing refers to trying to find the high point in the market to sell high. It is true: Nobody is able to tell when a market has reached its peak.

The fall and winter seasons of the economic cycle

(This is Part III in a four-part series about how understanding economic cycles could inform your financial decisions. Part I is Understanding economic cycles: An introduction. Part II is Recognizing economic seasons: recovery and growth. Part IV is How to profit from economic cycles.)

You will recall from Part II of this short series about economic seasons that the spring of early recovery and the summer growth season resemble the corresponding seasons in nature fairly closely. In this post, we will look at the other two seasons of the economy: fall and winter.

But before we do, it is important to keep in mind that, though the seasons in nature change every three months, the seasons of an economic cycle do not have a fixed length. In terms of economic cycles, a season can last years; and it is difficult to set a calendar to know when the season changes.

As in nature, we have two change seasons (spring and fall) and two main seasons (summer and winter). Last time we looked at one of each. Here are the other two.