Calling the Shots: How to Be the CEO of Your Own Life

During the 1990s, my financial life was like a Caribbean cruise ship during hurricane season: I was in a cabin at the center of the ship, unaware of the storms approaching from the horizon. By 2001, I’d wandered onto the deck in the midst of Hurricane Debt and Failure; I found myself in financial and personal trouble. It took a few years, but eventually I discovered that I had more control over that cruise ship than I thought.

In 2006, I shared with Get Rich Slowly readers the circumstances that allowed me to start moving in the right direction. In short, I realized that I could no longer sit by and let external forces — the hurricanes: my bosses, a difficult situation at work, my increasing debt, a deteriorating personal relationship — control my life. I learned how to manage my own money, using the basic approaches of earning more and spending smarter. I removed the negative forces in my life — anything that worked against my long-term goals to improve my finances, my life, and my identity — and replaced them with positives.

In my old life, I put the blame for failure or the credit for success on outside forces, such as luck or the economy. But this just made me feel helpless about my situation. In my new life, I shifted my philosophy from an external locus of control to an internal one: the belief that the circumstances in my life were due to choices I made. (Or worse, the choices I didn’t make.) This made all the difference.

Taking the Red Pill

While working for a company in the finance industry, I learned how large public corporations operate. I began to apply some of these lessons at home; I started looking at myself as the Chief Financial Officer (CFO) of my own life.

Like a public company, I published regular reports of my financial progress online. I didn’t do this to brag; in fact, at first there was more embarrassment than anything else. Holding myself accountable to Consumerism Commentary readers was a good move for me, and almost eight years later after my first post in 2003, I still publish these monthly reports and field questions and suggestions from readers. (Here’s the first monthly report of 2011.)

In December, after building a business on the side that could more than sustain me, I quit my corporate job and shifted exclusively to writing and developing my own online projects. I’ve been tracking my discoveries working for no boss other than myself in a series called “Life After Salary”.

The path I chose may not be for you. But the concept of being the CFO of your own life applies to everyone. You have to make choices if you want to live your life a certain way rather than let life happen to you. The best way to describe this feeling of awakening is to compare it with the moment in the film The Matrix where Neo, the “One,” can at last see the Matrix for what it is, and realizes he can control his environment.

You are in control of your life, even if you work for someone else. You choose whether to get out of bed in the morning, understanding the consequences if you don’t. You decide whether to take on the assignment your boss gives you. You either choose to be happy or not — every second of every day.

With my recent shift to self-employment, I discovered yet another level of control necessary to better reach my long-term goals, both financial and non-financial.

How to Be the CEO of Your Own Life

In business, the Chief Executive Officer (CEO) is responsible for guiding a company towards its mission, vision, and goals. The Chief Financial Officer (CFO) ensures the company manages its finances properly in order to reach those goals. In the business world, the CFO answers to the CEO. But in your own life, you need to play both roles.

Here’s how to operate as the CEO of your own life:

- Take ownership. Sometimes people need to hit bottom before realizing they need to take control of their situation. But rock bottom isn’t a pretty place. Don’t wait for it. Start attributing your success and failures to the decisions you make (or don’t make), and you’ll see that there’s no need to let others control your life. When you’ve decided to stop taking orders from the world, to stop waiting for someone else to make your decisions, you’ll be promoting yourself from administrative assistant to boss.

- Set goals. I like to set lofty non-financial goals to give my life direction. Dry financial goals are vacuous. What’s the point of having a goal of retiring at age 45 with $2 million in the bank? What will you do when you no longer have any work to keep you busy all day? Focus on the person you want to be, and what you would like your New York Times obituary to say — then you can figure out what your finances need to be in order to get there.

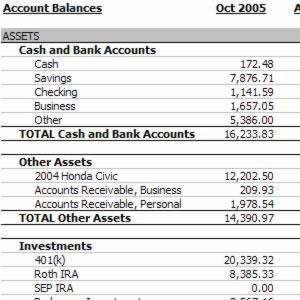

- Track your finances. You know your destination, but you can’t set your course yet because you don’t know where you are. Know where you stand (your net worth) and your velocity (your income and expenses over time) so you can determine the right path for you. This requires some tools, whether software like Quicken or a pencil and pad.

- Recruit a positive environment. Build a support team. I did this by creating a blog, but if you’re more normal, you may wish to share your goals with friends and family while keeping the gory details private. Escape the negative attitudes around you. “Negative energy” sounds a little new-agey, but there’s truth to the idea that people who bring you down emotionally will eventually become an obstacle to reaching your goals.

- Make your own choices. Don’t wait for other people to tell you what to do. The worst thing that can happen is you refuse to make a choice because you don’t know if it’s perfectly correct — as J.D. has said, the perfect is the enemy of the good. Arm yourself with the best information you can find from sites like Get Rich Slowly, Consumerism Commentary, and other sources that work for you, as well as what you’ve learned from tracking your finances. Gather the essential tools like a great savings account and a low-cost broker like Vanguard, and learn how to use them.

- Don’t let other things get in the way. CEOs and CFOs of large companies are focused on their responsibilities, and delegate all but the highest level of decisions. You don’t have the luxury to delegate, so don’t get distracted by anything that pulls you away from your mission. (But that doesn’t mean you can’t have fun; life is short, and you need to live it now.)

For every CEO or CFO that’s involved with a financial scandal, there are dozens who do great things for their organizations, build a company up from nothing, and make a difference in the world.

There was a time in my life when I wasn’t making any difference for myself, for my future. My finances suffered, my attitude suffered, and I was headed for imminent disaster. Now, I call the shots — all of them. I still have a lot of work to do and more to learn, but now I’m motivated by the idea that whether I succeed or fail, it’s only the choices that I make that lead me to that point.

When you’re the captain of your cruise ship and have the information and tools you need, you have the power to safely navigate through even the worst storms.

Cloud photo by joiseyshowaa.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)