Twenty years of U.S. government inflation data

Inflation is the silent killer of wealth. Year after year, the purchasing power of your dollar (or pound or euro or yen) gradually erodes. My father was one of those "hide money under your mattress" type folks because he believed that was the best way to keep his cash safe. He was wrong.

If you sit on your money, it doesn't maintain its value. It loses value.

At his Carpe Diem blog, economics professor Mark Perry recently published a new version of the following chart, which visualizes the effects of inflation on certain consumer goods and services.

Why don’t Americans save?

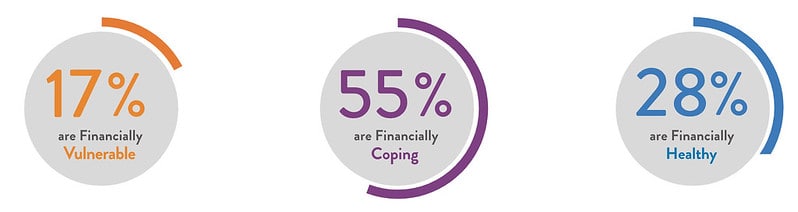

A new report from the Center for Financial Services Innovation says that only 28% of Americans are financially healthy. And it reinforces something we already knew: The U.S. saving rate sucks. Americans don't save.

The U.S. Financial Health Pulse divides people into three tiers of financial health.

- Financially healthy people (28% of the U.S., 70 million people) are "spending saving, borrowing, and planning in a way that will allow them to be resilient and pursue opportunities over time."

- Financially coping people (55%, 138 million) are "struggling with some, but not necessarily all, aspects of their financial lives."

- Financially vulnerable people (17%, 42 million) are "struggling with all, or nearly all, aspects of their financial lives."

The boots theory of socioeconomic unfairness

When I wrote about my $80 pajamas, I never imagined it'd spark a three-part series of articles. Yet here we are.

- On Monday, I wrote about why I chose to buy high-quality pajamas. (I've been wearing them all week, by the way. They're awesome.)

- On Wednesday, I published a follow-up piece that explored the "buy it for life" philosophy, and explained why sometimes it makes sense to shop based on quality instead of price.

- Today, I want to spend a little time exploring the ethical implications of buying expensive items.

Quality tends to come with a price. While there are ways to mitigate some of these higher costs -- buy used, wait for sales, etc. -- if you want to buy new quality items, you're going to pay a premium.

Because of this, quality is often something reserved for the rich. If you have money, you enjoy the luxury of being able to buy quality items (if that's what you want). If you're struggling with money, if you're still in debt, then it may be difficult for you to prioritize quality over price.

Bull vs. bear: A visual history of U.S. bull and bear markets since 1926

Who am I kidding?

I can't go an entire month without publishing anything here at Get Rich Slowly. I need to write. And judging from the feedback regarding my planned sabbatical, you folks want me to write! Tell you what, let's change the premise.

Instead of taking all of September off from publishing, I'll instead vow that for the next four weeks, I won't tackle any major articles. If there's something that I want to share and that thing can be shared in 20-30 minutes, I'll do it. This plan will serve the same objective -- freeing my mind to focus on the other tasks that need to get done around here -- while also giving me an outlet for my writing (and giving you something to read).

What it means to be rich: The difference between income and wealth

I'm generally a pretty laid-back guy but, like anyone, I do have pet peeves. Because I write about money, I have lots of trivial personal finance pet peeves. (It's "saving rate", not "savings rate". Dave Ramsey did not invent the debt snowball, and his version is but one kind of debt snowball. It's not the only debt snowball. See? I told you these pet peeves were trivial!)

It's silly that I'm bugged by this stuff, but I am. I'm sure you have pet peeves too, especially when it comes to your work.

One of my top pet peeves in the world of personal finance is when people who should know better conflate income and wealth. A high income can lead to great wealth -- although it doesn't always -- but they're not the same thing.

The relationship between time, money, and happiness

The older I get, the more I'm convinced that time is money (and money is time). We're commonly taught that money is a "store of value". But what does "store of value" actually mean? It's a repository of past effort that can be applied to future purchases. Really, money is a store of time. (Well, a store of productive time, anyhow.)

Now, having made this argument, I'll admit that time and money aren't exactly the same thing. Money is a store of time, sure, but the two concepts have some differences too.

For instance, time is linear. After one minute or one day has passed, it's irretrievable. You cannot reclaim it. If you waste an hour, it's gone forever. If you waste (or lose) a dollar, however, it's always possible to earn another dollar. Time marches forward but money has no "direction".

18 favorite financial rules of thumb (and some useful money guidelines)

Financial rules of thumb provide helpful shortcuts for making quick calculations and decisions. You don't always have time (or want to take the time) to create elaborate spreadsheets when choosing a course of action. In these cases, it's nice to have some rough guidelines you can rely on.

You've probably heard of the "rule of 72", for example. This shortcut says that if you divide 72 by a particular rate of return, you'll get the number of years it'll take to double your money. If your savings account yields 4%, say, it will take about 18 years for your nest egg to increase by 100%. But if you were able to earn 12% on your investment, that money would double in six years.

A brief history of U.S. homeownership

During the month of May at Get Rich Slowly, we're going to turn our attention to home and garden topics. To start, I want to take a brief look at the history of the U.S. housing market. Some folks might find this dry. I think it's fascinating.

Private land ownership is baked into the U.S. culture and Constitution. It's part of the material plenty we expect from the American Dream. For most Americans, homeownership implies success and freedom and wealth.

But for a long time, homeownership was the exception rather than the rule. Only farmers were likely to own land and a house during the country's early days. With the coming of the Industrial Revolution, homeownership became more common for urban dwellers. Still, less than half of all Americans owned their homes until the late 1940s.

How to think like a billionaire: Opportunity costs and conscious spending

Whenever you make a choice, there's a cost.

By choosing to buy one item, you pass on the opportunity to purchase other items. By choosing to do one thing, you pass on the opportunity to spend your time on anything else. Opportunity cost is what we give up in order to have the thing we choose.

Your saving rate: The most important number in personal finance

In order to survive and thrive, you need to earn a profit.

You already know profit is the lifeblood of every business. It's like food and water for the human body. Although proper nutrition isn't the purpose of life, we couldn't exist without it. Food and water give us strength to do the stuff that matters most. So too, profit isn't necessarily the purpose of business — but a company can't survive without it.

Here's a secret: People need profit too. Continue reading...