The Get Rich Slowly investment philosophy and strategy

As you spend less and earn more, you'll begin to earn a profit and save more money. Maybe at first you'll have a few dollars per month in surplus. Eventually, however, you'll find that you're saving 10%, 20%, or even 50% of your everything you earn.

The average person spends his surplus on whatever wants come to mind. Instead of using the money to get ahead, he stays in the same place. Or, worse, he falls behind by taking on debt. A smart money manager puts her profit to use by investing for the future.

At first, you'll pursue short-term goals.

The parking lot attendant worth half a million bucks

In this week's installment of Get Rich Slowly Theater, we're going to look at a real-life money boss: Earl Crawley, a parking attendant from Baltimore. Mr. Earl (as he's known) was profiled on the PBS show MoneyTrack. Here's a six-minute segment about this super saver:

https://www.youtube.com/watch?v=ov3y_tas6J8

Mr. Earl has worked as a parking attendant for 44 years -- at the same parking lot! He's never made more than $12 per hour. He's never earned more than $20,000 in a year, yet he has a net worth over half a million dollars.

The power of compounding: How your wealth snowball grows with time

So much of financial success involves good habits practiced over long periods of time.

Yes, you can still have a positive impact on your financial future if you're starting late in life -- but if you're 59 years old and just beginning to think about financial freedom, you have a lot of work to do.

But if you're 19, you have an extra forty years to set yourself up for financial success. This extra time makes a ginormous difference!

What is the average rate of return on stocks?

One of the fundamental ideas I try to promote here at Get Rich Slowly is your savings ought to be invested for long-term growth. You ought to use the magic of compounding to create a wealth snowball.

Naturally, you want put your money into an investment that offers a reasonable return and acceptable risk. But which investment is best? I believe -- as do most financial experts -- that you're most likely to achieve high returns by investing in the stock market.

But why do so many people favor the stock market? How much does the stock market actually return? Is it really better than investing in real estate? Or Bitcoin? Let's take a look.

Best online brokerage accounts for beginners 2023

Investing for the first time is a lot like taking that plunge into a new activity - you are intimidated by everything you think you don't know and you don't want to appear clumsy in front of others. With the plethora of online brokerages, the opportunities for first-time investors are wide open. However, this wide variety of investment options means you do need to be educated before you begin. You don't want to put your money in the wrong hands when you start to invest.

Keith McGurrin, Certified Financial Planner and a lead financial planner at T. Rowe Price has some tips for newcomers.

"Investing has the potential to build funding for long-term goals," McGurrin said. "But, investing can also be risky, especially in the short-term. Having a plan can help - here are considerations for investors starting out."

How to invest: An essential guide

When I told readers that January would be "back to basics" month at Get Rich Slowly, the number-one request I received was to write about how to invest.

Rather than scatter investing info throughout the month, I decided to collect the essentials into one mammoth article. Here it is: all you need to know about how to invest -- even if you're a beginner.

In writing this article, I tried not to bog it down with jargon and definitions. (I'm sure I let some of that slip through the cracks, though. I apologize.) Nor did I dive deep. Instead, I aimed to share the basic info you need to get started with investing.

Book review: The Simple Path to Wealth

Yesterday, my pal Jim Collins dropped me a line. "The audio version of my book just came out," he told me. "Audible is letting me give away some free copies. Do you think your readers would be interested?" I do think so! Plus, this is a perfect opportunity to migrate my review of The Simple Path to Wealth from Money Boss to Get Rich Slowly. At the end of this article, I'll explain how you can get a copy of Jim's audiobook, if you're interested (and lucky).

During late July 2015, we stopped for a few days on the Wisconsin side of Lake Michigan. My friend Jim Collins had invited us to spend some time at Shamba, the waterfront vacation home that belongs to his sister-in-law. For several days, we sipped wine and walked in the surf with Collins and his wife. We also talked about work. (I had just begun formulating plans for Money Boss; Jim was writing a book.)

How mutual fund fees can cost you big bucks

Robert Farrington from The College Investor recently went to bat for one of his readers. "I feel like my advisor isn't steering me in the right path," his reader told him. "When I mention [index funds] to him, he changes the subject or diverts to other topics."

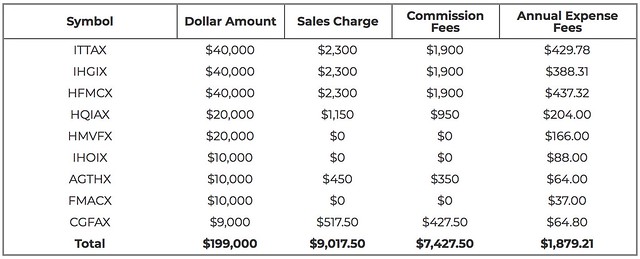

Farrington ran the numbers and discovered that his reader's financial advisor stood to gain $7247.50 in commissions by recommending expensive mutual funds. But that's not all. "When you add in the expense ratio, this portfolio is costing the investor $11,004.71 in year one," Farrington writes. "And potentially costing the investor $1,879.21 or more per year after!" (And that doesn't include any commissions and fees created by rebalancing the portfolio periodically.)

The difference between investing and speculation (or: The problem with Bitcoin)

Hold onto your hats, folks. It's rant time!

Based on what I'm hearing on Facebook, Twitter, and in real life, it's time for a refresher course on the difference between investing and speculation. Although these two concepts share some commonalities, they're very different things.

Let me start by telling a story, one I've told many times before. It's the story of the worst "investor" I've ever known: me.

Is $10 million enough to never worry about money again?

When people send me email, they usually have very specific questions about their very specific circumstances. "What should I do about my ailing parents?" "Should I fund my kids' college first or put money aside for retirement?" "How should I save for a down payment?"

Recently, though, a Money Boss reader named Mark sent me a simple hypothetical question. Here's the entirety of his email:

If you had $10,000,000 (in cash) at the age of 60, would you say that you would never have to worry about money again?