Why you should make a home your first investment

Originally, this was to be a two-part series discussing the pros and cons of buying a home as opposed to investing. The purpose wasn't to pick a winner or loser, per se. (After all, one of the main tenets of Get Rich Slowly is that you really should do what works for you.) Instead, the purpose was to highlight the strengths and weaknesses of both options in case you were faced with a choice for some reason.

Holly Johnson's article should you buy a home or (invest?) was first; and she said that, if she had to make that choice, she "would invest for the future and forgo the house in a New York minute." I intended to explain the benefits of the opposite side of the hypothetical.

But you stole my thunder! So many people made great comments in response to Holly's post that I thought it would be better to explain what was left over or unclear for some reason. We both started by looking at the past.

How to invest in index funds

This is the third installment of a three-part series examining index funds. In Part I, we looked at the managed mutual fund market. In Part II, we looked at how an index is calculated and what an index fund is. In this installment, we'll consider how to evaluate index funds and where to buy them.

Despite the fact managed mutual funds still dominate the mutual fund landscape, there has been a steady migration of assets from managed funds to index funds and ETFs (most of which are indexed). In fact, there are more than 350 index funds from which to choose, so when you start to look into investing your money in an index fund, you'll need to understand these two things:

- What kinds of index funds are available

- Where do you get them

Types of Index Funds

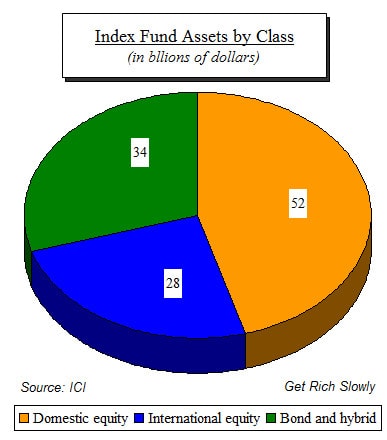

Some people classify money market funds as index funds because they're passively managed, but money market funds are not based on an index. Instead, three broad categories describe how index funds are generally broken down, as shown in this pie chart from ICI data:

Should you buy a home or invest?

The path toward retirement and financial independence usually involves buying a home and investing for retirement and the future. But, what if you had to choose?

William Cowie posed this question to me recently and asked which path I would take to financial independence if given the option. My answer: I would invest for the future and forgo the house in a New York minute. Let's look at why I think that makes sense.

Performance Over Time - 1940 to Present

Throughout history, housing prices have appreciated over time. Because of this, both real estate investors and homeowners have built wealth with ease by building equity in their homes and properties.

What is an index fund exactly?

[This is the second installment in a series examining index funds. In Part I, we looked at the managed mutual fund market. In this installment, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

In the first part of this series, we saw that mutual funds are the dominant investment vehicle for individuals because they reduce risk through diversification on a scale that individuals cannot achieve on their own. And we mentioned that index funds typically have larger returns and lower fees than managed funds but that investors are largely unaware of their existence.

But why do we have index funds, and what are they?

What are mutual funds and how do they work?

[This is the first installment in a series examining index funds. We'll discuss the managed mutual fund market first to form a basis of comparison with index funds. In Part II, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

We can't predict the future — so when it comes to investing, minimizing risk is the name of the game. One highly effective strategy to help limit investment risk is through diversification, and most of us achieve it by investing in mutual funds.

Mutual funds, and their close cousins, Exchange Traded Funds (ETFs), achieve diversification by buying a wide variety of different bonds, stocks, or whatever investments they focus on. You and I typically don't have enough money to achieve that kind of diversification on our own, but we can get it on our limited budget by investing in a mutual fund. Continue reading...

How to profit from economic cycles

(Since April is Financial Literacy Month, a number of articles will be devoted to more educational topics. This is Part IV in a four-part series about how understanding economic cycles could inform your financial decisions. Part I is Understanding economic cycles: An introduction. Part II is Recognizing economic seasons: recovery and growth. Part III is The fall and winter seasons of the economic cycle.)

In the first three parts of this series, you saw how the economy moves in cycles of seven to 10 years, and how each cycle can be broken down into four phases which correspond closely to the seasons of nature. We also looked at some of the telltale signs of economic activity that can help us recognize where we are in the cycle.

You may be thinking, "That's all interesting, but how can I apply that knowledge to my personal financial life?" Let's start by decapitating the elephant in the room -- market-timing. Market-timing is a fool's game. However, most of the time market-timing refers to trying to find the high point in the market to sell high. It is true: Nobody is able to tell when a market has reached its peak.

Understanding economic cycles: An introduction

(Since April is Financial Literacy Month, a number of articles will be devoted to more educational topics. This is Part I in a four-part series about how understanding economic cycles could inform your financial decisions. Part II is Recognizing economic seasons: recovery and growth. Part III is The fall and winter seasons of the economic cycle. Part IV is How to profit from economic cycles.)

Getting rich slowly is built on these four commonly understood pillars:

- Get out of debt (and stay out of debt)

- Find ways to earn more

- Spend less than you earn

- Invest the difference

Despite the fact that many people followed those four guiding principles during the Great Recession, some "got poor quickly" instead. I believe that is because there is something else to know about the economy and how it affects our finances. This post is the first in a short series explaining what I understand about the economy and its seasons.

How to build wealth from scratch

When you are living paycheck to paycheck, down on your luck, or living a student lifestyle, it can be difficult to imagine a world where you are suddenly building wealth. Take this comment from Kendra on one of our Ask the Readers posts, "What do you do when you're broke?"

"I feel like like Caleb a bit -- in that most of these blogs don't cover how to get started. I mean for a student, for someone who's been born into poverty, how does one get started? I'm a student. I have NO income and my graduate program won't allow me to get a job. I only have 'living' money from loans -- and quite frankly, when I need more, I just get another school loan. (I have full faith that I'll be able to pay debt off quickly and make great pay at a job sometime in June/July).

"But as someone who doesn't know much about money other than what's on these blogs how do I START making money work? What can I do with $20? $50? You know what I mean?"

Why gold should be part of your investment portfolio

[Editor's note: This is Part II of a two-part series on whether it makes sense to include gold in your portfolio. Part I is "Should gold be part of my portfolio?"]

This is the second installment of a two-part series about gold as an investment for your portfolio. The two posts may appear like a candidate's debate or popularity contest, but they really aren't. Our purpose is not to win an argument in either direction -- it is, simply, to provide you with both sides of an issue which doesn't have a clear-cut best side (no matter what people may try to tell you). Our hope is that this format provides you with sufficient information to make an informed decision.

Yesterday you saw the reasons why gold should not be part of your investment portfolio. And those reasons are valid, but (and you knew there was a "but" coming) before you shut your mind to the notion of owning gold in some form, you might want to ask yourself: How come, if gold was such a terrible thing to invest in, is it by far the oldest, and most consistent investment of all in the history of humanity?

Should gold be part of my portfolio?

[Editor's note: This is Part I of a two-part series on whether it makes sense to include gold in your portfolio. Part II is "Why gold should be part of your investment portfolio."]

Humans have valued gold for several millennia, and that will likely continue. It is understandable, then, that a human such as yourself might consider trading some green for gold. I say, "Don't bother," and here's why….

1. Gold isn't a consistently good investment Continue reading...