DIY personal finance: How to take control of your financial life

This story originally appeared on Boing Boing in slightly different form. It’s my favorite article I’ve ever written.

I’m not a trained financial professional; I don’t have a degree in finance, and I’m not a certified financial planner. I have no formal training. I’m just an average guy who was deep in debt, and finally got fed up with his situation. After deciding to turn things around, I read dozens of financial books, and used what I learned to pay off my debt and begin to save.

In four years of reading and writing about money nearly every day, I’ve learned that in nearly every instance, the way to take control of your finances is to embrace the DIY ethic. Instead of trusting others to manage your money, you need to have the guts manage it yourself.

DIY Personal Finance

Last summer, O’Reilly media — the folks behind Make magazine and the computer books with the animals on the cover — asked me if I’d be willing to write a book about money. But not just any book about money. Your Money: The Missing Manual would let me share the tips I’d gleaned since starting Get Rich Slowly in 2006.

I knew right away that I wanted to encourage readers to take control of their financial lives. One of my mantras is: “Nobody cares more about your money than you do.” Other people, both pros and amateurs, are keen to offer advice, but their recommendations are often counter to your own interests. To really build a financial future that meets your needs, you have to learn how to save and invest, set financial goals, and master the art of conscious spending.

My belief that you need to take charge of your own financial life has only been strengthened over the past two years. The housing crisis, the market meltdown, the controversy over credit card policies — while these things can’t be avoided entirely even by smart money managers, their effects can be mitigated. If you call the shots when buying a house, the real estate agent can’t talk you into spending more than you can afford. (My brother lost two houses to foreclosure because he listened to his real estate agent instead of making his own decisions.) If you invest based on your risk tolerance, you can avoid catastrophic losses during a market crash — or insure that you don’t miss out on the subsequent boom.

Why Bother?

Why bother with DIY finance? There are many advantages to taking charge of things yourself, including:

- You have more control over the outcome. Instead of placing your money at the mercy of somebody else, you succeed or fail based on your own decisions.

- You can customize your financial framework. You can choose the accounts that work best for your situation, you can invest the way you want, and you can choose your own financial goals.

- You get more bang for your buck. When you do more of the work yourself, you pay fewer fees to other people. You’re also able to find products and tools that work best for your needs.

- It’s satisfying. Just as you feel a sense of accomplishment when you build a computer or install a new window, it can feel awesome to do the research to find the best bank account in your hometown.

Now, it’s important to understand that DIY finance is just like DIY anything else. You can’t enter a woodshop and expect to be building Stickley furniture overnight. You need to read. You need to practice. You need to start small. If you try using the heavy powertools first — say, directing your own investments — you can get into a lot of trouble if you don’t know what you’re doing.

And there will always be times you’ll want to call in an expert. I’ve promised my wife that I won’t mess with major plumbing or electrical work; for big jobs, I call in somebody who knows what they’re doing. The same is true with money. Though I can handle most of the routine stuff myself, I have a team of trusted experts at my disposal for when strange stuff happens: if I sell a business, if a parent dies, if the IRS audits me. An important part of the DIY ethic is knowing when to pass things off to the pros.

Action Steps

If you’ve decided you want to take control of your financial life, there are a few essential steps to get you started. I can’t give you the secret to wealth and happiness in a single blog post (I just wrote a 300-page book, and even that felt short!), but I can give you some basic guidelines.

1. Take Control of Your Spending

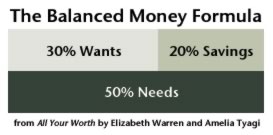

I’m not a big believer in detailed budgets. They work fine for some people (and if you’re one of them, that’s great), but for many others, a broader budget makes more sense. After trying (and failing) to use all sorts of detailed budgets, I finally settled on the Balanced Money Formula, as described by Elizabeth Warren and Amelia Warren Tyagi in their book, All Your Worth. Here’s what it looks like:

Whatever you decide to do, start tracking what you spend. Sign up with a service like Mint and start watching your pennies the same way you watch your calories.

Some people think frugality is a bad thing. It’s not. Frugality is an important part of personal finance. While it’s true that you can save tons of money by being smart when you buy a car or a home, chances to save on these things don’t come along very often. But there are tons of opportunities to save at the grocery store or when shopping for your kids’ clothes. Make the most of them. Save on the big stuff and the small stuff.

The bottom line? By practicing conscious spending, you can spend on the things that are important to you while pinching pennies on the things that don’t matter.

2. Take Control of Your Debt

The only way you’re going to get out of debt is to start spending less than you earn. I know that some people are in tight spots, trapped by medical problems or catastrophic accidents. But most Americans are in debt because they buy things they can’t afford.

In the past four years, I’ve talked with hundreds (thousands?) of people who have struggled with debt. Those who have managed to kick debt to curb have one thing in common: They’ve stopped waiting for help and decided to help themselves. If you’re willing to put in the time and effort, you can get out of debt.

I tend to favor the debt snowball method of debt reduction, which has been made popular by financial guru Dave Ramsey. Using this technique, you pay off your lowest balances first (instead of your highest interest rates). You pay a little more in the long run, but it works. This free debt snowball calculator lets you compare different debt-reduction strategies to find one that works for you.

Once you’ve taken control of debt, you need to avoid it in the future. To do that, you need to learn how to use credit wisely.

3. Take Control of Your Credit

Credit can be a convenience, or it can kill you. Establish some ground rules: Don’t buy on credit if you wouldn’t (or couldn’t) pay cash, pay off your balance at the end of every month, and always read the fine print. Pick a card that works for you (from a site like CardRatings.com or Index Credit Cards) and use it responsibly. Don’t just accept a card that is loaded with fees.

At the same time, take control of your credit score. Take the time to educate yourself on how credit scores work. A great place to start is Credit Report Card, a free service that rates your credit and gives you advice on how to improve it. (If you want to really geek out on this, pick up a copy of Liz Weston’s Your Credit Score, which is packed with information. Also, you can stay up-to-date with the world of credit and credit cards by reading CreditBloggers.)

4. Take Control of Your Banking

Why are you with your current bank? Because it’s close to home? Because they gave you a free Frisbee when you signed up? Your bank won’t make you rich, but it’s the central hub for much of your financial life. You should choose a place with features and fees to match your needs.

Rates are low right now, but they’ll rise over the next couple of years. As they do, take the time to be sure your money is working hard for you. Like many readers at Get Rich Slowly, I use a local credit union for my checking account, and I use a high-yield online savings account for my savings. (I use ING Direct, but there are other great options.) Here’s a tool to help you find a credit union near you. You may also want to look into reward checking accounts, which often give better returns than high-yield savings accounts!

5. Take Control of Your Investing

If your employer offers a retirement plan, use it — especially if they offer any sort of matching contributions. While it’s wrong to say that an employer’s 401(k) is “free money”, it’s still a damn fine deal. Whether or not you have a retirement plan at work, start a Roth IRA, which is an easy way for individuals to set money aside for the future. (Here’s a free Roth IRA e-book that explains the basics.)

What should you invest in? First off, don’t make the mistake of believing that you need a broker or adviser to pick your investments for you. Studies show that paying others to make these decisions for you generally costs more than you gain from it — if you gain anything at all. If you want to learn about stocks and bonds, do some research at the American Association of Individual Investors website, or borrow a stack of books from the public library.

But I’d encourage you to instead consider index funds, which are mutual funds designed to track the movement of the stock market (or a section of the stock market). For example, Vanguard’s VFINX fund is designed to mirror the movement of the S&P 500 index. Some people argue that index funds don’t make sense because they can never beat the market. While that’s true, they still perform better than 80% of investors (professional or otherwise) over long periods of time.

If you don’t believe me, maybe you’ll believe Warren Buffett, the most successful investor the world has ever seen. He advocates index funds for most investors, having once said:

I believe that 98 or 99 percent — maybe more than 99 percent — of people who invest should extensively diversify and not trade. That leads them to an index fund with very low costs.

Nobody Cares More About Your Money Than You Do

These tips just scratch the surface. In Your Money: The Missing Manual, I spend over 300 pages explaining how you can reclaim your financial life by taking back control from other people.

- I want you to learn how to negotiate, not just when buying a car, but when buying furniture and appliances.

- I also want you to know how to negotiate your salary.

- I want you to read contracts instead of blindly signing them.

- I want you to learn how to research big purchases.

- I want you to know how to buy a house you can actually afford.

None of this is rocket science. But many of us never learned the basics. Our parents did their best to teach us, but they didn’t know a lot of this stuff either. And we live in a society that is hell-bent on encouraging us to spend, so it can be tough to master the mental side of money. My goal is to help as many people as possible realize they can be masters of their financial destiny.

Taking charge of your own finances has a powerful side effect: When you encounter new financial situations — buying a home, starting a business — you feel less intimidated. You’re able to grasp the basics quickly, and can have the confidence that you’ll be able to figure out the rest. Plus, you put yourself in a position to parse the advice from the so-called experts. (You can even use your bullshit detector to process articles like this one.)

So, don’t wait for someone to give you permission to do this stuff. You’re an adult. Nobody’s going to give you the go-ahead. Take charge of your own financial life today.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)