How to earn more money: Three ways to boost your income

There's no question that frugality is an important part of personal finance — you can't outearn dumb spending — but trying to get rich by pinching pennies is like trying to win a car race by conserving gas. If you want to reach the finish line fast, you can't be shy with the accelerator!

There's no question that frugality is an important part of personal finance — you can't outearn dumb spending — but trying to get rich by pinching pennies is like trying to win a car race by conserving gas. If you want to reach the finish line fast, you can't be shy with the accelerator!

Today I want to explore a better way to boost your savings. Let's talk about how you can earn more money. Whether you're self-employed or working for somebody else, your income is determined by three factors:

- Your knowledge and skills. If you want to earn more, it pays to learn more.

- Your productivity. Both the quality and the quantity of your work affect how much people are willing to pay you.

- Your ability to sell yourself. To be paid what you're worth, you have to ask for it.

If you want to earn more money, you have to become more valuable in the job marketplace — and demonstrate that value for the market to see. Let's look at how to make that happen.

The More You Learn, the More You Earn

In the United States, education has a greater impact on work-life earnings than any other demographic factor. Your age, race, gender, and location all influence what you earn, but nothing matters more than what you know. That's great news, really, because you have total control over your level of education.

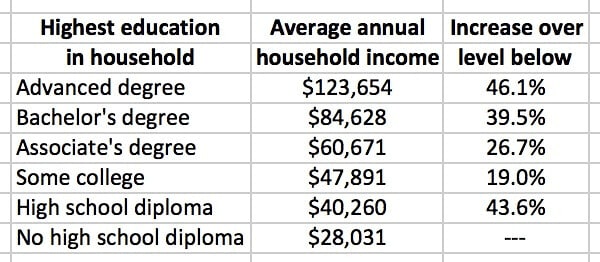

How much does schooling matter? Here are some numbers from the 2014 Consumer Expenditure Survey conducted by the U.S. Bureau of Labor Statistics:

The average college graduate earns twice as much as his friend whose education ended with high school.

Even a two-year degree from a community college helps. The average worker with an associate's degree earns twice the annual income of a high-school dropout and 50% more than somebody with only a high school diploma. Two years of community college typically boosts income by $20,000 per year. (That's almost a million dollars during a typical 40-year career!)

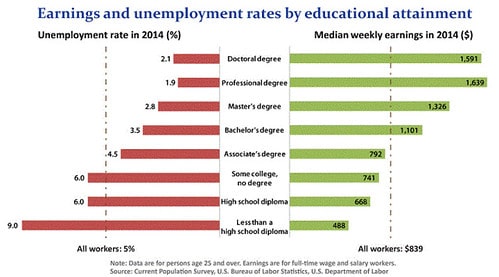

Similar research from the Current Population Survey shows that education also affects unemployment rates:

A college degree doesn't guarantee you'll earn more money, of course. Some philosophy majors wind up working in convenience stores for the rest of their lives, and some high-school dropouts become billionaires.

Outliers aside: The more you learn, the more you earn.

The best time to pursue education is at the start of your career, when you're young. The next best time is now.

I know it can be tough to find time and energy to go back to school once you have a family and career, but it can be done. Let's look at some examples:

- After ten years as a used car salesman, my friend Jeremy decided to become an accountant. He continued to sell cars and spend time with his wife and kids while he took online courses and studied for exams. Today, he's a full-fledged CPA.

- My girlfriend Kim was the office manager for a large dental practice near Sacramento. At age 35, she decided she wanted to earn more money. She quit work to get a dental hygiene degree, and now enjoys better pay and increased job satisfaction.

- I've done this too. In 1997, when I was 28, I took computer programming classes at the local community college on evenings and weekends. In eighteen months, I was skilled enough to pick up programming work in addition to my main job as salesman for the family box factory.

If you can't commit to college, it's still possible to improve your knowledge and skills through an ongoing campaign of self-education.

I'm a vocal proponent of self-directed life-long learning. I'm always reading books and blogs about personal finance. I take writing classes at the local community college. I listen to podcasts and online courses. I attend conferences to learn from my colleagues. And as I write this, I'm in the middle of a $2000 web-based course about how to build a better online business.

The more you know and the more you grow, and the more valuable you become in the job marketplace.

Tip: A key change in my own life was moving from passive/consumptive hobbies — television, computer games, watching sports — to active/productive hobbies. I'm happier when I'm reading, writing, or doing web design (or exercising or building something) than I was with less-productive pastimes. And these things help me earn more money.

Work More. Work Better.

Education isn't the only factor that affects your income. Your pay is also based on the quality and quantity of your work. If you want to earn more, you can increase the number of hours you work, your output per hour, or the value of your output.

The quickest and easiest way to boost your income is to increase the number of hours you work each week. That might mean going from a part-time employee to a full-time employee. It might mean working overtime. For many folks, it means finding a second job.

Working two jobs can be tough, especially if you have young children. And some people feel like a second job is beneath them. To overcome these objections, recognize that a second job is not a life sentence. It's a way to supercharge your income for the short term.

- I know a highly-paid biologist who takes jobs at upscale clothing stores during the holiday season. She earns extra cash and gets an employee discount, allowing her to build her professional wardrobe on the cheap.

- After taking the computer classes I mentioned above, I found a couple of part-time gigs that put my new skills to use. For a while, I worked three jobs totaling nearly 80 hours per week. The hours were long, but the money I earned helped me pay down debt.

- When my ex-wife taught high-school science, it was common for her colleagues to put their summers to good use. They'd work in bookstores, act as tour guides, or even work as bartenders!

If you can't add hours to your workday, you can enhance your value by doing more work in the time you have. If you've been producing ten widgets per hours, challenge yourself to produce twelve. If you've been making forty sales calls each week, find a way to do fifty.

When you produce more, you're worth more.

In addition to increasing the quantity of your work, it pays to increase the quality of your work. This may seem obvious, but you'd be surprised at how many people “go through the motions” at the office every day. You'll never get ahead if you're only faking it.

It's tough to provide general advice on how to do better work. “Better” varies from job to job. But you know what quality output looks like for your profession. (If you don't, that's a problem you should solve immediately.)

Note: Here's a non-intuitive way to enhance the value of what you do: Change where you work. Maybe that means moving to a different position within your current firm. Maybe that means taking a job with a competitor. Or maybe that means changing careers completely. (When my ex-wife decided she wanted to earn more money, she left her career as a science teacher to become a forensic chemist. Same skillset, completely different job.)

Sell Yourself

Your income is dictated by the value of your work, and the value of your work is determined by your education and productivity. But there's one last piece to this puzzle. Your income is also influenced by how well you market yourself.

Your income is dictated by the value of your work, and the value of your work is determined by your education and productivity. But there's one last piece to this puzzle. Your income is also influenced by how well you market yourself.

Like it or not, you are a product. Your work and expertise are a commodity.

Your employer wants to pay as little as possible for your work. Your goal, on the other hand, is to be paid what you're worth. To bridge the gap between these two numbers, a smart money boss negotiates his salary.

Think of it like this. When you shop for a new car, you try to pay as little as possible, right? You might need that automobile, but you're not going to pay sticker price if you don't have to. At the same time, the dealer does its best to get you to pay more.

Your boss is the car buyer. She needs an employee but would prefer to pay less than “list price”. You're like that car dealership. You want to convince the buyer — your employer — to pay a premium price for your services.

You can increase your lifetime earnings by half a million dollars — or more — if you learn the art of salary negotiation.

It's one thing to know that you should negotiate your salary, but it's something entirely different to do it. What's the trick?

In his excellent book Negotiating Your Salary: How to Make $1000 a Minute, career coach Jack Chapman promotes a five-step process that almost anyone can use:

- Delay salary discussions until after you're offered a job. (Same with raises: Discuss a pay increase after your performance review.)

- Let them make the first move. The first person to name a number loses, so always let the employer suggest a salary first. (For advice on how to deflect questions about your salary expectations, check out this video and this article.)

- When you hear the offer, repeat the top value — then stop talking. This “flinch” is a piece of play-acting that buys you time while putting pressure on the employer.

- Counter the offer with a researched response. Before the interview, do your homework so you know a reasonable salary for the position. Use this knowledge to ask for more. (Start your salary research at sites like Glassdoor and PayScale.)

- Clinch the deal — then deal some more. After you've locked in your salary, negotiate additional benefits like extra vacation days or a company car.

According to a 2011 study in the Journal of Organizational Behavior, failing to negotiate your starting salary can cost $600,000 during the typical career.

The same ideas apply when asking for a raise. The difference, of course, is that your company already knows whether you're an asset or a liability. To improve the odds of a salary increase during your next performance review, be prepared to state your case. Sell yourself!

Only about half of all employees in the U.S. negotiate their salary. A money boss always does.

Note: There are other ways to market yourself and your career. You might, for instance, develop an ongoing portfolio of your accomplishments at the office. This is handy when asking for a raise or when applying for a new position. You're also marketing your skills and abilities when you network with colleagues at seminars and conferences.

You Are 100% Responsible for Your Income

How much you earn directly reflects what the market believes you're worth. Your income is based on the demand for your knowledge and skills, the quality and quantity of your work, and how well you market yourself to potential employers or customers. If you have a certain skill set, you can easily make money by selling your services or teaching others.

If you want to earn more, you must be worth more.

What the market values might not seem “fair” to you — but “fair” is irrelevant. Is it obscene that professional athletes are paid so much? Maybe. Should teachers be paid more? Perhaps. But it doesn't matter. These numbers are a product of supply and demand. If you want to increase your income you have to supply more of what employers demand.

Excercise:

Now it's time to act. Spend five minutes thinking about each of these questions:

- What's one thing you can do to increase your knowledge or skillset?

- What's one thing you can do to increase the quantity or quality of the work you do?

- What's one thing you can do to better market yourself to your employer — or to other employers?

For each question, pick one best course of action. Now here's the tough part: Commit to yourself that over the course of the next six months, you'll actually do these three things. Then report back here to let everyone know the results!

Note: During the month of March, I'm migrating old Money Boss material to Get Rich Slowly — including the articles that describe the “Money Boss method”. This is the sixth of those articles.

- Part one answered the question, “What is financial independence?”

- Part two looked at why you should run your life like a business.

- Part three explained how to write a personal mission statement.

- Part four explored the importance of saving rate.

- Part five showed why the best way to spend less is to cut back on the big stuff.

Look for further installments in the “Money Boss method” series twice a week until they've all been transferred from the old site.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)