The best way to spend less? Cut back on the big stuff!

You don’t need a high income to achieve Financial Independence.

Making more money helps, sure, but if you’re diligent about cutting costs, it’s possible to reach financial freedom on even an average salary.

I want you to meet my friend, John. John is an 81-year-old retired shop teacher. He’s a millionaire — but you’d never know it.

John started life as a carpenter. In his thirties, he went back to school to become a teacher. He spent the next twenty years teaching shop at a junior high school in a poor part of town. He retired to financial freedom at age 58. He never had a huge income and he didn’t inherit a fortune.

So, how’d he get rich? He pinched his pennies and doted on his dollars. John achieved Financial Independence by ruthlessly cutting costs.

- John doesn’t live in a mansion. He lives in the same small ranch house he bought for $10,500 in 1962. He paid off his mortgage early, and has now lived in the place for 53 years!

- John doesn’t drive a brand-new Mercedes or BMW. He drives a 1998 Chevy minivan he bought for cheap five years ago. It’s ugly, but he doesn’t care. It meets his needs and he has no plans to upgrade.

- John doesn’t take lavish vacations. He spends his summers in southeast Alaska on an old 38-foot fishing boat that he bought with cash in 1995. He spends his winters doing volunteer work on farms and ranches in New Zealand.

- John doesn’t like to dine in fancy restaurants. He’d rather make his own meals at home. “For me, restaurants are a waste of money,” he says. “I don’t appreciate them.”

Does John sound like a typical millionaire to you? If you were to believe TV, movies, and magazines, you might think most millionaires live like this:

We’re constantly bombarded by messages that wealthy people enjoy lavish lifestyles filled with luxury. From my experience meeting with dozens of millionaires over the past decade, this kind of lifestyle is the exception not the rule.

Most wealthy people I know are like John. They’re quiet millionaires. They practice stealth wealth.

But don’t just take my word for it. Let’s look at what the experts say.

Lifestyles of the Rich and Fameless

In The Millionaire Next Door, authors Thomas Stanley and William Danko share what they learned through years of academic research into the habits of America’s wealthy. Here’s one key takeaway:

What are three words that profile the affluent? FRUGAL FRUGAL FRUGAL…Being frugal is the cornerstone of wealth-building.

They write that millionaires tend to “play great offense” with money — their incomes are much higher than average — but they also “play great defense”. They’re not big spenders. They’re thrifty. They opt out of consumer culture, making purchases based on their personal needs and wants rather than status and fashion.

“Few people can sustain profligate spending habits and simultaneously build wealth,” write the authors. “[Millionaires] became millionaires by budgeting and controlling expenses, and they maintain their affluent status the same way.”

Study after study shows the same thing. To get and stay rich, you have to manage your lifestyle. You can’t outearn dumb spending.

Great. You get it. To achieve your goals, you’ve got to cut costs. But how?

There are two schools of thought:

- Most money writers emphasize saving on small stuff. They teach how to clip coupons, conserve electricity, and spend less on entertainment. These small wins are usually quick and easy to achieve.

- A few folks urge readers to pursue “big wins”. They argue that the quickest way to wealth is to spend less on big-ticket items like your home and your car. The downside to this approach? Big wins take a lot of work, and opportunities to pursue them are rare.

I believe that a smart money manager does both. She practices thrift on a daily basis and she seizes every opportunity to slash spending on the big stuff.

Frugality is an Important Part of Personal Finance

You could save maybe 50 cents a day by drinking a glass of water instead of a can of soda. That doesn’t mean much if you only do it once, but over the course of an entire year that single change would increase your personal profit by nearly $200. When taken together, many such small economies make a noticeable difference.

Small amounts do matter.

Rather than provide some made-up examples of how much you could save, here are actual numbers from my own life. When I dug out of $35,000 in debt a few years ago, I decided to:

- Switch my cable TV package from $65.82 per month to $12.01 per month, saving $645.72 every year.

- Get rid of my home phone line (roughly $46.50 per month) and my subscription to Audible ($21.95 per month), saving $821.40 per year.

- Cancel my magazine and newspaper subscriptions, saving $137 per year.

- Make use of the public library instead of shopping at bookstores, saving $391.95 in the first year.

- Plant a vegetable garden to grow my own produce, saving more than $300 per year. (Yes, I’m such a nerd that I kept a spreadsheet to track how much I saved!)

With these changes alone, I increased my cash flow by $2,281.61 per year. That’s an additional profit of almost $200 every month.

You won’t get rich — slowly or otherwise — by cutting your cable bill or growing your own tomatoes. But when small changes are a part of an ongoing campaign of saving and investing, they can bring big changes indeed!

True story: I recently had a friend ask me how to get out of debt. “You can start by getting rid of your $200 cable package,” I told him. “No way!” he said. “That’s the first thing everyone says, and it’ll be the last to go. TV is important to me.” Right. More important than being debt-free, apparently.

The Magic of Thinking Big

While it’s important to save money on everyday stuff, it’s even more important to watch how much you spend on major purchases. By making smart choices on big-ticket items, you can save thousands of dollars in one blow. If you spend fifty grand less when you buy a house, that’s fifty grand (or more!) you never have to earn.

Housing

Housing is the biggest expense for most Americans — and by a wide margin. According to the U.S. Bureau of Labor Statistics’ 2015 Consumer Expenditure Survey, the typical American household spends 32.8% of its income on housing, which includes mortgage (or rent), maintenance, insurance, interest, and utilities.

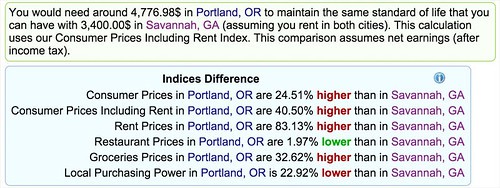

In an ideal world, you’d slash your housing expense by buying an affordable home in a city with a low cost of living.

While relocating to a cheaper home in a cheaper city would probably provide a huge financial reward, it’s not exactly easy. A more practical alternative might be to move within your current city. Sell your home (or move out of your rental) and choose something more affordable.

Think about it: If you’re an average American who spends $1534 per month on a place to live, dropping that expense by 10% would save you $150 per housing payment. Drop it by 30% and you’ll save more than $5000 per year!

“If you’re not yet wealthy but want to be someday, never purchase a home that requires a mortgage that is more than twice your household’s annual realized income. Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.” — The Millionaire Next Door

Transportation

Transportation is our second-largest expense in the U.S. We spend an average of $792 per month (17 percent of the typical budget) to get around, including vehicle payments, gasoline, insurance, and repairs. I know Americans love their automobiles. They’re loath to let them go, even in the face of logic. But imagine how much you could save if you could cut your car costs in half! How do you do that?

- Sell your current car. Replace it with a used vehicle, one that’s fuel efficient. (Side benefit: An older, used vehicle will cost less to insure!)

- Drive your car only when necessary. When possible, bike or walk to reach your destination. (Side benefit: Increased fitness, which also saves you money!)

- Make use of public transportation. (Side benefit: Time to read!)

When I recommend people change the way they get around, I’m usually met with a wall of objections. But let me suggest that instead of looking for reasons you can’t do this, instead look for ways you can. You’ll save buckets of money.

Other Expenses

Together, housing and transportation consume half of the average American budget. There are enormous opportunities to save if you choose to economize on these two categories. But you can achieve big wins in other areas too.

The Consumer Expenditure Survey shows that the typical household spent $1846 on clothing in 2015, $4342 on health care, $2842 on entertainment, and $7023 on food.

Because each of us is different and we spend in different ways, opportunities for big wins vary from person to person. After tracking my spending for the last half of 2013, for instance, I realized that I was spending way too much on travel. In 2014, I cut my travel costs in half. This allowed me to save money for other goals, such as buying a motorhome.

The Best Way to Spend Less

A few years ago, I asked my friend John if he had advice for young people who want to retire early.

“Here’s the secret to financial freedom,” he told me. “I don’t care how much you make — you spend less than you earn. You don’t have to like it. You just have to do it. Because that is the secret.”

The best way to spend less is to optimize the big stuff.

I’m not saying you shouldn’t make your own laundry detergent or plant a vegetable garden. By all means, do these things! But understand that if all you do is the small stuff, your only hope is to get rich slowly. You can do better.

Exercise

Pull out your personal mission statement. With that in front of you, brainstorm ways to reduce your spending. No idea is too small. No idea is too big. No idea is too stupid. Do a rapid braindump of any (and all) actions you could take to cut costs. If all your spending were aligned with your goals and mission, where would the money go?

After you’re finished brainstorming, pick three specific ways — large or small — you’ll reduce spending starting this week. (Examples: I’ll walk to the grocery store. I’ll sign up for a library card. I’ll finally cancel my landline.) Also pick one “big win” that you will work to achieve in, say, the next two years. Make this a big, hairy audacious goal. (Example: We’ll go from a three-car family to a one-car family.)

Note: During the month of March, I’m migrating old Money Boss material to Get Rich Slowly — including the articles that describe the “Money Boss method”. This is the fifth of those articles.

- Part one answered the question, “What is financial independence?”

- Part two looked at why you should run your life like a business.

- Part three explained how to write a personal mission statement.

- Part four explored the importance of saving rate.

Look for further installments in the “Money Boss method” series twice a week until they’ve all been transferred from the old site.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)