Why are weddings so expensive? How we cut costs, and how you can too

Think you need to spend a fortune to tie the knot? It's just not so. Kris and I got hitched for a couple grand in 1993. In this post from JerichoHill, he explains how he kept costs down for his wedding last summer.

Weddings are expensive affairs. Couples often spend tens of thousands of dollars for an event that lasts only a day or two. I know, I know — the memories last a lifetime. But that's the catch-phrase of the industry that's sprung up around this occasion. In economics, this is called conspicuous consumption.

Ramit at I Will Teach You to Be Rich recently wrote an article about the cost of weddings. On average, a wedding costs $28,000. That's more than half what the typical American household earns in an entire year! Continue reading...

Overview of Estate Planning Software for Wills and Trusts

It's that spooky haunted time of year — my annual post about estate planning! Last year I shared a brief guide to creating a will. Today I'm going to look at a recent New York Times article by Christine Larson that provides an overview of will preparation software.

Larson writes, "Recently, the increasing sophistication of software and services for estate planning, combined with growing consumer comfort with online financial management, has led to a boom in homegrown estate planning." Here's a list of the products and services she mentions (along with the canned spiel from the corresponding website or Amazon page):

- LegalZoom: "Save time and money on common legal matters! Created by top attorneys, LegalZoom helps you create reliable legal documents from your home or office. Simply answer a few questions online and your documents will be prepared within 48 hours. We even review your answers and guarantee your satisfaction."

- Suze Orman's Will & Trust Kit: "This is an easy-to-use and fast way for you and other members of your household to create your own will, living revocable trust, and all the other must-have documents you need to protect you and your family. It's as easy as 1-2-3—simply personalize, print, and protect."

- Quicken WillMaker Plus: "Help protect your family and your assets, and save on legal fees! Quicken WillMaker Plus 2008 provides the legal forms you need. So comprehensive, the software assembles your forms from among 40,000 document possibilities—but so easy to use, you'll have them finished in minutes."

- Living Trusts on the Web: "We only do one thing, Living Trusts, and we do it better than anyone else! Remember, with our program you are getting all of the documents an attorney would prepare for you, with all of the detail an attorney would provide, without paying an attorney fee."

Based on my research, these sorts of software and services are excellent choices for people with uncomplicated needs. In her article, Larson warns that estate planning software isn't for everyone:

<Early Retirement: Couples Who Made It Happen

I recently mentioned two Liz Pulliam Weston articles in passing. They're good enough to merit closer attention. Both articles profile couples who found the courage to save money when they were young so that they could enjoy the freedom of early retirement. Weston writes:

Think it's impossible to retire in your 40s? I'd like you to meet some ordinary folks who have done it. "Ordinary" may be a misnomer, because retiring after just 20 years or so in the workplace is an extraordinary act, and most took extraordinary measures to get where they are. But they're ordinary in the sense that they were working people with pretty regular jobs. They didn't strike it rich with stock options, inheritances or the lottery.

[...]

Accelerated mortgage payments (and the GRS amortization calculator)

What if you've reviewed the compromises required to pay your mortgage early and the idea still appeals to you? You might pay a bank to set up a bi-weekly payment plan or a money merge account. But you can do just as well by taking mortgage acceleration into your own hands. Here are three options I've considered:

- Rather than pay my mortgage, I could deposit my money into a high-yield savings account earning roughly 5% interest. Though this earns the lowest possible rate of return on my money, it gives me the greatest flexibility. I could withdraw the money to pay down the mortgage at any time. Or I could save for other goals.

- On the other hand, I might make extra payments on my mortgage each month. This would effectively earn me a guaranteed rate of return equal to my mortgage interest rate (6.25%). This would also help me spend less on interest. Doing this, however, ties up my money, making it difficult to access if I decide I want it for something else.

- My third choice is to invest the money in low-cost index funds. This would, in theory, provide the highest possible rate of return for my money, but as with any stock market investment, there's an element of risk. If my goal is to pay off my mortgage, a bear market is going to make me sweat.

Kris and I will decide what we intend to do by early next year. Initially, I thought we'd make payments directly on the loan, but after previous discussions here at Get Rich Slowly, I'm leaning toward placing the money in a high-yield savings account until we know better what our long-term financial goals are.

HELOC Payment Calculator for Excel

Meanwhile, I was curious: How long would it take to pay off my mortgage using the HELOC I already have? Would using the HELOC actually save time over applying the payment directly to the mortgage itself? To play with the numbers, I developed a mortgage amortization spreadsheet. (This spreadsheet doesn't account for inflation — that's beyond my Excel acumen.) Continue reading...

Shaking the new car itch: A tale of priorities

When I went to the street to get the mail on Saturday, the latest issue of The New Yorker was in the box. Walking up the sidewalk to the house, I idly began to remove the subscription cards. I stopped, though, when I came to a full-page cardstock advertisement. I read the front of the ad. I read the back.

At the kitchen table, I carefully removed the ad from the magazine, carried it upstairs, and sat down at my computer. I typed in the listed URL, and for the next two hours, I was at the mercy of the advertiser. What was this ad for? The 2007 MINI Cooper.

I've mentioned before that I hate my current vehicle — a 2000 Ford Focus. I bought it in a hurry after my 1992 Geo Storm was totaled by a wayward tractor-trailer rig. I've loathed the Focus since day one. Continue reading...

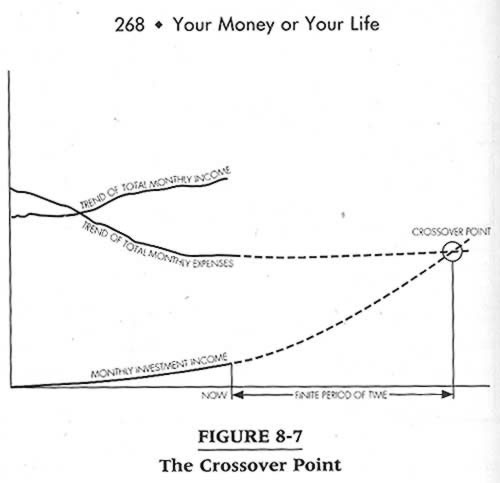

An introduction to the crossover point

The book Your Money or Your Life popularized the notion of the Crossover Point. The Crossover Point is simply that point in time at which your investment income exceeds your monthly expenses. For most people, this never occurs.

YMoYL is about getting readers to the Crossover Point. The authors want people to achieve Financial Independence, which they define as "having enough — and then some". They ask readers to track income, expenses, and investment income, plotting each of these on a wall chart. The entire book is about finding ways to get the investment income line (low on the graph) to meet (and then cross over) the expenses line.

This is esoteric, I know, but it's important. Reaching the Crossover Point means that, if you wanted, you could stop working for money. You could retire. You could work for self-fulfillment. You could travel the world or write a book. If YMoYL were a novel, this would be the climax of the story: Continue reading...

Questions and answers about Roth IRAs (Updated!)

The series on Roth Individual Retirement Arrangements (Roth IRAs) has covered a number of topics -- what they are, how (and where) to open one, and which investments are best. Now, in the final part, we turn to some of your questions. Remember: I am not a financial adviser. I'm just a regular guy trying to gather information to help you. If you need more specific answers, please consult a CPA or an investment professional.

All of the questions below were submitted by Get Rich Slowly readers via comment or email. If your question isn't here, please drop us a line so we can research an answer and add it to the list. If you are new to Roth IRAs, this article is not the place to begin. Start here, instead.

The New Graduate’s Guide to Financial Freedom

I graduated from college in 1991 with a degree in psychology and a minor in English lit. I was one course shy of a second minor in speech comm. With credentials like these, it's no surprise that my first job out of school was knocking on doors, selling crummy insurance to little old ladies in Eastern Oregon. I hated the job, but I could not quit. I was trapped by debt.

After I was hired, I had gone a little crazy. Because I would soon be earning a steady income, I figured it was safe to spend some of my future earnings. My car — a silver 1983 Ford Escort — was a piece of junk. I didn't think it made sense to repair it. Fortunately, the bank gave me a loan for a new car. I bought a 1992 Geo Storm. Then, using credit cards, I bought an entire wardrobe of business attire and a Super Nintendo. "It's okay," I kept telling myself. "I have a job. I'll be able to pay for this."

Which Should You Choose: Joint or Separate Finances?

Several months ago I mentioned in passing that my wife and I keep separate finances. I promised to eventually explain why, and to discuss the pros and cons of doing so.

Our story

When I was a boy, my parents fought about money often. And loudly. They had joint finances, but it didn't seem to matter. Each accused the other of being financially irresponsible. (Both were right.) Their example left me disenchanted with the notion of mutual money management.

During the years Kris and I dated, we had our own accounts. From the beginning, I was a spendthrift and Kris was a saver. She always made smart financial decisions. Because my money was my money, and her money was her money, my poor choices did not drain her savings.

What is a financial plan and why have one?

Having a financial plan is a lot like having a travel plan — it identifies where you're going, how and when you'll get there, how much it'll cost, and things do along the way. Like planning a vacation, your financial plan can be loosely structured or highly detailed based on your individual needs. But having no plan at all could leave you stranded in the middle of nowhere.

A financial plan answers three primary questions:

- How much, when, and where should you save while you're spending less than you earn? Examine your wages, debt payments, living expenses and other budget items to determine how much to contribute to your plan (when you have a cash-flow surplus), and decide which account the money should go in.

- How should your savings be invested until they're needed? Identify which asset classes to invest in, how much to put in each, and which actual investments to use. Diversification helps you manage investment risk.

- How much, when, and from where will you access savings when it comes time to spend them? Address situations when financial needs exceed available cash from income (a cash-flow deficit) and must be supplemented by withdrawing savings from your plan. This might be a limited-term need such as paying for a child's college education, or a lifetime need such as partial or full retirement.

To properly address these questions, identify your financial goals. Questions to ask yourself include: Continue reading...