The Calculus of cats and dogs

The other day, I made a passing comment in my article about judging (or not judging) others. I mentioned that although my friend Michael is in dire financial straits, he's still making life decisions based around the fact that his family has two dogs. (They're renting a larger, more expensive home than they otherwise would, for example.) "What about getting rid of the dogs?" I asked.

Well.

This suggestion struck a nerve with a lot of people. Many GRS readers argued that giving up pets during financial crisis is irresponsible. Tiffany's response was typical:

The psychology of consumerism

This article was written by David M. Carter, a graduate of the master of applied positive psychology program at the University of Pennsylvania, and the first graduate of the program to emphasize the inherent link between increased well-being and sustainable consumption.

A recent story in my local newspaper dealt with a sad-case family. The son was in jail for drugs, and his mother was trying desperately to find a way to give her son hope. The story described her stark home, which she shared with her son before he went to jail, containing four cats, a 50-inch plasma Panasonic and little else. The mom was particularly motivated to get back her son's 2000 BMW and 2001 Audi Quattro, both of which were recently stolen by his “friends”. She felt that by getting his cars back for him, it would give him some hope for the future.

The newspaper story addressed how this family is dealing with a lot of deep-seated issues. Yet, the plasma TV and European cars stand out as symbols of an illness that exists in our society that few want to think about, and many don't even know about.

Layoff: Catastrophe or Opportunity?

At the age of 50, I was laid off.

It was a Thursday morning in August of 2013 and it came on a conference call along with hundreds of co-workers. I had been working in one way or another since the age of 13 — babysitting, apple picking, camp counselor, journalist. It was the first time I had ever been involuntarily out of work.

Did I mention it happened while I was technically on vacation? Yep. I had to dial in to a conference call to lose my job while at the beach on Cape Cod. Oh, Corporate America. Continue reading...

More money: 5 ways to earn extra cash in your spare time

The discussion yesterday about how to earn money when you've lost your job got me thinking about ways to earn extra income outside regular employment. None of these are quick fixes, but they're ways to generate cash in your spare time.

Get a Second Job

A second job can be an excellent way to earn extra money if you have the time and energy. Why have a second job?

A philosophy of failure

Though I've been reading and writing about money for six years now, I still do stupid things sometimes. Most of these errors are un-interesting — it's the compulsive spending that's interesting, and I seem to have that under control — but sometimes it's instructive to look at the mundane mistakes I make, like shopping while hungry.

Well, last week I made another relatively un-interesting mistake, but one that's educational at the same time. Since it's typical of the dumb things I do from time to time, I want to share it, and talk about why I'm not going to let it bother me.

The Importance of Routine

Because I know myself and my forgetful ways, I've tried to create routines around many basic financial chores. (Learning how to outsmart yourself is a great way to make behavioral change.) For instance, I've automated most of my bill payments so that I don't have to worry about forgetting to send a check. Plus, I sit down for 30 to 60 minutes every weekend to work on my finances. Doing this prevents me from losing track of what I have and what I owe.

Shopping addiction: How to stop being a shopaholic

Yesterday, I mentioned that because I grew up poor, I inherited a faulty money blueprint from my parents. They didn't know how to handle money effectively, so they couldn't teach me how to handle it effectively. I entered adulthood with many of the same bad habits they'd had when I was a kid.

I was a compulsive spender, for instance. I had a shopping addiction. I had no willpower, no impulse control. Even when I had no money in the bank, I still found ways to spend. I took on over $20,000 in credit card debt before I turned 25!

Nowadays, I mostly have my spending under control. I'm no longer in debt, and I force myself to make conscious decisions about what I purchase. (Conscious spending is one of the keys to overcoming emotional spending.)

A brief guide to cybersecurity basics

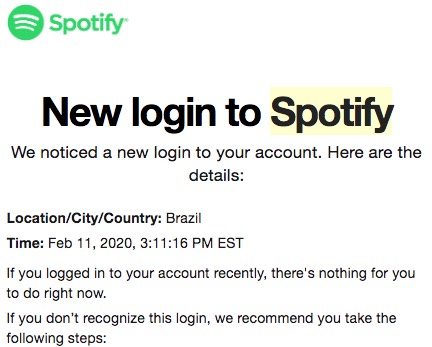

Last Monday, I got an email from Spotify saying that somebody in Brazil had logged into my account.

I checked. Sure enough: A stranger was using my Spotify to listen to Michael Jackson. I told Spotify to "sign me out everywhere" — but I didn't change my password. Continue reading...

How I invest my money

After my recent article about coping with haters, a reader named Sandy left the following comment.

How about...you make a detailed post on how you invest. Let's see some real life detail. I'm sure you won't want to post exactly how much you have invested and that's fine. I'm talking more along the lines of:

a: what stocks/funds you hold

b. what criteria you use to shift funds to maintain balance (good/bad/sky is falling markets)

c. your rate of return each quarter

d. how much you invest each month (ballpark)

The best streaming services

Which streaming services are best? Kim and I have been wrestling with this question for a week now. We've done lots of research and testing to see what we like. We've pencilled out prices. And then I put all of the info into a spreadsheet. (Yay, nerds!)

We learned that there's plenty of choice for cord cutters at the moment — even for folks who want to watch free TV. There might even be too much choice. In fact, whereas I was once hopeful about the future of streaming entertainment, now I'm wary.

I used to envision a world in which big players like Apple gathered all content in a central location, then customers could select what they wanted, like ordering from a restaurant menu. That's what people have been demanding from cable for years, after all, and for a time it seemed that streaming might head that direction. Continue reading...

How to homeschool on one income

When I wrote about the pros and cons of homeschooling recently, I left one major piece of the puzzle untouched: How does a family handle the loss of income if a stay-at-home parent is required?

It's not just the loss of monthly income. The parent who stays at home doing the bulk of the educating is also missing out on some other benefits of employment (employer contributions to a 401(k), social security benefits, avoiding a resume gap, etc.). These aren't necessarily easy to quantify.

So let's take a look at the financial piece of the puzzle to the extent we can; but first, is it possible to homeschool without losing income?