Financial advice for an 18-year-old?

Last week, Isaac asked Get Rich Slowly readers for advice on how to handle life after grad school. He's about to enter the workforce and needed tips on what to do until he gets his first paycheck. Isaac was very pleased with your helpful responses.

This week, we've got a chance to help somebody even younger than Isaac. Nico is 18, a sophomore in college, and financially clueless. He needs help! Here's his story:

I'm pretty young — about to start my sophomore year of college — and I literally have absolutely no knowledge of anything financial. I do have a simple student account with a paltry amount of money in it, and that's really about it. So yeah, the majority of your site goes over my head and some things are quite intimidating.

Scratch Beginnings: An interview with Adam Shepard

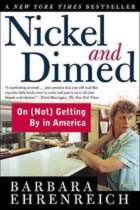

I just finished reading Barbara Ehrenreich's Nickel and Dimed: On (Not) Getting By in America for the third time. In this book, the author chronicles three one-month stints working as one of the American poor. Her goal is to demonstrate that it's difficult to succeed as a waitress, or a maid, or a Wal-Mart employee.

I just finished reading Barbara Ehrenreich's Nickel and Dimed: On (Not) Getting By in America for the third time. In this book, the author chronicles three one-month stints working as one of the American poor. Her goal is to demonstrate that it's difficult to succeed as a waitress, or a maid, or a Wal-Mart employee.

This is a book that I wanted to like — I sympathize with the author's motives — but what could have been an interesting project (and an interesting book) is instead a bizarre Marxist screed about class warfare. Ehrenreich enters her experiment with the end in mind — failure — and she seems to do everything she can to make this end come to fruition.

Nickel and Dimed could have been so much more. I wanted to hear about the people Ehrenreich worked with, wanted to hear their backgrounds and stories and dreams, but very little of that comes through in the book. Instead, we learn about all the little ways in which Ehrenreich sabotages any chance at success.

Busting the myths: Why coupons are a valuable part of your financial arsenal

But that all changed in 2002 when I found myself jobless and 7-1/2 months pregnant with my first child. My husband was a first year pipefitters' apprentice earning about $9 an hour, and my high-paying job was our bread and butter. We managed for a few months on my severance and unemployment, but when we found out I was pregnant again only three months after our first boy was born, we knew that finding a job was not in the cards and that drastic measures were called for.

This was when I discovered the Grocery Game. I wish I could say it immediately transformed our finances, but I made every rookie mistake in the book. I didn't truly understand how to use coupons, and I wound up purchasing only the cheapest items from the stores I shopped at. I was every coupon myth/misconception/excuse embodied in one. Perhaps you're under many of the same false impressions:

Help! I co-signed on a loan and now I wish I hadn’t!

Ah, relationships. Without other people, money management would be easy! Easy-er, anyhow. But love, family, and business relationships tend to make people do things they know they really oughtn't.

Take Patrick, for example. He fell in love, and it led him to commit a financial faux pas. Here's Patrick's l-o-n-g story and his questions:

A couple years back, I met a girl, fell in love, and we moved in together. A few months into our cohabitation, her car died. Since we needed to separate cars for work, we went to a dealer to see what she could find in the way of a used vehicle.

How to earn more money: Three ways to boost your income

There's no question that frugality is an important part of personal finance -- you can't outearn dumb spending -- but trying to get rich by pinching pennies is like trying to win a car race by conserving gas. If you want to reach the finish line fast, you can't be shy with the accelerator!

There's no question that frugality is an important part of personal finance -- you can't outearn dumb spending -- but trying to get rich by pinching pennies is like trying to win a car race by conserving gas. If you want to reach the finish line fast, you can't be shy with the accelerator!

Today I want to explore a better way to boost your savings. Let's talk about how you can earn more money. Whether you're self-employed or working for somebody else, your income is determined by three factors:

- Your knowledge and skills. If you want to earn more, it pays to learn more.

- Your productivity. Both the quality and the quantity of your work affect how much people are willing to pay you.

- Your ability to sell yourself. To be paid what you're worth, you have to ask for it.

If you want to earn more money, you have to become more valuable in the job marketplace -- and demonstrate that value for the market to see. Let's look at how to make that happen.

Drafting a plan for discretionary spending

I've decided to develop a budget.

This probably sounds strange coming from a guy who has been anti-budget all his life. Besides, haven't I paid off all my debt? Don't I have a positive cash-flow of over $1,000 per month? Yes, these things are true. But I've noticed something troubling: I've begun to experience that lifestyle inflation I'm always warning others about.

Lifestyle inflation is the natural tendency to increase our spending as our incomes increase. When we get a raise at work, we're likely to spend more at home. A little lifestyle inflation is fine. But there's a real danger of becoming too comfortable with increased spending. Once we become accustomed to a certain lifestyle, it's difficult to cut back.

More money: 5 ways to earn extra cash in your spare time

The discussion yesterday about how to earn money when you've lost your job got me thinking about ways to earn extra income outside regular employment. None of these are quick fixes, but they're ways to generate cash in your spare time.

Get a Second Job

A second job can be an excellent way to earn extra money if you have the time and energy. Why have a second job?

A philosophy of failure

Though I've been reading and writing about money for six years now, I still do stupid things sometimes. Most of these errors are un-interesting — it's the compulsive spending that's interesting, and I seem to have that under control — but sometimes it's instructive to look at the mundane mistakes I make, like shopping while hungry.

Well, last week I made another relatively un-interesting mistake, but one that's educational at the same time. Since it's typical of the dumb things I do from time to time, I want to share it, and talk about why I'm not going to let it bother me.

The Importance of Routine

Because I know myself and my forgetful ways, I've tried to create routines around many basic financial chores. (Learning how to outsmart yourself is a great way to make behavioral change.) For instance, I've automated most of my bill payments so that I don't have to worry about forgetting to send a check. Plus, I sit down for 30 to 60 minutes every weekend to work on my finances. Doing this prevents me from losing track of what I have and what I owe.

How I invest my money

After my recent article about coping with haters, a reader named Sandy left the following comment.

How about...you make a detailed post on how you invest. Let's see some real life detail. I'm sure you won't want to post exactly how much you have invested and that's fine. I'm talking more along the lines of:

a: what stocks/funds you hold

b. what criteria you use to shift funds to maintain balance (good/bad/sky is falling markets)

c. your rate of return each quarter

d. how much you invest each month (ballpark)

We offered to buy a home for $128,000 over list — but it wasn’t enough!

Sunday evening, Kim and I made an offer on a house. The Greenwood Place (as we'll call it) was listed at $649,000. We offered $677,777 escalating to $777,777; no repairs required; and a $50,000 appraisal gap waiver.

Our offer was not accepted.