Saving more and working longer: Two powerful ways to increase your retirement resources

The July 2018 issue of the AAII Journal — the monthly publication of the American Association of Individual Investors — includes an intersting article about how to “increase your retirement resources”. This plain English piece summarizes some of the findings from the authors’ research paper “The Power of Working Longer“.

According to the article, there are three primary factors that determine “the adequacy of retirement resources”. Those are:

- When a person begins participating in an employer-sponsored saving plan,

- What percentage of their earnings they save in such a plan (i.e., their saving rate), and

- At what age they retire and begin taking Social Security benefits.

Until Elon Musk invents a time submarine, it’s impossible for a worker to go back to their youth and begin saving for retirement earlier. Because of this, the authors focused their research on the relative power of saving more and working longer.

Note: To simplify matters, the authors make some assumptions. For instance, instead of investing in the highly-variable stock market, they assume their hypothetical subjects invest in a vehicle with a fixed rate of return: an annuity. This is a little goofy, but helps them come up with more precise numbers than they’d otherwise be able to achieve. Just keep this in mind as we talk about the article’s conclusions.

The Power of Working Longer

First, the authors look at what happens when a person decides to delay retirement by a year — or more. Generally speaking, each extra year worked brings roughly a 7.5% increase to standard of living during retirement. And that’s assuming a real (inflation-adjusted) investment return of 0%!

When you consider that stocks produce a long-term annual real return of about 6.8%, working an extra year has an even greater impact on standard of living in retirement.

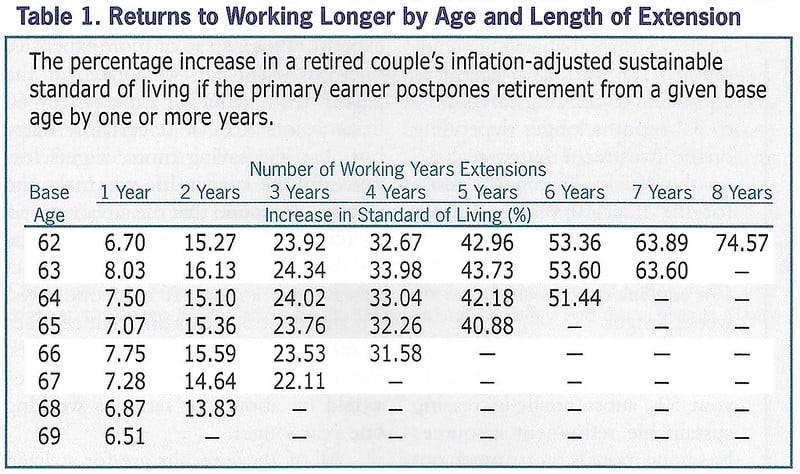

Here’s a table from the article that shows the potential increases in standard of living that come from delaying retirement. (All of these numbers assume 0% real returns.)

As you an see, if a 62-year-old opted to work an additional three years instead of retire, they’d enjoy an increased standard of living of nearly 24%. Working longer is a powerful way to increase your “retirement resources”.

The authors’ research found that while investment returns do have an effect on retirement standard of living, they’re not nearly as large as the effect of working longer. Assuming 0% real returns on investments, delaying retirement age from 66 to 67 leads to a 7.75% increase in standard of living. With a 7% real return (similar to average stock market returns), that one-year delay in retirement brings an increased standard of living of 9.56%. It’s a boost, yes, but not even a boost of two percentage points over assuming zero investment returns.

The bottom line? Each extra year you work past your target retirement age brings a boost of roughly 10% to your post-retirement standard of living. Not too shabby.

The Power of Saving

The real reason this article caught my eye was the authors’ discussion of saving. They dismiss saving rate as being less powerful than working longer, but I’m not sure that I agree. (Remember, I believe that your saving rate is the most important number in personal finance.)

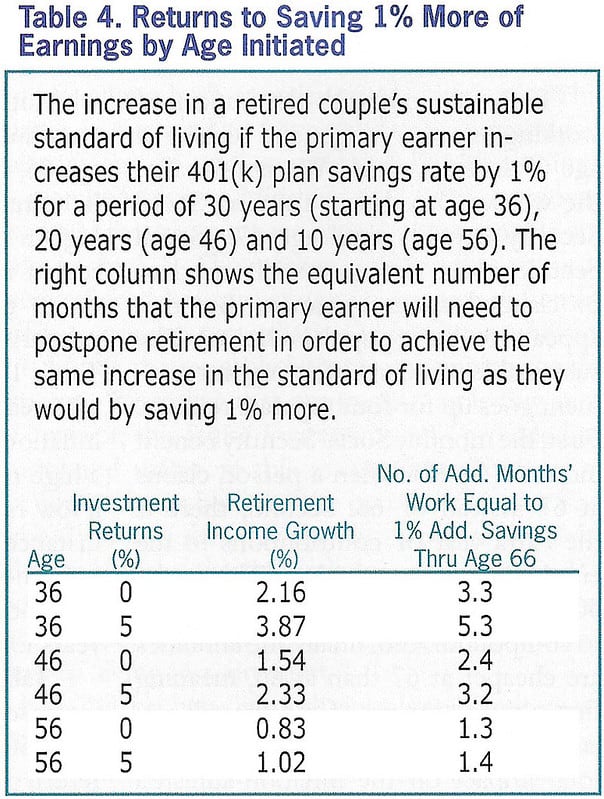

Why are the authors dismissive of saving rate? Their research shows that for each bump of one percentage point in saving rate over thirty years, a person can expect a 2.16% increase in standard of living at retirement — assuming a 0% real return. This same increase could be achieved by working an extra 3.3 months past target retirement age.

But what if instead of assuming a 0% real return on investment, we assume a 7% real return on investment (which is close to the long-term return of stocks)? Then each increase of one percentage point in saving rate over thirty years leads to a 4.79% increase of standard of living during retirement. In this case, it would take six months of extra work to match a one percentage point jump in saving rate.

I think the authors are far too quick saving rate in favor of working longer. They’re working with tiny, tiny fractions. Instead of talking about increasing savings by one percentage point, why not talk about something meaningful, such as an increase to saving rate of ten or twenty percentage points?

Assuming average stock-market returns (instead of 0% returns) — where every one percentage point increase to savings is equivalent to six months of extra work — then we find that by boosting your saving rate for ten percentage points over thirty years means you can retire five years earlier. If you boost your saving rate by twenty percentage points, you can retire ten years earlier. These are significant amounts of time!

To summarize, this article gives us two new financial rules of thumb. First, for each year you work past standard retirement age, you’ll enjoy roughly a 10% increase to your post-retirement standard of living. Second, each percentage point bump to your saving rate is roughly equivalent of six months you don’t have to work.

What if You Start Late?

To me, there shouldn’t be an argument about whether it’s better to work longer or to save more. Both strategies produce notable increases to standard of living in retirement. If we save more now, we’ll have more later. And if we work a little longer, that’ll provide a boost to our standard of living too.

Last of all, I’d like to point out that the authors correctly conclude that the later you start saving, the less powerful saving actually is. If you don’t begin saving for retirement until age 56, there’s far less time for the power of compounding to grow your wealth snowball. As a result, for older folks each percentage point increase to saving rate is equivalent to about a month-and-a-half of extra work (as opposed to between three and six months).

This doesn’t mean that you shouldn’t start saving in your forties and fifties. It just means that the power of saving is diminished. And it means that, realistically speaking, you’ll probably have to work beyond your desired retirement age.

[Increasing your retirement resources: The Power of working longer, AAII Journal]Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)