Spending rate versus saving rate

For years, I've argued that your saving rate is the most important number in personal finance. “Saving rate” in the world of personal finance is the same as profit in the world of business. We all understand that a company needs to earn a profit in order to grow and thrive, but what most people fail to realize is that people need profit too.

The greater the gap between your earning and spending, the faster you're able to grow your wealth snowball and achieve your goals.

Last week, the always-excellent Michael Kitces published an interesting article that argues spending rates matter more than saving rates. He writes:

Most households struggle to save because there is no money left at the end of the month to save in the first place. Because technically their problem isn’t a savings rate that’s too low; it’s a spending rate that’s too high.

When I began reading Kitces' article, I thought he was picking nits. After all, saving rate and spending rate feel are two sides of the same coin. Turns out, however, Kitces has a good point.

Saving Rate vs. Spending Rate

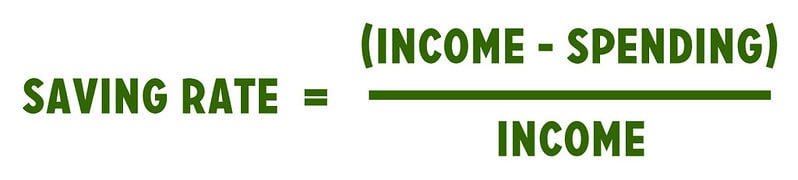

Your saving rate — and note that it's not “savings rate” — is calculated by dividing your profit (your income less your expenses) by your income.

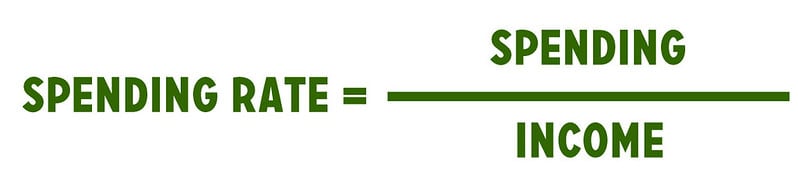

Your spending rate is calculated by dividing your spending by your income.

As you can see from the equations, saving rate and spending rate are simply the inverse of one another. If you have an 80% spending rate, then you have a 20% saving rate. If you have a 5% saving rate, then you have a 95% spending rate.

Because of this, it's easy to dismiss tracking your spending rate as a needless exercise. That number is implicit in your saving rate!

But Kitces argues that shifting the attention from saving to spending makes sense because saving is, essentially, a side effect. The two numbers you actually control in this equation are your earning and spending. Saving is a byproduct. It's not a primary factor but a secondary one. This observation is subtle but it's important.

Saving as Side Effect

For the past couple of years, I've led what seems like a futile crusade to convince folks that they ought not make debt elimination a primary financial goal. That might seem crazy, but I have reasons.

I've seen many instances where folks make it their mission to get out of debt, but once they're debt-free they fall right back into poor financial habits. Similarly, I'm now seeing people pursue financial independence as a goal, and some who achieve it realize it's not the panacea they had hoped for.

To me, both debt reduction and financial independence ought to be treated as side effects. They're the byproducts of other more-important financial choices. If you boost your income and cut your spending, you will get out of debt. It'll happen without you making it a goal. And if you're clear on your personal mission, then you will achieve financial independence — if FI is aligned with that particular mission. (FI doesn't fit every purpose in life.)

Kitces helped me to see that saving rate is a side effect too. “The real key to saving isn’t actually the ‘saving' itself, but setting reasonable and prudent spending guidelines,” he writes. He's right.

In the fundamental wealth equation, the two variables that you control are your income and your spending. You don't directly control your saving. That rises or falls depending on the other two factors.

- If you decrease your spending, your saving rate rises. If you increase your spending, your saving rate falls.

- If you increase your income, your saving rate rises. If your income decreases, your saving rate falls.

If you want to save more, you can't tell yourself, “This month, I'm going to focus on setting aside 10% instead of 5%.” In order for your saving to increase, you have to adjust your spending (or your income). To set aside 10%, you need to spend 90% of your income instead of 95%.

Control What You Can Control

The biggest reason I like the shift from “saving rate” to “spending rate” is that it puts the focus on what you can actually do to improve your situation. You can't directly improve side effects. You have to make adjustments to primary causes, and in this case the primary causes of your saving rate are your income and your spending. Of these two, you have much more control over your spending.

Don't get me wrong. You should absolutely do whatever you can to earn more money. Become better educated. Work harder and smarter. Learn how to negotiate your salary. But opportunities to boost income are infrequent. Opportunities to reduce spending happen every day.

I believe that becoming proactive is the number-one skill to improve your financial life. You can practice being proactive by reducing your spending rate. How?

- The best way to spend less is to reduce your housing costs. For the average American family, housing is the largest monthly expense — and by a huge margin. No, high housing costs aren't quick or easy to fix. I get it. But cheaper housing is the best way to decrease your spending rate.

- Transportation is the second-largest expense in the average American budget. Best of all, it's a line-item that can be cut drastically today, if you've got the guts. It takes time to move somewhere cheaper. You can ride the bus or bike to work as soon as you decide the inconvenience is worth the financial reward.

- Another way to practice being proactive is to reduce recurring monthly expenses. Nowadays, most of us have a whole host of subscriptions and recurring fees. I'm very guilty of this. For instance, I have paid subscriptions to Spotify, Pandora, and Apple Music. Plus, I'm paying for Netflix and Hulu and YouTube TV. This is absurd, and I know it. Yet I'm not alone. I've spoken with many others who let monthly subscriptions pile up until they're sizable drains to their cash flow.

So, does spending rate matter more than saving rate? Do I agree with the premise of Kitces' article? Yes — and no.

Because spending rate is the mathematical inverse of saving rate, you can't really argue that one is more important than the other. They're essentially the same thing, but looked at from different angles. That said, saving is a side effect, not a primary factor. I like the fact that an individual can directly affect her spending.

I appreciate that Kitces introduced me to the idea of a spending rate. It's a fascinating concept. But the truth is: I'm going to keep the conversation at Get Rich Slowly focused on saving rates. (For now, anyway.)

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)